Table of Contents

- 1 What are Financial Documents?

- 2 Definition of Financial Documents

- 3 Objectives of Financial Documents

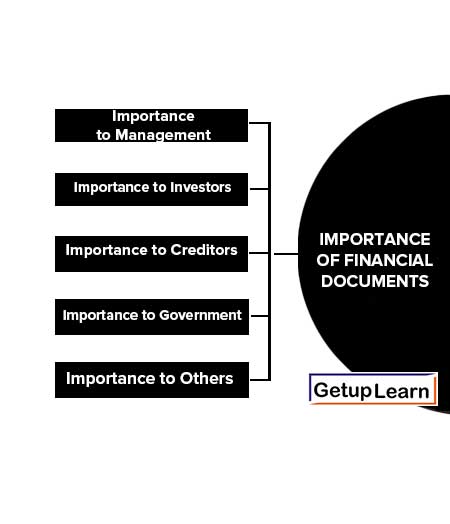

- 4 Importance of Financial Documents

- 5 Types of Financial Documents Analysis

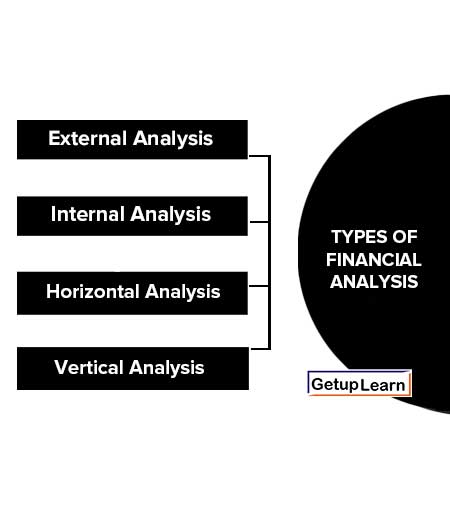

- 6 Types of Financial Analysis

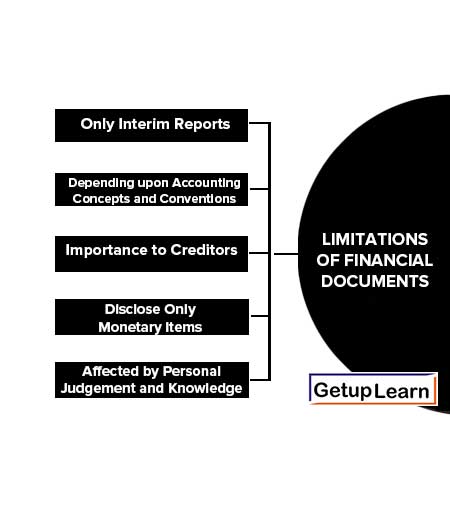

- 7 Limitations of Financial Documents

-

8 FAQs about Financial Documents

- 8.1 What is Financial Document?

- 8.2 What is the meaning of financial documents?

- 8.3 What is financial document analysis?

- 8.4 Discuss various types of financial document analysis.

- 8.5 What is profit and loss account?

- 8.6 What is balance sheet?

- 8.7 What are the objectives of financial documents?

- 8.8 What is the importance of financial documents?

What are Financial Documents?

Financial documents contain summarised information about the firm’s financial affairs. Its main purpose is to present the firm’s financial situation to the users. The financial documents are the end-product of the financial accounting process.

These documents present financial information in concise and capsule form. Financial documents are prepared by top management and these should be prepared in a very careful manner.

Definition of Financial Documents

These are the definitions of financial documents given by the authors:

[su_quote cite=”Hampton John J”]A financial document is an organized collection of data according to logical and consistent accounting procedures. Its purpose is to convey an understanding of some financial aspects of a business firm. It may show a position at a moment of time as in the case of a balance sheet or may reveal a series of activities over a given period of time, as in the case of a profit and loss account.[/su_quote]

Thus, the term ‘financial documents’ generally refer to basic documents prepared for the purpose of external reporting to owners, investors, and creditors. These are the key financial documents that are usually prepared by corporate firms are:

Profit and Loss Accounts

According to S.N. Maheshwari, “The profit and loss account is normally recognized to be the most useful of all financial documents. The profit and loss account gives a report of operations over a specified period of time, summarises the revenues or incomes and the expenses or costs attributed to that period, and indicates the net profit or loss for a specified period of time.

