Table of Contents

- 1 What is Capitalization?

- 2 Definition of Capitalization

- 3 Theories of Capitalization

- 4 Earning Theory of Capitalization

- 5 Overcapitalization

- 6 Causes of Overcapitalization

- 7 Effects of Over Capitalization

- 8 Remedies for Over Capitalization

- 9 Undercapitalization

- 10 Causes of Under-Capitalization

- 11 Effects of Under-Capitalization

- 12 Remedies of Under-Capitalization

- 13 FAQs About the Overcapitalization and Undercapitalization

What is Capitalization?

Capitalization implies long-term funds available for a firm. Long-term funds include shares, debentures, long-term borrowings, and retained earnings.

Definition of Capitalization

[su_quote cite=”Doris”]Capitalization is the total accounting value of the capital stock surplus in whatever form it may appear and long-term debts.[/su_quote]

[su_quote cite=”A.S.Dewing”]The term capitalization or the valuation of the capital includes capital stock and debts.[/su_quote]

[su_quote cite=”E.F.Lincoin”]Capitalization refers to the sum of the outstanding stocks and funded obligations which may represent wholly fictitious values.[/su_quote]

Theories of Capitalization

There are two important theories to determine the amount of capitalization:

- Cost Theory of Capitalization

- Merits of Theory of Capitalization

- Limitations of Theory of Capitalization

Cost Theory of Capitalization

According to this theory, the amount of capitalization is equal to the total cost incurred in setting up of firm s going concern. Thus the estimation of capital requirements of a newly promoted firm is based on the total initial outlays for setting up of a firm. The amount of capital is, under this theory, determined by aggregating:

- Cost of fixed assets such as land and building, plant and machinery, furniture, etc.

- The amount of regular working capital to carry on business operations.

- The expenses of promotion.

- The cost of establishing the business.

Example:

Statement Showing Total Capitalization of New Firm

| Fixed Assets | Rs. In Crore |

| Permanent Working Capital | 90.00 |

| Establishment Expenses | 10.50 |

| Promotion Expenses | 1.50 |

| Total Capitalization | 0.50 |

| 102.50 |

The cost theory of capitalization is useful for those firms in which the amount of fixed capital is more and whose earnings are regular, such as construction and public utility concerns.

Merits of Theory of Capitalization

- This theory is easy to understand.

- It is useful to ascertain the capitalization required for a new firm. It enables the promoters to know the amount of capital to be raised.

Limitations of Theory of Capitalization

- The amount of capitalization calculated under this theory is based on cost and not on earning capacity of a firm. The capitalization will remain the same irrespective of the earning capacity of the firm.

- Since some assets are idle or become obsolete, the earning capacity will be severely affected. But still, the capitalization will remain high s it is based on the cost of assets.

Earning Theory of Capitalization

According to this theory, the amount of capitalization of a firm is determined by its earning capacity. In other words, the worth of a firm is not measured by the capital raised but by the earning made out of the productive harnessing of the capital.

To determine the amount of capitalization, a new firm will have to estimate the average annual future earnings and the normal rate of earnings (also known as capitalization rate) prevalent in the industry.

For example, suppose the estimated earning of X Ltd. is Rs.12 lakh per annum and the fair rate of return expected is 12% The amount of capitalization of the firm is:

For a return of Rs . 12, capitalization required = Rs. 100

For Earning Rs. 12 lacks, capitalization required

=12,00,000 * 100/12 = Rs.1,00,00,000

So, the amount of capitalization of the firm is Re. 1 crore.

Merits

- The amount of capitalization found under this method represents the true worth of the firm.

- The amount of capitalization arrived at on the basis of earnings can be used as a standard for comparison.

Limitation

Estimation of future earnings of a new firm is not easy. If the earning is not estimated correctly, the amount of capitalization would be misleading.

Overcapitalization

A firm should raise long-term funds in a way that it is able to pay interest on borrowed funds and also a fir dividend on equity capital. If a firm is unable to pay interest on borrowed funds and a fir rate of dividend on equity shares out of profit, it is said to be over-capitalized.

A company is said to be overcapitalized when its earning are not large enough to yield a fir return on the number of stocks and bonds that have been issued or when the amount of securities is called overcapitalization.

For example, if a firm earns a profit of Rs.1 lakh and the expected rate of earnings is 10% the maximum limit of capitalization is Rs .10 lakh (i.e.1 lakh /10%). In case the firm raises Rs.20 lakh, the average earnings shall be 5% i.e., below the expected rate. Such a situation is called overcapitalization.

In short, over-capitalization is a situation when the profitability of a firm does not justify funds raised/borrowed. This situation signifies when part of the funds remains unutilized or idle.

