Table of Contents

What is the Evaluation of Investment Proposals?

Evaluating investment proposals involves a number of methods and techniques to determine the potential profitability and risk associated with a particular investment. These methods help decision-makers to choose the most viable and profitable investment.

Three steps are involved in the evaluation of an investment:

- Estimation of cash flows.

- Estimation of the required rate of return (the opportunity cost of capital).

- Application of a decision rule for making the choice. Specifically, we focus on the merits and demerits of various decision rules.

Investment Decision Rule

The investment decision rules may be referred to as capital budgeting techniques, or investment criteria. A sound appraisal technique should be used to measure the economic worth of an investment project.

The essential property of a sound technique is that it should maximize the shareholders’ wealth. The following other characteristics should also be possessed by a sound investment evaluation criterion:

- It should consider all cash flows to determine the true profitability of the project.

- It should provide an objective and unambiguous way of separating good projects from bad projects.

- It should help the ranking of projects according to their true profitability.

- It should recognize the fact that bigger cash flows are preferable to smaller ones and early cash flows are preferable to later ones.

- It should help to choose among mutually exclusive projects that project which maximize the shareholders’ wealth.

- It should be a criterion that is applicable to any conceivable investment project independent of others

These conditions will be clarified as we discuss the features of various investment criteria in the following pages.

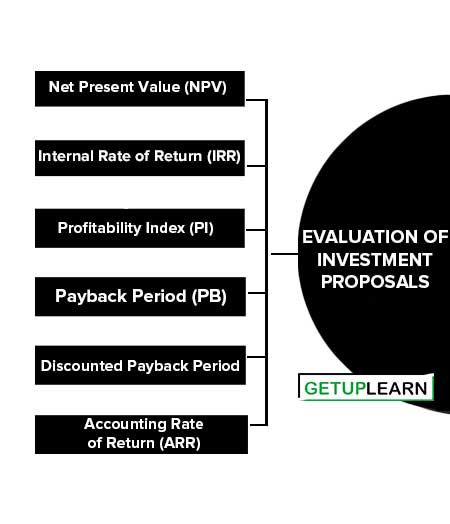

Evaluation Criteria: A number of investment criteria (or capital budgeting techniques) are in practice. They may be grouped into the following two categories:

- Discounted Cash Flow (Dcf) Criteria

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Profitability Index (PI)

- Non-discounted Cash Flow Criteria

- Payback (PB) Period

- Discounted payback period

- Accounting Rate of Return (ARR).

Evaluation of Investment Proposals

Here are the most common methods used to evaluate investment proposals:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Profitability Index (PI)

- Payback Period (PB)

- Discounted Payback Period

- Accounting Rate of Return (ARR)

Discounted Cash Flow (Dcf) Criteria

Net Present Value (NPV)

The Net Present Value (NPV) method is the classic economic method of evaluating investment proposals. It is a DCF technique that explicitly recognizes the time value of money. It correctly postulates that cash flows arising at different time periods differ in value and are comparable only when their equivalent’s present values are found out. The following steps are involved in the calculation of NPV:

- The cash flows of the investment project should be forecasted based on realistic assumptions.

- An appropriate discount rate should be identified to discount the forecasted cash flows. The appropriate discount rate is the project’s opportunity cost of capital, which is equal to the required rate of return expected by investors on investments of equivalent risk.

- The present value of cash flows should be calculated using the opportunity cost of capital as the discount rate.

- The net present value should be found by subtracting the present value of cash outflows from the present value of cash inflows. The project should be accepted if NPV is positive (i.e., NPV > 0).

Net Present Value Advantages and Disadvantages

| S.No. | NPV Advantages | NPV Disadvantages |

| 1. | Considers all cash flows. | Requires estimates of cash flows which is a tedious task. |

| 2. | A True measure of profitability. | Requires computation of the opportunity cost of capital which poses practical difficulties. |

| 3. | Recognizes the time value of money. | Ranking of investments is not independent of the discount rates |

| 4. | Satisfies the value-additivity principle (i.e., NPVs of two or more projects can be added). | |

| 5. | Consistent with the Shareholders’ Wealth Maximization (SWM) principle. |

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) method is another discounted cash flow technique, which takes into account the magnitude and timing of cash flows.

