Download Methods of Calculating National Income Class 12 Notes PDF, Question papers, MCQ PDF, NCERT Books, and Syllabus free of cost in just minutes. We provide complete study material of methods of calculating national income Class 12 Notes.

This study material includes methods of calculating national income Class 12 Notes, previous year question paper class 12, Mcq Pdf, NCERT books, Latest syllabus by CBSE 2022-2023.

Table of Contents

You can download methods of calculating national income Notes PDF Class 12 the below article.

Table of Contents

- 1 Download Methods of Calculating National Income Class 12 Notes PDF

- 2 Methods of Calculating National Income Class 12 Notes PDF

- 3 Methods of Calculating National Income Class 12 MCQ Questions PDF

- 4 Methods of Calculating National Income Class 12 MCQ Questions and Answers PDF

- 5 Methods of Calculating National Income Class 12 Questions and Answers PDF

- 6 Methods of Calculating National Income Class 12 Important Questions PDF

- 7 More About Methods of Calculating National Income Class 12 Notes

- 8 Methods of Calculating National Income Notes

- 9 FAQ Related to Methods of Calculating National Income

Download Methods of Calculating National Income Class 12 Notes PDF

This is a downloading table for methods of calculating national income class 12 notes pdf:

| Short Run Equilibrium Output Class 12 Notes PDF | (HOW TO DOWNLOAD) |

| ????Methods of Calculating National Income Class 12 Notes PDF | ????Download |

| ????Methods of Calculating National Income Class 12 MCQ Questions PDF | ????Download |

| ????Methods of Calculating National Income Class 12 MCQ Questions and Answers PDF | ????Download |

| ????Methods of Calculating National Income Class 12 Questions and Answers PDF | ????Download |

| ????Methods of Calculating National Income Class 12 Important Questions PDF | ????Download |

Methods of Calculating National Income Class 12 Notes PDF

CBSE Class 12 Macroeconomics chapter 3 methods of calculating national income Notes PDF are made by research of last ten years NCERT question paper. Further, they are all designed with the latest CBSE guidelines 2022-2023, and only important topics are covered because of the high chances to appear in exams.

NCERT Class 12 Macroeconomics chapter 3 methods of calculating national income Class 12 Notes is very useful for students because it is necessary to understand all important questions and answer them in an efficient manner.

[su_button url=”https://drive.google.com/file/d/19oPKFIM0txnELbIpl9xFiOav90yiN-vr/view” target=”blank” style=”flat” wide=”yes” center=”yes” radius=”10″ text_shadow=”0px 0px 0px #ffffff” download=”https://drive.google.com/file/d/19oPKFIM0txnELbIpl9xFiOav90yiN-vr/view” id=”download”]Download PDF[/su_button]

Download All: ????Macroeconomics Class 12 Notes PDF????

Download Class 12th Notes PDF

[su_spoiler title=”Macroeconomics Class 12 | Indian Economy Class 12” style=”fancy” icon=”plus-circle”]

Macroeconomics Class 12

Indian Economy Class 12

- Indian Economy on the Eve of Independence

- Indian Economy 1950 to 1990

- Economic Reforms Since 1991

- Liberalisation Privatisation and Globalisation

- Poverty

- Human Capital Formation in India

- Rural Development

- Employment and Unemployment

- Infrastructure

- Environment and Sustainable Development

- Comparative Development Experiences of India and Its Neighbours

[/su_spoiler]

With these methods of calculating national income notes pdf sample papers, students will have no problem making revision notes before exams and they don’t have to waste time making CBSE revision notes. You guys can download macroeconomics notes class 12 in just minutes. Methods of Calculating National Income Notes Pdf notes are well structured and prepared based on CBSE latest syllabus class 12 2022-2023.

These NCERT macroeconomics notes chapter 3 methods of calculating national income Notes PDF for class 12 are well-defined and easy-to-understand concepts and include some practical questions for practice purposes.

We provided CBSE notes in pdf format for Students and they can use sample papers for preparing for the CBSE board exam 2022-202. CBSE Class 12 macroeconomics chapter 3 methods of calculating national income Notes is very important for exam perspectives because it is a practical question chapter, not theory-based chapter. And for exam perspective this important chapter because it has higher marks weightage in macroeconomics.

With the help of CBSE revision notes students can revise for the exam. Class 12 macroeconomics Chapter 3 methods of calculating national income Notes are the best finest notes because these are prepared by very experienced teachers. Class 12 macroeconomics chapter 3 methods of calculating national income notes is made in very easy language which helps the students understand easily.

