Table of Contents

What is Promissory Note?

Section 4 of the Act defines, “A promissory note is an instrument in writing (note being a bank-note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.”

Essential Elements: An instrument to be a promissory note must possess the following elements:

- It must be in writing: A mere verbal promise to pay is not a promissory note. The method of writing (either in ink or pencil or printing, etc.) is unimportant, but it must be in any form that cannot be altered easily.

- It must certainly be an express promise or clear understanding to pay: There must be an express undertaking to pay. A mere acknowledgment is not enough. The following are not promissory notes as there is no promise to pay.

If A writes:

- “Mr. B, I.O.U. (I owe you) Rs. 500”

- “I am liable to pay you Rs. 500”.

- “I have taken from you Rs. 100, whenever you ask for it has to pay”

The following will be taken as promissory notes because there is an express promise to pay:

If A writes:

- “I promise to pay B or order Rs. 500”

- “I acknowledge myself to be indebted to B in Rs. 1000 to be paid on demand, for the value received”.

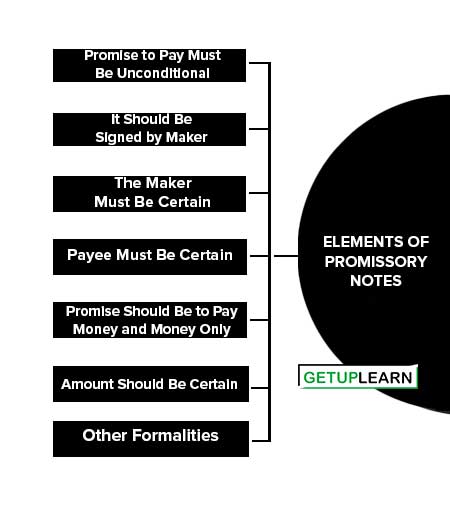

Elements of Promissory Notes

An instrument to be a promissory note must possess the following elements:

- Promise to Pay Must Be Unconditional

- It Should Be Signed by Maker

- The Maker Must Be Certain

- Payee Must Be Certain

- Promise Should Be to Pay Money and Money Only

- Amount Should Be Certain

- Other Formalities

Promise to Pay Must Be Unconditional

A conditional undertaking destroys the negotiable character of an otherwise negotiable instrument. Therefore, the promise to pay must not depend upon the happening of some outside contingency or event. It must be payable absolutely.

It Should Be Signed by Maker

The person who promises to pay must sign the instrument even though it might have been written by the promisor himself. There are no restrictions regarding the form or place of signatures in the instrument. It may be in any part of the instrument. It may be in pencil or ink, a thumb mark, or initials.

The promotion can be signed by the authorized agent of the maker, but the agent must expressly state on whose behalf he is signing, otherwise, he himself may be held liable as a maker. The only legal requirement is that it should indicate with certainty the identity of the person and his intention to be bound by the terms of the agreement.

The Maker Must Be Certain

The note self must show clearly who the person agreeing to undertake the liability to pay the amount. In case a person signs in an assumed name, he is liable as a maker because a maker is taken as certain if from his description sufficient indication follows about his identity. In case two or more persons promise to pay, they may bind themselves jointly or jointly and severally, but their liability cannot be in the alternative.

Payee Must Be Certain

The instrument must point out with certainty the person to whom the promise has been made. The payee may be ascertained by name or by designation. A note payable to the maker himself is not pronate unless it is endorsed by him.

In case, there is a mistake in the name of the payee or his designation; the note is valid if the payee can be ascertained by evidence. Even where the name of a dead person is entered as the payee in ignorance of his death, his legal representative can enforce payment.

Promise Should Be to Pay Money and Money Only

Money means legal tender money and not old and rare coins. A promise to deliver paddy either in the alternative or in addition to money does not constitute a promissory note.

Amount Should Be Certain

One of the important characteristics of a promissory note is certainly not only regarding the person to whom or by whom payment is to be made but also regarding the amount. However, paragraph 3 of Section 5 provides that the sum does not become indefinite merely because:

- There is a promise to pay the amount with interest at a specified rate.

- The amount is to be paid at an indicated rate of exchange.

- The amount is payable in installments with a condition that the whole balance shall fall due for payment on a default being committed in the payment of anyone installment.

