Table of Contents

- 1 What is Investment?

- 2 Definition of Investment

-

3 Functions of Investment

- 3.1 Financial Investment

- 3.2 Economic Investment

- 3.3 Business Investment

- 3.4 General Investment

- 3.5 Wealth Creation

- 3.6 Income Generation

- 3.7 Capital Formation

- 3.8 Risk Management

- 3.9 Retirement Planning

- 3.10 Financing Business Operations

- 3.11 Supporting Innovation and Entrepreneurship

- 3.12 Liquidity Management

- 4 Scope of Investment

- 5 FAQs About the What is Investment?

What is Investment?

Investment is an activity that is engaged in by people who have savings. But all savers are not investors. Investment is different from savings. It means many things to many people. One person may purchase gold in large quantities for the purpose of price appreciation and consider it as his investment.

Another person may take an insurance policy to avail so many benefits offers in the future. That is his investment. Yet another person may lend some amount to somebody with the intention to get interested at a future date and may consider the same as his investment.

In all these cases, one thing is common i.e. the amount is invested with the aim of achieving some additional income or growth in value.

Hence, it involves the commitment of resources that have been saved in the hope that some benefits will accrue in the future. With this discussion, we shall now proceed to see some of the definitions given by the scholars.

Definition of Investment

These are the definitions of investment explained by the authors:

[su_quote cite=”John Maynard Keynes“]Investment is the act of real income creation. It involves building up capital assets from homes to factories, purchase of all kinds of capital goods, and adding to inventories.[/su_quote]

[su_quote cite=”Jack Clark Francis”]Investment can be defined as “committing funds to an asset or project that offers potential profitable returns in the form of interest, income, or appreciation in value.[/su_quote]

[su_quote cite=”F. Amling”]According to F. Amling the term investment means, the purchase by an individual or institutional investor of a financial or real asset that produces a return proportion to the risk assumed over some future investment period.[/su_quote]

[su_quote cite=”Donald E. Fischer and Ronald J. Jordan”]In the words funds are made in the expectation of some positive rate of returns. If the investment is properly undertaken, the return will be commensurate with the risk the investor assumes.[/su_quote]

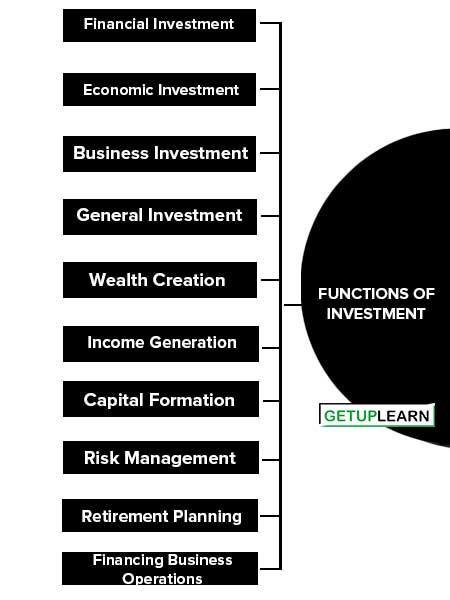

Functions of Investment

Investments serve several crucial functions within the financial and economic context. Here are some of the key functions of investment:

- Financial Investment

- Economic Investment

- Business Investment

- General Investment

- Wealth Creation

- Income Generation

- Capital Formation

- Risk Management

- Retirement Planning

- Financing Business Operations

- Supporting Innovation and Entrepreneurship

- Liquidity Management

Financial Investment

Allocation of monetary resources to assets that are expected to yield some gain or positive return over a given period of time is known as a financial investment. Purchasing of shares, debentures, post office savings certificates, and insurance policies all are investments in financial assets.

These investments range from safe investments to risky investments. Such investments yield return in the form of interest, dividend, rent, premium, pension benefits, or the appreciation of the value of their principal capital. while making investments in these assets, decisions as to type of investment, amount of investment, period of investment, etc. are necessary to be taken.

Economic Investment

According to economists, investment means the net additions to the economy‘s capital stock, which consists of goods and services that are used in the production of other goods and services.

Hence, it includes all types of plant, machinery, equipment, inventory, and construction materials as well as all types of services. Such investments generate physical assets.

Business Investment

Putting money into a private business is known as a business investment. For instance, a man is investing Rs. 2,00,000 in his newly started provisional store. Such an investment is called a business investment.

General Investment

Sometimes, some persons invest in avenues, which do not give any additional income such as interest, dividends, rent, etc., or capital growth. Such people are called The Man on the street‖.

For example, if a person buys a car or scooter for his personal use, such an investment is called a general investment or personal investment. He will not receive any additional income from such an investment.

Wealth Creation

Investments can grow in value over time, leading to an increase in the investor’s wealth. This is especially true for investments like stocks, bonds, and real estate, which have the potential to appreciate in value.

Income Generation

Some types of investments, such as bonds or dividend-paying stocks, generate regular income for the investor. Rental properties can also provide a steady stream of income.

Capital Formation

Investments lead to capital accumulation, contributing to the expansion of industries and businesses, which ultimately boosts economic growth.

Risk Management

Diversified investment can help manage and mitigate financial risk. If one investment performs poorly, others may perform well and balance the overall portfolio performance.

Retirement Planning

Investments play a crucial role in retirement planning. By investing wisely, individuals can ensure they have sufficient funds to maintain their lifestyle in retirement.

Financing Business Operations

Investments provide businesses with the funds necessary to carry out operations, undertake new projects, expand, and innovate.

Supporting Innovation and Entrepreneurship

By investing in start-ups and innovative businesses, investors can help drive technological advancement and economic development.

Liquidity Management

Some investments, like money market instruments, allow investors to manage their liquidity needs effectively.

Scope of Investment

The scope of investment is vast and varied, encompassing a wide range of assets and opportunities. Depending on an individual’s financial goals, risk tolerance, time horizon, and available capital, they can explore the following investment avenues:

- To understand various investment decision rules.

- To know what are the good investments decisions rules.

- To know the category of investment decision rules.

- You can take investment decisions only after analyzing the entire process of investment that starts with funds contribution and ends with getting expectations fulfilled.

- The investment decision rules allow you to formalize the process and specify what condition or conditions need to be met to accept the project.

- You will take the decision only after ensuring that the required expectations in terms of returns are ensured at any cost.

FAQs About the What is Investment?

What is the meaning of investment?

Investment can be defined as “committing funds to an asset or project that offers potential profitable returns in the form of interest, income, or appreciation in value.

What is the simple definition of investment?

Investment is the act of real income creation. It involves building up capital assets from homes to factories, purchase of all kinds of capital goods, and adding to inventories.

What are the functions of investment?

The functions of investment are:

1. Financial Investment

2. Economic Investment

3. Business Investment

4. General Investment

5. Wealth Creation

6. Income Generation

7. Capital Formation

8. Risk Management

9. Retirement Planning.