The finance manager’s main responsibilities are to procure and effectively utilize funds while considering the financial implications of all decisions. All decisions involving the management of funds fall under their jurisdiction.

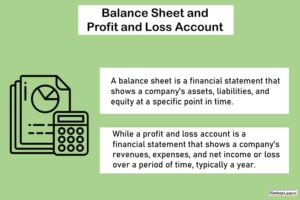

The finance manager must manage funds to optimize utilization and ensure that procurement is balanced in terms of risk, cost, and control. The accountant’s role, on the other hand, is to record business transactions and prepare financial statements.

Although historically some accountants have managed funds, in modern business, finance is a separate, complex function with specialized tasks for the finance manager.

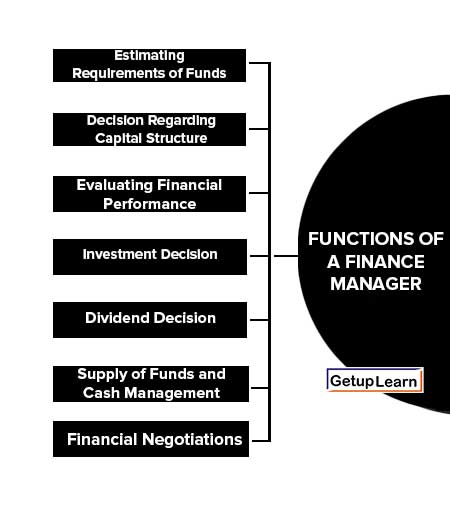

Functions of A Finance Manager

Let’s discuss the functions of a finance manager:

- Estimating Requirements of Funds

- Decision Regarding Capital Structure

- Investment Decision

- Dividend Decision

- Supply of Funds and Cash Management

- Evaluating Financial Performance

- Financial Negotiations

Estimating Requirements of Funds

In a business, the requirements of funds have to be carefully estimated. Certain funds are required for long-term purposes i.e., investment in fixed assets, etc. A careful estimate of such funds and of the exact timing when such funds are required must be made.

Also, an assessment has to be made regarding the requirements of working capital which involves estimating the number of funds blocked in various current assets and the number of funds likely to be generated for short periods through current liabilities.

Forecasting the requirements of funds involves the use of techniques of budgetary control and long-range planning. Estimates of requirements of funds can be made only if all the physical activities of the organization have been forecasted. They can then be translated into monetary terms.

Decision Regarding Capital Structure

After estimating the requirement of funds, the finance manager must decide on the sources from which funds will be raised, considering the different issues associated with each source. They must maintain a balance between long-term and short-term funds, and ensure sufficient long-term funds are raised to finance fixed assets and other investments.

The finance manager must also maintain a balance between loan funds and own funds, and decide on the ratios between outside long-term funds and own funds. These decisions, collectively known as financing decisions, must ensure the company can procure funds at minimum cost and withstand lean periods.

Investment Decision

Funds procured from different sources have to be invested in various kinds of assets. Long-term funds are used in a project for various fixed assets and also for current assets. The investment of funds in a project has to be made after careful assessment of the various projects through capital budgeting.

A part of long-term funds is also to be kept for financing the working capital requirements. Asset management policy would be determined by the production manager and the finance manager keeping in view the requirement of production and the future price estimates of raw materials and the availability of funds.

Dividend Decision

The finance manager is also concerned with the decision to pay or declare a dividend. He has to assist the top management in deciding as to what amount of dividend should be paid to the shareholders and what amount should be retained in the business itself. This involves a large number of considerations.

Economically speaking, the amount to be retained or to be paid to the shareholders should depend on whether the company or the shareholders can make more profitable use of the funds. However, in market prices, the requirement of funds for future growth, the cash flow situation, the tax position of shareholders, etc., are to be kept in mind.

The principal function of a finance manager relates to decisions regarding procurement, investment, and dividends. However, the finance manager also undertakes the following subsidiary function.

Supply of Funds and Cash Management

The finance manager has also to ensure that all sections i.e., branches, factories, departments, and units of the organization are supplied with adequate funds. Sections that have an excess of funds have to contribute to the central pool for use in other sections that need funds.

An adequate supply of cash at all points in time is absolutely essential for the smooth flow of business operations. Even if one of the 200 retail branches does not have sufficient funds, the whole business may be in danger.

Hence the need for laying down cash management and cash disbursement policies with a view to supplying adequate funds at all times and at all points in an organization is an important function of a finance manager. Cash management should also ensure that there is no excessive cash.

Evaluating Financial Performance

Management control systems are often based on financial analysis. One prominent example is the ROI (return on investment) system of divisional control. A finance manager has to constantly review the financial performance of the various units of the organization.

The ROI chart is extremely useful in this regard. Analysis of the financial performance helps the management for assessing how the funds have been utilized in various divisions and what can be done to improve it.

Financial Negotiations

A major portion of the time of the finance manager is utilized in carrying out negotiations with financial institutions, banks, and public depositors.

He has to furnish a lot of information to these institutions and persons and has to ensure that the rising of funds is within the statutes like the Companies Act, etc. Negotiations for outside financing often require specialized skills.

FAQs About the Functions of A Finance Manager

What are the functions of a finance manager?

The following are the functions of a finance manager:

1. Estimating Requirements of Funds

2. Decision Regarding Capital Structure

3. Investment Decision

4. Dividend Decision

5. Supply of Funds and Cash Management

6. Evaluating Financial Performance

7. Financial Negotiations.