Table of Contents

- 1 What is Working Capital?

- 2 Meaning of Working Capital Management

- 3 Types of Working Capital

- 4 Difference Between Gross and Net Working Capital

- 5 Objectives of Working Capital

- 6 Components of Working Capital

- 7 Determining Factors of Working Capital

- 8 Advantages of Adequate Working Capital

- 9 Disadvantages of Excess Working Capital

- 10 Methods of Working Capital for Forecasting

- 11 FAQs About the Working Capital

What is Working Capital?

Working capital is part of the firm’s capital that is required for financing short-term or current assets such as stock, receivables, marketable securities, and cash. Money invested in these current assets keeps revolving with relative rapidity and is being constantly converted into cash.

These cash flows rotate again in exchange for other such assets. Working Capital is also called as “short-term capital”. “Liquid Capital”, “Circulating or revolving capital”, The Working Capital management refers to the management of the working capital or to be more precise the management of current assets and current liabilities.

The goal of working capital management is to manage the firms’ current assets and current liabilities in such a way that a satisfactory level of working capital is maintained. This is so because, if the firm cannot maintain a satisfactory level of working capital, it is likely to become insolvent and may even be forced into bankruptcy.

Each of the short-term sources of financing must be continuously managed to ensure that they are obtained and used in the best possible way. The current assets should be large enough to cover its current liabilities in order to ensure a reasonable margin of safety.

Meaning of Working Capital Management

Working capital management is a very important to ensure that the company has enough funds to carry on with its day-to-day operations smoothly. A business should not have a very long Cash Conversion Cycle.

A cash Conversion Cycle measures the time period for which a firm will be deprived of funds if it increases its investments as a part of its business growth strategies.

For this the company has to take certain measures such as reducing the credit period of the customers, negotiating with the suppliers and increasing its own credit period with them, maintaining the right level of inventory which reduces the raw material costs, and proper cash management which ensures that cash holding costs are reduced. If these measures are followed, the working capital requirement automatically comes down.

Types of Working Capital

These are the following basis of types of working capital:

On the Basis of Concept

Gross Working Capital

In a broad sense, the term working capital refers to the gross working capital and represents the amount of funds invested in current assets.

Thus, the gross working capital is the capital invested in the total current assets of the enterprise. Current assets are those assets which in the ordinary course of business can be converted into cash within a short period of time normally one accounting year. Examples of current assets are:

- Cash in Hand and Bank Balances

- Bills Receivables

- Sundry Debtors (less provision for bad debts)

- Short-Term loans and advances

- Inventories of stocks, as:

- Raw-materials

- Work-in-process

- Stores and spares

- Finished goods

- Temporary investment of surplus funds

- Prepaid Expenses

- Accrued Incomes

Net Working Capital

In a general sense, the term working capital refers to the net working capital is the excess of current assets over current liabilities. Or say: Net Working Capital = Current Assets – Current Liabilities Net working capital may be positive or negative.

When the current assets exceed the current liabilities, the working capital is positive, and the negative working capital results when the current liabilities are more than the current assets.

Current Liabilities are those liabilities that are intended to be paid in the ordinary course of business within a short period of time normally one accounting year, out of the current assets or the income of the business. Examples of current liabilities are:

- Bills payable.

- Sundry Creditors or Accounts Payable,

- Accrued or Outstanding Expenses.

- Short-term loans, advances, and deposits,

- Dividends Payable.

- Bank Overdraft.

- Provision for taxation, if it does not amount to appropriation of profits.

The gross concept is sometimes referred to as the net concept of working capital for the following reasons.

- It enables the enterprise to provide the correct amount of working capital at the right time.

- Every management is more interested in the total current assets with which it has to operate than the sources from where it is made available.

- The gross concept takes into consideration the fact that every increase in the funds of the enterprise would increase its working capital.

- The gross concept of working capital is more useful in determining the rate of return on investments in working capital.

