Table of Contents

- 1 What is Capital Structure?

- 2 Meaning of Capital Structure

- 3 Definition of Capital Structure

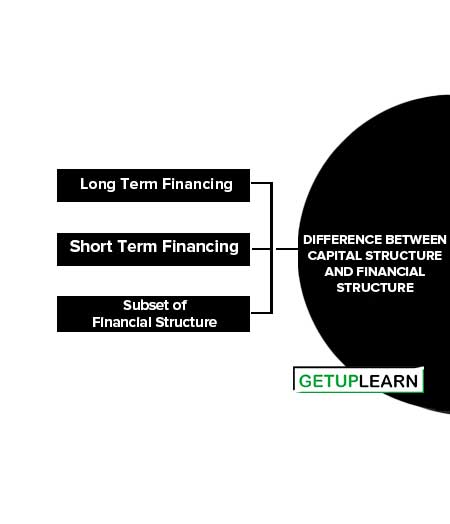

- 4 Difference Between Capital Structure and Financial Structure

- 5 Difference Between Capital Structure and Capitalization

- 6 Difference Between Financial Structure and Capitalization

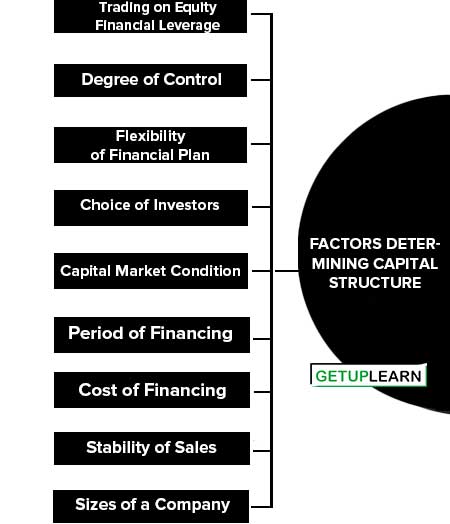

- 7 Factors Determining Capital Structure

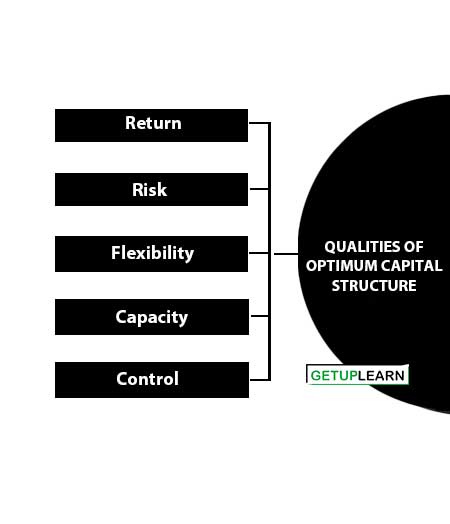

- 8 Qualities of Optimum Capital Structure

- 9 FAQs about the Capital Structure

What is Capital Structure?

Capital structure is the composition of different types of capital or financing a company employs to acquire resources necessary for its business operations and growth. Commonly, the capital structure comprises stockholders’ investments (equity capital) and long-term loans (loan capital).

Meaning of Capital Structure

Capital structure decision is concerned with the decision-making about the mix of various sources of capital viz equity capital, preference capital, retained earnings, and long-term debt in the total worth of a firm.

Definition of Capital Structure

The following are definitions of capital structure given by the authors:

[su_quote cite=”Gerstenberg”]Capital structure of a firm refers to the composition of the makeup of its capitalization and it includes all long-term capital resources viz loans, reserves, shares, and bonds.[/su_quote]

[su_quote cite=”R.H Wessel”]The term capital structure is frequently used to indicate the long-term sources of funds employed in a business enterprise.[/su_quote]

[su_quote cite=”Weston and Brigham”]Capital structure is the permanent financing of the firm represented by long-term debt, preferred stock, and net worth./su_quote]

Difference Between Capital Structure and Financial Structure

These are three simple points to understand the difference between capital structure and financial structure:

Long Term Financing

The capital structure of a company is long-term financing which includes long-term debt, common stock, preferred stock, and retained earnings.

Short Term Financing

Financial structure on the other hand also includes short-term debt and accounts payable along with long-term financing.

Subset of Financial Structure

Capital structure is thus a subset of the financial structure of a company.

Difference Between Capital Structure and Capitalization

The difference between capital structure and capitalization:

- Capitalization means an amount of capital invested in a business. It is used in the case of companies only. It includes all the sources of funds used in an organization.

- Capital structure is a qualitative term that gives the ratio in which the total capital is contributed by different sources. It may be high-geared or low-geared and is influenced by external factors.

Difference Between Financial Structure and Capitalization

The difference between financial structure and capitalization:

- Financial structure refers to the balance between all of the company’s liabilities and its equities. It thus concerns the entire “Liabilities plus Equities” side of the balance sheet.

- Capital structure, by contrast, includes equities and only long-term liabilities. It refers to the makeup of the company’s underlying value, in particular the relative balance between funding from equities and funding from long-term debt. The presumption is that funds from both sources are used for acquiring income-producing assets. Capital structure is also known as capitalization.

