Table of Contents

What is Risk in Banks?

The word “Risk” has been derived from the Latin word Rescum. Risk is the potentiality that both the expected and unexpected events may have an adverse impact on the bank‘s capital or earnings. Risk arises due to uncertainty or unpredictability of the future due to changes in internal and external business environment.

Risk and uncertainties form an integral part of banking. In the banking sector, risk results from variations and fluctuations in assets or liabilities or both.

Since risk is directly proportionate to return, the more risk a bank takes, it can expect to generate more money.

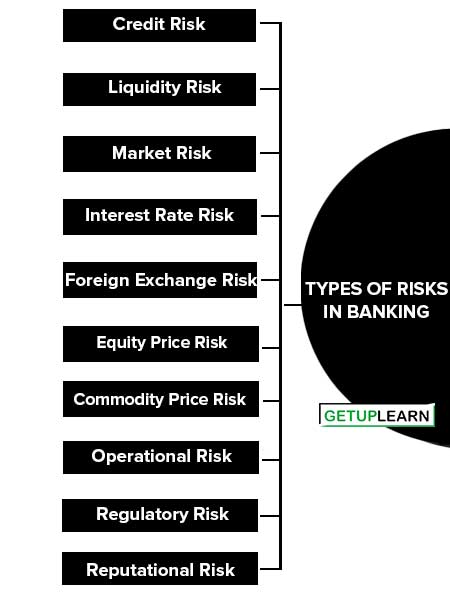

Types of Risks in Banking

The various types of financial and non-financial risks to which the banks. Let’s discuss the types of risks in banking:

- Credit Risk

- Liquidity Risk

- Market Risk

- Interest Rate Risk

- Foreign Exchange Risk

- Equity Price Risk

- Commodity Price Risk

- Operational Risk

- Strategic Risk

- Regulatory Risk

- Reputational Risk

Financial Risks

The following are the financial risks in banking:

- Credit Risk

- Liquidity Risk

- Market Risk

- Interest Rate Risk

- Foreign Exchange Risk

- Equity Price Risk

- Commodity Price Risk

Credit Risk

Credit risk refers to the risk that the borrower of the bank fails to repay the loan on agreed terms and the bank may lose the principal of the loan or the interest associated with it or both. It also includes the pre-payment risk resulting in a loss of opportunity for the bank to earn higher interest income.

Credit risk is an essential characteristic of the business of lending funds. Loans given by banks are considered to be the largest source of credit risk.

Liquidity Risk

Liquidity is the capacity of the bank to make the cash available to meet depositors’ payment commitments on demand or as and when they are due and to undertake new transactions when they are profitable. Liquidity risk is the risk that a bank will not have sufficient liquid resources to carry out its day-to-day operations and meet its commitments.

Market Risk

Market risk is defined as the risk of losses in on- or off-balance sheet positions that arise from movement in market prices. Market risk arises from movements in market prices which are caused due to changes in interest rates, foreign exchange rates, and equity and commodity prices.

Market risk is the most prominent risk for banks. The bank should develop a sound and well-informed strategy to manage market risk.

Interest Rate Risk

Interest Rate Risk is inherent in the banking business. This risk to the income or capital arises due to fluctuations in the interest rates. Due to the deregulation of interest rates, interest rates are determined by market forces. Interest rate risk significantly impacts and alters a bank‘s profitability and market value.

The fluctuations in interest rates affect banks’ earnings by changing their Net Interest Income (NII). The cost of liabilities and the earning of assets of the banks are also closely related to market interest rate volatility. This type of risk arises when there is a mismatch between the assets & liabilities of the bank, which are subject to interest rate adjustment within a specified period.

Foreign Exchange Risk

When a bank holds assets or liabilities in foreign currencies it is exposed to foreign exchange risk as exchange rates are volatile and no one can predict what the exchange rate will be in the next period. The uncertain movement in the exchange rate poses a threat to the earnings and capital of the bank if such a movement is in an undesired and unanticipated direction.

This undesired movement in the exchange rates can lead to sizeable losses. Foreign exchange risk is also known as exchange rate risk or currency risk. It involves currency rate risk, transaction risks (profits/loss on the transfer of earned profits due to time lag), and transportation risk (risks arising out of exchange restrictions).

Equity Price Risk

This risk arises due to the potential of banks to suffer losses on their exposures in the capital markets, due to adverse movements in the prices of equity.

Commodity Price Risk

This risk arises due to the exposure of banks in commodity markets. Commodity price risk is more volatile and complex to measure. Banks in developed markets use derivatives to hedge commodity price risk.

Non-Financial Risks

The following are the non-financial risks in banking:

Operational Risk

Basel II has recognized operational risk as a distinct class of risk outside credit and market risk. The Basel Committee on Banking Supervision defines operational risk as the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events.

Operational risk occurs in all day-to-day banking activities. This risk is highly dynamic in nature and arises due to many causes such as incompetency of personnel and misuse of powers, the failure of the information technology system, and the possibilities of errors in information processing, data transmission, data retrieval, and inaccuracy of result or output. Two of the most common operational risks are:

-

Transaction Risk: Transaction risk is the risk arising from fraud, both internal and external, failed business processes, and the inability to maintain business continuity and manage information.

