Table of Contents

- 1 What is a Bank?

- 2 Origin of Banking

- 3 Ancestors of Modern Bank

- 4 Meaning of Banking

- 5 Definition of Banking

-

6 Features of Bank

- 6.1 Commercial Establishment

- 6.2 Individual or Firm or Company

- 6.3 Acceptance of Deposits

- 6.4 Provide Safety to Money

- 6.5 Advancing Loans

- 6.6 Payment and Withdrawal

- 6.7 Agency and Utility Services

- 6.8 Profit and Service Organisation

- 6.9 Credit Creation

- 6.10 Ever Increasing Functions

- 6.11 Banking Business

- 6.12 Name Identity

- 7 Principles of Banking

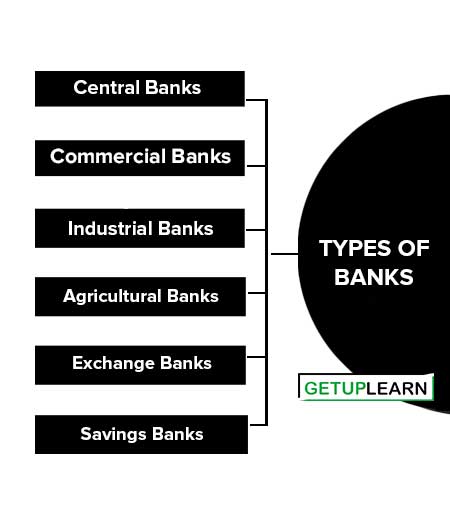

- 8 Types of Banks

- 9 FAQs Related to the What is a Bank?

What is a Bank?

A bank is a financial institution that accepts deposits from the public and leads those who need it thereby making a profit out of it. The lending rate of a bank is higher than the rate it pays to its depositors. A bank, therefore, acts as a reservoir into which the idle surplus money of individuals and households flows and from which loans are given to needy borrowers.

Besides this, a modern bank performs various other functions such as credit creation, agency work, and general services besides dealing in money. Using banks and the many services they offer saves an incredible amount of time and ensures that the funds of micro as well as macroeconomic agents “pass hands” in a legal and structured manner. There are also other types of financial institutions that operate just like banks.

Origin of Banking

The origin of banking can be traceable to the early times of human history. In ancient Rome and Greece, the practice of storing precious metals and coins at safe places and loaning out money for public and private purposes on interest was prevalent.

In India, the reference to money lending business is found in the ‘Manu Smrite’. The origin of banking lies in the business of money changing in ancient days. The emergence of banks in the early period was the need for borrowing by monarchial governments from finance companies. In the middle ages, in Italy the first public enterprise bank called the ‘Bank of Venice’ was established in 1157.

History shows the existence of a ‘Monte’ in Florence in 1336. Monte means – a standing bank or amount of money. The word ‘Bank’ is derived from the Greek word ‘banque’ or the Italian word ‘Banco’, which means a bench.

A bench is a place at which money lenders and money chargers are used to display their coins and transact the business. The modern banking business was first started in 1349 in Barcelona. In 1407 Bank of Genoa, and in 1609 Bank of Amsterdam were established. In England, initially, The Bank of England was established in 1694 on Italian lines to support the government with finance.

Modern Joint-stock commercial Banks came into existence with the passage of the Banking Act of 1833 in England. In India, modern banking started when the English agency houses in Calcutta and Bombay began to serve as bankers to the East India Company. The Hindustan Bank was the first banking institution of its kind, established in 1779.