Methods of Calculating National Income Class 12 MCQ Questions PDF

Below that you can download the methods of calculating national income class 12 MCQ questions pdf. We have covered all related MCQ’s methods of calculating national income class 12 MCQ questions in this pdf. You can practice all of them by these methods of calculating national income MCQ questions PDF.

Methods of Calculating National Income Class 12 MCQ Questions and Answers PDF

Here are some of the methods of calculating national income class 12 mcq questions and answers pdf mentioned below. You can download methods of calculating national income class 12 MCQ pdf form. These are the most relevant MCQ questions and have a higher chance of appearing on exam papers.

Methods of Calculating National Income Class 12 Questions and Answers PDF

Here we are providing methods of calculating national income class 12 questions and answers pdf and in this notes we have covered all Important Questions and Answers from Chapter 3 methods of calculating national income. Methods of Calculating National Income notes of Economics Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Methods of Calculating National Income Class 12 Important Questions PDF

This is the methods of calculating national income class 12 important questions pdf which we are providing for you. We have selected all those important questions from previous years’ question papers. If you learn the following methods of calculating national income class 12 important questions you don’t have to open your textbook again and by these questions, you score high in exams.

More About Methods of Calculating National Income Class 12 Notes

CBSE is an educational board in India and is based on the NCERT syllabus for CBSE schools and other schools affiliated with the CBSE Board of India. Also, we are providing Study material for Class 12 macroeconomics for students so they can get rid of stress.

Getuplearn provides chapter-wise macroeconomics revision notes and short keynotes for the CBSE board exam. You can download methods of calculating national income class 12 notes pdf Keynotes is easy to understand and also free downloadable PDF format so students can practice it for their exams and get good marks in their board examinations.

Getuplearn provides class 12 notes for subjects like Accounts, Economics, Hindi, Business Studies, English, and Physical Education. You can download free study material in pdf format for all streams science, commerce, arts, etc. Also, class 6 notes, class 7 notes, class 8 notes, class 9 notes, class 10 notes, class 11 notes, and class 12 notes.

Methods of Calculating National Income Notes

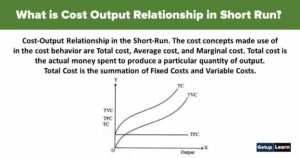

Methods of Measuring National Income

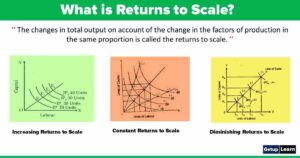

There are three methods of estimation of National Income:

Value Added Method

In this method, the value of final goods and services produced by all units of production in the country is aggregated. In this method production of final goods and services is being measured by the Net Value Addition in the Production Process.

Net Value Addition = Gross Value Addition – the Cost of Raw Materials. For example- if A thread manufacturing unit produced a thread of Rs. 3000 during a year and used Cotton of Rs. 1000 as the raw material for this the net value added by the thread unit is Rs. 2000.

Value-added of a firm = Value of output produced by the firm — Cost of intermediate goods used

Steps for calculation of national income by Value-added method

Estimation of the value of output produced by each firm in all the sectors of the economy during the year:

Value of output is the market value of goods and services produced by a firm during an accounting year.

Value of output = Output produced (in units) x Market price

If a firm had no initial unsold stock in the beginning of the year:

Value of output produced = Sales + Value of unsold stock

Note: Sales = Output sold (in units) x Market price Sales = Sale of goods and services to domestic buyers + Exports of goods and services.

If a firm had some unsold stock in the beginning of the year:

Value of output = Sales + Net change in stock

Income Counting Method

In this method, the income from productive activities of all citizens is aggregated in a year. In other words in this method, the income of factors of production is aggregated in a year. Factors of production get incomes as the following form:

- Wage Income

- Rent Income

- Interest Income

- Profit Income

Expenditure Method

In this method, the expenditure made by al citizens in a year is aggregated. It is assumed that a person either expend or save their income. In this way, the national Income must be equal to the total expenditure savings in the economy.

What are the 3 methods of calculating national income?

Following are methods of measuring national income: Census of Product, Method Census of Income Method, Census of Expenditure Method, Value Added Method.

How many methods are there to calculate national income?

There are three methods of calculating national income which are Product Method, Income Method, Expenditure Method Value Added Method.

What are the methods of calculating?

In economics, economists use three methods of calculating national income which is product method, expenditure method, value-added method, income method.

Which method is best for calculating national income?

Product Method: This is the best simple method to calculate the national income.