In India, there was an acute shortage of capital and people lacked initiative and enterprise. Means of transport were undeveloped and as such Industry was in bad condition. Thus there is a need for an institution that removes all the above deficiencies and this led to the emergence of Banks.

“A bank is an Institution, which touches and should touch the lives of millions, has necessarily to be inspired by a larger social purpose and has to subserve national priorities and objectives.” A well-developed banking system provides a basic foundation for the economic development of the country. The role of a commercial bank in a developing country is discussed as under.

Table of Contents

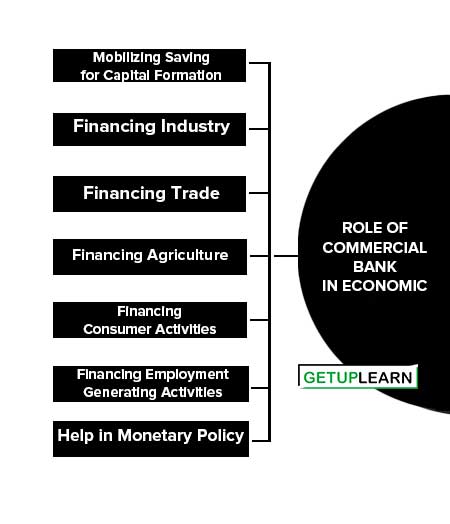

Role of Commercial Bank in Economic Development

The role of commercial bank in economic development is explained below:

- Mobilizing Saving for Capital Formation

- Financing Industry

- Financing Trade

- Financing Agriculture

- Financing Consumer Activities

- Financing Employment Generating Activities

- Help in Monetary Policy

Mobilizing Saving for Capital Formation

Capital formation is the most important function of commercial banks. Commercial banks help in mobilizing savings through a network of branch banking in different areas. People in developing countries have low incomes and through the variety of deposit schemes, banks induce them to save.

They collect deposits from the public and by mobilizing savings; the banks channel these deposits into productive investments. Thus they help in the capital formation of a developing country.

Financing Industry

Commercial banks finance the industrial sector by providing them with short-term, medium-term, and long-term loans. In India, commercial banks provide short-term and medium-term financing of small-scale industries and also provide hire-purchase finance.

Besides, these, they also underwrite the shares and debentures of large-scale industries. Thus banks provide two types of finance to industries:

- One is by giving them a short-term or medium-term loan.

- The second is by providing underwriting facilities to them.

Financing Trade

Commercial banks provide finance for internal and external trade. Internal finance includes providing loans to retailers and wholesalers to purchase goods with which they deal. Banks also help in the movement of goods from one place to another by providing all types of facilities such as discounting and accepting bills of exchange, providing overdraft facilities, issuing drafts, etc.

External finance includes providing finance to both exports and imports of developing countries by providing foreign exchange facilities to importers and exporters of goods.

Financing Agriculture

Commercial banks provide loans to traders who deal in agricultural commodities. With the aim to provide agricultural finance, commercial banks open a network of branches in rural areas. They provide finance directly to agriculturists for the marketing of their produce, for the use of machines in their farms, for providing irrigation facilities, etc.

They also provide financial assistance for animal husbandry, dairy farming, sheep breeding, poultry farming, and horticulture.

For the small and marginal farmers and landless agricultural workers, artisans, and petty shopkeepers in rural areas, Government provides financial assistance through the regional rural banks in India, which are operated under a commercial bank. Thus commercial banks cater to the need of the credit requirements of all types of rural people.

Financing Consumer Activities

People in underdeveloped countries are poor and are having low incomes and because of it, they do not have sufficient finance to purchase durable consumer goods. Commercial banks provide loans to such consumers for the purchase of durable items such as houses, scooters, fans, refrigerators, etc. In this way, they also help in raising the standard of living of the people in developing countries.

Financing Employment Generating Activities

Commercial banks also provide finance for employment-generating activities in developing countries by providing educational loans to young people studying engineering, medicine, and other vocational institutes of higher learning.

They provide loans to young entrepreneurs, medical and engineering graduates, and other technically trained persons in establishing their own businesses which further generates more employment opportunities for others. Hence, the banks not only help in human capital formation but also provide help in increasing entrepreneurial activities in developing countries.

Help in Monetary Policy

By fully implementing the monetary policy of the central bank, commercial banks help the economic development of a country. In fact, the success of monetary policy depends upon commercial banks in keeping with the requirements of a developing economy.

FAQs About the Role of Commercial Bank in Economic Development

What is the role of commercial bank in economic development?

The role of commercial bank in economic development are:

1. Mobilizing Saving for Capital Formation

2. Financing Industry

3. Financing Trade

4. Financing Agriculture

5. Financing Consumer Activities

6. Financing Employment Generating Activities

7. Help in Monetary Policy.