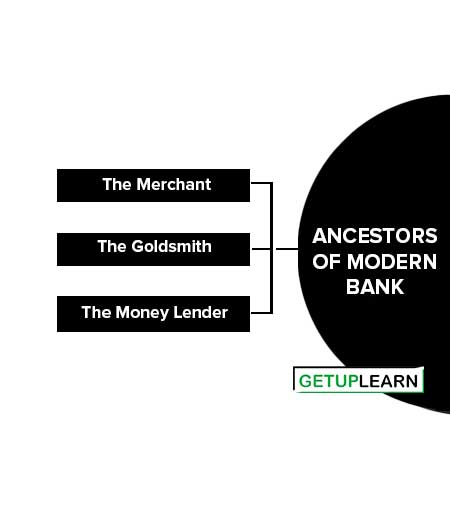

Ancestors of Modern Bank

According to Crowther, There are three ancestors of modern banks:

The Merchant

The Merchant banker forms the earliest stage in the evolution of modern banking. Trading activities require remittances of money from one place to another. Because of the possibility of theft of metallic money during transportation, traders issued documents like hundi or letters of transfer to remit the funds. Modern banks remit.

The Goldsmith

The goldsmith ancestry of the modern banks is purely an English affair. Since goldsmiths dealt with precious metals, they necessarily provided secure safe to protect them.

In a period when money consisted of gold and silver, because of the danger of theft, people started leaving their precious bullion and coins in the custody of goldsmiths. As the practice of safeguarding others’ money became widespread the goldsmiths began imposing charges for the safekeeping service.

The Money Lender

The goldsmiths soon realized that daily withdrawals were equal to daily deposits and only a contingency reserve was required for the periods when withdrawals exceeded deposits.

After keeping this reserve, the goldsmiths loaned out the remaining deposits on interest. Thus, the money lender performs two functions of a bank i.e., accepting deposits and advancing loans.

Crowther says “The progeny of money-lender are concerned with flat money, piled up money, savings. The progeny of goldsmiths are concerned with round money, circulating money, and cash. The modern bank performs both functions.

Meaning of Banking

A bank is a financial institution that accepts deposits from the public and leads those who need it thereby making a profit out of it. The lending rate of a bank is higher than the rate it pays to its depositors.

A bank, therefore, acts as a reservoir into which the idle surplus money of individuals and households flows and from which loans are given to needy borrowers. Besides this, a modern bank performs various other functions such as credit creation, agency work, and general services besides dealing in money.

Using banks and the many services they offer saves an incredible amount of time and ensures that the funds of micro as well as macroeconomic agents “pass hands” in a legal and structured manner. There are also other types of financial institutions that operate just like banks.

Definition of Banking

These are the following definitions of banking or bank by the authors:

A bank “collects money from those who have it to spare or who are saving it out of their incomes, and it lends this money to those who require it”.

Crowther

A bank is an establishment that makes to individuals such advances of money as may be required and safely made, and to which individuals entrust money when not required by them for use.

Getuplearn

Nobody can be a banker who does not (1) take deposit accounts (2) take current accounts, (3) issue and pay cheques and (4) collects cheques – crossed and uncrossed for its customers”.

John Paget

A banking company is one which carries on as its principal business, the acceptance of money deposits on current account or otherwise subject to withdrawal by cheque, draft or order.

Indian Central Banking Enquiry Committee

Bank is an establishment for the custody of money, which it pays out on customer’s order.

Oxford Dictionary

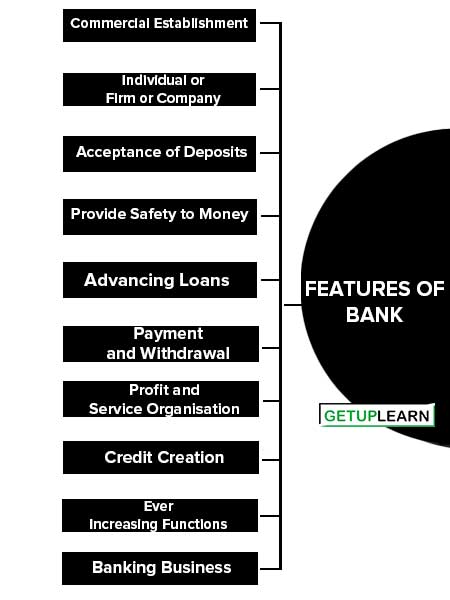

Features of Bank

These are the various features of bank:

- Commercial Establishment

- Individual or Firm or Company

- Acceptance of Deposits

- Provide Safety to Money

- Advancing Loans

- Payment and Withdrawal

- Agency and Utility Services

- Profit and Service Organisation

- Credit Creation

- Ever Increasing Functions

- Banking Business

- Name Identity

Commercial Establishment

A commercial bank is a commercial establishment that deals in money. It accepts money as deposits and advances loans in cash and cheques.

