Table of Contents

What is Rate of Interest?

In the common language, interest refers to the payment paid for the use of capital. Interest is the payment made by the borrower to the lender for the use of money. The person who lends money is known as the lender (the creditor) and the person who borrows money is known as the borrower (the debtor).

In other words, Interest is charged by the lender from the borrower for the money that he lends as a loan. It is usually calculated on the principal of the amount and can be expressed as an annual rate in terms of money.

But in the real economic sense, interest is defined differently. According to economists, interest refers to the return to capital as a factor of production. Interest is the price paid for the productive services rendered by capital. Capital means machines, raw materials, buildings, cash, or money.

But the payment made for all these services is not termed as interest. It means the payment is made only for the use of money. Thus, interest is the price of the loan, i.e. capital, which may be borrowed either for production or even for consumption.

Definition of Interest Rates

These are the simple definition of interest rates:

[su_quote cite=”Carver”]Interest is the income that goes to the owner of capital.[/su_quote]

[su_quote cite=”Keynes”]Interest is a purely monetary phenomenon and payment for the use of money”. It is the reward for parting the liquidity of money.[/su_quote]

[su_quote cite=”Mc Connell”]Interest is the payment for the use of money or the use of loanable funds.[/su_quote]

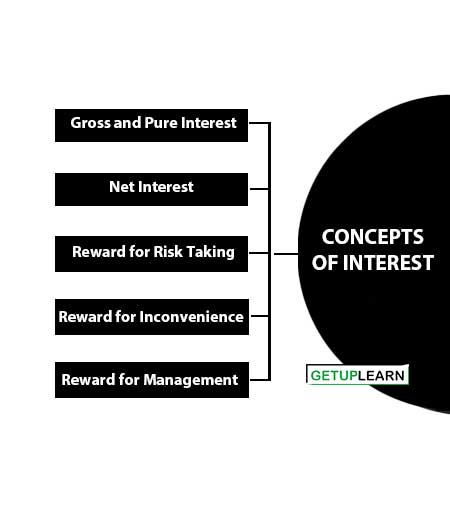

Concepts of Interest

Let’s understand the concepts of interest:

- Gross and Pure Interest

- Net Interest

- Reward for Risk Taking

- Reward for Inconvenience

- Reward for Management

Gross and Pure Interest

The payment which the debtor makes to the creditor excluding the principal is gross interest.

Net Interest

It is the payment for the use of capital only. This is interest in the purely economic sense.

Gross interest = Net interest + reward for risk-taking + reward for inconvenience + reward for management.

Net interest = Gross interest – (reward for risk-taking + reward for inconvenience + reward for management).

Reward for Risk Taking

When a lender lends his money then he remains deprived of its use, he has to sacrifice his money or liquidity, and the return he earned for this sacrifice is known as a reward for risk-taking.

Reward for Inconvenience

When a lender lends money, he deprived its use for the period of the loan. His money is locked up and cannot be used for more profitable purposes and even if he needs this amount for his own use, he will have to bear the inconvenience of arranging it from some other source. While fixing interest rates, the lender includes in it the reward for such inconveniences.

Reward for Management

The lender has to incur expenditures in maintaining proper accounts of the borrowers. He purchases account books and even maintains staff.

He has to remind debtors and sometimes has to file a case against them for the recovery of payment. The payment that the lender receives from the debtor also includes the expenses for management.

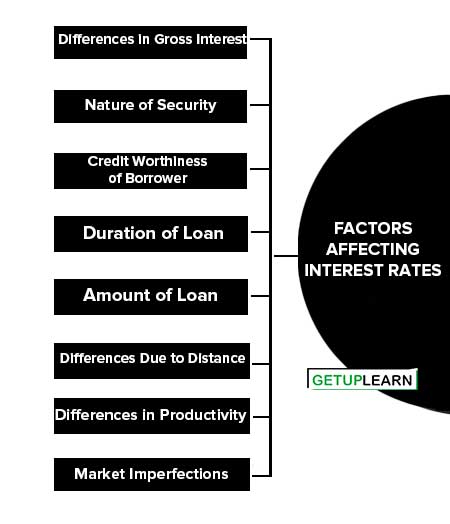

Factors Affecting Interest Rates

Interest rates vary from person to person and from place to place. There are many factors that cause variations in interest rates which are discussed as under:

- Differences in Gross Interest

- Nature of Security

- Credit Worthiness of Borrower

- Duration of Loan

- Amount of Loan

- Differences Due to Distance

- Differences in Productivity

- Market Imperfections

Differences in Gross Interest

Variations in the rate of interest are due to differences in gross interest which include risk and inconvenience, cost of keeping records and collection of loans, etc. The higher the risk and inconvenience and the cost of management of loans, the higher will be the rate of interest and vice versa.

Nature of Security

The interest rate varies with the type of security of the loan. Loans against the security of gold carry a low-interest rate as compared to loans against the security of immovable property like land or a house. The more liquid the asset, the lower the interest rate, and vice versa.

Credit Worthiness of Borrower

The Creditworthiness of the borrower also affects the interest rate as a person of known integrity and creditability can get loans on easy terms.

Duration of Loan

The rate of interest also depends upon the time duration of the loan. Long-term loans carry higher rates of interest as compared to short-term loans. In a long-term loan, the money gets blocked up for a longer duration and hence less liquid. Naturally, the lender wants to be compensated for his sacrifice by a higher rate of interest.

Amount of Loan

The rate of interest has a negative relation to the amount of the loan. The larger the amount of the loan, the lesser the rate of interest, and vice versa.

Differences Due to Distance

Distance between the lender and the borrower also causes differences between interest rates. People are willing to lend at a lower rate of interest nearer home than at a long distance.

Differences in Productivity

The productivity of capital differs from project to project. People are willing to borrow at a higher rate of interest for productive projects and vice versa.

Market Imperfections

Differences in interest rates are also due to market imperfections that may be found in a loan market. Different lending policies are followed by Money lenders, indigenous banks, mutual funds, commercial banks, etc and hence charge various interest rates.

FAQs About the Rate of Interest

What are the factors affecting interest rates?

The factors affecting interest rates are:

1. Differences in Gross Interest

2. Nature of Security

3. Credit Worthiness of Borrower

4. Duration of Loan

5. Amount of Loan

6. Differences Due to Distance

7. Differences in Productivity

8. Market Imperfections.