Table of Contents

- 1 What is Insurance?

- 2 Definition of Insurance

- 3 Characteristics of Insurance

- 4 Nature of Insurance

- 5 Functions of Insurance

- 5.1 Provide Protection

- 5.2 Collective Bearing of Risk

- 5.3 Evaluation of Risk

- 5.4 Provide Certainty Against Risk

- 5.5 Spreading Risks

- 5.6 Prevention of Losses

- 5.7 Small Capital to Cover Larger Risks

- 5.8 Contributes Towards Development of Larger Enterprises

- 5.9 Means of Savings and Investment

- 5.10 Source of Earning Foreign Exchange

- 5.11 Promotes Exports

- 5.12 Provides Social Security

- 6 Limitations of Insurance

- 6.1 All Risk Cannot Be Insured

- 6.2 Insurable Interest in Subject Matter

- 6.3 Impossibility of Measurement of Real Loss

- 6.4 High-Risk Coverage

- 6.5 Higher Premium Rates

- 6.6 Moral Hazards

- 6.7 Uninsurable Personal Rights

- 6.8 Unattractive Investment

- 6.9 Cooperation of Government is Necessary

- 6.10 All Pure Risks are Not Insured

- 7 FAQs About the What is Insurance?

What is Insurance?

Insurance is a contract whereby one person, called the insurer, undertakes in return for the agreed consideration called premium, to pay to another person called the insured, a sum of money or its equivalent on a specified event.

In other words, Insurance may be described as a social device to reduce or eliminate risks of loss of life and property. It is a provision that a prudent man makes against inevitable contingencies, loss, or misfortune.

Under the plan of insurance, a large number of people associate themselves by sharing risks attached to individuals. As in private life, in business also there are dangers and risks of different kinds. The aim of all types of insurance is to make provisions against such dangers.

The risks which can be insured against include fire, the perils of the sea (marine insurance), death (life insurance), accidents, and burglary. Any risk contingent upon these may be insured against at a premium commensurate with the risk involved. Thus, the collective bearing of risks is insurance.

Definition of Insurance

These are some simple definitions of insurance by authors:

Insurance is a plan by which a large number of people associate themselves and transfer to the shoulders of all, risks that attach to individuals.

John Magee

Insurance is a device for the transfer to an insurer of certain risks of economic loss that would otherwise come by the insured.

Allen Z. Mayerson

Insurance has been defined as a plan by which large numbers of people associate themselves, with the shoulders of all, risks attached to individuals.

Magee D.H

Insurance is a contract in which a sum of money is paid by the assured in consideration of insurers incurring the risk of paying a large sum upon a given contingency.

Justice Tindal

Insurance in its technical sense is a social device that employs the use of a pooling technique to eliminate uncertainty.

Schultz and Bradwill

Insurance may be described as a social device whereby a large group of individuals, through a system of equitable contributions, may reduce or eliminate certain measurable risks of economic loss common to all members of the group.

Encyclopedia Britannica

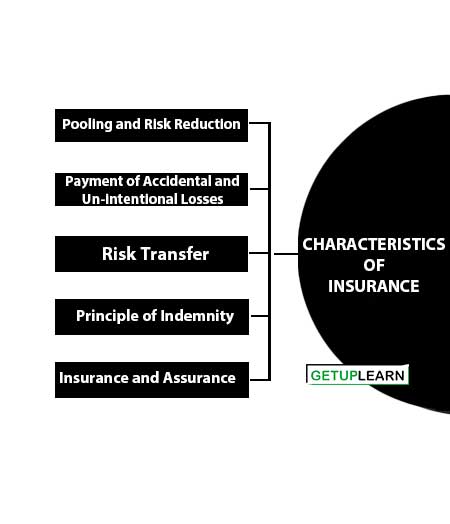

Characteristics of Insurance

The following are the characteristics of insurance:

- Pooling and Risk Reduction

- Payment of Accidental and Un-intentional Losses

- Risk Transfer

- Principle of Indemnity

- Insurance and Assurance

Pooling and Risk Reduction

It means spreading losses incurred by the few over the entire group. As a result, the average loss is substituted for the actual loss. To predict future losses, exposure persons in large numbers are to be grouped together to apply the principle of large numbers.

For this purpose, there must be a large number of exposed persons facing the same kind of perils. In other words, pooling in an insurance implies sharing of losses by the entire group, and using the law of large numbers to predict future losses.

Payment of Accidental and Un-intentional Losses

Insurance covers such losses which are accidental in nature. The insurance must cover all the unforeseen losses which occur at random. The losses must be the result of the accident but not a result of chance.

