Table of Contents

- 1 What is the Meaning of Price?

- 2 Objectives of Pricing

- 3 Determinants of Pricing

-

4 Factors Influencing Pricing Decisions

- 4.1 Objectives of Business

- 4.2 Cost of Product

- 4.3 Market Position

- 4.4 Competitor’s Price

- 4.5 Distribution Channel Policy

- 4.6 Price Elasticity and Demand Elasticity

- 4.7 Products Stages

- 4.8 Product Differentiation

- 4.9 Buying Pattern of Consumers

- 4.10 Economic Environment

- 4.11 Government Policy

- 4.12 Social and Ethical Consideration

- 5 Approach to Pricing Setting

- 6 FAQ Related to Pricing Methods

What is the Meaning of Price?

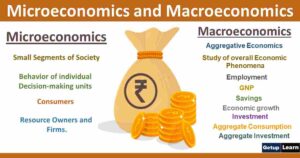

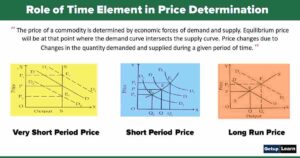

Pricing is defined as the process of determining what a company will receive in exchange for its products. Pricing factors are manufacturing cost, marketplace, competition, market condition, and quality of the product. Pricing is also a key variable in microeconomic price allocation theory.

Pricing is a fundamental aspect of financial modeling and is one of the four Ps of the marketing mix. Price is the only revenue-generating element amongst the four Ps, the rest being cost centers.

Pricing is one of the most important elements of the marketing mix. Price represents the quantity of money or goods and services in a barter system received by the firm or seller for its products. To a customer price always represents the product’s value.

For a marketer, it is important that products are priced correctly. The major challenge to the marketer is to assess the customer’s perception of the future value of his other product. This can be again met by taking correct pricing decisions at the right time.

To arrive at a good price strategy, the marketer should be able to decide on the price objectives. Thus, price decision and management of the price variable is a crucial task that confronts a marketer. In order to take correct decisions, it is important that he understands the concept and influences on pricing decisions.

Objectives of Pricing

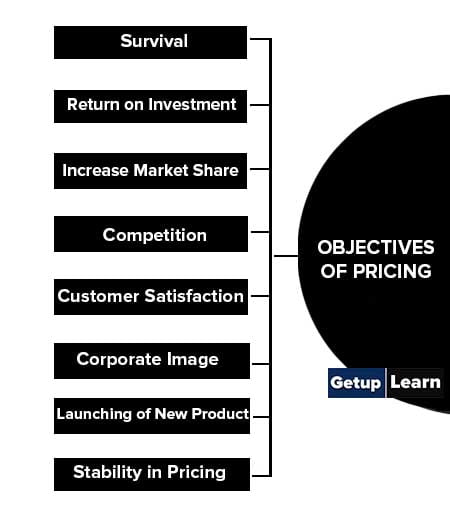

These are the objectives of pricing:

- Survival

- Return on Investment

- Increase Market Share

- Competition

- Customer Satisfaction

- Corporate Image

- Launching of New Product

- Stability in Pricing

Survival

Survival is a very important objective of pricing. The company depends upon the selling price to cover the cost.

Company managers always try to find out pricing strategies that will result in long-term survival in business. Price helps to bring stability into current business and help to move forward towards growth.

Return on Investment

A company should set pricing for its product in such a way as to earn a minimum return on its investment. Every company has a particular target to have a minimum return on investment.

Example: If a company has made a total investment of INT 5 cr. into business and its expectation of return on investment is 15% then the company should earn a minimum of INR 75 lakhs every year. By keeping in mind the ROI company should set the pricing strategies for its product.

Pricing plays important role in increasing the market share of a company. If the company thing that its market share is low in the industry then it should make its pricing strategies in such a way that desired market share can be achieved in the industry.

For example, if the company belongs to the FMCG sector and its market share is less then it should either charge a lower price or give an offer to the customer to increase the market share.

Competition

Pricing has acted as a barrier to the entry of new competitors into similar businesses. The company modified its pricing strategies to deal with its competitor. While fixing the price for its production company should see the price of its competitor.

Sometimes company even sells their goods at lower prices to keep competitor away from the market.

Customer Satisfaction

The customer is the ultimate user of the company product. Customer satisfaction helps the company to achieve growth in the market. A reasonable pricing policy helps the company to win customer confidence and trust.

Once a company gets customer trust in their product it will enable them to grow faster and give better services to the customer.

Corporate Image

Proper pricing policy has an effect on the company’s goodwill in the market. Companies create a good image in the minds of consumers by charging reasonable prices. A good image in the mind of customers helps the company to increase its customer base and grow faster.

