Table of Contents

- 1 What is Business Cycle?

- 2 Definition of Business Cycle

-

3 Characteristics of Business Cycle

- 3.1 A Business Cycle is Synchronic in Nature

- 3.2 It Exhibits a Wave Like Variation in Economic Activity

- 3.3 Business Fluctuations are Recurrent in Nature

- 3.4 Although Business Cycles are Recurrent

- 3.5 Cyclical Fluctuations are Self-reinforcing and Cumulative

- 3.6 Cyclical Movement are Generally Asymmetrical

- 3.7 Impact of a Cycle is Differential

- 3.8 Business Cycles May Be International in Character

- 4 Four Stages of Business Cycle

- 5 Types of Business Cycle

- 6 Control of Business Cycle

- 7 FAQ Related to Business Cycle

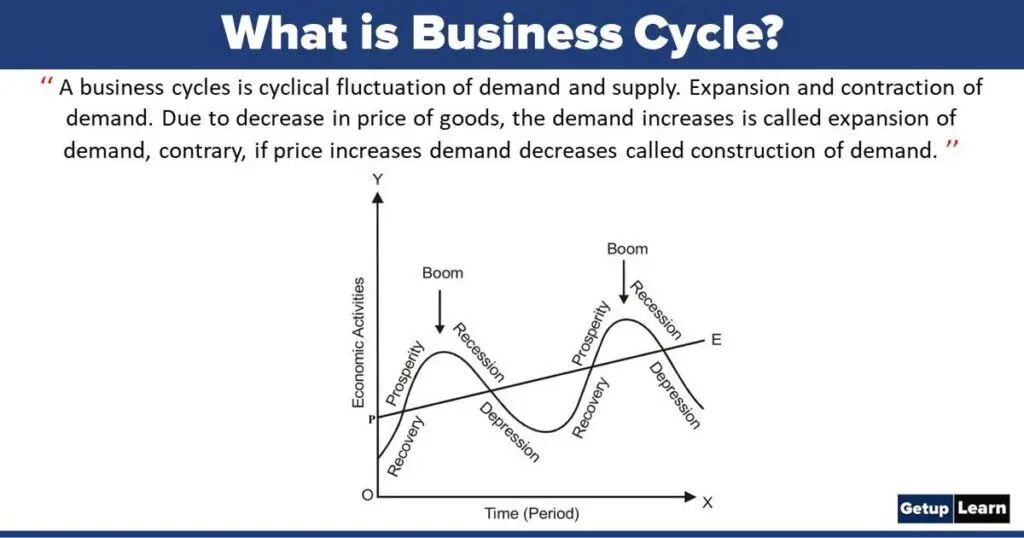

What is Business Cycle?

Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises. The cycle consists of expansions occurring at about the same time in many economic activities followed by similarly general recessions, contractions and revivals which merge into the expansion phase of the next cycle this sequence of change is recurrent but not periodic, in duration business cycles vary from more than one year to ten or twelve years, they are not divisible into shorter cycles with amplitudes approximating their own.

An important feature of the working of a capitalist economy is the existence of alternating periods of prosperity and depression, generally referred to as ‘business cycle‘ or trade cycle‘ There is no unanimity of opinion among the economists regarding the causes of this complex phenomenon.

Their explanations range widely from natural influences to technological and other exogenous forces. The business cycle is associated with sweeping fluctuations in economic activity, i.e., production, prices and employment, etc.

Definition of Business Cycle

These are some definition of business cycle given by economists:

[su_quote cite=”Keynes”]A business cycle is “composed of periods of good trade characterised by rising prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages.[/su_quote]

[su_quote cite=”Gordon”]Business cycle consist of recurring alternations of expansion and contraction in aggregate economic activity, the alternating movements in each direction being self-reinforcing and pervading virtually all parts of the economy.[/su_quote]

[su_quote cite=”A. H. Hansen”]The business cycle is a “manifestation of the industrial segment of the economy from which prosperity or depression is redistributed to other groups in the highly inter-related modern society.[/su_quote]

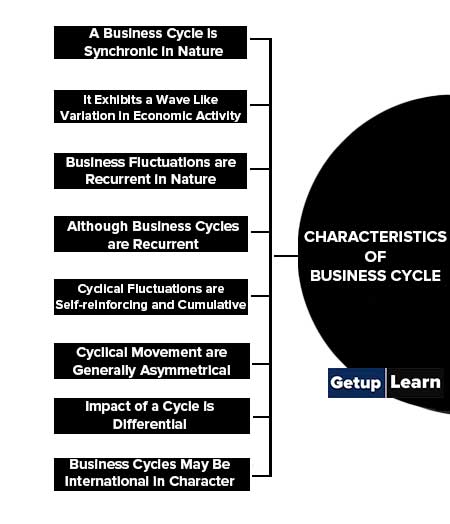

Characteristics of Business Cycle

On the basis of the above definitions, the following important characteristics of business cycle:

- A Business Cycle is Synchronic in Nature

- It Exhibits a Wave Like Variation in Economic Activity

- Business Fluctuations are Recurrent in Nature

- Although Business Cycles are Recurrent

- Cyclical Fluctuations are Self-reinforcing and Cumulative

- Cyclical Movement are Generally Asymmetrical

- Impact of a Cycle is Differential

- Business Cycles May Be International in Character

A Business Cycle is Synchronic in Nature

Whenever the process of fluctuations gets started in any sector or group of industries, it is not possible to restrict the fluctuations exclusively to that sector or group of industries. The rest of the economic activities in a country are bound to be affected by the cyclical phenomenon and thus all the sectors or industries in the economic system do experience almost simultaneous expansions and contractions.

