Capital budgeting can be defined as investment appraisal, is a critical process in corporate finance and business management. It involves the decision-making process used by companies to determine whether major long-term investments or projects are worth funding through the firm’s capitalization structure (debt, equity, or retained earnings).

Table of Contents

-

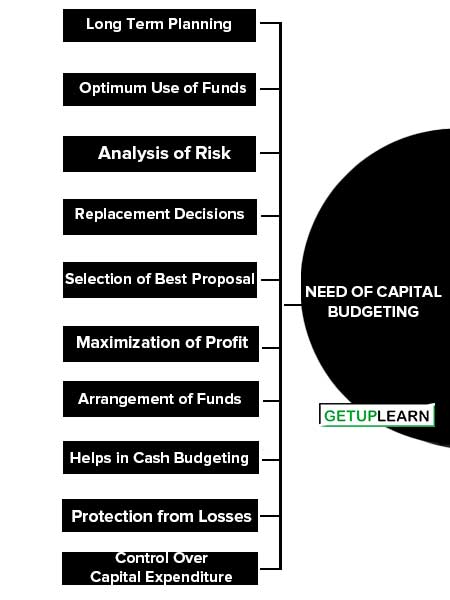

1 Need of Capital Budgeting

- 1.1 Long Term Planning

- 1.2 Optimum Use of Funds

- 1.3 Analysis of Risk

- 1.4 Replacement Decisions

- 1.5 Selection of Best Proposal

- 1.6 Maximization of Profit

- 1.7 Arrangement of Funds

- 1.8 Helps in Cash Budgeting

- 1.9 Protection from Losses

- 1.10 Control Over Capital Expenditure

- 1.11 Helps in Formulation of Depreciation Policy

- 2 FAQs Related to the Need of Capital Budgeting

Need of Capital Budgeting

Capital budgeting decisions are of paramount importance in financial decision-making. These decisions are related to fixed assets which in generating earnings for the firm. These decisions are the most crucial and critical and they have a significant impact on the profitability aspect of the firm.

These are some major need for capital budgeting:

- Long Term Planning

- Optimum Use of Funds

- Analysis of Risk

- Replacement Decisions

- Selection of Best Proposal

- Maximization of Profit

- Arrangement of Funds

- Helps in Cash Budgeting

- Protection from Losses

- Control Over Capital Expenditure

- Helps in Formulation of Depreciation Policy

Long Term Planning

Capital expenditure is a strategic investment of some magnitude and is of a non-routine nature. It has economic life and its benefits continue over a series of years.

Optimum Use of Funds

Capital investment decisions require an amount of funds. Capital is a scarce resource of business. So it is essential to utilize capital in such a manner so that the wealth of l shareholders may be increased Capital budgeting ensures optimum utilization of larger the business.

Analysis of Risk

Capital budgeting helps in analyzing the risk involved in various projects under consideration. Capital expenditures involve greater risks as they require huge investments.

Replacement Decisions

Capital budgeting helps in taking decisions regarding the replacement of an old asset by a new one. The new asset may be useful and profitable for the business. A comparative study is made between these options and profitable decisions may be taken.

Selection of Best Proposal

Capital budgeting suggests the best proposal available. This is done by using various modern techniques of capital budgeting.

Maximization of Profit

Fixed assets generate earnings and require huge investments. Capital budgeting decisions ensure the best utilization of fixed assets. Cost control and reduction in cost ensure the maximization of the profit of the business.

Arrangement of Funds

There are many sources for collecting funds and each has its own cost and merits and demerits. Capital budgeting decision helps in determining the economic source of capital.

Helps in Cash Budgeting

Capital budgeting helps in preparing the cash budget of the firm. It is helpful in the forecasting of cash requirements.

Protection from Losses

Capital expenditure decisions are not reversible. A wrong decision may be the cause of business failure. Capital budgeting protects from such: may occur due to lack of knowledge.

Control Over Capital Expenditure

Capital budgeting helps in controlling capital expenditures. Actual performance may be compared with budgeted results and necessary actions may be taken by management.

Helps in Formulation of Depreciation Policy

Capital budgeting helps in determining the depreciation policy of fixed assets. A proper method of depreciation should be adopted to calculate the correct cost of the product and also to reduce tax liability.

What is the need of Capital Budgeting?

The following are the need of capital budgeting:

1. Long-Term Planning

2. Optimum Use of Funds

3. Analysis of Risk

4. Replacement Decisions

5. Selection of Best Proposal

6. Maximization of Profit

7. Arrangement of Funds

8. Helps in Cash Budgeting

9. Protection from Losses

10. Control Over Capital Expenditure

11. Helps in the Formulation of Depreciation Policy.