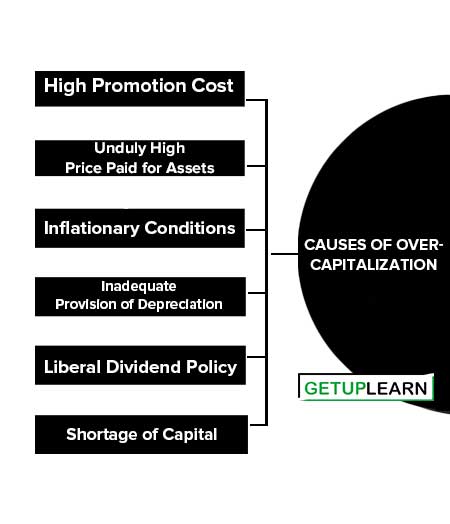

Causes of Overcapitalization

The causes for over-capitalization are as follows:

- High Promotion Cost

- Unduly High Price Paid for Assets

- Inflationary Conditions

- Inadequate Provision of Depreciation

- Liberal Dividend Policy

- Shortage of Capital

High Promotion Cost

At the time of promotion, many firms incur heavy preliminary expenses such as promoter fees, brokerage and underwriting commission, and purchase of patents/goodwill.

Unduly High Price Paid for Assets

if a new firm is formed by converting partnership or private firms, assets are transferred at inflated prices. These assets do not give commensurate returns or contribute to the earning capacity of the firm. This leads to the earning capacity of the firm. This leads to the firm becoming over-capitalized.

Inflationary Conditions

Floatation of a firm during a boom period leads to assets being acquired t inflated prices. But it is not able to increase its earnings accordingly and hence becomes over-capitalized.

Inadequate Provision of Depreciation

If sufficient provision is not made for the depreciation of an asset, the result is that adequate funds are not available when the asset has to be replaced or becomes obsolete. New assets at very high prices have to be purchased and the amount of capital invested is not justified and the firm may become over-capitalized.

Liberal Dividend Policy

If dividends are distributed liberally out of profits, reserves that enhance the earning capacity of the firm are not created. The firm borrows from external sources and raises capital through the issue of shares. In such a situation, the firm finds itself over-capitalized if the high cost of capital is not justified by earnings.

Shortage of Capital

In case the capital is inadequate due to inaccurate planning, then the firm has to depend on borrowings from external sources at high rates of interest. Working efficiency is affected adversely because of a shortage of capital.

Effects of Over Capitalization

Over-capitalization has its effects on a firm, its shareholders as well as society. The effect of each one is analyzed as follows:

Effects on Firm

Over-capitalization has the following adverse effects on the company:

- Because of its reduced earning capacity, the market value of the shares of a firm falls drastically.

- Since earnings are decreasing, the firm cuts down the expenditure on maintenance. Replacement of assets and adequate provision for depreciation are also not made.

- The reputation of a firm is affected and goodwill is lost. The firm has to go in for either internal or external reconstruction.

- The firm may resort to the manipulation of accounts to show profits. Sometimes dividends are paid out of capital as there are no profits.

- It becomes difficult for such a company to raise loans or attract public deposits since its credit rating is lowered.

Over-capitalization has the following adverse effects on shareholders:

- Shareholders‘ investments in the firm are depreciated due to a fall in the market value of the shares. They incur huge losses when their shares are sold.

- Since the earnings of the firm are reduced, their dividend income is Also affected adversely. It becomes uncertain and irregular.

- In case reorganization of the firm takes place, the shareholders have to bear the brunt because the face value of their shares is brought down.

- The shares of such firms are not accepted as security for advances and loans.

Effects on Society

Over-capitalization has the following adverse effects on society:

- Due to a fall in profits, an overcapitalized firm my resort to an increase in prices and compromising with the quality of the products.

- An over-capitalized firm is a drain on the resources of society as it is unable to earn adequate profits.

- Creditors of the firm are affected adversely as they may not get interested regularly and repayment of the principal amount becomes uncertain.

- It leads to labor unrest and strikes as wages are curtailed and not paid regularly.

Remedies for Over Capitalization

The following remedial steps may be taken to convert an over-capitalized firm into a properly capitalized firm:

- The earning capacity of the firm should be increased by enhancing the efficiency of human and non-human resources belonging to the firm.

- The debentures and cumulative preference shares should be redeemed or the existing debenture holders may be persuaded to take new debentures at a lower rate of interest and the preference shareholders may be persuaded to accept equity shares.

- Long-term borrowings carrying a higher rate of interest may be redeemed out of existing resources.

- The par value and/ or number of equity shares may be reduced.

- Management should follow a conservative policy in declaring dividends and should take all measures to cut down unnecessary expenses on administration.

Undercapitalization

Undercapitalization implies a situation where the profits earned are exceptionally high but the capital employed is relatively small. A firm is said to be under-capitalized when:

- Profits earned are exceptionally high.

- The value of long-term assets is higher than the capital raised.

According to Gerstenberg A corporation may be under-capitalized when the rate of profits it is making on total capital is exceptionally high in relation to the return enjoyed by similarly situated companies in the same industry or when it has too little capital with which it conducts its business‖.