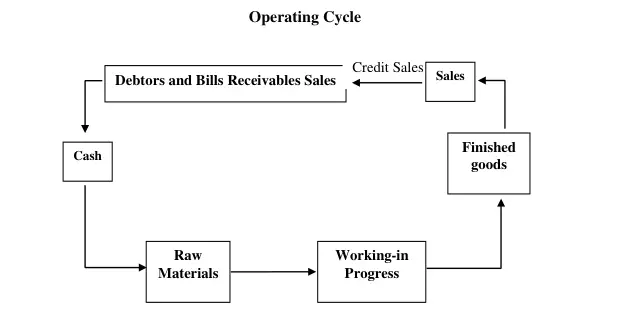

Another concept is the “operating concept.” The duration of time required to complete the sequence of events right from the purchase of raw materials/goods for cash to the realization of sales in cash is called the operating cycle or working capital cycle.

The net duration of the operating cycle is calculated by adding the number of days involved in the different stages of operation. This concept is more appropriate than others. According to this concept, the necessary liquid funds required by a firm for production, administration, and selling can be determined for the whole year.

If cash working capital requirements are known in advance, then non-cash current assets may be better managed. Now it is an important tool in projecting the working capital requirements of an enterprise.

Permanent Working Capital

It means that the minimum amount which is permanently blocked in the business and cannot be converted into cash in the normal course of business. This amount is definitely required throughout the year on a continuous basis for maintaining the circulation of current assets.

London committee has identified this capital as a core current asset. As the business grows the requirement of permanent working capital also increases due to an increase in current assets. This portion of working capital is financed through long-term sources.

Variable Working Capital

The amount which is above the permanent level of working capital is called temporary working capital. Such requirement of this part of working capital is financed from short-term funds, whenever needed. It is classified further:

Seasonal Working Capital

Some the industries like refrigerators and coolers may need extra funds to carry on production and to accumulate stock before the sale operations. It is of short-term nature, it has to be financed from short-term sources like bank loans, etc.

Specific Working Capital

Such capital is required to meet unforeseen contingencies like slumps and others. It is arranged to meet special exigencies.

Difference Between Gross and Net Working Capital

The difference between gross working capital and net working capital does not in any way undermine the relevance of the concepts of either gross or net working capital. A financial manager must consider both of them because they provide different interpretations.

The gross working capital denotes the total working capital or the total investment in current assets. A firm should maintain an optimum level of gross working capital. This will help to avoid:

- The unnecessary stoppage of work or chance of liquidation due to insufficient working capital.

- The Effect on profitability (because overflowing working capital implies cost) Therefore, a firm should have just an adequate level of total current assets. The gross working capital also gives an idea of the total funds required for maintaining current assets.

On the other hand, net working capital refers to the amount of funds that must be invested by the firm, more or less, regularly in current assets. The remaining portion of current assets is financed and maintained by the firm.

Both concepts of working capital i.e. the gross working capital and the net working capital have their own relevance and a financial manager should give due attention to both of these. The cash inflows and outflows for any firm are seldom synchronized and so, some working capital is necessary.

The cash outflows occurring from the existence of current liabilities are more easily and correctly predictable but the cash flows assets are difficult to be accurately predicted. The more predictable, these cash flows are, the less the net working capital required by the firm.

The firm with more and more uncertain cash inflows must maintain higher and higher levels of current assets adequate to cover the current liabilities.

Objectives of Working Capital

The following are the main objectives of working capital management:

- To Manage Firm Assets and Liabilities

- Short-term Liquidity

- To Maintain Optimum Level of Current Assets and Liabilities

- Trade-off Between Profitability and Risk

- Trade-Off

- Apart From Profitability

To Manage Firm Assets and Liabilities

The goal of working capital management is to manage the firm’s current assets and current liabilities in such a way that a satisfactory level of working capital is maintained, to meet the short-term obligations as and when they arise.

Short-term Liquidity

A significant objective of working capital management is to ensure short-term liquidity and to see that profitability is not affected by the way current assets and current liabilities are managed.

To Maintain Optimum Level of Current Assets and Liabilities

The main theme of working capital management is the interaction between the current assets and the current liabilities and arriving at the optimum level of both. The optimum level thus arrived must have provision for contingencies.

Trade-off Between Profitability and Risk

The level of a firm’s Net working capital has a bearing on its profitability as well as risk. The term profitability used in this context is measured by profits after expenses. The term risk is defined as the probability that a firm will become technically insolvent so that it will not be able to meet its obligations when they become due for payment.