It Exhibits a Wave Like Variation in Economic Activity

The system moves from one extreme to another like a pendulum. The expansion or prosperity is followed by contraction and vice-versa.

Business Fluctuations are Recurrent in Nature

If a period of a good trade is followed by a period of bad trade, it does not mean that the system will thereafter suffer continuously from the effects of low sales, low prices and incomes. A cyclical change is recurrent. There will be alternately expansions and contractions in the economic activities.

Although Business Cycles are Recurrent

Some trade cycles may last only two or three years, while others may last for a longer period of say, six or eight or even larger years. The actual experience of the business world has clearly shown that no fixed periodicity can be contemplated for a complete cycle.

Cyclical Fluctuations are Self-reinforcing and Cumulative

Once the cyclical movement starts in one direction, it continues to feed on itself and as a result, the rate of change becomes more and more accelerated. Over the contraction phase, the initial decline in sales or production may be very small but as the time passes, it assumes more and more catastrophic proportions. A similar pattern is exhibited by the expansion phase also.

Cyclical Movement are Generally Asymmetrical

The movement from the trough (minimum point) to the peak may be slow and halting but the downward movement may occur at a sudden and catastrophic pace. Thus, expansion may last longer than contraction. But the reverse cannot also be denied. It is always a matter of empirical circumstance than will determine whether prosperity or depression will longer in the economic system.

Impact of a Cycle is Differential

It is true that economic cycles are: pervasive, yet the impact of fluctuations upon different industries and sectors in a country is usually differential. Some industries are more sensitive to fluctuations than others and they may be affected disproportionately more than may others. For example, the capital – goods industries or construction industries are relatively much more sensitive than the other industries.

Business Cycles May Be International in Character

The cyclical changes in the advanced countries generally get transmitted to other countries of the world, since most of the countries in the present-day world economy are mutually interdependent in the matters of international trade and payments.

The conditions of prosperity or depression in one country affect, to a larger or smaller degree, the economic activities in the rest of the countries. The international transmission of cyclical fluctuations may not take place if a particular economic system is fully insulated from the effect of the forces of trade and payments.

The above characteristics tend to impress that the behaviour pattern of the business cycles is generally the same. But we must remember that no two individual cycles are exactly similar. The differences may exist in respect of their periodicity, causes and intensity.

Four Stages of Business Cycle

A typical four stages of business cycle involve:

Depression

This constitutes the first stage or phase of a business cycle. It is a protracted period in which business activity in the country is below the normal. It is characterized by a sharp reduction in production, mass unemployment, low employment, falling prices, falling profits, low wages, contraction of credit, a high rate of business failures and all-around pessimism and despair.

A decline in output or production is accompanied by a reduction in the volume of employment. The consumer goods industries, such as food, clothing etc. are not so much affected by unemployment as the basic capital goods industries. The prices of manufactured goods fall too low levels since the costs are ‘sticky’ and do not fall as rapidly as prices, the manufacturers suffer huge financial losses.

Many of these firms have to close down on account of accumulated losses. The fall in prices distorts the relative price structure. The prices of agricultural commodities and raw materials fall to a greater extent than the prices of finished manufactured goods. The agriculturists are hit more than the manufacturing classes.

Recovery

The Depression phase does not continue indefinitely. Depression contains in itself the gems of recovery. The rule workers now come forward to work at low wages. As the prices are at their lowest the consumers, who postponed their consumption expecting a still further fall in price, now start consuming.

The banks, with accumulated cash reserves, now come forward to give loans at easier terms and lower rates. As demand increases the stock of goods becomes insufficient. The economic activity has now started picking up. Investment picks up, and Employment and output slowly and steadily begin to rise. Increased income increases demand, resulting in rising in prices, profits investment, employment and incomes.

The wave of recovery once initiated soon begins to feed upon itself. Stock markets become life thus hastening the revival. Optimism develops among entrepreneurs. Bank loans and demand for credit start rising. The depression phase at its through then gave way to recovery.

Prosperity

This stage is characterised by increased production, high capital investment, in basic industries, expansion of bank credit, high prices, high profits, a high rate of formation of new business enterprises and full employment. There is a general feeling of optimism among businessmen and industrialists.

