Table of Contents

- 1 What is National Income?

-

2 Components of National Income

- 2.1 Gross Domestic Product GDP

- 2.2 Gross National Product GNP

- 2.3 Net National Product NNP

- 2.4 Net National Product at Factor Cost NNPfc

- 2.5 Net Domestic Product At Market Prices NDPMP

- 2.6 Income From Domestic Product Accruing To Private Sector

- 2.7 Private Income

- 2.8 Personal Income

- 2.9 Personal Disposable Income

-

3 Importance of National Income

- 3.1 Comparison of Real and Nominal Income

- 3.2 Indication of Prosperity

- 3.3 Regional Comparison

- 3.4 Reflect Sectoral Contribution

- 3.5 Guide to Economic Planning and Policy Formulation

- 3.6 Inflationary and Deflationary Gaps

- 3.7 Basis of Economic Welfare

- 3.8 Basis of Economic Policy

- 3.9 Basis of Economic Structure

- 3.10 Basis of Distribution of National Income

- 3.11 Basis of Budgetary Policies

- 3.12 National Expenditur

- 3.13 International Sphere

- 3.14 Distribution of Grants and Aids

- 3.15 Facilitates Business Forecasting

- 3.16 Indicator of Economic Progress

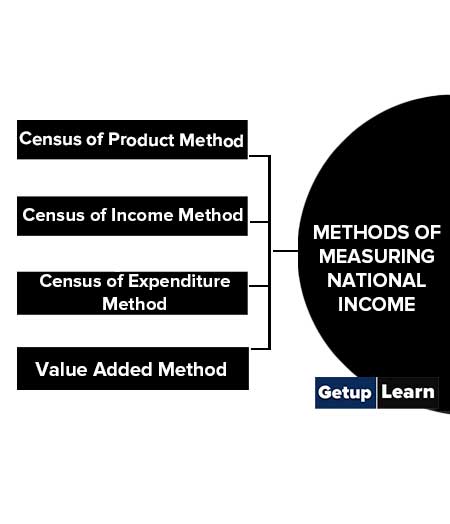

- 4 Methods of Measuring National Income

-

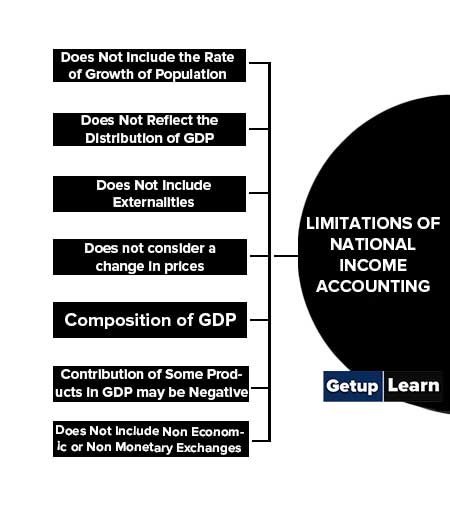

5 Limitations of National Income Accounting

- 5.1 Does Not Include the Rate of Growth of Population

- 5.2 Does Not Reflect the Distribution of GDP

- 5.3 Does Not Include Non Economic or Non Monetary Exchanges

- 5.4 Does Not Include Externalities

- 5.5 Does not consider a change in prices

- 5.6 Composition of GDP

- 5.7 Contribution of Some Products in GDP may be Negative

-

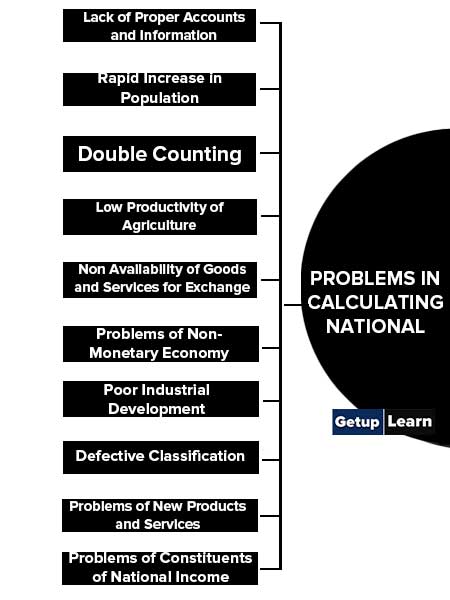

6 Problems in Calculating National Income

- 6.1 Lack of Proper Accounts and Information

- 6.2 Rapid Increase in Population

- 6.3 Double Counting

- 6.4 Low Productivity of Agriculture

- 6.5 Non Availability of Goods and Services for Exchange

- 6.6 Problems of Non-Monetary Economy

- 6.7 Poor Industrial Development

- 6.8 Defective Classification

- 6.9 Problems of New Products and Services