The risk of becoming technically insolvent is measured using Net Working Capital. The greater the net working capital, the more liquid the firm is and therefore the less likelihood of it becoming technically insolvent. The relationship between liquidity, net working capital, and risk is such that if either net working capital or liquidity increases, the firm’s risk decreases.

Trade-Off

If a firm wants to increase its profits, it must also increase its risk. Inversely, if it decreases risk, its profitability too tends to decrease. The trade-off between these variables is that regardless of how the firm increases its profitability through the manipulation of working capital, the consequence is a corresponding increase in risk as measured by the level of Net working capital.

Apart From Profitability

Risk is a trade-off, another important ingredient of the theory of working capital management is determining the financing mix. The financing mix refers to the proportion of current assets that would be financed by current liabilities and by long-term resources.

Components of Working Capital

These are the two components of working capital:

Current Assets

Current assets are those which are either in the form of cash or can be converted into cash within a year. Current assets are important to businesses because they are the assets that are used to fund day-to-day operations and pay ongoing expenses. The main items that comprise current assets are:

- Inventories: Inventories represent raw materials and components, work in progress, and finished goods.

- Trade Debtors: Trade Debtors comprise credit sales to customers.

- Prepaid Expenses: These are those expenses, which have been paid for goods and services whose benefits have yet to be received.

- Loan and Advances: They represent loans and advances given by the firm to other firms for a short period of time.

- Investment: These assets comprise short-term surplus funds invested in government securities, shares, and short-term bonds.

- Cash and Bank Balances: These assets represent cash in hand and at the bank, which is used for meeting operational requirements. One thing you can see here is that this current asset is purely liquid but non-productive.

Current Liabilities

Current liabilities form part of working capital that represents obligations that the firm has to clear to the outside parties in a short- period, generally within a year, it includes:

- Sundry Creditors: These liabilities stem out of the purchase of raw materials on credit terms usually for a period of one to two months.

- Bank Overdrafts: These include withdrawals in excess of credit balance standing in the firm’s current accounts with banks.

- Short-term Loans: Short-term borrowings by the firm from banks and others form part of current liabilities as short-term loans.

- Provisions: These include provisions for taxation, proposed dividends, and contingencies.

Determining Factors of Working Capital

In order to determine the proper amount of working capital of a firm, the following factors should be considered carefully:

- Seasonal nature of the firm

- Firm’s credit policy

- Size of Business

- Nature of business

- Rate of growth of business

- Business cycle

- Duration of the operating cycle

- Change in terms of purchase and sales.

The amount of working capital required depends upon a large number of other factors like political stability, means of transport, coordination of activities, rate of industrial development, speed of circulation of working capital, profit margin, etc.

The above determinants should be considered because no certain criteria to determine the number of working capital needs that may be applied to all firms.

Advantages of Adequate Working Capital

Inadequate working Capital is harmful to a business organization. Adequate working capital is a source of energy for a business. The profitability of a business also depends upon the planning of adequate working capital. These are the advantages of adequate working capital:

- Adequate working capital enables a firm to pay its suppliers immediately.

- It creates an environment of confidence, high morale, confidence and increases the overall efficiency of the business.

- Adequate working capital increases the productivity and efficiency of fixed assets in the business. The adequacy of working capital affects the use of fixed assets.

- Due to adequate working capital, a firm can pay its debt in time and also its collection from debtors is relatively in time. Hence, it increases the goodwill of the firm because adequate working capital provides better security.

- Despite sufficient profits, if a firm has inadequate working capital, then it cannot distribute appropriate and enough dividends. Hence, if there is adequate working capital a firm can distribute sufficient profits and it can bring satisfaction to shareholders.

- Due to better creditworthiness, a firm can easily fetch short-term loans and advances from banks for completing its seasonal and short-period needs.

Disadvantages of Excess Working Capital

Excess working capital refers to idle funds which do not earn any profit for the firm. If there are idle funds with a firm. These are the disadvantages of excess working capital:

- If management is not utilizing its current resources then it indicates inefficient management.

- Excess working capital means, there is a defective credit policy and collection policy.

- There may be more chance of holding excess inventory if there is excess working capital such a situation results in the company’s profitability and efficiency in using its resources.

- Excess working capital results in a low rate of return and it will cause dissatisfaction among shareholders.

- Due to idle funds, the efficacy of the firm to earn profits is affected, hence due to more interest liability, it reduces the amount of profits.

