Table of Contents

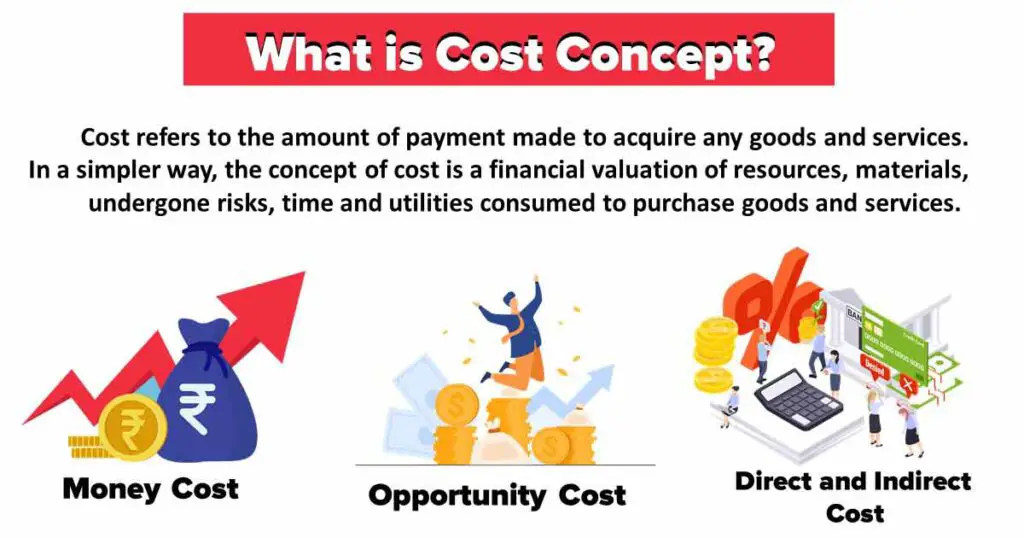

- 1 What is Cost Concept?

-

2 Types of Costs

- 2.1 Money Cost

- 2.2 Real Cost or Social Cost

- 2.3 Opportunity Cost

- 2.4 Direct and Indirect Cost

- 2.5 Incremental Costs and Sunk Costs

- 2.6 Replacement Costs and Historical Costs

- 2.7 Fixed Costs and Variable Costs

- 2.8 Short Run Costs and Long-Run Costs

- 2.9 Controllable and Uncontrollable Cost

- 2.10 Urgent and Postponable costs

- 3 FAQ Related to Cost Concept

What is Cost Concept?

Cost and output analysis is related to the production function, factor prices and efficiency of the entrepreneur. Various Cost Concepts have been propounded by different managers, economists and accountants. Production function explains the inputs and the resultant output relationship through which an Individual takes a decision regarding the production and tries to attain its objective of maximization of output and minimization of cost of production. An entrepreneur tries to take decisions accordingly.

The meaning of the cost differs from one discipline to another. An accountant has a different point of view than that an economist. A sociologist thinks in different ways and his point of view is different from those of accountants and economists. Hence the concept of cost is used in different forms. The Cost Concepts is used in different ways in decision-making by business managers.

Types of Costs

Following are some important concepts of cost and types of costs:

- Money Cost

- Real Cost or Social Cost

- Opportunity Cost

- Direct and Indirect Cost

- Incremental Costs and Sunk Costs

- Replacement Costs and Historical Costs

- Fixed Costs and Variable Costs

- Short Run Costs and Long-Run Costs

- Controllable and Uncontrollable Cost

- Urgent and Postponable costs

Money Cost

Money cost is that cost that is expressed or measured in monetary terms. It is the cost in which the expenses are included namely the price of raw materials, wages of labour, and interest on capital. rent on land, salaries of managers and the normal profit of entrepreneurs.

Money cost is called the accounting cost of production. Money cost consists of three elements in it. They are:

Explicit Costs

These costs consist of all the payments made on the basis of a contract to various factors of production employed by a firm like prices of raw materials, rent, wages, interest, salaries, depreciation of plant and machinery and selling cost incurred during a given period of time. The record of such costs is maintained by the accountant.

Implicit Costs

These costs are the invisible costs of production. The payment made to the owned factors of production is included in these costs. Interest on owned capital, wages to owned labour, salary to owned managers, rent to owned building, furniture and other infrastructures of the owner of the firm are part of implicit costs. The calculation of implicit cost is a difficult task.

Normal Profit

It is also a part of the money cost. It is the minimum remuneration that a firm should get in order to remain in an industry. It is over and above the explicit and implicit cost of an individual firm. It is a motivational factor for a firm to continue its functions.

A business manager should take into consideration all three parts of money cost because they affect his business decisions. Explicit costs can easily be calculated as their record is maintained by the accountant in a business firm while the calculation of implicit costs is difficult. Money cost can be calculated as follows:

Money cost = Explicit cost + Implicit Cost ÷ Normal Profit

Real cost means all those pains, efforts and sacrifices which are borne for the production of any commodity. In other words, efforts and sacrifices made by various sections of society for the production of any commodity are the real cost of production.