- 6.10 Problems of Constituents of National Income

- 6.11 Regional Imbalances

- 6.12 Problem of Collection of Correct Data

- 6.13 Difficult to Know the Value of Services

-

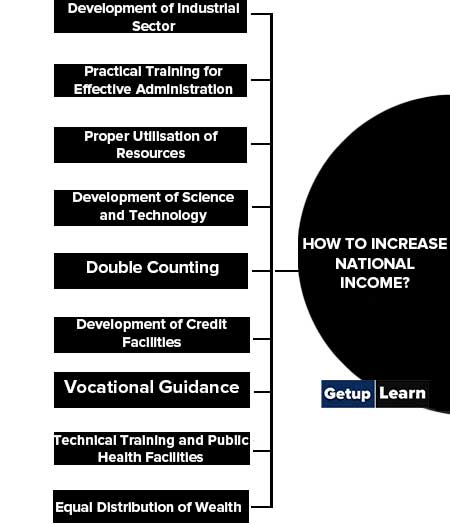

7 How to Increase National Income?

- 7.1 Development of Industrial Sector

- 7.2 Practical Training for Effective Administration

- 7.3 Proper Utilisation of Resources

- 7.4 Development of Science and Technology

- 7.5 Double Counting

- 7.6 Development of Credit Facilities

- 7.7 Vocational Guidance

- 7.8 Technical Training and Public Health Facilities

- 7.9 Equal Distribution of Wealth

- 8 FAQ Related to National Income

What is National Income?

A national income estimate measures the volume of commodities and services turned out during a given period counted without duplication. In other words, Is defined as the total market value of all the final goods and services produced in an economy in a given period of time.

Table of Contents

Thus it measures the monetary value of the flow of output of final goods and services produced in an economy over a period of time.

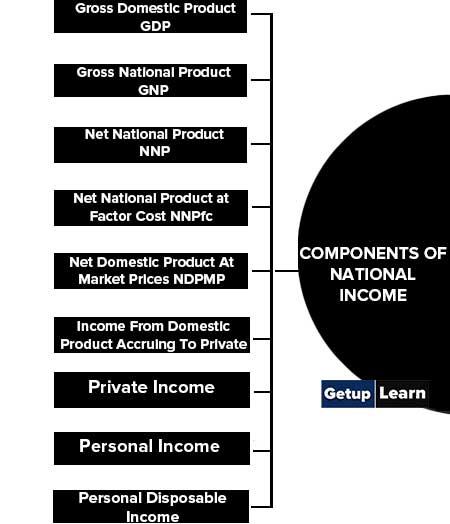

Components of National Income

These are the component of national income discussed below:

- Gross Domestic Product GDP

- Gross National Product GNP

- Net National Product NNP

- Net National Product at Factor Cost NNPfc

- Net Domestic Product At Market Prices NDPMP

- Income From Domestic Product Accruing To Private Sector

- Private Income

- Personal Income

- Personal Disposable Income

Gross Domestic Product GDP

Gross domestic product relates to the product of the factors of production employed within the political boundaries i.e., within domestic territory. It is defined as a measure of the total flow of goods and services produced by an economy over a specified time period, usually a year.

All value of intermediate products is excluded. So only the market value of final products is included to define GDP.

