Table of Contents

-

1 Determinants of Dividend Policy

- 1.1 Capital Market Considerations

- 1.2 Dividend Payout Ratio

- 1.3 Legal, Contractual, and Internal Constraints and Restrictions

- 1.4 Inflation

- 1.5 Age of Corporation

- 1.6 Stability of Earnings

- 1.7 Requirement of Additional Capital

- 1.8 Liquidity of Funds

- 1.9 Trade Cycles

- 1.10 Government Policies

- 1.11 Taxation Policy

- 1.12 Policy of Control

- 2 FAQs About the Determinants of Dividend Policy

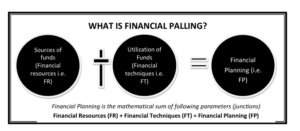

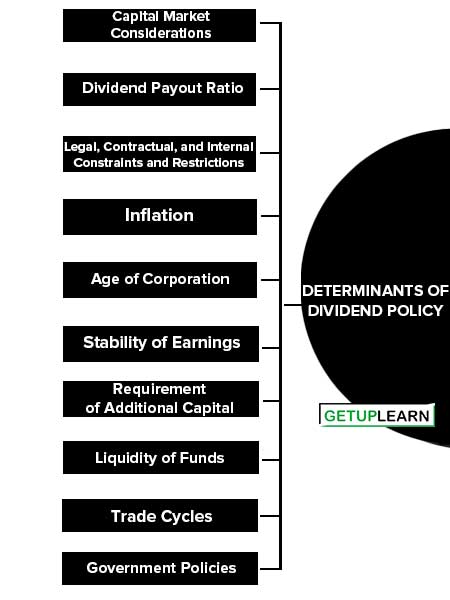

Determinants of Dividend Policy

Dividend policy refers to the approach a company takes to distribute profits back to its shareholders. While some companies might prefer to reinvest most of their profits back into the business, others may opt to distribute a substantial portion of the profits as dividends. These are the various determinants of dividend policy:

- Capital Market Considerations

- Dividend Payout Ratio

- Legal, Contractual, and Internal Constraints and Restrictions

- Inflation

- Age of Corporation

- Stability of Earnings

- Requirement of Additional Capital

- Liquidity of Funds

- Trade Cycles

- Government Policies

- Taxation Policy

- Policy of Control

Capital Market Considerations

Capital market consideration is also a determinant of dividend policy. If the company has easy access to the capital market in such case company should follow a liberal dividend policy and if the company has limited access to the capital market, it can opt for a low dividend payout ratio. Such companies rely on retained earnings as a major source of financing for future growth.

Dividend Payout Ratio

The dividend payout ratio refers to the percentage of the net earnings distributed to the shareholders as dividends. On the basis of dividend policy owners of the company takes the decision to pay out earnings or to retain them for reinvestment in the firm.

A sufficient amount of dividend creates satisfaction among the shareholders and the retained earnings constitute a source of finance. So, it is necessary that a) dividend policy should maintain a balance between current dividends and future growth which maximizes the price of the firm’s shares.

The dividend payout ratio of a firm should be optimum so that the firm can able to maximize the wealth of the firm’s owners and provide sufficient funds to finance growth.

Legal, Contractual, and Internal Constraints and Restrictions

A company is not legally bounded for declaration of dividend but, they have to specify the conditions under which dividends must be paid. Such conditions pertain to capital impairment, net profits, and insolvency. It may be that a company accepts important contractual restrictions (when the company obtains external funds) in respect of the payment of dividends.

These restrictions may cause the firm to restrict the payment of cash dividends until a certain level of earnings has been achieved or limit the amount of dividends paid to a certain amount or percentage of earnings. Internal constraints are unique to a firm and include liquid assets, growth prospects, financial requirements, availability of funds, earnings stability, and control.

Inflation

In case of a situation of inflation, the funds generated from depreciation may not be sufficient to replace obsolete equipment and machinery. In such a situation, a company should rely upon retained earnings as a source of funds to replace those assets. Thus, the dividend payout ratio is negatively affected due to inflation.

Age of Corporation

A newly established company will invest their earning for expansion and plant improvement and may adopt a rigid dividend policy. But if the company is well established, it can frame a more consistent policy in respect of dividends. So, we can say that dividend policy is also affected by the age of the corporation.

Stability of Earnings

If a company has the stability of earnings, such a company can maintain consistency in its dividend policy. The stability of earnings depends on the nature of the business e.g. firms dealing in luxurious or fancy goods can earn more profits. So, we can say that the nature of business has an important bearing on the dividend policy.

Requirement of Additional Capital

In the case of small companies, they face the difficulties of additional finance for expansion programs. Every company retains a part of its profits for strengthening its financial position. Thus, such Companies distribute dividends at low rates and retain a big part of profits.

Liquidity of Funds

If a company decides to pay dividends in cash then it may be only if the company has sufficient funds. So, the availability of cash and a sound financial position is equally affected by dividend policy. Payment of dividends represents a cash outflow.

More availability of funds and good liquidity position of the company show the better ability to pay dividends. If the cash position is weak, the stock dividend will be distributed and if the cash position is good, the company can distribute the cash dividend.

Trade Cycles

Business cycles also exercise an influence on dividend Policy. The dividend policy is adjusted according to the business oscillations. During the boom, prudent management creates food reserves for contingencies that follow the inflationary period.

Higher rates of dividends can be used as a tool for marketing the securities in an otherwise depressed market. Financial solvency can be proved and maintained by the companies in dull years if adequate reserves have been built up.

Government Policies

Various Government Policies: Fiscal, industrial, taxation, etc. affect the earnings capacity of the enterprise. The dividend policy has to be modified according to the changes in government policies.

Taxation Policy

The taxation policy of the government also affects the decision of distribution of dividends. In case of a high taxation rate, a major part of earnings will be paid to the government by way of tax, hence the rate of dividends will be lowered. In the case of low taxation, the company will be able to pay dividends at a higher rate.

Policy of Control

A policy of control is another determining factor so far as dividends are concerned. If the directors want to have control of the company, they would not like to add new shareholders and therefore, declare a dividend at a low rate.

Because by adding new shareholders they fear dilution of control and diversion of policies and programs of the existing management. So they prefer to meet the needs through retained earnings. If the directors do not bother about the control of affairs they will follow a liberal dividend policy. Thus control is an influencing factor in framing the dividend policy.

FAQs About the Determinants of Dividend Policy

What are the determinants of dividend policy?

The determinants of dividend policy are: Capital Market Considerations 2. Dividend Payout Ratio 3. Inflation 4. Age of Corporation 5. Stability of Earnings 6. Requirement of Additional Capital 7. Liquidity of Funds 8. Trade Cycles.