- Compliance Risk: Compliance risk is the risk of legal or regulatory sanction, financial loss, or reputation loss that a bank may suffer as a result of its failure to comply with any or all of the applicable laws, regulations, code of conduct, and standards of good practice.

Strategic Risk

This is the risk arising out of certain strategic decisions taken by the banks for sustaining themselves in the present-day scenario for example decision to open a subsidiary may run the risk of losses if the subsidiary does not do good business.

Regulatory Risk

It is defined as the risk associated with the impact on profitability and financial position of a bank due to changes in the regulatory conditions, for example, the introduction of asset classification norms has adversely affected the banks of NPAs and balance sheet bottom lines.

Reputational Risk

Reputational risk is the risk of damage to a bank‘s image and public standing. It leads to a loss of confidence in the public in a bank. It occurs due to the following reasons:

- The bank‘s failure to honor commitments to the government, regulators, and the public.

- Mismanagement of the bank‘s affairs.

- Non-observance of the codes of conduct under corporate governance.

- Suppression of facts and manipulation of records and accounts are also instances of reputational risk.

- Bad customer service, inappropriate staff behavior, and delay in decisions.

What is Risk Management in Banks?

Risk Management is defined as a planned way of dealing with potential loss or damage. It is an ongoing process of forecasting, analyzing, and evaluating potential risks and taking some corrective actions to reduce or minimize those risks.

Risk Management is an important tool for the optimum use of capital for generating profits. Now a day‘s all banks set up separate risk management departments in order to monitor, manage, and measure these risks.

The department continuously measures the risk of the bank’s current portfolio of assets, loans, liabilities, deposits, and other exposures. The department also communicates the bank‘s risk profile to other bank functions and takes steps, either directly or in collaboration with other bank functions, to reduce the possibility of loss or to mitigate the size of the potential loss.

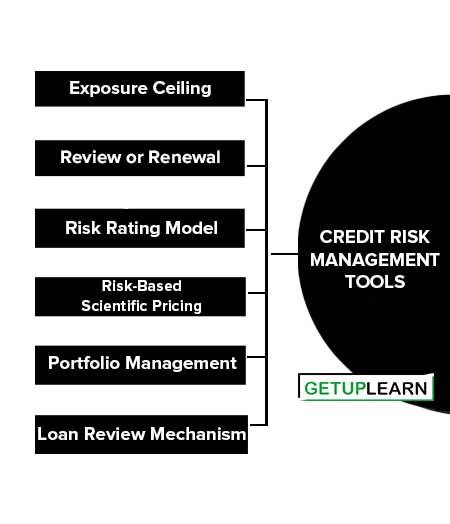

Credit Risk Management Tools

The following are the credit risk management tools:

- Exposure Ceiling

- Review or Renewal

- Risk Rating Model

- Risk-Based Scientific Pricing

- Portfolio Management

- Loan Review Mechanism

Exposure Ceiling

Prudential Limit is linked to Capital Funds – say 15% for individual borrower entity, 40% for a group with an additional 10% for infrastructure projects undertaken by the group, the Threshold limit is fixed at a level lower than Prudential Exposure; Substantial Exposure, which is the sum total of the exposures beyond threshold limit should not exceed 600% to 800% of the Capital Funds of the bank (i.e. six to eight times).

Review or Renewal

Multi-tier Credit Approving Authority, a constitution-wise delegation of powers, Higher delegated powers for better-rated customers; the discriminatory time schedule for review/renewal, Hurdle rates, and Benchmarks for fresh exposures and periodicity for renewal based on risk rating, etc are formulated.

Risk Rating Model

Set up a comprehensive risk scoring system on a six to nine-point scale. Clearly define rating thresholds and review the ratings periodically preferably at half-yearly intervals. Rating migration is to be mapped to estimate the expected loss.

Risk-Based Scientific Pricing

Link loan pricing to expected loss. High-risk category borrowers are to be priced high. Build historical data on default losses. Allocate capital to absorb the unexpected loss. Adopt the RAROC framework.

Portfolio Management

The need for credit portfolio management emanates from the necessity to optimize the benefits associated with diversification and to reduce the potential adverse impact of concentration of exposures to a particular borrower, sector, or industry. Stipulate quantitative ceiling on aggregate exposure on specific rating categories, distribution of borrowers in various industries, and business groups and conduct rapid portfolio reviews.

The existing framework of tracking the non-performing loans around the balance sheet date does not signal the quality of the entire loan book. There should be a proper & regular ongoing system for the identification of credit weaknesses well in advance. Initiate steps to preserve the desired portfolio quality and integrate portfolio reviews with the credit decision-making process.

Loan Review Mechanism

This should be done independently of credit operations. It is also referred to as Credit Audit covers a review of the sanction process, compliance status, review of risk rating, pick up of warning signals, and recommendation of corrective action with the objective of improving credit quality.

It should target all loans above a certain cut-off limit ensuring that at least 30% to 40% of the portfolio is subjected to LRM in a year so as to ensure that all major credit risks embedded in the balance sheet have been tracked. This is done to bring about qualitative improvement in credit administration. Identify loans with credit weakness.