Launching of New Product

An effective pricing strategy at the time of introducing new products in the market is very important.

In the introduction, a state company should generally charge low prices for its product to create a customer base and win customer confidence. A low pricing policy for new products helps the company to encourage buyers to purchase the product.

Stability in Pricing

Companies charging stable prices for its product get more preferred by customers in the market. Most of the company change prices for its product on a seasonal basis. A stable price throughout the year helps to get more prospective consumers. The company should adopt pricing strategies to remove seasonal fluctuation in its price.

Determinants of Pricing

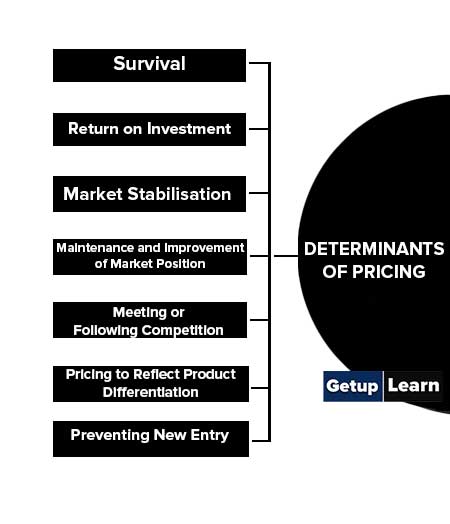

The following are the determinants of pricing used in most industrial markets:

- Survival

- Return on Investment

- Market Stabilisation

- Maintenance and Improvement of Market Position

- Meeting or Following Competition

- Pricing to Reflect Product Differentiation

- Preventing New Entry

Survival

Survival is arguably the most fundamental pricing determinant and comes into play when the conditions facing the organization are proving to be extremely difficult. Thus, prices are reduced often to levels far below cost simply to maintain a sufficient flow of cash for working capital.

Also, if the factory production capacity is underutilized to a large extent or unsold finished products have piled up due to intense competition, a firm is unable to sell its products. To keep the factory going and to convert the inventory to sales, an industrial firm reduces prices.

Return on Investment

Prices are set partly to satisfy the needs of the customers, but more importantly to achieve a predetermined level of return on the capital investment involved.

Market Stabilisation

Having identified the leader in each market, the firm determines its prices in such a way that the likelihood of the leader relating is minimized. In this way, the status quo is maintained and market stability is ensured.

Maintenance and Improvement of Market Position

Recognizing that price is often an effective way of improving market share. The firm uses price partly as a means of defending its current position and partly as a basis for gradually increasing its share in those parts of the market where gains are most likely to be made and least likely to result in competitive action.

Meeting or Following Competition

Having entered a market in which competitors are finally entrenched, the firm may decide quite simply to take its lead in pricing from others until it has built up the sufficient experience and established a firm reputation on which it can subsequently build.

Pricing to Reflect Product Differentiation

For a firm with a broad product range, differences between the products can often be made most apparent by means of price variations related to each market segment.

The differences in price are not necessarily linked to the costs of the product but are instead designed to create different perceptions of their product’s value and indirectly increase profits.

Preventing New Entry

Because of the potentially powerful role, that price can play, a low price may have the effect of preventing others from entering the market as they recognize the low returns available and the dangers of becoming involved in a price war.

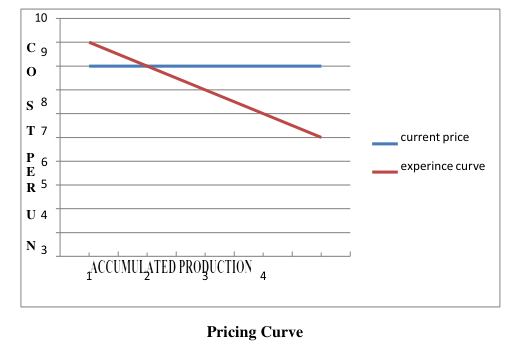

In this way, the firm may be able to minimize the amount of competition, while recognizing that the returns may be relatively unattractive procurement costs are cut, and so on. The result in fig. shows that average cost tends to fall with accumulated production experience. The decline in the average cost with accumulated production experience is called the experience curve or learning curve.

The experience curve or the learning curve has a greater strategic significance. In the 1960s, evidence emerged to suggest that phenomenon was limited not just to labor costs but applied also to all total value-added costs including administration, sales, marketing, distribution, and so on.

A series of studies by BCG (Boston Consultancy Group) then found evidence of the learning curve effect which is applicable to a wide variety of industries ranging from high-technology to low-technology products, service to manufacturing, new to mature products, and process to assembly plants.

