Table of Contents

What is Capital Budgeting Process?

Capital expenditure or investment planning and control involve a process of facilitating decisions covering expenditures on long-term assets. Since a company’s survival and profitability hinge on capital expenditures, especially the major ones, the importance of capital budgeting or investment process cannot be over-emphasized.

A number of managers think that investment projects have strategic elements, and the investment analysis should be conducted within the overall framework of corporate strategy. Some managers feel that the qualitative aspects of investment projects should be given due importance.

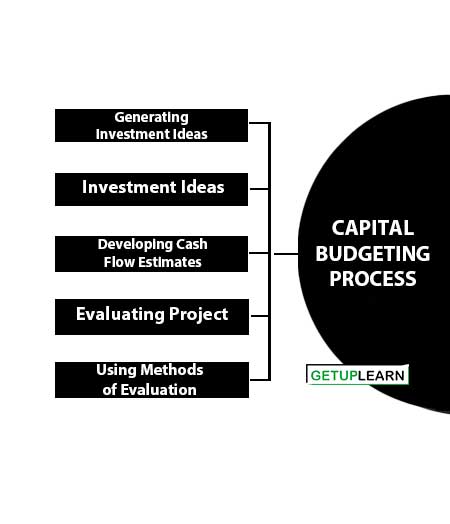

Capital Budgeting Process

The capital budgeting process is the business undertakes to evaluate potential major projects or investments. Its purpose is to identify the most profitable investments or projects. The Capital budgeting process involves the following steps:

- Generating Investment Ideas

- Investment Ideas

- Developing Cash Flow Estimates

- Evaluating Project

- Using Methods of Evaluation

Generating Investment Ideas

Investment opportunities have to be identified or created; they do not occur automatically. Investment proposals of various types may originate at different levels within a firm. Most proposals, like cost reduction or replacement or process or product improvements, take place at the plant level.

The contribution of the top management in generating investment ideas is generally confined to expansion or diversification projects. The proposals may originate systematically or haphazardly in a firm.

The proposal for adding a new product may emanate from the marketing department or from the plant manager who thinks of a better way of utilizing idle capacity.

Investment Ideas

In a number of Indian companies, investment ideas are generated at the plant level. The contribution of the board to idea generation is relatively insignificant. However, some companies depend on the board for certain investment ideas, particularly those that are strategic in nature. Other companies depend on research centers for investment ideas.

Developing Cash Flow Estimates

Estimation of cash flows is a difficult task because the future is uncertain. Operating managers with the help of finance executives should develop cash flow estimates. An operating manager should properly handle the risk associated with cash flows and should also take into account the process of decision-making.

Estimation of cash flows requires the collection and analysis of all qualitative and quantitative data, both financial and non-financial in nature. Large companies would generally have a Management Information System (MIS) providing such data.

Executives in practice do not always have clarity about estimating cash flows. A large number of companies do not include additional working capital while estimating the investment project cash flows. A number of companies also mix up financial flows with operating flows.

Evaluating Project

These are various investment criteria or capital budgeting techniques that are used practically. For example, the production people may be generally interested in having the most modern type of equipment and increased production even if productivity is expected to be low and goods cannot be sold.

This attitude can bias their estimates of the cash flows of the proposed projects. Similarly, marketing executives may be too optimistic about the sales prospects of goods manufactured, and overestimate the benefits of a proposed new product. It is, therefore, necessary to ensure that projects are scrutinized by an impartial group and that objectivity is maintained in the evaluation process.

Using Methods of Evaluation

Most Indian companies use the payback criterion as a method of evaluation. In addition to payback and/or other methods, companies also use Internal Rate of Return (IRR) and Net Present methods. A few companies use the Accounting Rate of Return (ARR) method. IRR is the second most popular technique in India.

The major reason for payback to be more popular than the DCF techniques is the executives’ lack of familiarity with DCF techniques. Other factors are a lack of technical people and sometimes the unwillingness of the top management to use the DCF techniques.

FAQs About the Capital Budgeting Process

What is the capital budgeting process?

These are some steps of the capital budgeting process mentioned below:

1. Generating Investment Ideas

2. Investment Ideas

3. Developing Cash Flow Estimates

4. Evaluating Project

5. Using Methods of Evaluation.