Table of Contents

- 1 What is Monetary Policy?

- 2 Definition of Monetary Policy

- 3 Objectives of Monetary Policy

- 4 Features of Monetary Policy

- 5 Limitations of Monetary Policy

-

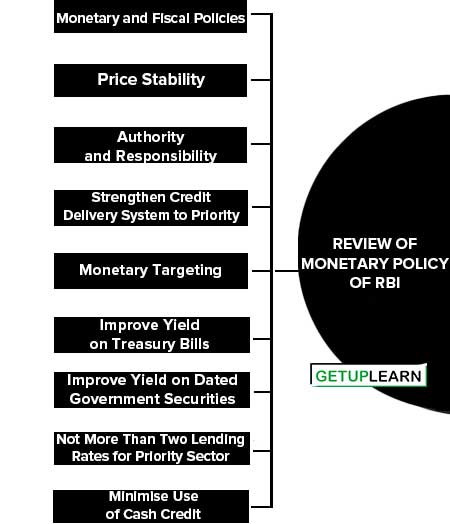

6 Review of Monetary Policy of RBI

- 6.1 Monetary and Fiscal Policies

- 6.2 Price Stability

- 6.3 Authority and Responsibility

- 6.4 Strengthen Credit Delivery System to Priority Sector

- 6.5 Monetary Targeting

- 6.6 Improve Yield on Treasury Bills

- 6.7 Improve Yield on Dated Government Securities

- 6.8 Not More Than Two Lending Rates for Priority Sector

- 6.9 Minimise Use of Cash Credit

- 7 FAQs About the Monetary Policy

What is Monetary Policy?

Monetary policy refers to the use of instruments under the control of the central bank to regulate the availability, cost, and use of money and credit. The goal: achieving specific economic objectives, such as low and stable inflation and promoting growth.

The monetary policy of a nation involves the overall set of laws and practices that control the quantity and quality of money in an economy.” From these definitions, it is clear that a monetary policy is related to the availability and cost of money supply in the economy in order to attain certain broad objectives.

The Central Bank of a nation keeps control of the supply of money to attain the objectives of its monetary policy.

Definition of Monetary Policy

These are the definitions of monetary policy by economists:

A policy employing the central banks control of the supply of money as an instrument for achieving the objectives of general economic policy is a monetary policy.

Prof. Harry Johnson

A policy which influences the public stock of money substitute of public demand for such assets of both that is policy which influences public liquidity position is known as a monetary policy.

A.G. Hart

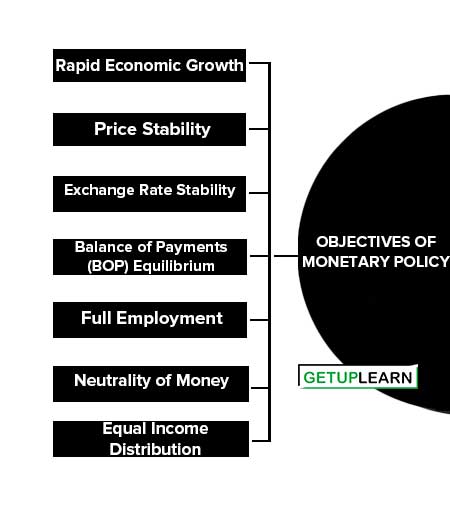

Objectives of Monetary Policy

The objectives of monetary policy are as follows:

- Rapid Economic Growth

- Price Stability

- Exchange Rate Stability

- Balance of Payments (BOP) Equilibrium

- Full Employment

- Neutrality of Money

- Equal Income Distribution

Rapid Economic Growth

Amongst the most important objectives of a monetary policy is rapid economic growth. The monetary policy by controlling the real interest rates and its resultant impact on investment can influence economic growth.

Also, the investment level in the economy can be encouraged if the RBI opts for a cheap or easy credit policy by reducing interest rates. This increased investment can speed up economic growth. If the monetary policy succeeds in maintaining income and price stability then faster economic growth is possible.

Price Stability

Inflation and deflation mark all economies the situation is called Price Instability and is harmful to the economy. Thus, the monetary policy having an objective of price stability tries to keep the value of money stable, as helps in reducing wealth and income inequalities.

