Table of Contents

What is Cost of Capital?

Cost of capital may be defined as the rate that must be earned on the net proceeds to provide the cost elements of the burden at the time they are due.

Cost of capital, for an investor, is the measurement of the disutility of funds in the present as compared to the return expected in the future. From the firm’s point of view, its meaning is somewhat different. From its point of view, the cost of capital is the required rate of return needed to justify the use of capital.

On the other hand, Cost of capital is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. Cost of capital is the required rate of return on its investments which belongs to equity, debt, and retained earnings.

If a firm fails to earn a return at the expected rate, the market value of the shares will fall and it will result in the reduction of the overall wealth of the shareholders.

Definition of Cost of Capital

These are some simple definitions of cost of capital given by the authors:

[su_quote cite=”John J. Hampton”]Cost of capital is the rate of return the firm required from investment in order to increase the value of the firm in the marketplace.[/su_quote]

[su_quote cite=”Solomon Ezra“]Cost of capital is the minimum required rate of earnings or the cut-off rate of capital expenditure.[/su_quote]

[su_quote cite=”C. Van Horne”]Cost of capital is “A cut-off rate for the allocation of capital to the investment of projects. It is the rate of return on a project that will leave unchanged the market price of the stock.[/su_quote]

Thus, it is clear from the above that the cost of capital is the minimum rate of return that a company is expected to earn from a proposed project so as to make no reduction in the earning per share to equity shareholders and its market price. It is the combined coal of each type of source by which a firm raises funds.

Assumptions of Cost of Capital

These are the assumptions of cost of capital while computing the cost of capital:

- The cost can be either explicit or implicit.

- The financial and business risks are not affected by investing in new investment proposals.

- The firm’s capital structure remains unchanged.

- The cost of each source of capital is determined on an after-tax basis.

- Costs of previously obtained capital are not relevant for computing the cost of capital to be raised from a specific source.

- It consists of three important risks such as zero risk level, business risk, and financial risk. The cost of capital can be measured with the help of the following equation.

K = rj + b + f.

Where,

K = Cost of capital.

rj = The riskless cost of the particular type of finance.

b = The business risk premium.

f = The financial risk premium.

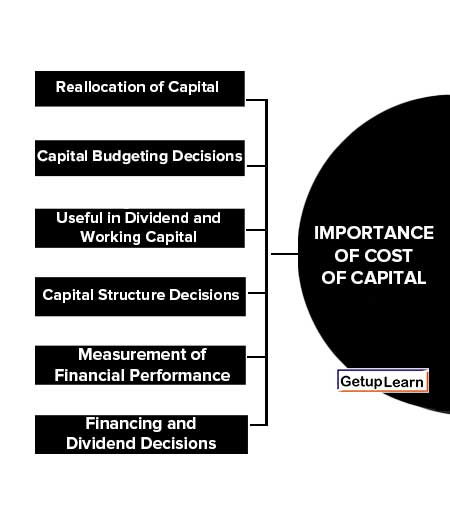

Importance of Cost of Capital

The primary functions of every finance manager are to arrange adequate capital for the firm from various sources of funds at the lowest possible cost and to maintain the market value as well. The cost of capital is a very important concept in financial management.

Prior to the development of the concept of cost of capital, the problem was ignored or bypassed. The progressive management always takes notice of the cost of capital while taking a financial decision. The importance of cost of capital is explained below:

- Reallocation of Capital

- Capital Budgeting Decisions

- Useful in Dividend and Working Capital

- Capital Structure Decisions

- Measurement of Financial Performance

- Financing and Dividend Decisions

Reallocation of Capital

This concept is very useful in the allocation of capital to various investment proposals. It is the cornerstone of the investment decisions. The main goal of financial management is the wealth maximization of its shareholders. So the company must choose only those investment opportunities that are financially beneficial to the shareholders.

Capital Budgeting Decisions

It measures the financial performance and determines the acceptability of all investment opportunities by discounting cash flows under the present value method. The cost of capital being the minimum rate of return desired, is used to compare with the actual rate of return (internal rate of return). Thus, the cost of capital provides the criterion of accepting or rejecting the proposals in capital expenditure decisions.

Useful in Dividend and Working Capital

Useful in Dividend Policy and Working Capital Management: The measurement of the cost of capital helps the management in taking decisions relating to dividend policy and working capital requirements.

Capital Structure Decisions

While designing an optimal capital structure, the management should raise capital from different sources in such a way that it optimizes the risk and cost factors.

Measurement of Financial Performance

The cost of the capital framework can be used to evaluate the financial performance of top management. If the actual profitability of the project is more than the projected and the actual cost of capital, the performance may be said to be satisfactory.