For example, a person may fall while getting down from a bus and one of his limbs may be broken. Such a loss is the result of the accident and is hence covered under insurance.

Risk Transfer

The contract of insurance is one where the risk of one party is transferred to the other who is the insurer and can make good the loss of the insured. Risks of death, theft, illness, etc., are all examples, where the risk of the insured can be transferred to the insurer. Thus, insurance is the most common form of risk transfer.

Principle of Indemnity

All valid insurance contracts are contracts of insurance excluding life insurance contracts. Indemnity means to make good the loss suffered by the insured and to put him back in the same financial position as he was before the occurrence of the loss.

In the case of household insurance, the insurer pays the actual loss in case of any theft or damage caused to the household appliances covered under the policy. However, the insured cannot claim more than the actual loss caused to him.

Insurance and Assurance

The two terms “insurance” and “assurance” are often used for the discussion of the insurance business to mean one and the same thing. But the terms are not synonymous. Assurance refers to a contract under which the sum assured is bound to be payable sooner or later.

A contract of insurance is a contract for compensation for damage or loss as in the case of fire or marine insurance. In these types of insurance, the insured must suffer a pecuniary loss before he can claim compensation from the insurer. If there is no such loss, the claim does not arise.

Contrary to this, a contract of assurance is an out-and-out contract, e.g., a contract of life insurance. In such a contract the payment of the sum of money assumed is bound to be made either on the maturity of the policy or the death of the assured.

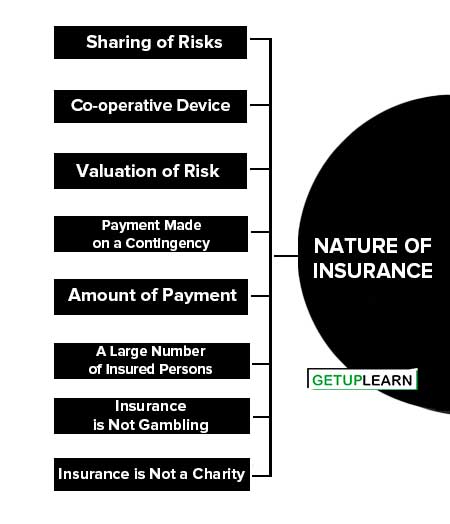

Nature of Insurance

These are some main natures of insurance that we discussed below:

- Sharing of Risks

- Co-operative Device

- Valuation of Risk

- Payment Made on a Contingency

- Amount of Payment

- A Large Number of Insured Persons

- Insurance is Not Gambling

- Insurance is Not a Charity

Insurance is a cooperative device for the division of risk which may fall on an individual or his family on the happening of some unforeseen events such as the sudden death of earning member, marine, perils in marine insurance, fire in fire insurance, and theft in case of general insurance.

Co-operative Device

A large number of persons share loss arising due to a particular risk and as such insurance is a cooperative device.

Valuation of Risk

Before the insurance contract, the evaluation of risk is made by which the insurance premium is determined which forms the basis of the insurance contract.

Payment Made on a Contingency

The Insurer is bound to pay the insured when a certain contingency arises. The happening may be due to death, fire marine perils etc.

Amount of Payment

The amount of payment depends upon the value of loss that occurred due to the particular risk provided insurance is there up to that amount.

A Large Number of Insured Persons

To make the insurance cheaper it is essential to insure a large number of persons or property.

Insurance is Not Gambling

In insurance, uncertainty is converted into certainty because the insurer promises to pay a definite sum for damage or death.

Insurance is Not a Charity

Charity is given without consideration but insurance is not possible without a premium and thus insurance is not charity.

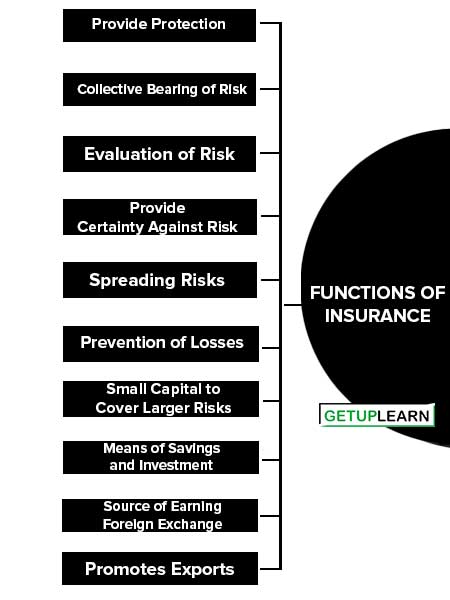

Functions of Insurance

The functions of insurance may be categorized as below:

- Provide Protection

- Collective Bearing of Risk

- Evaluation of Risk

- Provide Certainty Against Risk

- Spreading Risks

- Prevention of Losses

- Small Capital to Cover Larger Risks

- Contributes Towards Development of Larger Enterprises

- Means of Savings and Investment

- Source of Earning Foreign Exchange

- Promotes Exports

- Provides Social Security

Primary Functions of Insurance

The primary functions of insurance include the following:

- Provide Protection

- Collective Bearing of Risk

- Evaluation of Risk

- Provide Certainty Against Risk

- Spreading Risks

Provide Protection

The primary purpose of insurance is to provide protection against future risks, accidents, and uncertainty. Insurance cannot check the happending of the risk, but can certainly provide for the losses of risk.

Professor Hopkins observes, “Insurance is a protection against economic loss by sharing the risk with others.” He further adds “Insurance is the protection against economic loss.”

Collective Bearing of Risk

Insurance is a device to share the financial loss of a few among many others. Dinsdale opines insurance is a means by which few losses are shared among longer people. Similarly, William Beveridge observes, “The collective bearing of risks is insurance.”

All the insureds contribute the premiums towards a fund and out of which the persons exposed to a particular risk are paid. Similarly, Rigel and Miller observe, “Insurance is a device whereby the uncertain risk may be made more certain.”

Evaluation of Risk

Insurance determines the probable volume of risk by evaluating various factors that give rise to risk. Risk is the basis for determining the premium rate also.

Provide Certainty Against Risk

Insurance is a device that helps to change from uncertainty to certainty. This may be the reason that John Magee writes that the function of insurance is to provide certainty. Similarly, Riegel and Miller observe, “The function of insurance is primarily to decrease the uncertainty of events.”

Spreading Risks

Professor Thomas has correctly written that “Insurance is the device for spreading or distributing risks.”

Secondary Functions of Insurance

These are the secondary functions of insurance explained:

- Prevention of Losses

- Small Capital to Cover Larger Risks

- Contributes Towards Development of Larger Enterprises

Prevention of Losses

Insurance cautions individuals and businessmen to adopt suitable devices to prevent unfortunate consequences of risk by observing safety instructions; installing automatic sparklers or alarm systems, etc. Prevention of losses causes the lesser payment to the assured by the insurer and this will encourage more savings by way of premiums.

Reduced rates of premiums stimulate more business and better protection for the insureds. The Loss Prevention Association of India formed by the insurers, alerts the people about future risks and uncertainties through publicity measures.

Small Capital to Cover Larger Risks

Dinsdale observes insurance relieves businessmen and others from security investments, by paying a small amount of premium against larger risk and uncertainty. There is no need for them to invest separately for security purposes and this money can be invested in other activities.

Contributes Towards Development of Larger Enterprises

Insurance provides development opportunities to those larger enterprises having more risks in their setup. Even financial institutions may be prepared to give credit to sick industrial units which have insured their assets including plant and machinery.

Other Functions of Insurance

There are indirect functions of insurance that benefit the economy indirectly. Some of such functions are:

- Means of Savings and Investment

- Source of Earning Foreign Exchange

- Promotes Exports

- Provides Social Security

Means of Savings and Investment

Insurance serves as savings and investment. Insurance is a compulsory way of saving and it restricts the unnecessary expenses by the insureds. For the purpose of availing income-tax exemptions also, people invest in insurance.

In the words of Magee “Although investment is not the primary function of insurance. Investment service is proved to be an important benefit of insurance.

Source of Earning Foreign Exchange

Insurance is an international business. The country can earn foreign exchange by way of the issue of marine insurance policies.

Promotes Exports

Insurance makes foreign trade risk-free through different types of policies issued under marine insurance cover. In case of loss of cargo and others due to marine perils, the insurance company makes good the loss.

Through various social protection plans, insurance provides social security to people. It not only provides security at the time of death but also provides assistance to the insureds at the time of sickness, old age, maternity, etc.