Individual or Firm or Company

A bank may be an individual, a firm, or a joint stock company. A banking company refers to a company that is in the business of banking.

Acceptance of Deposits

A bank accepts money from customers in the form of deposits which are generally payable on demand or after the expiry of a specified period.

Provide Safety to Money

A bank provides safety to the money of its clients. It also performs the role of custodian of funds of its customers.

Advancing Loans

A bank lends out money in the form of advances or loans to those who need it for different purposes. The public can borrow from banks to meet their needs and requirements.

Payment and Withdrawal

A bank offers easy payment and withdrawal facilities to its clients through cheques and drafts. It also brings bank money into circulation. This money circulation is in the form of cheques, drafts, etc.

Agency and Utility Services

A bank offers different banking facilities to its clients which involve general facility services and agency services such as transfer of funds, collection of dividends, payment on behalf of customers, etc.

Profit and Service Organisation

A bank being a financial intermediary is a profit-seeking institution with having service-oriented approach.

Credit Creation

A bank can create credit i.e., the creation of additional money for lending.

Ever Increasing Functions

Banking is an evolutionary approach. A bank expands and diversifies regularly as regards its functions, services, and activities.

Banking Business

The main function of a bank should be to perform banking business which should not be a subsidiary of any other business.

Name Identity

A bank should always add the word ‘Bank’ to its name to enable the public to know that it is a bank and it deals in money and debts.

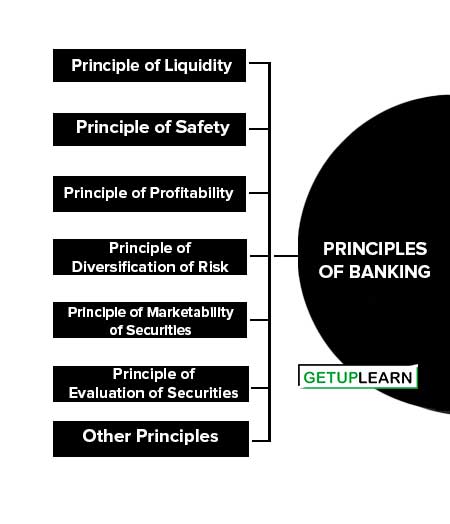

Principles of Banking

Banks are financial institutions. Their principal function is to accept deposits from the people and make investments in the deposits. Investment is done with a view to maximizing profits, without sacrificing the ‘liquidity’ and ‘security’ of the assets. These are the principles of banking which explained below:

- Principle of Liquidity

- Principle of Safety

- Principle of Profitability

- Principle of Diversification of Risk

- Principle of Marketability of Securities

- Principle of Evaluation of Securities

- Other Principles

Principle of Liquidity

The banks must ensure that they have sufficient liquid power all the time. At any time must be in a position to honor all their commitments of liquidity.

The banks should invest only in those sources which have the merit of shift ability without loss. Short-period loans have this merit. Banks should, therefore, give loans only to generate working capital. Loans should not be given for fixed assets as it is difficult to convert fixed assets into cash.

Principle of Safety

Banks should invest their capital only in safe channels. Safe investments are those which do not sink or fall in value. Banks should avoid investing in speculation activity, as it is often highly risky and uncertain.

Also, proper management of capital requires that the entire capital is not invested in terms of loans to one individual or firm. Long-period investment should generally be avoided.