Financing and Dividend Decisions

Other important financial decisions can also be taken with the help of cost of capital such as regarding dividend policy, capitalization of profits, and selecting different sources of capital.

Types of Cost of Capital

There is four basis of types of cost of capital:

- Historical Cost and Future Cost

- Specific Cost and Composite Cost

- Average Cost and Marginal Cost

- Explicit Cost and Implicit Cost

Historical Cost and Future Cost

Historical costs are those which are calculated on the basis of the existing capital structure. Future cost relates to the cost of funds intended to finance the expected project, historical costs are useful for analyzing the existing capital structures. Future costs are widely used in capital budgeting and capital structure design decisions.

Specific Cost and Composite Cost

The cost of individual sources of capital is referred to as the specific cost and the cost of capital of all the sources combined is termed as composite cost. It is, thus the weighted cost of capital.

Average Cost and Marginal Cost

The average cost is the average of the various specific costs of the different components of capital structure at a given time. The marginal cost of capital is the average cost which is concerned with the additional funds raised by the firm. It is very important in capital budgeting decisions.

Explicit Cost and Implicit Cost

An explicit cost is the discount rate which equates the present value of cash inflows with the present value of cash outflows. In other words, it is the internal rate of return of cash flows. Implicit cost is also known as opportunity cost. It may be defined as the rate of return associated with the best investment opportunity for the firm.

Factors Affecting Cost of Capital

These are the most important factors affecting cost of capital of a firm:

- Nature of Business

- Requirements of Firm

- Attitude of Management

- Financing Mix Decision

- Business Risk and Financial Risk

Nature of Business

Firms that require heavy investments in fixed assets bear a high cost of funds in comparison to firms that require low investments in fixed assets.

Requirements of Firm

Firms requiring large amounts of funds consequently bear higher costs compared to firms requiring less amount of funds because large fund requirements lead to heavy external borrowings.

Attitude of Management

If the company’s management is aggressive, it will have less liquid funds thereby decreasing its total cost, a conservative management will keep a large amount of funds leading to an increase in total cost.

Financing Mix Decision

The overall cost of capital of the firm is decided on the basis of the proportion of different sources of funds. The high proportion of high-cost funds will increase the total cost and the low proportion of high-cost funds will decrease the total cost.

Business Risk and Financial Risk

If the business risk of a firm is high, its cost of capital increases, and as the financial risk increases bankruptcy risk also increases for a given firm. The higher the risk of bankruptcy, the higher the cost of capital.

Problems in Determination of Cost of Capital

The determination of cost of capital is not an easy task. The financial manager is confronted with a large number of problems. These problems in determination of cost of capital can briefly be summarized as follows:

- Computation of Cost of Equity

- Problems of Weight

- Determination of Cost of Retained Earnings

- Conceptual Controversy

- Future Cost Versus Historical Cost

Computation of Cost of Equity

Determination of cost of equity is a difficult task because the equity shareholders value the equity shares of company on the basis of a large number of factors, financial as well as psychological.

Problems of Weight

The assignment of weights to each type of funds is a complex task. The finance manager has to make a choice between the book value to each source of funds and the market value of each source of funds. The result would be different in each case.

Determination of Cost of Retained Earnings

The cost of retained earnings is determined according to the approach adopted for computing the cost of equity shares which is itself a controversial problem.

Conceptual Controversy

There is major controversy whether or not the cost of capital is dependent upon the method and level of financing by the company. According to traditional theorists, a firm can change its overall cost of capital by changing debt-equity mix. On the other hand, the modern theorists reject the traditional view and holds that cost of capital is independent of the method and level of financing.

Future Cost Versus Historical Cost

It is argued that for decision making purposes, the historical cost is not relevant. The future cost should be considered. It, therefore, creates another problem whether to consider marginal cost of capital or average cost of capital.

FAQs About Cost of Capital

What is the meaning of cost of capital?

Cost of capital is the rate of return the firm required from investment in order to increase the value of the firm in the marketplace.

What is the importance of cost of capital?

The following are the importance of cost of capital:

1. Reallocation of Capital

2. Capital Budgeting Decisions

3. Useful in Dividend and Working Capital

4. Capital Structure Decisions

5. Measurement of Financial Performance

6. Financing and Dividend Decisions.

What are the problems in determination of cost of capital?

The problems in determination of cost of capital are:

1. Computation of Cost of Equity

2. Problems of Weight

3. Determination of Cost of Retained Earnings

4. Conceptual Controversy

5. Future Cost Versus Historical Cost.