Each time the cumulative volume of a product doubled, the total value-added costs fell by a constant and predictable percentage. In addition, the cost of purchased items usually fell as supplies reduced prices and their costs fell, also due to the experience effect.

The relationship between costs and experience was called the learning curve. The strategic implications of the experience curve are potentially significant since by pursuing a strategy to gain experience faster than competitors, an organization lowers its cost base and has a greater scope of adopting an aggressive and offensive pricing strategy.

The learning curve is of potentially enormous strategic value and has considerable implications for the development of a long-term pricing strategy.

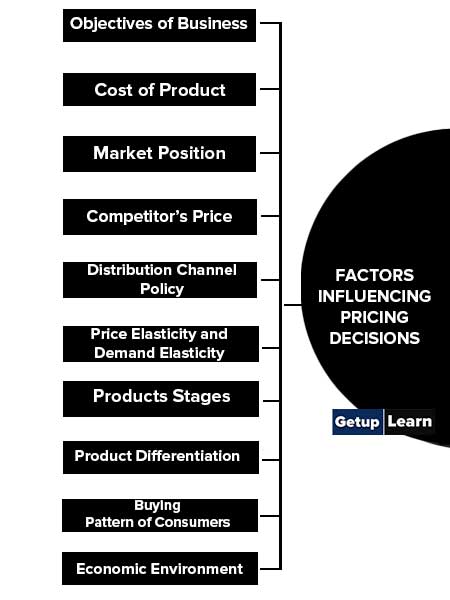

Factors Influencing Pricing Decisions

The following are the factors influencing pricing decisions:

- Objectives of Business

- Cost of Product

- Market Position

- Competitor’s Price

- Distribution Channel Policy

- Price Elasticity and Demand Elasticity

- Products Stages

- Product Differentiation

- Buying Pattern of Consumers

- Economic Environment

- Government Policy

- Social and Ethical Consideration

Objectives of Business

There may be various objectives of the firm such as getting a reasonable rate of return, the capture of the market, maintenance, and control over sales and profit. Thus pricing policy should be established only after proper consideration of the objective of the firm.

Cost of Product

The cost and price of the product are closely related. Normally, the price shall not be fixed below its cost (including the product administrative and selling costs).

Market Position

The prices of different producers are different either because of differences in quality or because of the goodwill of the firm or because of differences in costs.

A reputed company may fix up the higher price for its products; on the other hand, a new producer may fix lower prices for its products. Competition may also affect the pricing decision.

Competitor’s Price

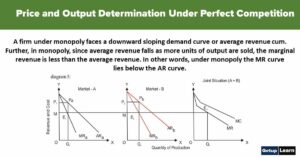

A competitive condition affects the pricing decision. Even in monopolistic competition, the producer has to consider the competition within substitute products before fixing the price of his own products. If suppose. electric company increases the rate of electricity, the consumer may shift to kerosene or gas.

Moreover, some people may invent other lower substitutes. Besides this number of competitors also affect the pricing decision.

Distribution Channel Policy

The nature of distribution channels used and the trade discounts which have to be allowed to distributors and distribution expenses also affect the pricing decisions.

If the channel of distribution is lengthy, distribution expenses are made by each middleman. If on contrary, the channel is short, the price may be fixed lower.

Price Elasticity and Demand Elasticity

Price elasticity means the consequential changes in demand for the change in prices of the commodity. If the demand for the product is inelastic, the high price may be fixed.

On the other hand, if the demand is elastic the firm cannot fix high prices rather it should fix lower prices than that of competitors. If the demand is highly elastic, the price reduction strategy would be adopted.

Products Stages

Product stages in the life cycle of a product: Pricing decision is affected by the product in its Life cycle. In the introduction phase, the policy followed is of penetration type, i.e. Lower price. This builds goodwill. In the growth phase price can be raised to the extent tolerated by the consumers. In the decline stage, prices are to be reduced to maintain the demand.

Product Differentiation

The price of the product also depends on the product’s characteristics. In order to attract customers, different characteristics are added to the product such as quality, size, alternative uses, etc. Customers pay more price for product which is of new fashion, style, better quality or packaging, or durability.

Buying Pattern of Consumers

If the frequency of purchase of the product is higher, a lower price should be fixed to have a low-profit margin. It will facilitate increasing the sales volume and the total profit of the firm.

All consumer items of daily use have high purchase frequency. Low purchase frequency products are sold at high-profit margins and therefore at high prices. Consumer durable items like refrigerators are priced higher.

Economic Environment

In a recession period, the prices are reduced to a sizable extent to maintain the level of turnover. On the other hand, price is increased during the boom period to cover the increasing cost of production and distribution.

Government Policy

If the producer fixes a higher price, the government may nationalize the cause. Something, the government starts selling that product through fair-price shops.

