Table of Contents

What is Forward Contract?

A forward contract is a simple customized contract between two parties to buy or sell an asset at a certain time in the future for a certain price. Unlike future contracts, they are not traded on an exchange, but rather traded in the over-the-counter market, usually between two financial institutions or between a financial institution and one of its clients.

In brief, a forward contract is an agreement between the counterparties to buy or sell a specified quantity of an asset at a specified price, with delivery at a specified time (future) and place. These contracts are not standardized, each one is usually customized to its owner’s specifications.

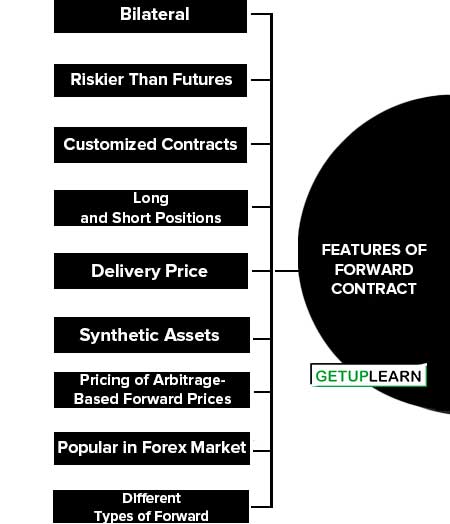

Features of Forward Contract

The basic features of forward contract are given in brief here as under:

- Bilateral

- Riskier Than Futures

- Customized Contracts

- Long and Short Positions

- Delivery Price

- Synthetic Assets

- Pricing of Arbitrage-Based Forward Prices

- Popular in Forex Market

- Different Types of Forward

Bilateral

Forward contracts are bilateral contracts, and hence, they are exposed to counter-party risk.

Riskier Than Futures

There is a risk of non-performance of the obligation by either of the parties, so these are riskier than futures contracts.

Customized Contracts

Each contract is custom designed, hence, is unique in terms of contract size, expiration date, asset type, quality, etc.

Long and Short Positions

In a forward contract, one of the parties takes a long position by agreeing to buy the asset at a certain specified future date. The other party assumes a short position by agreeing to sell the same asset on the same date for the same specified price.

A party with no obligation offsetting the forward contract is said to have an open position. A party with a closed position is, sometimes, called a hedger.

Delivery Price

The specified price in a forward contract is referred to as the delivery price. The forward price for a particular forward contract at a particular time is the delivery price that would apply if the contract were entered into at that time.

Synthetic Assets

It is important to differentiate between the forward price and the delivery price. Both are equal at the time the contract is entered into. However, as time passes, the forward price is likely to change whereas the delivery price remains the same.

In the forward contract, derivative assets can often be contracted from the combination of underlying assets, such assets are often known as synthetic assets in the forward market.

The forward contract has to be settled by delivery of the asset on the expiration date. In case the party wishes to reverse the contract, it has to compulsorily go to the same counterparty, which may dominate and command the price it wants as being in a monopoly situation.

Pricing of Arbitrage-Based Forward Prices

In the forward contract, covered parity or cost-of-carry relations is relations between the prices of forward and underlying assets. Such relations further assist in determining the arbitrage-based forward asset prices.

Popular in Forex Market

Forward contracts are very popular in foreign exchange markets as well as interest rate-bearing instruments. Most of the large and international banks quote the forward rate through their ‘forward desk’ lying within their foreign exchange trading room. Forward foreign exchange quotes by these banks are displayed with the spot rates.

Different Types of Forward

As per the Indian Forward Contract Act- 1952, different kinds of forward contracts can be done like hedge contracts, transferable specific delivery (TSD) contracts, and non-transferable specific delivery (NTSD) contracts.

Hedge contracts are freely transferable and do not specify, any particular lot, consignment, or variety for delivery. Transferable specific delivery contracts are though freely transferable from one party to another but are concerned with a specific and predetermined consignment.

Delivery is mandatory. Non-transferable specific delivery contracts, as the name indicates, are not transferable at all, and as such, they are highly specific.

Difference Between Futures and Forwards Contracts

Forward contracts are often confused with futures contracts. The confusion is primarily because both serve essentially the same economic functions of allocating risk in the presence of future price uncertainty.

However, futures are a significant improvement over forward contracts as they eliminate counterparty risk and offer more liquidity. These are the points of difference between futures and forwards contracts:

Difference Between Futures and Forwards Contracts

| Futures Contract | Forwards Contract |

| Trade on an organized exchange. | OTC in nature. |

| Trade on an organized exchange. | Customized contract terms. |

| Hence more liquid. | Hence less liquid. |

| Requires margin payments. | No margin payment. |

| Follows daily settlement. | Settlement happens at end of period. |

FAQs About the Forward Contract

What is meaning of forward contract?

A forward contract is a simple customized contract between two parties to buy or sell an asset at a certain time in the future for a certain price. Unlike future contracts, they are not traded on an exchange, but rather traded in the over-the-counter market, usually between two financial institutions or between a financial institution and one of its clients.

What are the features of forward contract?

The following are features of forward contract:

1. Bilateral

2. Riskier Than Futures

3. Customized Contracts

4. Long and Short Positions

5. Delivery Price

6. Synthetic Assets

7. Pricing of Arbitrage-Based Forward Prices

8. Popular in Forex Market

9. Different Types of Forward.