The monetary policy should be an ‘easy money policy’ when the economy suffers from recession, but when there is an inflationary situation there should be a ‘dear money policy’.

Exchange Rate Stability

The price of a home currency expressed in terms of any foreign currency is called the exchange rate. The international community might lose confidence in our economy if this exchange rate is very volatile. The monetary policy aims at maintaining the relative stability in the exchange rate.

The RBI tries to Page 126 of 326 maintain the exchange rate stability by altering the foreign exchange reserves and trying to influence the demand for foreign exchange.

Balance of Payments (BOP) Equilibrium

India, along with many other countries, suffers from the Disequilibrium in the BOP. The Reserve Bank of India tries to maintain equilibrium in the balance of payments through its monetary policy.

The BOP has two aspects i.e. the ‘BOP Surplus’ that reflects an excess money supply in the domestic economy and the ‘BOP Deficit’, which stands for the stringency of money. BOP equilibrium can be achieved if the monetary policy succeeds in maintaining monetary equilibrium.

Full Employment

It was after Keynes’s publication of the “General Theory” in 1936 that the concept of full employment was much discussed. It refers to the absence of involuntary unemployment. To say, ‘Full Employment’ stands for a situation in which everybody who wants a job, gets a job.

However, it does not state that there is no unemployment and that full employment is actually full. Monetary policy can be used to achieve full employment. If the monetary policy is expansionary then credit supply can be encouraged and this in turn could assist in creating more jobs in different sectors of the economy.

Neutrality of Money

Money has always been looked at as a passive factor by economists such as Wicksted and Robertson. They feel that money should play only the role of medium of exchange and not more than that and hence the monetary policy should regulate the supply of money.

The change in the money supply creates monetary disequilibrium. Thus, to neutralize the effect of monetary expansion, monetary policy has to regulate the supply of money. However, this objective of a monetary policy is always criticized on the ground that it would be difficult to attain price stability if the money supply is kept constant then.

Equal Income Distribution

The role of fiscal policy is to maintain economic equality, felt many contemporary economists. However, in recent years economists have given the opinion that monetary policy can also help and play a supplementary role in attaining economic equality.

Special provisions for the neglected supply such as agriculture, village industries, and small-scale industries can be provided by Monetary policy, along with cheaper credit for the longer term. This can prove fruitful for these sectors to come up. Thus to reduce economic inequalities among different sections of society in the recent period, monetary policy can be of great help.

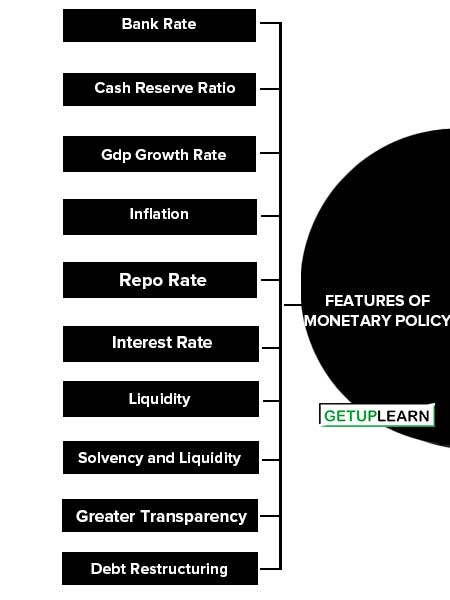

Features of Monetary Policy

The important features of the new Monetary and Credit Policy of the Reserve Bank of India for the year 2009-10 are as follows:

- Bank Rate

- Cash Reserve Ratio

- Gdp Growth Rate

- Inflation

- Repo Rate

- Interest Rate

- Liquidity

- Focus on Relationship With Depositors

- Greater Transparency

- Debt Restructuring

- Investment in Agricultural and Rural Areas

- Priority Concerns

Bank Rate

Bank rate (the rate at which the RBI finances commercial banks) has been maintained at 4.65% in July 2020 also. It indicates that a rise in interest rates will happen only at a slow pace.

