Table of Contents

What is Money?

Money is an important and indispensable element of modern times. In ordinary language, Money refers to What we use to pay for things. For a layman, in India, the rupee is the money. Similarly in America, Dollar is the money.

But for economists, the rupee, and dollar are just the different units of money. Thus, Money is anything that is generally accepted as a medium of exchange that has both legally and socially accepted by people with regard to making payment for buying commodities or receiving services.

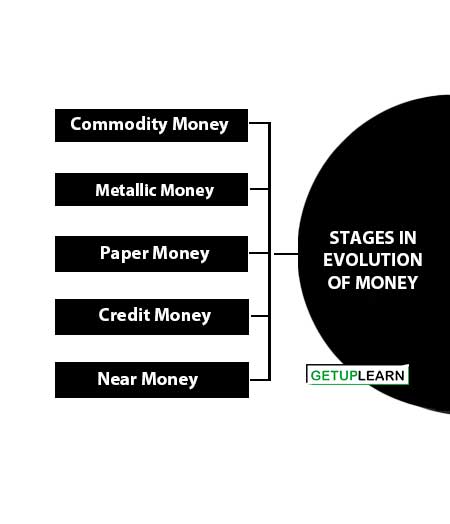

Stages in Evolution of Money

The word ‘money’ has been derived from the Latin word ‘Moneta’ which represents the surname of the Roman Goddess of Juno in whose temple at Rome, money was coined. The origin of money is lost in ancient times. Even the primitive man was having some sort of money and in every age, the type of money depended on the nature of its livelihood.

Depending upon the progress of human civilization at different times and places the evolution of money has passed through the following five stages:

Commodity Money

Various types of commodities have been used as money from the beginning of human civilization. In the period of hunting society, Stones, spears, skins, bows, and arrows, and axes were used as money. The pastoral society used cattle as money whereas the agricultural society used grains and foodstuffs as money.

Depending upon the place and standard of the society precious stones, tobacco, tea shells, fishhook, and many other commodities served as money at different times.

Metallic Money

With the development of human civilization and with the increase in trade relations by land and sea, metallic money was preferred over the place of commodity money. Many nations started using metallic money, i.e. silver, gold, copper, tin, etc. But metal was an inconvenient thing to accept, weigh, divide, and assess in quality.

Observing this weakness of metallic money, King Midas of Lydia in the eighth century B.C. innovated gold coins which were of predetermined weight. Thus coins came to be accepted as a convenient method of exchange. But as the price of gold began to increase, instead of using them as money, people start melting them in order to earn more by selling them as metal.

Since the intrinsic value of gold coins might be more than their face value, this led governments to mix copper or silver in gold coins. As gold became costlier and scarce, silver coins were used as metallic money, first in their pure form and later on mixed with alloy or some other metal.

Paper Money

The development of paper money started with goldsmiths who kept strong safes to store their gold. People started keeping their gold with them for safe custody As goldsmiths were thought to be honest merchants, In return, the goldsmiths issued a receipt to the depositor promising to return the gold on demand. These receipts were further used by the buyer of commodities to make payments to sellers.

Such receipts were backed by gold and thus can be easily converted into gold on demand. This ultimately led to the development of bank notes which were issued by the central bank of the country. With the rise in the demand for gold and silver, their prices also increased.

Thus during the beginning and after the First World War in all the countries of the world, the convertibility of bank notes into gold and silver was gradually given up. Since then bank money has ceased to be representative money and is simply ‘fiat money’ which is inconvertible and is accepted as money because it is backed by law.

Credit Money

The use of the cheque as money is another stage in the evolution of money in the modern world. The cheque is like a bank note in that it performs the same function. It refers to means of transferring money or obligations from one person to another.

But a cheque is different from a banknote as in a cheque specific sum is made and it expires once the transaction is finished whereas paper currency cannot get expired. It is simply a written order to transfer money. However, in the present times, large transactions are made through cheques, and banknotes are used only for small transactions.

Near Money

The final stage in the evolution of money is near money. Near money is highly liquid and can be easily converted into cash as and when required. Examples of near money are bills of exchange, treasury bills, bonds, debentures, savings certificates, etc. They refer to close substitutes for money and are liquid assets.

Thus, in the final stage of the evolution of money, money became intangible as its ownership is only transferred simply by book entry. In short, the character of money has undergone a drastic change during the long process of evolution.

In the present times, paper money, credit money, and near money are used everywhere. Commodity money and metallic money due to their drawbacks have been obsolete and rarely existed in the present world. But the evolution of money is a continuous process and shall continue to be so.

Definition of Money

It is very difficult to give a precise definition of money. Various authors have given different definitions of money:

Money can be defined as anything that is generally acceptable as a means of exchange and that at the same time acts as a measure and a store of value.