Principle of Profitability

While making investments, banks should not care for liquidity and safety alone. Profits should also be maximized. Generally, it is found that liquidity and profitability are opposite to each other. Capital in cash is a liquid asset, it does not yield any income.

On the other hand, long-period investments yield much income but are less liquid. An efficient investor must strike a balance between liquidity and profitability. One should not be unnecessarily forgone for the sake of the other. One can thus state that to take full care of its liquidity and safety, a bank should try to maximize its profits.

Principle of Diversification of Risk

A bank should not invest its entire capital in one kind of trade or industry. Capital should be invested in different kinds of trade, securities, and loans so that losses in one place could be made up with profits elsewhere.

If the entire capital is invested only in one kind of activity or trade, there is always the danger of capital loss. Thus, capital should be invested across diversified activities.

Principle of Marketability of Securities

A bank must make investments in such securities which are easily sold in the market in times of emergency. Investment should be made in trade bills, ready stocks or shares, and debentures of famous companies.

These investments not only have the merit of liquidity and safety but also of marketability. Investment in long-period loans should be avoided as these loans lack the merit of marketability.

Principle of Evaluation of Securities

A bank must evaluate the securities offered by the borrowers. It must make sure that the value of security exceeds the value of loans. If the value of security is likely to decrease in the near future, the bank must seek additional security to avoid the possible risk of losses.

Other Principles

A bank must formulate its investment policy parallel to the investment policy of the central bank of the country. So that in times of emergency, it can seek loans from the central bank. Besides, priority must be given to investment in such securities which are income tax-free or which carry less tax.

Types of Banks

Financial requirements in a modern economy are of diverse nature, distinctive variety, and large magnitude. Hence different types of banks have been established to cater to the varying needs of the community. Banks in the organized sector may be classified as:

Central Banks

A central bank is the apex financial institution in the banking and financial system of the country. It acts as a leader in the money market. It supervises, controls, and regulates the activities of the Commercial banks. It is a service-oriented financial institution primarily related to the ordering, supervising regulating, and development of the banking system in the country.

It can influence monetary and credit Conditions and financial developments in a country. It has the responsibility of carrying out the monetary and credit policies. India’s central bank is the Reserve Bank of India, established in 1935 as a shareholders’ organization. It was nationalized in 1949.

Functions of Central Bank

It is difficult to lay down the hard and fast rules regarding the functions of the central bank. The most important function of the central bank is that it is a bank of issue. And the central banks perform functions for the welfare of the public and for the development of the country. Its functioning is different from that of the Commercial bank.

The functions of a central bank are of a very special character calling for skill, experience, and judgment. Traditionally the central bank performs the function of monetary management. But now-a-day the changing objectives of the central bank aim at the development of the country. Following are the functions of the central bank.

- Note issue

- Banker, Agent, and Advisor of Government

- Bankers Bank

- Custodian of Cash Reserves

- Custodian of Foreign Exchange Reserves

- Controller of Credit created by Banks

- Implementing Government Monetary Policy

Commercial Banks

These banks perform all kinds of banking business and generally finance trade and commerce. Their deposits are for a short period. These banks normally advance short-term loans to businessmen and traders and avoid medium-term and long-term lending.

However commercial banks have extended their areas of operations to medium-term and long-term finance. The majority of the commercial banks are in the public sector. But there are certain private sector banks operating as joint stock companies. Hence, commercial banks are also called joint-stock banks.

In the modern world, banks perform a variety of functions. They are (1) Primary Functions, (2) Secondary Functions.

Primary Functions

-

Accepting Deposits: Banks accept deposits from the public to attract savings from all classes of individuals, banks maintain different types of accounts.

