Table of Contents

What is Swap?

The dictionary meaning of ‘swap’ is to exchange something for another. Like other financial derivatives, a swap is also an agreement between two parties to exchange cash flows. The cash flows may arise due to changes in interest rate or currency or equity etc.

In other words, a swap denotes an agreement to exchange payments of two different kinds in the future. The parties that agree to exchange cash flows are called ‘counter parties’. In the case of interest rate swap, the exchange may be of cash flows arising from fixed or floating interest rates, equity swaps involve the exchange of cash flows from returns of stocks index portfolio.

Currency swaps have the basis of cash flow exchange of foreign currencies and their fluctuating prices, because of varying rates of interest, pricing of currencies, and stock return among different markets of the world.

Features of Swaps

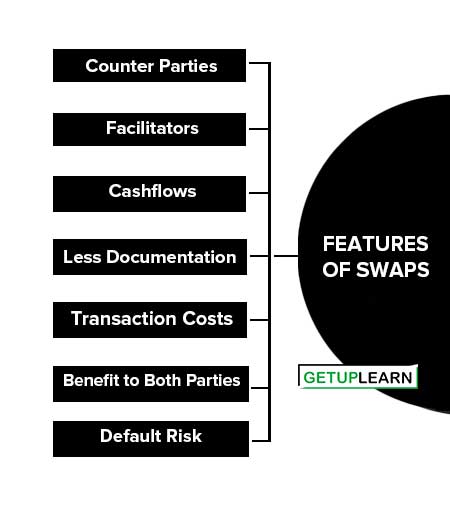

These are the features of swaps:

- Counter Parties

- Facilitators

- Cashflows

- Less Documentation

- Transaction Costs

- Benefit to Both Parties

- Default Risk

Counter Parties

Financial swaps involve the agreement between two or more parties to exchange cash flows or the parties interested in exchanging liabilities.

Facilitators

The amount of cash flow exchange between parties is huge and also the process is complex. Therefore, to facilitate the transaction, an intermediary comes into the picture which brings different parties together for the big deal.

These may be brokers whose objective is to initiate the counterparties to finalize the swap deal. While swap dealers are themselves counter-partied and bear the risk and provide portfolio management services.

Cashflows

The present values of future cash flows are estimated by the counterparties before entering into a contract. Both parties want to get assurance of exchanging the same financial liabilities before the swap deal.

Less Documentation

Less documentation is required in the case of swap deals because the deals are based on the needs of parties, therefore, less complex and less risk-consuming.

Transaction Costs

Generating a very less percentage is involved in the swap agreement.

Benefit to Both Parties

The swap agreement will be attractive only when parties get the benefits of these agreements.

Default Risk

Default risk is higher in swaps than in the option and futures because the parties may default on the payment.

Rationale Behind Swapping

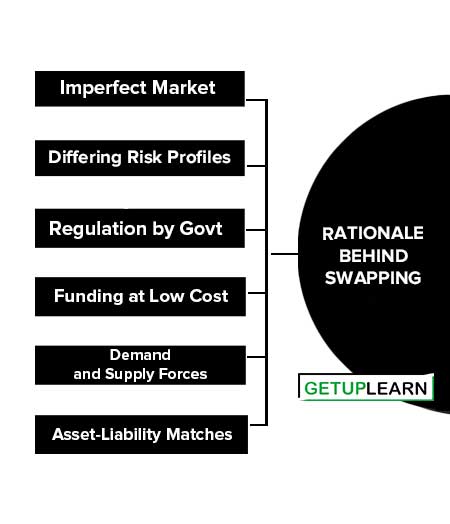

To avoid the risk of fluctuation in forex, interest rates, stock indices investors’ attitudes, etc. the swap market has merged now to explain why firms and people want to enter into swap agreements. The rationale can be explained by the following points:

- Imperfect Market

- Differing Risk Profiles

- Regulation by Govt

- Funding at Low Cost

- Demand and Supply Forces

- Asset-Liability Matches

Imperfect Market

As you know that swap agreements are meant for transforming financial claims to reduce risk. Since there lie different reasons for the growth in the swap market and the most important to the imperfection and inefficiency in the markets.

The swap agreements are required in order to investigate market imperfections, differences in the attitude of investors, information asymmetry, tax, and regulatory structure by the government, various kinds of financial norms and regulations, etc.

Had there been uniformity of standards and norms and perfect market conditions, swaps could not have generated much enthusiasm. Hence due to imperfect capital market conditions, swaps give the opportunity to the investors for hedging the risk.

Differing Risk Profiles

The basis of credit rating of bonds by financial institutions, banks, and individual investors is quite different. In other words, the computation of risks is different from the point of view of individual, institutional, and other types of investors, thereby changing the risk profile.

Based on this, the investor has to take the decision to hedge, speculate, or arbitrage opportunity. In some markets, the company can raise funds at a lower cost and can swap for a particular market.

A low credit-rated firm can raise funds from the floating rate credit market and enjoy a comparative advantage over a highly rated company because it pays a smaller risk premium. The differing interest rates in different markets can be arbitraged and disbursed between the counterparties.

Regulation by Govt

The regulatory practices of governments of different nations can make attractive or unattractive the swap markets. Sometimes the government restricts the funding by foreign companies to protect the interest of domestic investors.

It may also happen that to attract foreign companies the government opens the domestic markets. This phenomenon of government rule and regulations influences the growth of swap agreements.

Funding at Low Cost

In some businesses suppose export financing, there exists subsidized funding and currency swap agreements can take advantage of this situation. The company can swap the exchange risk by entering into a favorable currency swap.

Demand and Supply Forces

Depending on the needs of the country and its development plans, the central bank squeezes the reserve requirements thereby increasing the supply of funds because of the resultant lowering of interest rates.

Definitely, the borrowers will be interested in those markets where there is a sufficient supply of funds. Thus the borrowers can take arbitrage opportunities in their favor due to different economic conditions prevailing in those countries.

Asset-Liability Matches

The counterparties involved in swap sometimes desire to make the match between asset and liability. For this purpose, they take the help of swaps and funds can be tapped as per the requirements of the companies.

FAQs About the Swap Market

What are the features of swaps?

The following are the features of swaps:

1. Counter Parties

2. Facilitators

3. Cashflows

4. Less Documentation

5. Transaction Costs

6. Benefit to Both Parties

7. Default Risk.

What is swap in finance?

A swap is a financial agreement that exploits arbitrage opportunity between two markets and in which two counterparties agree to exchange a stream of cash flows over time according to a predetermined rule.

What is swaption?

A swaption is an option on an interest rate swap where the buyer of the swaption has a right to enter into an interest rate swap by some specified date in the future. The swaption agreement will specify whether the buyer of the swaption will be a fixed-rate receiver or a fixed-rate payer.

What is interest rate swap?

An interest rate swap is a contract in which two parties agree to swap interest payments for a pre-determined period of time traded in an over-the-counter market.

What is an equity swap?

An equity swap is a swap in which the exchange of one of the cash streams is derived from an equity instrument.

What is LIBOR?

LIBOR refers to London Inter Bank Offer Rate at which a bank is willing to lend to other bank on Euro-currency deposits.