Cash Reserve Ratio

The Cash Reserve Ratio (the portion of deposits of commercial banks to be deposited with RBI) will also remain unchanged at 4 percent in 2019 and 3% in 2020.

Gdp Growth Rate

It is expected that industry and service sectors would maintain their current growth momentum despite soaring oil prices and agricultural growth would be 3 percent pushing the GDP growth to six percent.

Inflation

This policy envisages that the inflation rate would be 3 percent in the medium term.

Repo Rate

The reserve repo rate has been reduced from 3.5 percent to 3.25 percent. The repo rate has been reduced to 4%.

Interest Rate

In order to revive the economy from its current slowdown, RBI in its new policy has followed another step of the Low-interest regime so as to reduce the burden of loans on the general people and industry.

Thus, the RBI reduced the “repo” and “reverse repo” rates, this would reduce the interest rates on loans for retail and industrial borrowers and thereby increase the demand for loans.

Moreover, the current lower interest regime would also be helpful to the government which needs to borrow large funds from the market to meet its huge expenditure program in the context of the global recession.

Liquidity

The stance of the policy is to provide appropriate liquidity to meet credit growth (estimated at 19% in the financial year 2006) and support investment and export demand in the economy while placing equal emphasis on price stability.

Focus on Relationship With Depositors

RBI advised to revert to focus on their basic relationship with depositors. As part of this, it has proposed a Banking Codes and Standards Board. Banks are being asked to refocus on deposit mobilization and empower depositors by providing wider access and better quality banking services.

Greater Transparency

It has also decided to go for a quarterly review of the monetary policy in order to ensure greater transparency as well as more frequent communication with the markets.

Debt Restructuring

RBI would explore modalities to meet the growing financial needs of small-scale industries. A simplified debt restructuring mechanism was also being considered for the sector. The Credit Information Bureau of India Ltd. was working on a project to provide credit reports on small-scale industries.

RBI is reviewing all its existing guidelines on financing the small-scale sector, debt restructuring, and nursing sick units with a view to rationalizing, consolidating, and liberalizing them.

Investment in Agricultural and Rural Areas

An expert group had been set up to formulate a strategy for increasing investment in agriculture. RBI would also take the help of an outside agency to assess customer satisfaction with credit delivery in rural areas by banks.

Priority Concerns

RBI’s latest policy continues the focus on the four primary concerns facing the central banks: Inflationary pressures, a global environment of rising interest rates, a widening current account deficit, and the need to balance continued credit growth with a tight monetary policy stance.

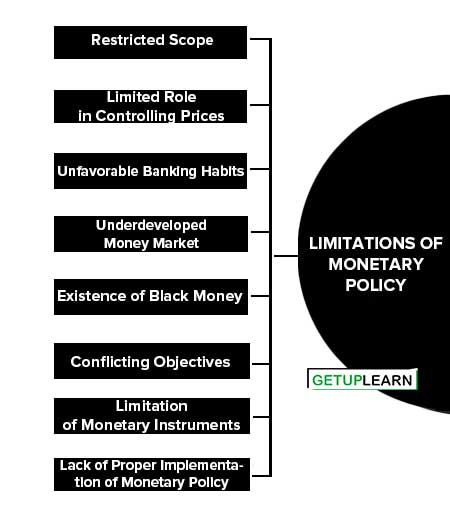

Limitations of Monetary Policy

The following are the main limitations of monetary policy adopted by the Reserve Bank:

- Restricted Scope

- Limited Role in Controlling Prices

- Unfavorable Banking Habits

- Underdeveloped Money Market

- Existence of Black Money

- Conflicting Objectives

- Limitation of Monetary Instruments

- Lack of Proper Implementation of Monetary Policy

Restricted Scope

The main limitation of the monetary policy of the Reserve Bank of India is its restricted scope. In reality, monetary policy has been assigned only a minor role in the process of economic development.

Limited Role in Controlling Prices

The monetary policy of the Reserve Bank has played only a limited role in controlling inflationary pressure. It has not succeeded in achieving the objective of growth with stability. The monetary policy of the Reserve Bank is not appropriately integrated with fiscal, foreign exchange, and income policies.