According to Prof. Marshall, “the direct and indirect efforts which are to be made by various types of workers in the production of any commodity, or the restraint or waiting which is required to be undertaken for accumulating capital, all such efforts or sacrifices are collectively called real cost of the commodity”.

The concept of real costs has been criticised on the following grounds:

- . The concept of real costs may be important from the viewpoint of society and the nation, but from a practical viewpoint, it has no importance.

- Pains and sacrifices may be experiences but these cannot be expressed in terms of money. In other words, the concept of real costs is psychological and subjective, because the realisation of pain for the same type of work is of different types for different persons, which cannot be considered for purposes of assessment of income, due to lack of any certain yardstick.

According to this concept, the price of any commodity will be equal to the total pain and sacrifice bore for production of that commodity.’ For example, in the production of commodity ‘A’, the pain and sacrifice involved is twice that for the production of commodity “B’.

Hence, the price of commodity ‘A’ will be two times of the price of commodity ‘B’, Marshall has termed real cost as ‘Social Cost’, because the society has to face the pains and sacrifices in the production’ of the commodities.

Opportunity Cost

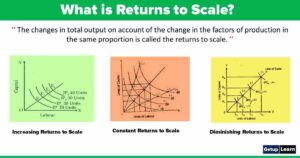

The concept of opportunity cost ‘is based on the fact that factors of production are limited and each factor has the possibility of alternative uses. When any particular factor is used for the production of any particular commodity, that factor loses the opportunity of being used for the production of another commodity.

Thus, that cost that induces any particular factor of production to remain in its existing use is known as opportunity cost. In other words, opportunity cost is the sacrifice of that alternative commodity or commodities, which can be produced with the help of these factors, from which the existing commodity has been produced.

According to Benham, “Opportunity cost or alternative cost of anything is the next best alternative that could be produced instead by the same factors or by an equivalent group of factors costing the same amount of money”.

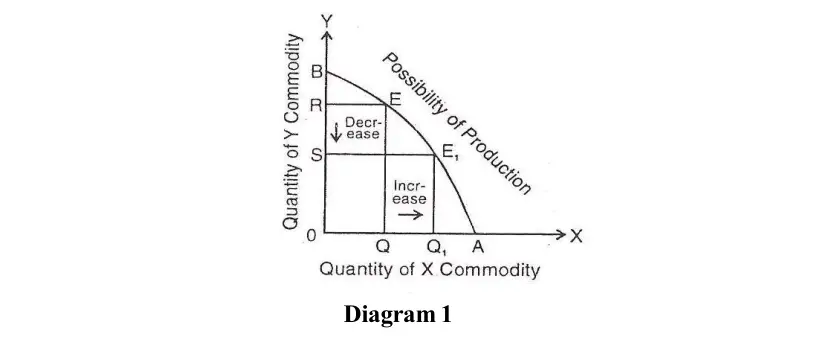

The opportunity cost may also be explained with the help of the diagram. In this diagram, AB line shows various possibilities of the production of two commodities ‘X’ and ‘Y’. It is known as the production possibility curve. The quantity of factors with the producer is limited, from which two commodities ‘X’ and ‘Y’ may be produced.

If the producer wants to increase the production of ‘X’, he will have to reduce the production of commodity ‘Y’. Hence, it is clear that for increasing the QQ quantity of ‘X’ commodity, RS quantity of ‘Y’ commodity will have to be reduced. This is called “opportunity cost”.

Following are the assumptions and characteristics of opportunity cost:

- Opportunity cost or income is expressed in terms of monetary cost or income.

- Opportunity cost includes both explicit and implicit costs.

- The quantity of factors of production remains constant, in a certain time period.

- The economy has the stage of full employment and perfect competition.

- This concept applies to all types of industries and all factors of production.

Opportunity cost depends upon specialisation. The factor which is highly specialised will have low opportunity cost. If it is fully specialised, then its opportunity cost will be zero, as this factor completely lacks another alternative.

- It is assumed that only two commodities ‘X’ and ‘Y’ are being produced in the economy.

- All units of factor are similar in all respect.

Direct and Indirect Cost

Direct cost is concerned with the production of a commodity. It is incurred directly on the factors of production. Such cost can easily be identified and it is directly concerned with the process of production. For example, there is the production of commodity-X the direct cost can be calculated by taking into consideration the salaries of all the employees, cost of raw material, fuel charges etc.

Indirect costs are those costs that are not concerned directly with the production of a commodity. Such costs consist of selling cost, office overheads, rent of the building, salaries of security staff, depreciation of the machines etc. The allocation of these costs should be done judiciously on all the departments, processes or goods. Thus indirect cost can be calculated by deducting the production cost of goods and services from the total cost.

Indirect Cost =Total Cost — Direct Cost

On the basis of direct and indirect costs, a business manager can make the decision regarding the contraction and expansion of any production activity, working of any department or process.

