Table of Contents

Commercial Banking in India

At the time of Independence, India had a fairly well-developed banking system with more than 645 Banks having more than 4800 branch offices. These banks although developed could not conform to the social needs of society.

These banks generally catered to the needs of industries and that too, big ones. (Other priority sectors like agriculture, small-scale industries, exports, etc., were almost neglected). To overcome these deficiencies, the Government announced the nationalization of 14 major commercial banks with effect from July 1969.

The objectives of nationalization were to control the heights of the economy and to meet progressively the needs of the development of the economy, in conformity with national policy and objectives. Six more banks were nationalized in 1980 (Two banks were merged in 1993,) so at present there are 20 nationalized banks.

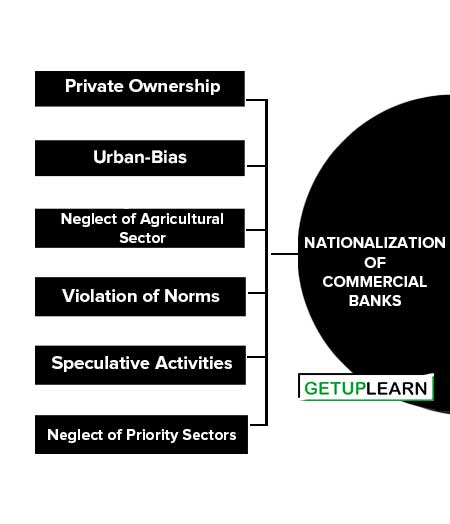

Nationalization of Commercial Banks

The following factors were responsible for the nationalization of commercial thanks in 1969:

- Private Ownership

- Urban-Bias

- Neglect of Agricultural Sector

- Violation of Norms

- Speculative Activities

- Neglect of Priority Sectors

Private Ownership

Private ownership of commercial banks and concentration of economic power: Until nationalization, all major banks were controlled by one or more business houses. These business houses used the resources contributed by the mass of people for their own personal benefits.

They financed those projects which ultimately enhanced their own financial resources. Thus, private ownership of banks resulted in the concentration of income and wealth in a few hands.

Urban-Bias

Prior to nationalization, commercial banks had shown no interest in establishing offices in semi-urban and rural areas. More and more branches were opened in cities, resulting in a concentration of banking facilities in urban areas.

For example, out of about 5.6 lakh villages in India, only 5000 were being served by commercial banks, and five major cities (Ahmedabad, Bombay, Calcutta, Delhi, and Madras) together had a one-seventh share in the number of bank offices and about fifty percent share of bank deposits and bank credit. This urban-biased nature of commercial banks led to a slow rate of growth in rural areas.

Neglect of Agricultural Sector

There was total neglect of the agricultural sector and its finance prior to the nationalization of Banks. The banks increasingly advanced finances to commerce and industry with the result that their share in the scheduled bank’s advances increased from 70 percent in 1951 to 87 percent in 1968. Agriculture accounted for only 2.2 percent of the total advances.

Violation of Norms

Commercial banks often violated the norms and priorities laid down in the plans and granted loans to even those industries which figure nowhere in the priority list.

Speculative Activities

Private commercial banks earned large profits and indulged in speculative activities. They even extended advances to hoarders and black marketeers against high rates of interest.

Neglect of Priority Sectors

Not only there was complete neglect of the agricultural sector, but other sectors such as export, small-scale industries, etc. were also completely neglected. In order to discipline the commercial banks so that they do not overlook the national priorities, the nationalization of banks was undertaken first in 1969 and then in 1980.

Objectives of Nationalization

Nationalization was meant for an early realization of the objectives of social control which were as follows:

- Removal of control by a few.

- Provision of adequate credit for agriculture and small industry and export.

- Giving a professional bent to management.

- Encouragement of a new class of entrepreneurs.

- The provision of adequate training as well as terms of services for bank staff.

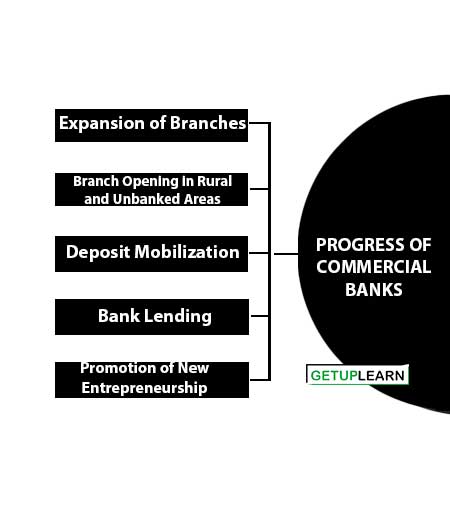

Progress of Commercial Banks

Progress of commercial banks after nationalization: After the nationalization of banks in 1969, commercial banking operations have become an integral part of India’s economic policy. Following developments have taken place since nationalization in 1969:

- Expansion of Branches

- Branch Opening in Rural and Unbanked Areas

- Deposit Mobilization

- Bank Lending

- Promotion of New Entrepreneurship

Expansion of Branches

There has been unprecedented growth in the branch network since nationalization. Compared to just 8,262 branch offices in 1969, the number of branch offices in 2014 has increased to 1,17,280 indicating a greater access to banking facilities to the common man. As a result, the population per bank office has reduced from 55,000 in 1969 to 10,000 in 2014.

Branch Opening in Rural and Unbanked Areas

There has been a qualitative change in branch expansion programs ever since the nationalization of banks. Before nationalization, there was a clear urban bias in the operations of banks. But after nationalization, they have started moving towards rural and less developed areas.

This will be clear from the fact that compared to just 22 percent of bank offices in rural areas in 1969, the percentage of rural branches bank improved to about 38.52 percent in March 2014. This has helped in checking imbalances in the disbursement of banking finance in India.

Deposit Mobilization

There has been a substantial rise in the rate of deposit mobilization since nationalization. The aggregate deposits of commercial banks have increased from Rs. 4,665 crore in 1969 to around Rs. 79,13,443 crore in 2014 forming almost fifty percent of the national income.

Bank Lending

There has been a spectacular rise in bank lending since the nationalization of banks in 1969. It has gone up from Rs. 3,399 crore in June 1969 to 61,39,045 crore in March 2013. The banks have taken special care of the priority sectors in their lending operations.

In 1969, agriculture, small-scale industries, and small retail trade accounted for about 14 percent of the commercial bank’s credit. This percentage has gone up 35.1 percent in March 2014.

Promotion of New Entrepreneurship

Banks, of late, have been financing the schemes, which promote entrepreneurship. For example, they have been actively participating in schemes such as IRDP, TRYSEM, JRY, NRY, etc. Moreover, in their lending operations, they now give high priority to the relevance of the projects for the economy as a whole, along with the genuine business productive requirements of the borrowers.