Gross National Product GNP

Gross National Product has been defined as the total market value of all final goods and services produced in a year. It is the money value of all the final goods and services that the labour and capital of a country working on its natural resources have produced in a year.

It includes not only the part of the production which is brought to the market for sale but also that part of the product that is kept for self-consumption.

Formula: GNP= GDP + Net income from abroad(X-M) , where X= Export, M= Import

If the value of (X-M) is negative then, GDP > GNP

Net National Product NNP

Net National Product (NNP) refers to the value of the net output of the economy during the year.

It is obtained by deducting the value of depreciation or replacement allowance of the capital

assets from the GNP. IN other words, The amount which comes after subtracting the depreciation or consumption of fixed capital from the gross domestic product is known as NDP.

Formula: NNP = GNP – D

where D = depreciation allowances

This value is measured at current prices, while GNP is expressed at the current market price. Net National Product, in fact, is the value of total consumption plus the value of net investment of the community.

It is the sum total of net values added by each producer in the productive process of an economy during one year period.

Net National Product at Factor Cost NNPfc

Net national product at factor cost is the net output evaluated at factor prices. It includes income earned by factors of production through participation in the production process such as wages and salaries, rents profits, etc. NNP at factor cost is also called National Income.

Formula: NNPmp = NNPfc – S + (IT+ GS) or, NNPmp or,

NNPmp = NNPfc – subsidies + (indirect tax+ surpluses from government enterprises)

NNPfc = NNPmp + S – (IT+ GS) or,

NNPfc = NNPmp + subsidies – (indirect tax+ surpluses from government enterprises)

Normally, NNP at market prices is higher than NNP at factor cost because indirect taxes exceed government subsidies. However, NNP at market prices can be less than NNP at factor cost when government subsidies exceed indirect taxes.

Net Domestic Product At Market Prices NDPMP

When net domestic product value is measured on the basis of the current prices in the market then it is known as a net domestic product at market prices. (NDPMP=NNPMP-NFIA).

In other words, NDPmp refers to the market value of final goods and services produced by all the production units in the domestic territory of a country during a given time period. It excludes depreciation and includes indirect taxes. It is equal to the net value added at market price.

Income From Domestic Product Accruing To Private Sector

In India, the creation of domestic income is being made by both the sectors i.e. public sector and the private sector. Income from domestic products accruing to the private sector refers to that part of the domestic product at factor cost which is accrued by the private sector. It may be calculated by applying the following formula:- income from domestic product accruing to private sector=NDFC- govt income – non-departmental and enterprises savings.

Private Income

Private income is income obtained by private individuals from any source, produce or otherwise, and retained income of corporations. It can be obtained from NNP at factor cost by making certain additions and deductions.

In other words, It refers to the income earned by individuals from whatever sources it also includes the retained income of companies

Formula: Private Income = National income (NNP at factor cost) +Transfer Payments + Interest on

Public Debt – Social Security – Profits and Surpluses of Public Undertakings.

Personal Income

Personal income is the total income received by the individuals of a country from all sources before direct taxes in one year. Personal income is never equal to the national income because the former includes the transfer payments whereas they are not included in national income.

Personal income is derived from national income by deducting undistributed corporate profits, profit taxes, and employee’s contributions to social security schemes. Personal income differs from private income actually it is less than private income because it excludes undistributed corporate profits.

Formula: Personal Income = National Income – Undistributed Corporate Profits – Profit Taxes – Social

Security Contributions + Transfer Payments + Interest on Public Debt.

Personal Disposable Income

It refers to that part of the personal income which is actually available to the consumers for consumption purposes or saving.

Though the concepts of national income are very clear in India there is difficulty is measuring it because there is a considerable non monetized section. The central statistical organization (CSO) who estimates the national income has gradually fined the method of estimation and has made estimates more accurate.