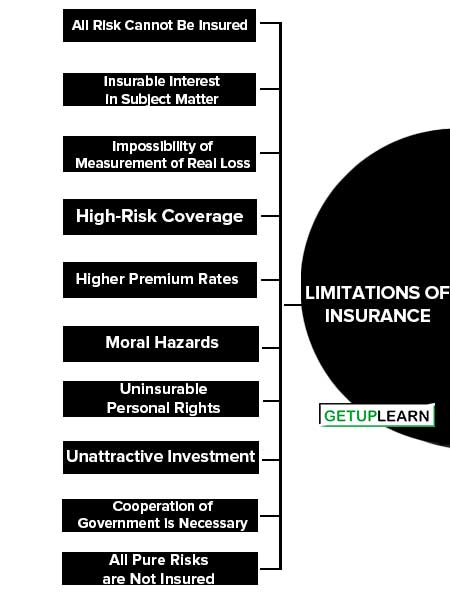

Limitations of Insurance

In spite of the number of advantages of insurance, it has certain limitations. On account of such limitations, the benefits of insurance could not be availed in full. These limitations of insurance are:

- All Risk Cannot Be Insured

- Insurable Interest in Subject Matter

- Impossibility of Measurement of Real Loss

- High-Risk Coverage

- Higher Premium Rates

- Moral Hazards

- Uninsurable Personal Rights

- Unattractive Investment

- Cooperation of Government is Necessary

- All Pure Risks are Not Insured

All Risk Cannot Be Insured

All the risks cannot be insured; only pure risks can be insured, and speculative risks are not insurable.

Insurable Interest in Subject Matter

Insurable interest (financial interest) on the subject matter: Insurance is possible only when the insured has an insurable interest in the subject matter of insurance either at the time of insurance or at the time of loss, or at both times; in the absence of which the contract of insurance becomes void.

Impossibility of Measurement of Real Loss

In case the loss arising from the happening of the event cannot be valued in terms of money, such risks are not insurable.

High-Risk Coverage

Not possible to insure the risk is covered by a single individual or a small group: Insurance against the risk of a single individual or a small group of persons is not advisable since it is not practicable due to the higher cost involved.

Another important limitation is that the premium rates are higher in our country and as such, certain categories of people cannot avail the advantage of insurance. The main reason for the higher rate of premiums is the higher operating cost.

Moral Hazards

It becomes difficult to control moral hazards in insurance. There are certain people who misutilized insurance plans for their self-interest by claiming false claims from insurance companies.

Uninsurable Personal Rights

Certain Rights Cannot Be Insured by Private Insurers: Private insurers are not permitted to insure certain specified types of risks like unemployment insurance, the bankruptcy of banks insurance, etc.

Unattractive Investment

Insurance is not a profitable investment. Its main objective is to provide security against risks. The insurance business cannot be a source to acquire profits.

Cooperation of Government is Necessary

In certain cases cooperation of the government is necessary: Certain specified risks can be insured with the cooperation of the government only; such as unemployment insurance, insolvency of banks, food insurance, etc.

All Pure Risks are Not Insured

All the pure risks are not insured by the insurer. Even if does with a higher rate of premium only. For example, the insurer does not take any interest to accept a proposal from a person whose heart surgery has gone through.

FAQs About the What is Insurance?

What is the meaning of insurance?

Insurance may be described as a social device whereby a large group of individuals, through a system of equitable contributions, may reduce or eliminate certain measurable risks of economic loss common to all members of the group.

What is the best definition of insurance?

Insurance is a contract in which a sum of money is paid by the assured in consideration of insurers incurring the risk of paying a large sum upon a given contingency. By Justice Tindal

What are the characteristics of insurance?

The following are characteristics of insurance given below:

1. Sharing of Risks

2. Cooperative Device

3. Evaluation of Risk

4. Payment on Happening of Specified Event

5. Amount of Payment

6. A large number of Insured Persons

7. Insurance is Not a Gambling

8. Insurance is Not a Charity

9. Protection Against Risks

10. Spreading of Risks and more.

What are the functions of insurance?

We can categorize functions of insurance into three categories: Primary, Secondary, and Others. Some of the functions of insurance are:

1. Provide Protection

2. Collective Bearing of Risk

3. Evaluation of Risk

4. Provide Certainty Against Risk

5. Spreading Risks

6. Prevention of Losses

7. Small Capital to Cover Larger Risks.

What are the limitations of insurance?

The limitations of insurance are: All Risk Cannot Be Insured 2. Insurable Interest in Subject Matter 3. Impossibility of Measurement of Real Loss 4. High-Risk Coverage 5. Higher Premium Rates 6. Moral Hazards 7. Uninsurable Personal Rights 8. Unattractive Investment 9. Cooperation of Government is Necessary 10. All Pure Risks are Not Insured.

What is the nature of insurance?

The following is the nature of insurance: Sharing of Risks 2. Co-operative Device 3. Valuation of Risk 4. Payment Made on a Contingency 5. Amount of Payment 6. A Large Number of Insured Persons 7. Insurance is Not Gambling 8. Insurance is Not a Charity.