Unfavorable Banking Habits

The unfavorable banking habits of the Indian population are another important limitation of the monetary policy of RBI. Indian prefers to make use of cash rather than cheque. It reduces the credit creation capacity of the banks.

Underdeveloped Money Market

The underdeveloped money market is also a major limitation of monetary policy in India. The monetary policy fails to achieve the desired results in the unorganized Indian money market.

Existence of Black Money

The working of the monetary policy is also adversely affected by the existence of black money in the Indian economy. Black money is rightly regarded as a threat to the official money credit policy mechanism to manage demand and price in several sectors of the economy.

Conflicting Objectives

Another important limitation of monetary policy arises from its conflicting objectives. The monetary policy fails to achieve proper coordination between its different objectives of economic development, price stability, etc.

Limitation of Monetary Instruments

Another important limitation of monetary policy is related to the different problems in the various instruments of credit control. These problems are regarding frequent and sharp changes in the bank rate, the CRR and SLR have been also fixed very high for most of the time. The limitations of monetary instruments disturb the smooth working of monetary policy.

Lack of Proper Implementation of Monetary Policy

The Reserve Bank of India is not successful in implementing the monetary policy due to various internal and external considerations of the economy.

Review of Monetary Policy of RBI

Recommendations of the Chakravarty Committee (1985) to review the working of the monetary policy.

The Reserve Bank of India appointed a committee to review the working of the Monetary System under the chairmanship of Shri Sukhmoy Chakravarty in 1982. The Committee submitted its report in 1985. The main recommendations of the Committee for the smooth functioning of the monetary policy are discussed below:

- Monetary and Fiscal Policies

- Price Stability

- Authority and Responsibility

- Strengthen Credit Delivery System to Priority Sector

- Monetary Targeting

- Improve Yield on Treasury Bills

- Improve Yield on Dated Government Securities

- Not More Than Two Lending Rates for Priority Sector

- Minimise Use of Cash Credit

Monetary and Fiscal Policies

Coordination Between Monetary and Fiscal Policies: The Committee suggested that the working of the monetary system must be according to the development strategies of the five-year plans.

Price Stability

The Committee has recommended that price stability should be the dominant objective of the monetary policy. It is essential to maintain only reasonable increases in prices to maintain a viable balance of payments position. It is also suggested that the credit of the Reserve Bank to the government should be restricted.

Matching Between Authority and Responsibility: There must be a proper balance between the authority and responsibility of the RBI in supervision and control over the functioning of the monetary system.

Strengthen Credit Delivery System to Priority Sector

The credit delivery system should be strengthened with a view to providing adequate and timely credit to target groups covered under priority sector lending.

Monetary Targeting

The Committee suggested that the target for the growth of the money supply in a year should be set within a range. It should be reviewed in the course of the year to accommodate revisions.

Improve Yield on Treasury Bills

The Committee suggested improving the yield on Treasury Bills. It should constitute the ideal short-term paper in the money market. Treasury Bills is a short-term instruments. It should not be used to finance medium or long-term requirements.

Improve Yield on Dated Government Securities

The yield on medium and long-dated government securities should be improved. The yields should be according to the expectations of the capital market with regard to the long-term movement of the price level.

Not More Than Two Lending Rates for Priority Sector

The committee recommended that there should not be more than two concessional lending rates in the priority sector lending. One rate should be equal to the basic minimum lending rate and the other should be slightly lower.

Minimise Use of Cash Credit

The committee suggested that the role of cash credit should be minimized. The widespread use of cash credit for providing working capital finance creates problems for the supervision of end-use control of bank credit.

It also hinders the growth of the bill market. The cash credit system suffers from certain drawbacks with serious implications for the monetary system.

FAQs About the Monetary Policy

What is the meaning of monetary policy?

A policy that influences the public stock of money substitute of public demand for such assets of both that is a policy which influences public liquidity position is known as a monetary policy.

What are the objectives of monetary policy?

The following are the objectives of monetary policy:

1. Rapid Economic Growth

2. Price Stability

3. Exchange Rate Stability

4. Balance of Payments (BOP) Equilibrium

5. Full Employment

6. Neutrality of Money

7. Equal Income Distribution.