Table of Contents

Irrelevance of Capital Structure

In this article, you will learn the irrelevance of capital structure. For this, you will study the NOI approach and the MM Hypothesis.

NOI Approach

According to NOI approach the market value of the firm is not affected by capital structure change. The market value of the firm is found by capitalizing the NOI at the overall or the WACC, which is a constant. The market:

MM Hypothesis

Modigliani and Miller (MM) do not agree with the traditional view. They argue that, in perfect capital markets without taxes and transaction costs, a firm’s market value and the cost of capital remain invariant to the capital structure changes.

The value of the firm depends on the earnings and risk of its assets (business risk) rather than the way in which assets have been financed. The MM hypothesis can be best explained in terms of their two propositions.

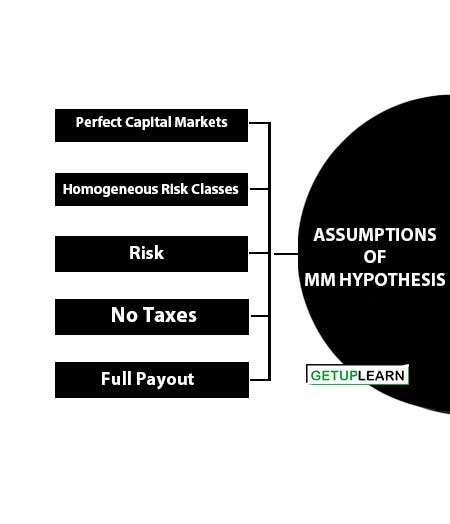

Assumptions of MM Hypothesis

MM’s Proposition I is based on certain assumptions. These assumptions relate to the behavior of investors and capital markets, the actions of the firm, and the tax environment.

These are the assumptions of MM hypothesis:

Perfect Capital Markets

Securities (shares and debt instruments) are traded in the perfect capital market situation. This specifically means that (a) investors are free to buy or sell securities; (b) they can borrow without restriction at the same terms as the firms do; and (c) they behave rationally. It is also implied that the transaction costs, i.e., the cost of buying and selling securities, do not exist.

The assumption that firms and individual investors can borrow and lend at the same rate of interest is a very critical assumption for the validity of MM Proposition I. Homemade leverage will not be a substitute for corporate leverage if the borrowing and lending rates for individual investors are different from the firms.

Homogeneous Risk Classes

Firms operate in similar business conditions and have similar operating risks. They are considered to have similar operating risks and belong to homogeneous risk classes when their expected earnings have identical risk characteristics. It is generally implied under the MM hypothesis that firms within the same industry constitute a homogeneous class.

Risk

The operating risk is defined in terms of the variability of the Net Operating Income (NOI). The risk of investors depends on both the random fluctuations of the expected NOI and the possibility that the actual value of the variable may turn out to be different than their best estimate.

No Taxes

There do not exist any corporate taxes. This implies that interest payable on debt does not save any taxes.

Full Payout

Firms distribute all net earnings to shareholders. This means that firms follow a 100 percent dividend payout.

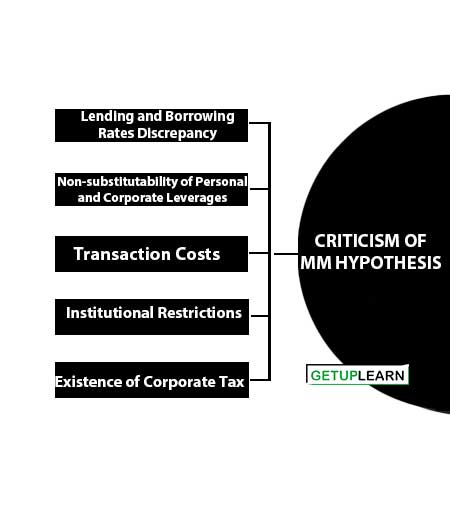

Criticism of MM Hypothesis

The arbitrage process is the behavioral foundation for MM’s hypothesis. The shortcomings of this hypothesis lie in the assumption of a perfect capital market in which arbitrage is expected to work.

Due to the existence of imperfections in the capital market, arbitrage may fail to work and may give rise to discrepancies between the market values of levered and unlevered firms. The arbitrage process may fail to bring equilibrium in the capital market for the following reasons:

- Lending and Borrowing Rates Discrepancy

- Non-substitutability of Personal and Corporate Leverages

- Transaction Costs

- Institutional Restrictions

- Existence of Corporate Tax

Lending and Borrowing Rates Discrepancy

The assumption that firms and individuals can borrow and lend at the same rate of interest does not hold in practice. Because of the substantial holding of fixed assets, firms have a higher credit standing.

As a result, they are able to borrow at lower rates of interest than individuals. If the cost of borrowing to an investor is more than the firm’s borrowing rate, then the equalization process will fall short of completion.

Non-substitutability of Personal and Corporate Leverages

It is incorrect to assume that ‘personal (home-made) leverage’ is a perfect substitute for ‘corporate leverage.’ The existence of limited liability of firms in contrast with unlimited liability of individuals clearly places individuals and firms on a different footing in the capital markets.

If a levered firm goes bankrupt, all investors stand to lose to the extent of the amount of the purchase price of their shares. But, if an investor creates personal leverage, then in the event of the firm’s insolvency.

He would lose not only his principal in the shares of the unlevered company, but will also be liable to return the amount of his personal loan. Thus, it is more risky to create personal leverage and invest in the unlevered firm than investing directly in the levered firm.

Transaction Costs

The existence of transaction costs also interferes with the working of arbitrage. Due to the costs involved in the buying and selling securities, it would become necessary to invest a greater amount in order to earn the same return. As a result, the levered firm will have a higher market value.

Institutional Restrictions

Institutional restrictions also impede the working of arbitrage. The ‘home-made’ leverage is not practically feasible as a number of institutional investors would not be able to substitute personal leverage for corporate leverage, simply because they are not allowed to engage in the “home-made” leverage.

Existence of Corporate Tax

The incorporation of the corporate income taxes will also frustrate MM’s conclusions. Interest charges are tax deductible. This, in fact, means that the cost of borrowing funds to the firm is less than the contractual rate of interest.

The very existence of interest charges gives the firm a tax advantage, which allows it to return to its equity and debt-holders a larger stream of income than it otherwise could have.