Other Formalities

The other formalities regarding number, place, date, consideration, etc. though usually found given in the promissory notes but are not essential in law. The date of the instrument is not material unless the amount is made payable at a certain time after the date.

Even in such a case, omission of date does not invalidate the instrument, and the date of execution can be independently ascertained and proved. On-demand (or six months after the date) I promise to pay Peter or order the sum of rupees one thousand with interest at 8 percent per annum until payment.

What is Bill of Exchange?

Section 5 of the Act defines, “A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

A bill of exchange, therefore, is a written acknowledgment of the debt, written by the creditor and accepted by the debtor. There are usually three parties to a bill of exchange drawer, the acceptor or drawee and the payee. The drawer himself may be the payee.

Essential conditions of a bill of exchange:

- It must be in writing.

- It must be signed by the drawer.

- The drawer, drawee, and payee must be certain.

- The sum payable must also be certain.

- It should be properly stamped.

- It must contain an express order to pay money and money alone.

For example, In the following cases, there is no order to pay, but only a request to pay. Therefore, none can be considered as a bill of exchange:

- I shall be highly obliged if you make it convenient to pay Rs. 1000 to Suresh.

- Mr. Ramesh, please let the bearer have one thousand rupees, and place it in my account and oblige.

However, there is an order to pay, though it is politely made, in the following examples:

- Please pay Rs. 500 to the order of ‘A’.

- Mr. A will oblige Mr. C, by paying to the order of’ P”.

- The order must be unconditional.

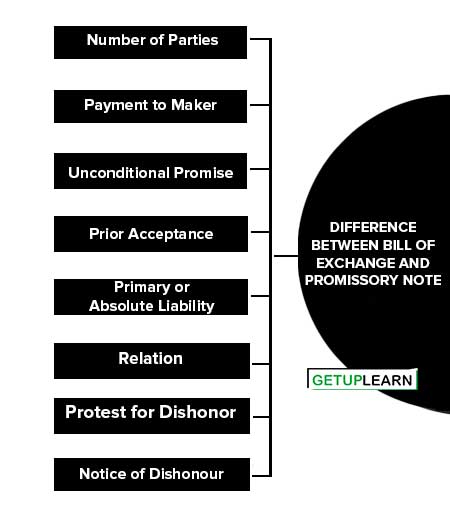

Difference Between Bill of Exchange and Promissory Note

These are the following points of difference between bill of exchange and promissory note:

- Number of Parties

- Payment to Maker

- Unconditional Promise

- Prior Acceptance

- Primary or Absolute Liability

- Relation

- Protest for Dishonor

- Notice of Dishonour

Number of Parties

In a promissory note, there are only two parties the maker (the debtor) and the payee (the creditor). In a bill of exchange, there are three parties; drawer, drawee, and payee; although any two out of the three may be filled by one and the same person.

Payment to Maker

A promissory note cannot be made payable to the maker himself, while in a bill of exchange to the drawer and payee or drawee and payee may be the same person.

Unconditional Promise

A promissory note contains an unconditional promise by the maker to pay to the payee or his order, whereas, in a bill of exchange, there is an unconditional order to the drawee to pay according to the direction of the drawer.

Prior Acceptance

A note is presented for payment without any prior acceptance by the maker. A bill of exchange payable after sight must be accepted by the drawee or someone else on his behalf before it can be presented for payment.

Primary or Absolute Liability

The liability of the maker of a promissory note is primary and absolute, but the liability of the drawer of a bill of exchange is secondary and conditional.

Relation

The maker of the promissory note stands in immediate relation with the payee, while the maker or drawer of an accepted bill stands in immediate relations with the acceptor and not the payee.

Protest for Dishonor

Foreign bills of exchange must be protested for dishonor when such protest is required to be made by the law of the country where they are drawn, but no such protest is needed in the case of a promissory note.

Notice of Dishonour

When a bill is dishonored, due notice of dishonour is to be given by the holder to the drawer and the intermediate indorsers, but no such notice need be given in the case of a note.

FAQs About the Difference Between Bill of Exchange and Promissory Note

What is the difference between bill of exchange and promissory note?

These are the basis of difference between bill of exchange and promissory note:

1. Number of Parties

2. Payment to Maker

3. Unconditional Promise

4. Prior Acceptance

5. Primary or Absolute Liability

6. Relation

7. Protest for Dishonor

8. Notice of Dishonour.