- Fixed Deposit Accounts

- Current Deposit Accounts

- Savings Deposit Accounts

- Recurring Deposit Accounts

- Special Deposit Accounts

-

Advancing Loans: After keeping certain cash reserves, the banks lend their deposits to needy borrowers. Various types of loans granted by the banks are:

- Money at call and short notice

- Cash Credit

- Overdraft

- Discounting Bills of Exchange

- Term Loans

- Credit Creation

- Promoting Cheque System

Secondary Functions

-

Agency Functions: Banks also perform certain agency functions on behalf of their customers:

- Remittance of Funds

- Collection and Payment of Credit Instruments

- Execution of Standing Orders

- Purchasing and Sale of securities

- Collection of dividends on shares

- Acts as a trustee and executor g) Acts as a representative and correspondent etc.

-

General Utility Services: In addition to agency services, modern banks provide many general utility services as given below:

- Locker Facility

- Travelers Cheques

- Letter of Credit

- Collection of Statistics

- Underwriting Securities

- Gift Cheques

- Acts as a Referee

- Foreign Exchange Business.

Industrial Banks

Industrial banks also known as investment banks, mainly meet the medium-term and long-term financial needs of industries. In India, the Indian Financial Corporation of India, State Finance Corporation etc are playing significant role in industrial development.

Functions of Industrial Banks

- Accepts long-term deposits.

- Grant long-term loans to purchase land, machinery, equipment, etc.

- Sell or underwrite the shares and debentures of the industrial firm.

- Provides information regarding the general economic position of the economy.

Agricultural Banks

Agriculture requires both short-term and long-term capital. Short-term capital is necessary to buy the seed and to meet the transplantation expenses. Long-term finance is needed to buy land and make improvements. As a result, the cooperative movement was started in India.

The history of Indian cooperative banking started with the passing of the cooperative societies Act in 1904. Later many amendments were made and many acts were passed. As a result of three-tier structure of the cooperative banking system was established in India. They are:

-

Primary Co-operative Banks or Primary Agricultural Credit Societies: In rural areas, there are primary cooperative banks that provide short-term and medium-term credit needs of the farmers. It accepts deposits, grants loans, and collects repayments. It acts as a link between the borrowers on the one hand and the other cooperative banks and the Reserve Bank, on the other hand.

-

District Cooperative Banks: These cooperatives are in the middle of the three-tier structure. The main function of this bank is to provide loans to primary cooperative societies. However, loans are also given to individuals and others.

- State Co-operative Banks: They are the apex in the three-tier structure, operating at the state level. The main function of state cooperative banks is to finance, control and supervise the district cooperative banks and through them, the primary banks.

Exchange Banks

Exchange banks finance foreign trade. They specialize in the foreign exchange business. They do have branches in important ports of the world.

Functions of Exchange Banks

- Collects information regarding importers and exporters.

- Accepts and discounts foreign bills.

- Issues letter of credit.

Savings Banks

The main purpose of saving banks is to promote saving habits among the general public. In India, postal saving banks do this job.

Functions of Saving Banks

- Promotes saving habits of the public.

- Issues postal cash certificates.

What is the meaning of banking?

A bank is a financial institution that accepts deposits from the public and leads those who need it thereby making a profit out of it. The lending rate of a bank is higher than the rate it pays to its depositors.

What is the best definition of banking?

A banking company is one which carries on as its principal business, the acceptance of money deposits on a current account or otherwise subject to withdrawal by cheque, draft, or order.

What are the features of bank?

The following are the features of the bank: 1. Commercial Establishment 2. Individual or Firm or Company 3. Acceptance of Deposits 4. Provide Safety to Money 5. Advancing Loans 6. Payment and Withdrawal 7. Agency and Utility Services 8. Profit and Service Organisation 9. Credit Creation 10. Ever-Increasing Functions.

What are the principles of banking?

The principles of banking are explained below:

1. Principle of Liquidity

2. Principle of Safety

3. Principle of Profitability

4. Principle of Diversification of Risk

5. Principle of Marketability of Securities

6. Principle of Evaluation of Securities.

What are the types of banks?

The types of banks are 1. Central Banks 2. Commercial Banks 3. Industrial Banks 4. Agricultural Banks 5. Exchange Banks 6. Savings Banks.