Formula: Disposable Income = National Income – Business Savings – Indirect taxes plus Subsidies –

Direct Taxes on persons – Direct Taxes on Business – Social Security

Direct Taxes on persons – Direct Taxes on Business – Social Security

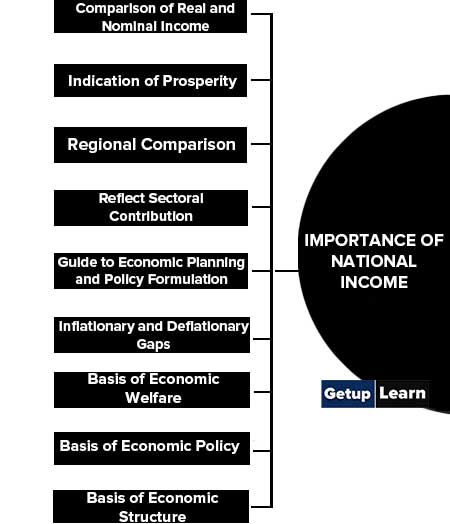

Importance of National Income

The followings are the importance of national income:

- Comparison of Real and Nominal Income

- Indication of Prosperity

- Regional Comparison

- Reflect Sectoral Contribution

- Guide to Economic Planning and Policy Formulation

- Inflationary and Deflationary Gaps

- Basis of Economic Welfare

- Basis of Economic Policy

- Basis of Economic Structure

- Basis of Distribution of National Income

- Basis of Budgetary Policies

- National Expenditur

- International Sphere

- Distribution of Grants and Aids

- Facilitates Business Forecasting

- Indicator of Economic Progress

Comparison of Real and Nominal Income

If the national income data for a number of years is available in the form of income and physical product, a comparison between real and nominal or money income can easily be made. This type of comparison will exhibit the trends of economic growth in a decade, a few decades or a century.

Indication of Prosperity

The national income data is an index of national progress and economic growth. Per capita income can indicate the rise or fall in the standard of living of the people.

Regional Comparison

National income data and other statistics help us to find out the contribution of a particular region in our total national product. the comparison between different regions will reflect the level of economic development and disparities between various regions.

Reflect Sectoral Contribution

The economy is generally divided into different sectors and sub-sectors. Through national income statistics, we can obtain a clear picture of the sectoral contribution to gross national product. This will determine the relative importance of each sector in the economy.

Guide to Economic Planning and Policy Formulation

We know very well that the government plays an important role in the economy in modern times. Planning has come to stay as an important tool for economic growth. National income data shows its distribution between various sections of the society.

Free education, medical aid and social security schemes go a long way to reducing income and inequalities. National income statistics are helpful in formulating necessary plans to develop backward areas and sectors.

Inflationary and Deflationary Gaps

National income statistics enable us to have an idea of inflationary or deflationary forces in an economy. In fact, inflationary and deflationary gaps are the result of inconsistencies of certain sub totals related to national product and aggregate expenditure. The excess expenditure over the value of available output at the base level of prices will result in an inflationary gap.

Basis of Economic Welfare

National income analysis reflects the well being of the inhabitants of the country. They enable us to compare the standard of living of the people in different countries or the people living in the same country at different times. We can measure the increase or decrease in the standard of living of the people with the help of national income.

Basis of Economic Policy

In the era of planning, national income statistics are regarded as a comprehensive tool of economic policy. They throw light on the data pertaining to the country’s gross income, output, saving, consumption etc. Without these estimates, planning is almost impossible.

Basis of Economic Structure

National income statistics enable us to have a detailed knowledge of the economic structure of the country. By this, we can know the contribution made to national income by different sectors like mining, agriculture, industry, trade etc.

Basis of Distribution of National Income

By national income, we can get data pertaining to wages, profits and interest which enables us to learn about the disparities in income among the different sections of the society.

Basis of Budgetary Policies

National income statistics enable the government to prepare its budgetary policies. The taxation and borrowing policies can be framed to neutralize the fluctuations in the level of employment.

National Expenditur

By national income, different departments can get the information on how to divide and use the national expenditure between consumption expenditure and investment expenditure.