The profit and loss account explains what has happened to a business as a result of operations between two balance sheet dates. For this purpose, it matches the revenue and costs incurred in the process of earning revenues and shows the net profit earned or loss suffered during a particular period.

The nature of “Income” which is the focus of the profit and loss account can be well understood if a business is taken as an organization that uses ‘inputs’ to ‘produce’ output. The outputs are the goods and services that the business provides to its customers.

The values of these outputs are the amounts paid by the customers for them. These amounts are called ‘revenues’ in accounting. The inputs are the economic resources used by the business in providing these goods and services. These are termed as ‘expenses’ in accounting.”

Balance Sheet

A balance sheet is the most significant and basic financial document of any firm. A firm prepares a Balance sheet to present a summary of its financial position at a particular moment in time.

In the language of accounting, a balance sheet communicates information about the assets of the firm (i.e. the resources of the firm) and the liabilities (i.e. obligations of the firm towards outsiders), and the owner’s equity of the firm as on a specific date. It may be noted that it depicts a snapshot of the financial position of the firm at the close of the firm’s accounting period.

Objectives of Financial Documents

The financial documents are prepared to present an accurate picture of the firm’s financial position and operating results in a summarized manner. These are the objectives of financial documents:

- Communicate with different parties regarding the financial position of the business (These parties include the shareholders, creditors, investors, management, government, financial institutions, financial analysts and labor, etc.).

- To analyze the operations and performance of the firm for planning.

- To give necessary information for optimum utilization of resources of the companies.

- To provide necessary information for taking actions relating to public and social welfare.

Importance of Financial Documents

Financial documents are useful for different related parties. The importance of financial documents explained below:

- Importance to Management

- Importance to Investors

- Importance to Creditors

- Importance to Government

- Importance to Others

Importance to Management

In the words of Gerstenberg Charles W., “Management can measure the effectiveness of its own policies and decisions to determine the advisability of adopting new policies and procedures and document to owners the result of their managerial efforts”.

To effectively and controlling the company’s activities, management can get necessary data from financial documents.

Importance to Investors

Investors are mainly interested in the safety of their investments and earning profit from these investments with the help of financial documents. Investors create their opinion about the company before investing.

For example, some factors they considered are the price-earnings ratio, earnings per share, future earning potential, the trend of sales of past years, and the financial strength of the company, etc.

Importance to Creditors

Creditors lent their money for short periods and they are keen interested in the company’s ability to repay the loan amount on time.

A creditor can compute various ratios like current ratio, quick ratio, etc. to know the company’s ability to repay. If a company earns less than the paid amount of interest, it is not safe to lend money to this company.

Importance to Government

Various ratios like turnover ratios and earning ratios indicate the health of the company. To regulate various economic activities, government analyzes the various ratios of companies in one industry.

Importance to Others

Other related parties like labor, stock exchanges, economists, news agencies, trade unions, etc. are interested in the analysis of financial documents to know the detailed position of the company and industry.

Types of Financial Documents Analysis

Analysis of Financial Documents is also necessary to understand the financial positions during a particular period.

According to Myres, “Financial document analysis is largely a study of the relationship among the various financial factors in a business as disclosed by a single set of documents and a study of the trend of these factors as shown in a series of documents”

Types of Financial Analysis

Analysis of financial documents may be broadly classified into two important types on the basis of material used and methods of operations.

Based on Material Used

Based on the material used, financial document analysis may be classified into two major types External analysis and internal analysis.

External Analysis

Outsiders of the business concern do normally external analysis but they are indirectly involved in the business concern such as investors, creditors, government organizations, and other credit agencies.

External analysis is very much useful to understand the financial and operational position of the business concern. The external analysis mainly depends on the published financial document of the concern. This analysis provides only limited information about the business concern.

Internal Analysis

The Company itself does disclose some of the valuable information to the business concerned in this type of analysis. This analysis is used to understand the operational performances of each and every department and unit of the business concern. Internal analysis helps to take decisions regarding achieving the goals of the business concern.

Based on Method of Operation

Based on the methods of operation, financial document analysis may be classified into two major types such as horizontal analysis and vertical analysis.

