Table of Contents

-

1 Need for Working Capital

- 1.1 Strengthen Solvency

- 1.2 Enhance Goodwill

- 1.3 Easy Obtaining Loan

- 1.4 Regular Supply of Raw Material

- 1.5 Smooth Business Operation

- 1.6 Growth and Expansion

- 1.7 Cash Flow Management

- 1.8 Seasonal and Cyclical Fluctuations

- 1.9 Business Stability and Resilience

- 1.10 Seizing Opportunities

- 1.11 Business Value

- 2 FAQs About the Need for Working Capital

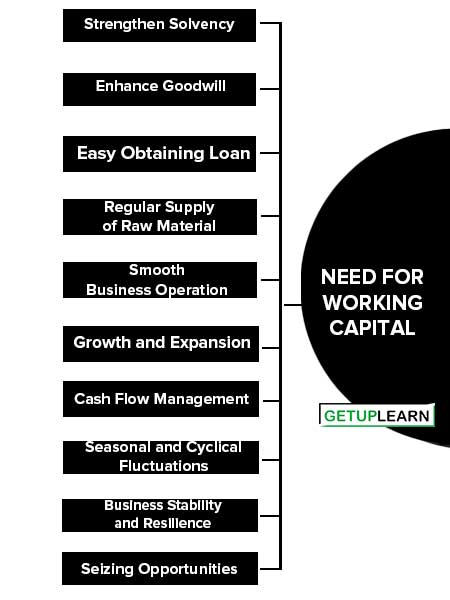

Need for Working Capital

Working capital is the lifeblood and nerve center of business. The need for working capital is crucial for the smooth functioning and long-term success of a business. Here are some key points need for working capital:

- Strengthen Solvency

- Enhance Goodwill

- Easy Obtaining Loan

- Regular Supply of Raw Material

- Smooth Business Operation

- Growth and Expansion

- Cash Flow Management

- Seasonal and Cyclical Fluctuations

- Business Stability and Resilience

- Seizing Opportunities

- Business Value

Strengthen Solvency

Working capital helps to operate the business smoothly without any financial problems for making the payment of short-term liabilities.

Purchase of raw materials and payment of salary, wages, and overhead can be made without any delay. Adequate working capital helps in maintaining the solvency of the business by providing an uninterrupted flow of production.

Enhance Goodwill

Sufficient working capital enables a business concerned to make prompt payments and hence helps in creating and maintaining goodwill. Goodwill is enhanced because all current liabilities and operating expenses are paid on time.

Easy Obtaining Loan

A firm having adequate working capital, high solvency, and good credit rating can arrange loans from banks and financial institutions on easy and favorable terms.

Regular Supply of Raw Material

Quick payment of credit purchase of raw materials ensures the regular supply of raw materials for suppliers. Suppliers are satisfied by the payment on time. It ensures a regular supply of raw materials and continuous production.

Smooth Business Operation

Working capital is really a lifeblood of any business organization which maintains the firm in good condition. Any day-to-day financial requirement can be met without any shortage of funds. All expenses and current liabilities are paid on time.

Growth and Expansion

When a business aims to expand its operations, enter new markets, or launch new products, additional working capital is often required. It supports the increased investment in inventory, equipment, marketing, and other expenses associated with growth initiatives.

Cash Flow Management

Working capital helps manage cash flow fluctuations, ensuring that a business has enough liquidity to meet its short-term obligations. It provides a cushion to cover any temporary cash shortfalls due to delayed customer payments or unexpected expenses.

Seasonal and Cyclical Fluctuations

Many businesses experience seasonal or cyclical variations in sales and revenue. Adequate working capital helps companies manage these fluctuations by providing the necessary resources during low-demand periods when sales are reduced.

Business Stability and Resilience

Adequate working capital provides a safety net for unexpected events or financial downturns. It allows businesses to navigate through challenging times, such as economic recessions or industry-specific disruptions, by providing the flexibility to adapt and sustain operations.

Seizing Opportunities

Having excess working capital can provide a competitive advantage by enabling a business to take advantage of new opportunities swiftly. It allows for quick investment in strategic projects, acquisitions, or capitalizing on favorable market conditions.

Business Value

Adequate working capital contributes to the overall financial health and value of a business. A well-managed working capital position indicates efficiency, profitability, and the ability to generate sustainable cash flows, which can positively impact the business’s valuation and attractiveness to investors.

FAQs About the Need for Working Capital

What is the need for working capital?

The following is the need for working capital:

1. Strengthen Solvency

2. Enhance Goodwill

3. Easy Obtaining Loan

4. Regular Supply of Raw Material

5. Smooth Business Operation

6. Growth and Expansion

7. Cash Flow Management

8. Seasonal and Cyclical Fluctuations

9. Business Stability and Resilience

10. Seizing Opportunities.