Factors Determining Capital Structure

The factors determining capital structure are explained below:

- Trading on Equity Financial Leverage

- Degree of Control

- Flexibility of Financial Plan

- Choice of Investors

- Capital Market Condition

- Period of Financing

- Cost of Financing

- Stability of Sales

- Sizes of a Company

Trading on Equity Financial Leverage

The word “equity” denotes the ownership of the company. Trading on equity means taking advantage of equity share capital to borrow funds on a reasonable basis. It refers to additional profits that equity shareholders earn because of the issuance of debentures and preference shares.

It is based on the thought that if the rate of dividend on preference capital and the rate of interest on borrowed capital is lower than the general rate of the company’s earnings, equity shareholders are at an advantage which means a company should go for a judicious blend of preference shares, equity shares as well as debentures. Trading on equity becomes more important when the expectations of shareholders are high.

Degree of Control

In a company, it is the directors who are the so-called elected representatives of equity shareholders. These members have got maximum voting rights in concern as compared to the preference shareholders and debenture holders.

Preference shareholders have reasonably fewer voting rights while debenture holders have no voting rights. If the company’s management policies are such that they want to retain their voting rights in their hands, the capital structure consists of debenture holders and loans rather than equity shares.

Flexibility of Financial Plan

In an enterprise, the capital structure should be such that there are both contractions as well as relaxations in plans. Debentures and loans can be refunded back as time requires.

While equity capital cannot be refunded at any point which provides rigidity to plans. Therefore, in order to make the capital structure possible, the company should go for the issue of debentures and other loans.

Choice of Investors

The Company’s policy generally is to have different categories of investors for securities. Therefore, a capital structure should give enough choices to all kinds of investors to invest. Bold and adventurous investors generally go for equity shares and loans and debentures are generally raised keeping mind-conscious investors.

Capital Market Condition

In the lifetime of the company, the market price of the shares has got an important influence. During the depression period, the company’s capital structure generally consists of debentures and loans. While in periods of boons and inflation, the company’s capital should consist of share capital generally equity shares.

Period of Financing

When the company wants to raise finance for a short period, it goes for loans from banks and other institutions; while for a long period, it goes for the issue of shares and debentures.

Cost of Financing

In a capital structure, the company has to look at the factor of cost when securities are raised. It is seen that debentures at the time of profit earning of the company prove to be a cheaper source of finance as compared to equity shares where equity shareholders demand an extra share in profits.

Stability of Sales

An established business that has a growing market and high sales turnover, the company is in a position to meet fixed commitments. Interest on debentures has to be paid regardless of profit.

Therefore, when sales are high, thereby the profits are high and the company is in a better position to meet fixed commitments like interest on debentures and dividends on preference shares. If a company is having unstable sales, then the company is not in a position to meet fixed obligations. So, equity capital proves to be safe in such cases.

Sizes of a Company

Small-size business firms’ capital structure generally consists of loans from banks and retained profits. While on the other hand, big companies having goodwill, stability and an established profit can easily go for issuance of shares and debentures as well as loans and borrowings from financial institutions. The bigger the size, the wider is total capitalization.

Qualities of Optimum Capital Structure

While developing an appropriate capital structure for his company, the financial manager should aim at maximizing the long-term market price of equity shares. The following are qualities of optimum capital structure:

Return

The capital structure of the company should give maximum return to the shareholders. Within the constraints, maximum use of the leverage at a minimum cost should be made so as to obtain maximum advantage of trading on equity at minimum cost.

Risk

The capital structure should involve minimal risk of financial insolvency. The use of excessive debt threatens the solvency of the company. Since the use of debt adds risk to the company and shareholders, it should be used cautiously with equity.

Flexibility

The Company should be able to change the proportion of debt and equity in the capital structure if required depending on changing conditions. The capital structure should be flexible to meet the changing conditions. It should also be possible for the company to provide funds whenever needed to finance its profitable activities.

Capacity

The Company should have the capacity to pay the fixed periodic charges (e.g., interest) and the installments of the principal sum. The debt capacity of the company should not be exceeded. The debt capacity of a company depends on its ability to generate cash flows.

Control

The capital structure should not involve loss of control of the shareholders. If there is too much debt then shareholders are likely to lose control to debenture holders. Thus, there is no mathematical formula that will determine the proportion of debt and equity. The relative importance of each of these features may differ from company to company.

For example, a company may give more importance to flexibility than control while another company may be more concerned about solvency than any other requirement. Furthermore, the relative importance of these requirements may change with changing conditions.

FAQs about the Capital Structure

What is the meaning of capital structure?

The capital structure of a firm refers to the composition of the makeup of its capitalization and it includes all long-term capital resources viz loans, reserves, shares, and bonds.

What are the factors determining capital structure?

The following are the factors determining capital structure:

1. Trading on Equity Financial Leverage

2. Degree of Control

3. The flexibility of Financial Plan

4. Choice of Investors

5. Capital Market Condition

6. Period of Financing

7. Cost of Financing

8. Stability of Sales

9. Sizes of a Company.

What are the qualities of optimum capital structure?

The following are qualities of optimum capital structure:

1. Return

2. Risk

3. Flexibility

4. Capacity

5. Control.