Horizontal Analysis

Under the horizontal analysis, financial documents are compared over several years and based on that, a firm may take decisions. Normally, the current year’s figures are compared with the base year (base year is considered as 100), and how the financial information is changed from one year to another. This analysis is also called dynamic analysis.

Vertical Analysis

Under vertical analysis, financial documents measure the quantities relationship of the various items in the financial document on a particular period. It is also called static analysis, because, this analysis helps to determine the relationship between various items that appeared in the financial document.

For example, a sale is assumed as 100, and other items are converted into sales figures.

Limitations of Financial Documents

These the following limitations of financial documents are explained below:

- Only Interim Reports

- Depending upon Accounting Concepts and Conventions

- Based on Historical Cost

- Disclose Only Monetary Items

- Affected by Personal Judgement and Knowledge

Only Interim Reports

Financial Documents are Only Interim Reports: According to this, it can be said that financial documents cannot be final because the exact amount of profit or loss of a business can be determined after closing down the business. So profit depicted by the Profit and Loss account and the financial position shown by Balance Sheet is not exact.

So, it is necessary to prepare financial documents for a relatively short accounting period. But this cutting off the balance sheet dates gives the problem of allocation of cost and income. Financial document data cannot afford to remain exact under such conditions.

Depending upon Accounting Concepts and Conventions

Financial documents are prepared on the basis of certain accounting concepts and conventions. The financial position presented by these documents may not be real. For example, the value of an asset represents the amount of asset which is valued on the basis of the “going concern concept”.

This means the value of fixed assets may not be the same which can be realized after the sale of the asset.

Based on Historical Cost

The financial documents are based on historical costs. They do not give the present value of the business or any information regarding the future.

Disclose Only Monetary Items

Financial documents do not give a true picture of the business because they do not show those items which cannot be expressed in monetary terms. For example, the health of workers and the efficiency of management, etc.

Affected by Personal Judgement and Knowledge

Many items of financial documents are affected by the personal judgment and knowledge of the accountant. Some of the items e.g. stock valuation methods, method of depreciation, capital, and revenue expenditure are decided by personal decision.

FAQs about Financial Documents

What is Financial Document?

A financial document is an organized collection of data according to logical and consistent accounting procedures. Its purpose is to convey an understanding of some financial aspects of a business firm. It may show a position at a moment of time as in the case of a balance sheet or may reveal a series of activities over a given period of time, as in the case of a profit and loss account.

What is the meaning of financial documents?

Financial documents contain summarised information about the firm’s financial affairs. Its main purpose is to present the firm’s financial situation to the users. The financial documents are the end-product of the financial accounting process.

What is financial document analysis?

Financial document analysis is the process of reviewing and examining financial documents to understand the financial health of an individual, company, or organization. This analysis involves studying financial documents such as balance sheets, income statements, cash flow statements, tax returns, and other financial reports to identify patterns, trends, and insights about the financial performance of the entity.

Discuss various types of financial document analysis.

There are various types of financial document analysis that individuals and organizations use to assess financial health and make informed decisions. Here are some of the most common types of financial document analysis:

1. Ratio Analysis

2. Trend Analysis

3. Vertical Analysis

4. Horizontal Analysis

5. Cash Flow Analysis

6. Credit Analysis.

What is profit and loss account?

The profit and loss account is normally recognized to be the most useful of all financial documents. The profit and loss account gives a report of operations over a specified period of time, summarises the revenues or incomes and the expenses or costs attributed to that period, and indicates the net profit or loss for a specified period of time.

What is balance sheet?

A balance sheet is the most significant and basic financial document of any firm. A firm prepares a Balance sheet to present a summary of its financial position at a particular moment in time.

What are the objectives of financial documents?

The following are the objectives of financial documents:

1. Record Keeping

2. Compliance

3. Analysis

4. Decision Making

5. Communication etc.

What is the importance of financial documents?

Financial documents are crucial for any organization, as they provide a clear and accurate picture of its financial position. The following is the importance of financial documents:

1. Helps in Decision Making

2. Facilitates Monitoring

3. Ensures Compliance

4. Builds Trust

5. Facilitates Strategic Planning.