Incremental Costs and Sunk Costs

When a business firm changes its business activities or the nature of its business then the incremental costs are incurred by the firms. It is the cost due to a change in the level of business activity. For example, a business firm purchases new machinery in place of old machinery or a new product is included in the process of production and all such changes increase the total cost of production of that firm is called incremental costs.

The difference between the changed total cost and initial total cost (before such change) is incremental cost. It is calculated as follows:

Incremental Cost = Changed Total Cost – Initial Total Cost

Sunk costs are those costs that are not affected by the changes in the level of business activity or nature of business of a business firm. These costs remain unchanged. Depreciation is an example of such costs. Such costs are also known as bad debt costs. When an investment is made in a sick unit it is a bad debt because the investment made by the business manager may be recovered or may not be recovered.

Both incremental cost and sunk costs are important when the various alternatives are evaluated by the business manager while taking the business decisions. The incremental costs differ from one alternative to another while sunk costs do not change.

Replacement Costs and Historical Costs

When an old machine is replaced with a new machine and cost incurred in such replacement is called replacement cost. It is also called substitution cost. It is important for such business firms where projects are replaced and the production process is changed.

Historical cost is that type of cost which is based on the purchase price of machinery initially. This cost is shown by an accountant in his balance sheet at the original cost of a machine rather than the present cost prevailing in the market or market cost of the machine. Replacement cost plays an important role in business decision making because it affects the total cost of a business firm.

Fixed Costs and Variable Costs

Fixed costs are those costs that are fixed whether production is being carried on or there is no production at all. These costs are short-run costs wherein they remain fixed from zero production to the maximum possible production of a business firm.

These costs are called supplementary costs, general costs, indirect costs and overhead costs. Rent of building, land tax, insurance premium, depreciation, salaries to managers, interest on permanent or fixed capital etc. are examples of such costs.

Variable costs are those costs that are directly related to the production of a firm. They vary with the production. When production is not carried on, such costs will not arise. Cost of raw materials, direct wages, expenses on fuel etc. are examples of such costs. These costs depend upon the volume of output.

Short Run Costs and Long-Run Costs

Short-run costs are those costs that are concerned with the short-run production of a firm. They are of two types namely fixed costs and variable costs.

Long-run costs are those costs that are concerned with the long-run process of production. In the long run, all the factors of production are variable and even the scale of production can be changed. All the costs during the long run are variable costs and no cost is a fixed cost.

Controllable and Uncontrollable Cost

Those costs which remain in the control of management and organization are known as controllable costs. Usually, Such costs include direct and variable costs.

Uncontrollable costs are those costs, which are beyond the control of the management and the organization, in the short term. Usually, fixed costs are uncontrollable costs.

Urgent and Postponable costs

The costs which are absolutely essential to keep the production, marketing and production function of the firm continued are known as urgent Costs. It is not possible to postpone their use. For Example, raw materials, labour, fuel, production overheads, office overheads and distribution and marketing overheads, etc.

In every firm, some costs are such they may be postponed for some time and they do not materially affect the production. These are known as postponing costs. For example, repair of buildings, painting and whitewashing, purchasing new furniture in place of old furniture and labour welfare activities, etc.

What is cost concept with example?

Cost and output analysis is related to the production function, prices of factors of production etc. The cost differs from one discipline to another. In short period cost can be divided into two parts i.e. fixed cost and variable cost because a part of factors of production remains fixed in a short period and a part of factors of production remains variable. While in long period all factors of production remains variable, therefore cost is variable only.

What are the 10 types of cost?

These are 10 types of costs based on different costs concepts Money Cost, Real Cost or Social Cost, Opportunity Cost, Direct and Indirect Cost, Incremental Costs and Sunk Costs, Replacement Costs and Historical Costs, Fixed Costs and Variable Costs, Short Run Costs and Long-Run Costs, Controllable and Uncontrollable Cost, Urgent and Postponable costs.

What is money cost and real cost?

Money cost is that cost which is expressed or measured in monetary terms. It is the cost in which they express are included namely the price of raw materials, wages of labour, interest on capital, rent on land, salaries of managers and the normal profit of entrepreneur. Money cost is called the accounting cost of production. Real cost means all those pains, efforts and sacrifices which are borne for the production of any commodity. In other words, efforts and sacrifices made by various sections of society for the production of any commodity are the real cost of production.

Which best defines opportunity cost?

That cost that induces any particular factor of production to remain in its existing use is known as opportunity cost. In other words, opportunity cost is the sacrifice of that alternative commodity or commodities, which can be produced with the help of these factors, from which the existing commodity has been produced.

What Is Direct and Indirect Cost?

Direct cost is concerned with the production of a commodity. It is incurred directly on the factors of production. Such cost can easily be identified and it is directly concerned with the process of production. Indirect costs are those costs that are not concerned directly with the production of a commodity. Such costs consist of selling costs, office overheads, rent of the building, salaries of security staff, depreciation of the machines etc.