International Sphere

National income statistics play a pioneering role in fixing the burden of international payments among different countries and to determine quotas of different countries to international organizations like IMF, IBRD, and UNO.

Distribution of Grants and Aids

In the federal setup, national income estimates enable the central government to distribute the quantum of grants in aid among the state government and other constituent units.

Facilitates Business Forecasting

On the basis of national income, producers can do changes in production and marketing mechanisms. Forecasting of long term trends of business activities is also made.

Indicator of Economic Progress

National income provides information about economic progress, and whether the nation is progressing well on the path of development or not.

Methods of Measuring National Income

According to this method, the incomes accruing to all the factors of production during the process of production are aggregated together to arrive at the national income of the country. This is known as national income at factor cost.

As is well known the various factors of production are paid remuneration for the services rendered by them in production. These payments are known as factor payments. They represent the cost of the producers

thus according to this method, the national product is obtained by adding up the factor incomes accruing to the concerned factors during the process of production.

Following are methods of measuring national income:

Census of Product Method

According to this method, the aggregate production of the final goods and services in an economy in any one year is equivalent in terms of money. The entire output of final goods and services is multiplied by their respective market prices to find out the gross national product.

From the gross national product so estimated, we have to deduct the depreciation of equipment and machinery involved in the process of production to arrive at the country’s national income. This method is sometimes referred to as the inventory method.

Census of Income Method

According to this method, the incomes accruing to all the factors of production during the process of production are aggregated together to arrive at the national income of the country. This is known as national income at factor cost.

As is well known the various factors of production are paid remuneration for the services rendered by them in production.

These payments are known as factor payments. They represent the cost of the producers; thus according to this method, the national product is obtained by adding up the factor incomes accruing to the concerned factors during the process of production.

Census of Expenditure Method

According to this method, the national product is obtained by adding up :

- Personal Consumption Expenditure

- Gross domestic Private Investment

- Govts Purchase of goods and services

- Net foreign investment

Value Added Method

The difference between the value of national outputs and inputs at each stage of production is the value-added.

In other words, the Product or value-added method is a way of computing the national income of a country. This system is also known as the output or inventory method. This method calculates national income by adding value to a product at every stage of its production.

Limitations of National Income Accounting

Following are the limitations of national income accounting:

- Does Not Include the Rate of Growth of Population

- Does Not Reflect the Distribution of GDP

- Does Not Include Non Economic or Non Monetary Exchanges

- Does Not Include Externalities

- Does not consider a change in prices

- Composition of GDP

- Contribution of Some Products in GDP may be Negative

Does Not Include the Rate of Growth of Population

Real GDP indicates the overall performance of the country. But Real GDP does not consider the changes in the population of a country. The prosperity of the country is better judged by the per capita real GDP. The per capita real GDP equals total real GDP divided by population.

An increase in per capita real GDP indicates an increase in the per capita availability of goods and services. If the rate of growth of the population is higher than the rate of growth of real GDP, then it will decrease the per capita availability of goods and services, which will adversely affect the economic welfare.

Does Not Reflect the Distribution of GDP

There is inequality in the distribution of income in the economy. GDP does not take into account changes in inequalities in the distribution of income. If with an increase in per capita real income or GDP, the inequality in the distribution of income/ GDP increases i.e. rich becoming richer and poor becoming poorer, then it may lead to a decline in welfare (because the utility of a rupee of income to the poor is more than to the rich).

In such a situation, if welfare rises, it may rise in less proportion as compared to the rise in per capita GDP.

Does Not Include Non Economic or Non Monetary Exchanges

There are many goods and services which contribute to economic welfare but are not included in the GDP. For example services of housewives and other family members (leisure time activities) etc.

These are non-monetary exchanges i.e. those exchanges and activities which are left out from the estimation of GDP or national income on account of non-availability of data and problems of valuation. Since these activities do not command a price i.e. no price is attached to them, although they contribute to economic welfare.

