Table of Contents

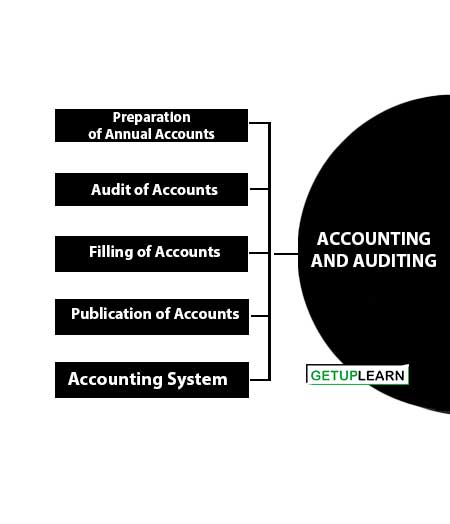

Accounting and Auditing

The provisions of the Act relating to annual accounts and audits of banking companies are given in sections 29-33 and are as follows:

- Preparation of Annual Accounts

- Audit of Accounts

- Filling of Accounts

- Publication of Accounts

- Accounting System

Preparation of Annual Accounts

On 31st March each and every banking company incorporated in India, in respect of all business transacted by it, and every banking company incorporated outside India, in respect of all business transacted through its branches in India shall prepare with reference to that year a balance sheet and profit and loss account as on the working day of the year in the forms set out in Third Schedule or as near thereto as circumstances admit.

Form A in the third schedule is the Balance Sheet and Form B is the Profit and Loss Account. Form A and B have been revised w.e.f. 1st April 1991. In other words, the annual accounts for the year ending 31st March 1992 and onwards are to be prepared in new formats as given in the book.

Audit of Accounts

The balance sheet and the Profit and Loss Account of a banking company are required to be audited by a Chartered Accountant. The appointment of the auditor of a banking company is made as per the provisions of the Companies Act, of 1956.

His powers, duties, and liabilities are also governed by the Companies Act, but the auditor’s report on the accounts of a banking company must include certain additional particulars.

Filling of Accounts

Three copies of the audited Balance Sheet and Profit and Loss Account together with the Auditors’ report shall be furnished as returns to the RBI within three months from the end of the accounting year to which it relates. This period of three months can be extended by the Reserve Bank for a further period of up to three months.

Reserve Bank is authorized to call for any further information as it may think proper from a banking company relating to the business of such a company.

Publication of Accounts

The Balance sheet, Profit and Loss Account, and Auditor’s report of each banking company shall be published in any newspaper circulating at the place where it has the principal office, within six months from the end of the accounting year.

Accounting System

The accounting system of a banking company is different from that of a trading or manufacturing enterprise. A bank has a large member of customers whose accounts are to be maintained in such a way that these should be kept up-to-date and checked regularly. The following are the main features of a bank’s accounting system:

- Entries in the personal ledgers are made directly from the vouchers.

- From such entries in the personal ledgers each day summary sheets in total are prepared which are posted to the control accounts in the general ledger.

- The general ledger trail balance is extracted and agreed upon every day.

- All entries in the personal ledgers and summary sheets are checked by persons other than those who made the entries with the result that most clerical mistakes are detected before another day begins.

- A trial balance of detailed personal ledgers is prepared periodically (generally after two weeks) and gets agreed upon with the general ledger control accounts.

- Two vouchers are prepared for every transaction not involving cash –one debit voucher and another credit voucher.