Crowther

Money can defines as “Anything which is widely accepted in payment for goods or in discharge of other kinds of business obligations.”

D H Robertson

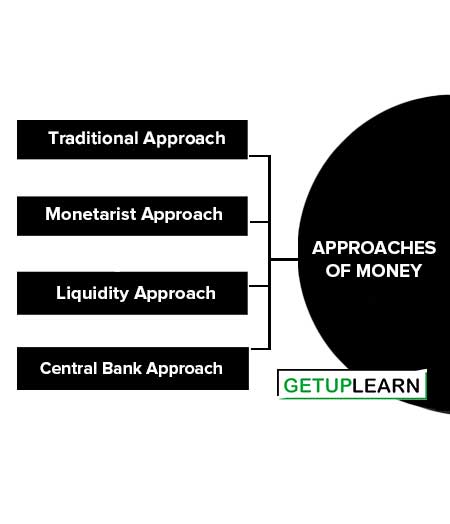

Approaches of Money

The following four approaches to the definition of money are discussed below:

Traditional Approach

This approach considers money as a medium of exchange. Money has the characteristics like spending, liquidity, etc. As per this approach, money includes:

M=C+DD

C: Currency with the public which includes notes and coins of all denominations in circulation excluding cash in hand with banks (C) and; DD: Demand deposits with commercial and co-operative banks, excluding inter-bank deposits (DD).

Monetarist Approach

Friedman and other theorists like Anna J. Schwartz, Karl Brunner, Phillip D. Cagan, Harry G. Johnson, and Allan H. Meltzer David Laidler gave this concept of money. According to them, money can be defined as “a temporary abode of purchasing power.”

A temporary abode means keeping your funds in near money and temporarily sacrificing your present purchasing ability. Thus, if one keeps funds in time deposits then that person has to first convert this deposit into cash and then only he/she can purchase. This definition includes time deposits with currency and demand deposits.

M=C+DD+TD

Thus, this definition includes the traditional view plus time deposits (TD). A time deposit is an interest-bearing bank deposit that has a specified date of maturity.

Liquidity Approach

Liquidity means it can be converted into cash as and when required. Thus the focus of this approach is that it defines money in terms of liquidity.

According to this approach, money supply included not only deposits of the commercial banks but also liabilities of non-banking intermediaries such as shares and bonds which plays an important role in the liquidity of the economy. This definition defines money supply as:

M=C+DD+TD+SB+S+B

This definition comprises the monetarist’s view plus saving bank deposits (SB), shares(S), bonds(B), etc. A non-banking institution which is a company and has the principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner is also a non-banking financial company.

Central Bank Approach

According to this approach, money includes monetarists’ view plus credit from non-banking financial institutions (NBFI) and credit from unorganized agencies (UA). This approach considered money as the total amount of credit extended by various modes and defines as:

M=C+DD+TD+NBFI+UA

This definition has a wider scope as compared to the monetarist approach and liquidity approach as they also added credit from unorganized agencies.

These are the unincorporated private enterprises owned by individuals or households engaged in financial services operated on a proprietary or partnership basis and with less than ten total workers. Hence, this approach takes a further step in increasing the scope of constituents of money.

Features of Money

For being known as money, it must carry some basic features in the absence of which, it would lose its status. The following are the features of money:

Divisibility

Money must be easily divided into small units so that people can purchase goods and services at any price. People can use a Rs 1000 note to purchase a chair or they can even use a Re1 note to purchase candy. According to their requirement, they can divide the money.

Transportability

Money serves the feature of transportability or portability in terms of easiness to carry. When people went to the market to buy something, then they need to bring with them their money. But to “bring with them money” they obviously need to have money. That is, the money must be transportable.

Acceptability

Money serves as a medium of exchange as it is universally accepted by the public. This acceptance is for the purpose of the exchange of money for goods and different types of services.

Durability

Money stays the same in shape and size over a long period and hence serves the characteristic of durability. Because of its durability, individuals are willing to take it as a form of payment as it can be further used for purchasing other goods or services.

Stability

Money’s value must remain relatively constant over long periods of time.

FAQs About the What is Money?

What is the meaning of money?

Money can defines as “Anything which is widely accepted in payment for goods or in the discharge of other kinds of business obligations.”

What is the simple definition of money?

Money can be defined as anything that is generally accepted as a means of exchange and that at the same time acts as a measure and a store of value. By Crowther

What are the stages in evolution of money?

These are the five major stages in the evolution of money: 1. Commodity Money 2. Metallic Money 3. Paper Money 4. Credit Money 5. Near Money.

What are the approaches to money?

The approaches to money are 1. Traditional Approach 2. Monetarist Approach 3. Liquidity Approach 4. Central Bank Approach.

What are the features of money?

These are the following features of money: Divisibility, Transportability, Acceptability, Durability, and Stability.