Does Not Include Externalities

Externalities refer to benefits or harms accompanying the production process for which no payment is made or received. They are excluded from the estimation of GDP. There are two types of externalities:

-

Positive Externalities: These are the benefits that accompany the production process but for which no payment is received. They are not included in GDP although they result in an increase in welfare.

For example, the construction of flyovers or highways reduces transport costs and journey time of its users who have not contributed anything towards its cost. Expenditure on construction is included in GDP but not the positive effects flowing from it hence underestimating the welfare indicated by GDP.

- Negative Externalities: These are the negative effects which accompany the production process and decrease the welfare of the people for which they are not penalized. For example environmental pollution caused by industrial plants. The output produced by plants is included in GDP but a decrease in welfare arising out of pollution of water and air caused by plants is not considered in the estimation of GDP.

This pollution adversely affects the health of the people thus producing goods increases welfare but creating pollution decreases welfare. Therefore, taking only GDP as an index of welfare overstates the welfare.

Does not consider a change in prices

If the increase in GDP is due to an increase in prices and not due to an increase in physical output, then it will not be a reliable index of economic welfare.

Composition of GDP

GDP includes different types of products like clothes, food articles, police and military services, house etc. Some of these products contribute more to the welfare of the people like food, clothes etc. whereas other products like police services and military services etc. may comparatively contribute less and may not directly affect the standard of living of the people.

Thus, if GDP increases, the increase in welfare may not be in the same proportion. Therefore, how much is the economic welfare, should depend more on the types of goods and services produced and not simply on how much is produced.

Contribution of Some Products in GDP may be Negative

GDP includes all final goods whether it is milk or liquor, some goods included in GDP measurement may reduce economic welfare. For example, liquor, cigarettes etc. because of their harmful effect on health. GDP includes only the monetary value of the products and not their contribution to welfare.

Therefore, economic welfare depends not only on the volume of consumption but also on the type of goods and services consumed. This should be considered while drawing conclusions about economic welfare from GDP.

Problems in Calculating National Income

These some problems in calculating national income are given below:

- Lack of Proper Accounts and Information

- Rapid Increase in Population

- Double Counting

- Low Productivity of Agriculture

- Non Availability of Goods and Services for Exchange

- Problems of Non-Monetary Economy

- Poor Industrial Development

- Defective Classification

- Problems of New Products and Services

- Problems of Constituents of National Income

- Regional Imbalances

- Problem of Collection of Correct Data

- Difficult to Know the Value of Services

Lack of Proper Accounts and Information

In developing countries, the economy is based on a small sector. The income of this sector is very low but the numbers of units are very large. These units are operated by very small artisans and uneducated and unskilled persons. In this sector, the accounts are not maintained properly, these industrialists do not keep proper accounts and records of their income.

The information provided by them is generally inaccurate and wrong and hence it is not possible to collect reliable information for national income.

Rapid Increase in Population

The major reason for low per capita income is the speedy growth of the population along with the slower growth of the NI. Hence, to improve the rate of growth of per capita income in the country, it would be necessary to have a two-pronged attack. One is to step up the growth of NI and the second is to take necessary steps to bring down the rate of growth of the population.

Double Counting

This is the most important difficulty in the measurement of national income. Several commodities and services are such which are used in the production process more than once. In such conditions possibilities exist of there being counted repeatedly. It is also difficult to correctly and clearly distinguish between intermediary and final products.

Low Productivity of Agriculture

Agriculture plays an important role in developing the economy, but in India, this sector has low productivity and poor performance.

Non Availability of Goods and Services for Exchange

We have studied that in the computation of national income only those commodities and services are included which are commercially used. In most the developing countries, people in rural areas do not incur many types of expenditure on the production of primary goods like villagers produce the required raw materials themselves.

Since their raw material is not sold in the market, it is not included in the national income. In such situations, national income is estimated on the lower side.

Problems of Non-Monetary Economy

As we know, nearly 70% of the population of our country lives in the villages. In villages non-monetary transactions are common. Most of the activities are not brought by money but by the barter system. In such conditions, the non-monetary transactions are not methods of national income and it results in the computation of national production on the lower side.