Other terms used to describe the IRR method are yield on an investment, marginal efficiency of capital, rate of return over cost, time-adjusted rate of internal return, and so on. The concept of internal rate of return is quite simple to understand in the case of a one-period project.

Internal Rate of Return Advantages and Disadvantages

| S.No. | Advantages of Internal Rate of Return | Disadvantages of Internal Rate of Return |

| 1. | Considers all cash flows. | Requires estimates of cash flows which is a tedious task. |

| 2. | True measure of profitability. | Does not hold the value additivity principle (i.e., IR of two or more projects do not add). |

| 3. | Based on the concept of the time value of money. | At times fails to indicate a correct choice between mutually exclusive projects. |

| 4. | Generally, consistent with the wealth maximization principle. | At times yields multiple rates. |

| 5. | Relatively difficult to compute. |

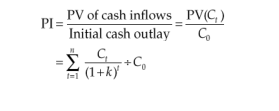

Profitability Index (PI)

Yet another time-adjusted method of evaluating investment proposals is the benefit–cost (B/C) ratio or profitability index (PI). The profitability index is the ratio of the present value of cash inflows, at the required rate of return, to the initial cash outflow of the investment. The formula for calculating the benefit-cost ratio or profitability index is as follows:

Profitability Index Advantages and Disadvantages

| S.No. | Advantages of Profitability Index | Disadvantages of Profitability Index |

| 1. | Considers all cash flows. | Requires estimates of the cash flows which is a tedious task. |

| 2. | Recognizes the time value of money. | At times fails to indicate a correct choice between mutually exclusive projects. |

| 3. | A relative measure of profitability. | |

| 4. | Generally consistent with the wealth maximization principle. |

Non-discounted Cashflow Criteria

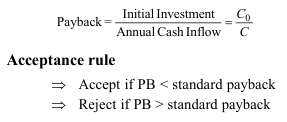

Payback Period (PB)

Payback (PB) is one of the most popular and widely recognized traditional methods of evaluating investment proposals. Payback is the number of years required to recover the original cash outlay invested in a project. If the project generates constant annual cash inflows, the payback period can be computed by dividing the cash outlay by the annual cash inflow. That is:

Payback Period Advantages and Disadvantages

| Advantages of Payback Period | Disadvantages of Payback Period |

| 1. Easy to understand and compute and inexpensive to use. 2. Emphasizes liquidity. 3. Easy and crude way to cope with risk. 4. Uses cash flow information. |

1. Ignores the time value of money. 2. Ignores cash flows occurring after the payback period. 3. Not a measure of profitability. 4. No objective way to determine the standard payback. 5. No relation with the wealth maximization principle |

Discounted Payback Period

One of the serious objections to the payback method is that it does not discount the cash flows for calculating the payback period. We can discount cash flows and then calculate the payback.

The discounted payback period is the number of periods taken in recovering the investment outlay on the present value basis. The discounted payback period still fails to consider the cash flows occurring after the payback period.

The discounted payback period for a project will be always higher than the simple payback period because its calculation is based on discounted cash flows. Discounted payback rule is better as it discounts the cash flows until the outlay is recovered.

Accounting Rate of Return (ARR)

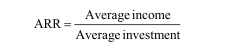

The Accounting Rate of Return (ARR), also known as the Return On Investment (ROI), uses accounting information, as revealed by financial statements, to measure the profitability of an investment. The accounting rate of return is the ratio of the average after-tax profit divided by the average investment.

The average investment would be equal to half of the original investment if it were depreciated constantly. Alternatively, it can be found by dividing the total of the investment’s book values after depreciation by the life of the project. The accounting rate of return, thus, is an average rate and can be determined by the following equation:

Accounting Rate of Return Advantages and Disadvantages

| Advantages Of Accounting Rate Of Return | Disadvantages of Accounting Rate of Return |

| 1. Uses accounting data with which executives are familiar. 2. Easy to understand and calculate. 3. Gives more weightage to future receipts. |

1. Ignores the time value of money. 2. Does not use cash flows. 3. No objective way to determine the minimum acceptable rate of return. |

FAQs About the Evaluation of Investment Proposals

What are the five methods of evaluating investment proposals?

These are the most common methods used to evaluate investment proposals:

1. Net Present Value (NPV)

2. Internal Rate of Return (IRR)

3. Profitability Index (PI)

4. Payback Period (PB)

5. Discounted Payback Period

6. Accounting Rate of Return (ARR).