For example, if a firm earns a profit of Rs. 1 lakh and the expected rate of earnings is 10% the maximum amount of capitalization is Rs.10 lakh. In case the firm raises only Rs.8 lakh, the actual average earning shall be 12.5% more than the expected rate. Such a situation is called under-capitalization.

In short, undercapitalization is a situation where the profitability of a firm is much higher as compared to the capital employed.

Causes of Under-Capitalization

Following are some of the causes of under-capitalization:

- Under Estimation of Earnings

- Floatation of a Firm During Depression

- Conservative Dividend Policy

- High Efficiency

Under Estimation of Earnings

capitalization is based on the earnings estimated. if the estimated earnings are lower, the capitalization figure is also lower. sometimes, the earning prove to be much higher and the capitalization figure previously calculated is lower.

Floatation of a Firm During Depression

When a firm acquires assets or is promoted during the recovery period, its earnings during the boom period may increase disproportionately to the capital employed.

Conservative Dividend Policy

If a firm follows a conservative dividend policy i.e. payout ratio is maintained at a low level in the initial stage, profits are retained in the business, and reserves are created or reinvested in the business. This results in higher earnings on the capital employed and hence under capitalization.

High Efficiency

If assets are used and maintained properly and costs are reduced because of improved technology, higher levels of vigilance and efficiency lead to improvement in productivity and profitability which is reflected by high earnings on capital employed.

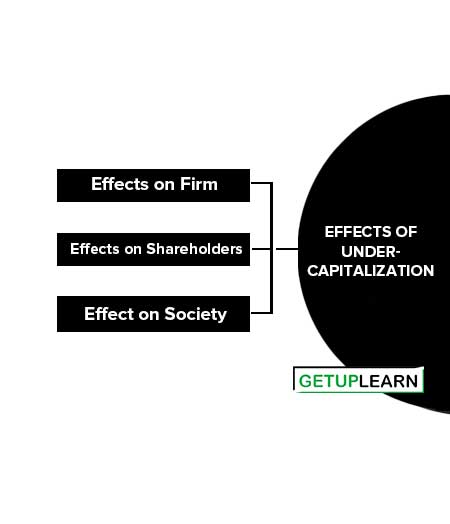

Effects of Under-Capitalization

Under-Capitalization has its effects on a firm, its shareholders as well as society. These effects of under-capitalization are summarized as under:

Effects on Firm

Undercapitalization affects a firm in the following ways:

- Undercapitalization increases the creditworthiness of the firm due to a higher rate of earnings.

- The higher rate of earnings may encourage outsiders to enter the field and increase competition.

- The employees demand higher salaries and wages and this leads to dissatisfaction and labor unrest.

Undercapitalization is always beneficial to the existing shareholders of the firm in the following ways:

- Due to the higher earnings of the firm, the shareholders regularly receive higher dividends on their investments.

- The shareholders also avail capital gains because the market value of the firm‘s shares increases very rapidly.

- Since the shares have great value as collateral security, the shareholders are at ease in getting loans against the security of shares of an under-capitalized firm.

Effect on Society

Effect on society: Undercapitalization affects society s follows:

- Undercapitalization leads to unhealthy speculation on the stock exchanges, which affects the investment climate adversely.

- Consumers feel exploited since the profits of the firms are high.

- It may also lead to labor unrest and strike if the demand for higher wages and an increase in benefits is not accepted by the firm.

Remedies of Under-Capitalization

The following remedial steps may be taken to convert an under-capitalized firm into a properly capitalized firm:

- Undercapitalization may be remedied by increasing the par value and/or number of equity shares by revising upward the value of assets. This will decrease the rate of earnings per share.

- Management may capitalize on the retained earnings by issuing bonus shares to the equity shareholders this will also reduce the rate of earnings per share without reducing the total earnings of the firm.

- Where undercapitalization is due to insufficiency of capital, more shares and debentures may be issued to the public.

FAQs About the Overcapitalization and Undercapitalization

What is overcapitalization?

A company is said to be overcapitalized when its earning are not large enough to yield a fir return on the number of stocks and bonds that have been issued or when the amount of securities is called overcapitalization.

What is the definition of capitalization?

Capitalization refers to the sum of the outstanding stocks and funded obligations which may represent wholly fictitious values. By E.F.Lincoin

What are the causes of overcapitalization?

The causes of overcapitalization are:

1. High Promotion Cost

2. Unduly High Price Paid for Assets

3. Inflationary Conditions

4. Inadequate Provision of Depreciation

5. Liberal Dividend Policy

6. Shortage of Capital.

What is undercapitalization?

According to Gerstenberg A corporation may be under-capitalized when the rate of profits it is making on total capital is exceptionally high in relation to the return enjoyed by similarly situated companies in the same industry or when it has too little capital with which it conducts its business‖.

What are the causes of under-capitalization?

The causes of under-capitalization are:

1. Under Estimation of Earnings

2. Floatation of a Firm During Depression

3. Conservative Dividend Policy

4. High Efficiency.