Poor Industrial Development

In developing countries, industrial development is not proper. The causes of poor industrial development are lack of sufficient capital formation, failure of the public sector to play the assigned role in spite of its dominance; defective fiscal policy and the under-utilisation of the capacity in the industrial sector etc.

Defective Classification

We calculate national income according to industries. But in developing countries, most of the workers are engaged in different activities partially in the agriculture sector or partially in the industrial sector. So it is difficult to calculate the true national income.

Problems of New Products and Services

National income is estimated at constant prices, as also at current prices. Some products are such, which are being produced, at present but were not produced in the base year. The important problem that arises from such goods is how to know the prices for the base year?

Problems of Constituents of National Income

This problem arises when we want to compare the national incomes of two or more countries. The problem is the constituents of national income are not the same in all countries of the world. therefore, it becomes difficult to compare the national income of various countries.

Regional Imbalances

Many states in India are extremely backward and underdeveloped. So regional imbalance creates problems in calculating accurate national income.

Problem of Collection of Correct Data

Data collection methods are not reliable in developing countries like India because several defects exist in various methods applied for the collection of data required for the measurement of national income.

For example, data related to agriculture in India are collected by Gram Sevaks or Patvaries, who are not trained in the art of data collection. They are not able to devote adequate time to data collection. Hence, such data are also neither accurate nor reliable.

Difficult to Know the Value of Services

Various types of services are included in the computation of national income. For example, the nurses or doctors provide their services in extra hours also, in addition to their assigned duty hours. It is difficult to know the values of such services. Hence, estimation of national income is also difficult for dispensation of such services.

How to Increase National Income?

Some suggestions are here to overcome or increase the national income. These are:

- Development of Industrial Sector

- Practical Training for Effective Administration

- Proper Utilisation of Resources

- Development of Science and Technology

- Double Counting

- Development of Credit Facilities

- Vocational Guidance

- Technical Training and Public Health Facilities

- Equal Distribution of Wealth

Development of Industrial Sector

The industrial and agricultural sectors should be developed rapidly. In this context, new agricultural techniques must be provided to the farmers and implemented in all agricultural areas. The fertilisers, pesticides, agricultural implements etc. should be used to improve the production. More stress should be laid on the development of cottage, small and rural industries.

Practical Training for Effective Administration

The official should be trained for effective administration. An effective administrative arrangement should be made for the maintenance of proper accounts and the collection of reliable and complete information and data regarding national income.

Proper Utilisation of Resources

The factors causing the underutilisation of productivity capacity must be removed. Natural resources and productive capacity should be utilised more effectively. Facilities for irrigation and power should be increased sufficiently.

Development of Science and Technology

The production techniques should be improved. More emphasis should be laid on the development of science and technology.

Double Counting

To overcome the problem of double counting Value of finally produce commodities and services alone should be included in national income estimates.

Development of Credit Facilities

Capital formation should be stepped up. Saving schemes should be popularised more.

Vocational Guidance

The problem of unemployment and under-employment must be tackled more effectively. Self-employment should be encouraged.

Technical Training and Public Health Facilities

Technical training and public health facilities should be strengthened in order to increase the efficiency of labour. The regional inequalities must be eliminated from the backward regions.

Equal Distribution of Wealth

Inequalities in the distribution of wealth income and economic opportunities should also be mitigated.

What is the national income and how it is calculated?

National income in the general sense means the total value of commodities and services produced in any country during a year, it is a term which is used interchangeably with national dividend, national output and national expenditure. National income is related to any particular country and is also calculated for a year. The national income has various concepts like GNP, NNP, Personal income, Disposable income, Per Capita income etc.

What is Importance of National Income?

National Income is a way to find out about a country’s growth. National Income enables the calculation growth of a country.

What are the limitations of national income?

In National Income estimation some problems are faced. These are lack of proper accounts and information, double counting, low productivity of agriculture, non-availability of goods and services for exchange, problems of the non-monetary economy, and difficulty to know the value of services etc.