Certain social and ethical consideration also affects the price decision:

-

Fair Price: Keeping in mind the social and ethical considerations, the producer fixes a fair price for their products, neither too high to exploit the customers nor too low to have unfairly low returns to the business.

-

Fear of Labour Leader: With the fear of higher wages and allowances, bonuses, and better facilities by the labor the producers fix the price at a sufficiently low level. It reduces labor disputes and promotes better labor relations.

- Consumer Reaction Towards Rising Prices: A relational consumer also reacts to rising prices. The awakened customer opposes the move of raising prices through a concerted effort by forming associations for the purpose.

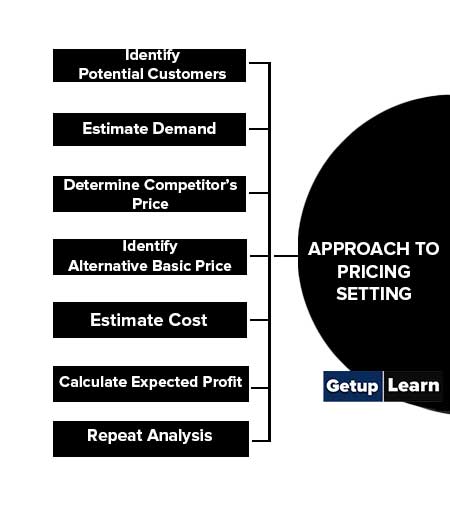

Approach to Pricing Setting

As price is one of the marketing mix variables, it requires a precise and logical method for price setting. A systematic approach to pricing involves eight steps:

- Identify Potential Customers

- Estimate Demand

- Determine Competitor’s Price

- Identify Alternative Basic Price

- Estimate Cost

- Calculate Expected Profit

- Repeat Analysis

Identify Potential Customers

Customers are the focal point of the pricing strategy. It is very important to identify those people whom the pricing plan is supposed to affect.

Estimate Demand

Here the users are grouped into market segments may be regional, economic, demographic, or psychographic. For each market segment, it is necessary to determine the relationship between alternative prices to potential demand.

Determine Competitor’s Price

This is the information on pricing in relation to the competition. It is mandatory for the market planner to know exactly what competitors are charging.

Identify Alternative Basic Price

It is the price from which actual prices can be determined by adding extra and deducting the intras. The actual price deviates from the basic prices because of two reasons namely:

- Product line pricing requires pricing differentials with different products in multiple lines.

- Differences are caused by market structures, geography, location, competitive conditions, etc.

The number of price alternatives will depend on the range of prices within which the company chooses to complete and the price elasticity that exists. The wider the range and greater the cross elasticity of demand, the more will be the number of pricing alternatives that must be considered. If the range is narrow and the cross elasticity is low, there should be only two or three distinct pricing alternatives.

Estimate Cost

Another cost to be incurred may be fixed or variables or semi-variables.

Calculate Expected Profit

The expected profit is obtained by multiplying the cost per unit by the expected volume and subtracting this amount from the total revenue anticipated by the manufacturer. Break-even analysis is the most convenient way of doing this.

Repeat Analysis

Repeat the analysis for each major segment: It might be necessary to develop separate pricing strategies for each segment if the marketer has more than one segment.

What is price and example?

Pricing is one of the most important elements of the marketing mix. Price represents the quantity of money or goods and services in a barter system received by the firm or seller for its products. To a customer price always represents the product’s value.

What are objectives of pricing?

Following are the objectives of pricing:

1. Survival

2. Return on Investment

3. Increase Market Share

4. Competition

5. Customer Satisfaction

6. Corporate Image

7. Launching of New Product

8. Stability in Pricing.

What are determinants of pricing?

Following are the determinants of pricing:

1. Survival

2. Return on Investment

3. Market Stabilisation

4. Maintenance and Improvement of Market Position

5. Meeting or Following Competition

6. Pricing to Reflect Product Differentiation

7. Preventing New Entry.

What are the factors influencing pricing decisions?

Following are the factors influencing pricing decisions:

1. Objectives of Business

2. Cost of Product

3. Market Position

4. Competitor’s Price

5. Distribution Channel Policy

6. Price Elasticity and Demand Elasticity

7. Products Stages

8. Product Differentiation

9. Buying Pattern of Consumers

10. Economic Environment

11. Government Policy

12. Social and Ethical Consideration.

What are approach to pricing setting?

Following are the approach to pricing setting:

1. Identify Potential Customers

2. Estimate Demand

3. Determine Competitor’s Price

4. Identify Alternative Basic Price

5. Estimate Cost

6. Calculate Expected Profit

7. Repeat Analysis.