Table of Contents

What is Marketable Securities?

Investment in marketable securities is an investment strategy undertaken by corporations or individual investors who purchase securities that can be easily converted into cash. These marketable securities, which include stocks, bonds, or money market instruments, are typically short-term, highly liquid investments that are readily marketable and carry minimal risk.

Marketable securities are short-term money market instruments that can easily be converted into cash, hence these are considered as a part of liquid assets. Management of marketable securities is an integral part of an investment of cash as this may serve both the purposes of liquidity and cash.

As the working capital needs are fluctuating, it is possible to park excess funds in some short-term securities, which can be liquidated when the need for cash is felt.

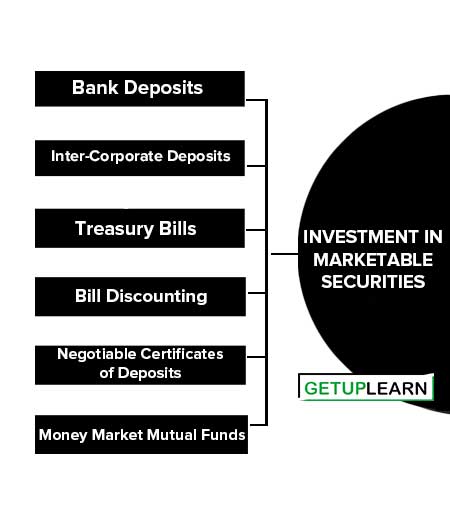

Investment in Marketable Securities

Moreover, the decision to invest in marketable securities must align with the company’s overall financial strategy.

If a company has better uses for its cash that could generate higher returns (like expanding operations, investing in research and development, etc.), it might choose to direct its cash there instead of investing in marketable securities:

- Bank Deposits

- Inter-Corporate Deposits

- Treasury Bills

- Bill Discounting

- Negotiable Certificates of Deposits

- Money Market Mutual Funds

Bank Deposits

All commercial banks offer short-term deposit schemes at varying rates of interest depending upon the deposit period. A firm having excess cash can make a deposit for even a short period of a few days only. These deposits provide full safety and facility for pre-mature payment.

Inter-Corporate Deposits

A firm having excess cash can make a deposit with other firms also. When a company makes a deposit with another company such a deposit is known as ‘Inter-Corporate deposit’. These deposits are usually for a period of three months to one year.

A higher rate of interest is an important feature of these deposits. However, these are generally unsecured and this lack of safety is the main drawback of these types of short-term investments, but returns are quite attractive.

Treasury Bills

Treasury bills are short-term government securities. The usual practice in India is to sell treasury bills at a discount and redeem them at par on maturity. The difference between the issue price and the redemption price, adjusted for the time value of money is the return on treasury bills. These bills are highly safe investments and are easily marketable.

Bill Discounting

A firm having excess cash can also discount the bills of other firms in the same way as commercial banks do. On the maturity date of the bill, the firm will get the money. However, the discounting of the bill as a marketable security is subject to two limitations:

- The safety of this investment depends upon the credit rating of the acceptor of the bill.

- Usually, the pre-mature payment of the bill is not available.

Negotiable Certificates of Deposits

NCDs are papers issued by banks acknowledging fixed deposits for a specified period of time. Commercial Papers are negotiable instruments.

Money Market Mutual Funds

Money market mutual funds (MMMFs) focus on short-term funds like marketable securities such as TBs, CPs, CDs or call money. They have a minimum lock-in period of 30 days, and after this period, an investor can withdraw his or her money at any time at short notice or even across the counter in some cases.

They offer attractive yields. MMMFs have become quite popular with institutional investors and some companies. UTI’s MMMF schemes are the most successful so far.

FAQs About the Investment in Marketable Securities

What is the investment in marketable securities?

The investment in marketable securities are: Bank Deposits 2. Inter-Corporate Deposits 3. Treasury Bills 4. Bill Discounting 5. Negotiable Certificates of Deposits 6. Money Market Mutual Funds.