Hence, it can be concluded that excess working capital reduces the return on investment while adequate working capital increases the firm’s profitability as well as goodwill.

Methods of Working Capital for Forecasting

There are the following methods of working capital for forecasting:

- Percentage of Sales Method

- Regression Analysis Method

- Operating Cycle Method

- Forecasting Net Current Assets Method

- Projected Balance Sheet Method

Percentage of Sales Method

The relationship between sales and working capital is calculated over the year; if it is found stable then it is taken as a base for determining working capital. In this method, the percentage of each item of working capital is determined.

On the basis of this relationship value of each component of working capital is calculated and then this estimated amount is summed up for the final result.

Regression Analysis Method

It is a statistical technique in which working capital requirements are calculated by using the least square method. The relationship between sales and working capital is expressed by the following equation:

| y = | a + bx |

| x = | Sales (Independent variable) |

| y = | Working Capital (Dependent variable) |

| a = | Intercept |

| b = | Slop of the time |

Operating Cycle Method

The operating cycle refers to the length of time that a company requires to convert its investment in inventory back into cash. This cycle fundamentally impacts the amount of working capital a firm needs to run its operation. Now, let’s discuss how it is used in forecasting working capital.

- Understanding the Operating Cycle: The first step is understanding the duration of the operating cycle. It’s the sum of the inventory period (time taken to sell inventory) and the receivables period (time taken to collect payment).

- Assessing Working Capital Needs: Companies analyze their operating cycle to understand their working capital needs. A longer operating cycle implies a larger investment in working capital (inventory, accounts receivable), while a shorter cycle means less working capital is needed.

- Cash Conversion Cycle (CCC): This is another crucial method for forecasting working capital. The CCC is calculated as the operating cycle minus the payable period (time taken to pay suppliers). A shorter CCC means that less working capital is tied up in the business process and thus is available for other uses.

- Sales Forecasting: The projected level of sales plays a critical role in estimating working capital. If sales are expected to grow, the company may need additional working capital to support this growth.

- Seasonal Variations: Companies also consider seasonal variations in their sales patterns. Some businesses may require more working capital during certain periods due to seasonal demand.

- Economic Indicators: Macroeconomic factors, industry trends, and market demand can also impact working capital requirements.

In summary, the methods of forecasting working capital revolve around the understanding of the operating cycle and other variables affecting the business process. By careful analysis and accurate forecasting, a company can ensure it has sufficient working capital to smoothly run its operations without unnecessary borrowing or capital raising.

Forecasting Net Current Assets Method

It’s a method that is also recommended by Tondon Committee for computing working capital requirements. In this method of forecasting first of all, an estimate of the stock of raw materials, the estimated value of work-in-process, the estimated value of the stock of finished goods, the amount receivable from debtors and others, and the estimated minimum cash balance required to meet day today payments required.

They also estimate outstanding payments for material, wages, and other administrative expenses. Now, the difference between the forecasted amount of current assets and current liabilities gives the net working capital requirements of the firm. A flat percentage may be added to this amount of provision for contingencies.

Projected Balance Sheet Method

In this method, estimates of different assets (excluding cash) and liabilities are made, taking into consideration the transactions in the ensuing period.

After that, a “Projected Balance Sheet is prepared on the basis of these forecasts. If the total assets side is more than the total of liabilities side, then it indicates the deficiency of working capital which is to be collected by the management either by taking a bank loan or from other sources.

On the contrary, if the total liabilities side is more than the total assets side then it represents the cash balance available to the firm. Such surplus cash may invest outside the business or as management plans for it. This method is not a popular method and calculations made through this method are not more scientific.

FAQs About the Working Capital

What is the meaning of working capital?

Working capital management is very important to ensure that the company has enough funds to carry on with its day-to-day operations smoothly. A business should not have a very long Cash Conversion Cycle.

What are the types of working capital?

The following are some types of working capital:

1. Gross Working Capital

2. Net Working Capital

3. Permanent Working Capital

4. Variable Working Capital.

What are the methods of working capital for forecasting?

The methods of working capital for forecasting are:

1. Percentage of Sales Method

2. Regression Analysis Method

3. Operating Cycle Method

4. Forecasting Net Current Assets Method

5. Projected Balance Sheet Method.