Boom

It is the rapid expansion stage in business activity of new high marks, resulting in high stocks and commodity prices, high products, high profits and overfull employment. The prosperity phase of the business cycle does not end up with a stable state of full employment. It leads to the emergence of the boom. The continuance of investment even after the stage of full employment results in a sharp inflationary rise in prices.

This causes undue optimism among businessmen and industrialists who make additional investments in various branches of the economy. This puts additional pressure on the factors of production which are already fully employed, causing a sharp rise in their prices. Soon a situation develops in which the number of jobs exceeds the number of workers available in the market. Such a situation is known as overfull employment.

This makes the businessman over-cautious. They now begin to stay away from new projects and even stop the expansion of the existing units. This prepares the ground for the succeeding stage. A boom as it is said inevitably followed up a bust.

Recession

Once the economy reaches its peak- the course changes. A downward tendency in demand is observed but the producers who are not aware of it go on producing further. The supply now exceeds demand. Now the producers come to notice that they’re stockpiling up. They are compelled to give up their future investment plans. The order for new equipment and raw materials is cancelled. A business even cuts down its existing business.

Workers are retrenched capital goods producers who lose orders. Bankers insist on repayment, stock accumulation and business failure increases investment ceases and unemployment leads to falling in income, expenditure, prices, profits and industrial and trade activities.

The desire for liquidity increases all-around producers are compelled to reduce prices so that they can find money to meet their obligations Consumers who expect a still further decline in prices postpone their consumption Stock goes on piling up. Some firms are forced into bankruptcy. The failure of one firm affects other firms with whom it has business connections. There is general distress. This phase of the business cycle is known as the Recession. It is the period of utmost suffering for a business.

Types of Business Cycle

The following are types of business cycle:

Major and Minor Trade Cycles

Major trade cycles are that period of which is very large. Minor trade cycles are those which occur during the period of a major cycle. Prof. Hanson determines the period of a major cycle between 8 years and 33 years. Two or three minor cycles occur during the period of a major cycle. The period of a minor cycle is 40 months.

Building Cycle

Building Cycles are those trade cycles which are related to the construction industry. Periods of such a cycle range from 15 to 20 years.

Long Waves

The period of a long wave is of 50 years. It was discovered by a Russian economist Kondratief. One or two major trade cycles occur during the period of a long wave.

Control of Business Cycle

Let’s discussed control of business cycle. The business cycle leads to greater unemployment and poverty. The various steps that can be taken to achieve economic stability are:

Monetary Policy

Monetary policy refers to the programs adopted by the central bank to control the supply of money. The Central bank may resort to open market operations, changes in bank rate or changes in the variable reserve ratio. The open market implies the purchase and sale of government bonds and securities. During the boom period, the Central Bank sells government bonds and securities to the public which helps to withdraw money from the public.

During the period of depression, the Central bank purchased government securities which increase the cash supply in the economy. This helps to increase investment. The central bank purchases government securities which increase the cash supply in the economy. This helps to increase investment.

The central bank may change the bank rate or rediscount rate. The bank rate is the rate at which commercial banks borrow from the central bank. When the central bank increases the bank rate the commercial banks in turn will raise their discount rates for the public. This discourages public borrowing and reduces investment.

During the depression the bank rate is lowered which will end up the increased investment. The central bank can regulate the money supply by changing the variable reserve ratio. When the central bank wants to reduce the credit creation capacity of commercial banks, it will increase the ratio of the deposits to be held by the commercial bank as a reserve with the central bank.

Fiscal Policy

This implies the variation in taxation and public expenditure programme by the government to achieve certain objectives. Taxation helps to withdraw cash from the public. An increase in tax results in the reduction of private disposable income. Taxes should be reduced during the depression will stimulate the private sector. During boom periods public expenditure must be curtailed, so that cash flow can be reduced.

The fiscal policy of the government to regulate purchasing power to control the business cycle is known as counter the cyclical fiscal policy. Counter-cyclical fiscal policy in the boom period implies a reduction in the public expenditure and heavy taxes and a surplus budget. The budget surplus can be used to eliminate previous deficits.

This implies an increase in public expenditure, reduction in taxation and deficit budgeting during the depression. The monetary policy proves more effective to control boom than depression. A proper mix of fiscal and monetary policy will be more fruitful in the control of business cycles.

Automatic Stabilizers

No doubt, Monetary policy and Fiscal Policy are two strong weapons to check the cyclical business fluctuation but they also pre-suppose a certain amount of alertness and promptness on the part of the government to enforce them at the right moment. The economists have, therefore, suggested the introduction of a number of automatic stabilizers to deal with the business cycle.

An automatic stabilizer is an economic shock absorber that helps smooth the cyclical business fluctuations of its own accord without requiring deliberate action on the part of the government. One such device is the progressive income tax. This tax is so devised that people in higher income brackets are taxed at a progressively higher rate than those in the lower-income brackets.

For example, a rich man with a very high income may have to pay a tax of 50% whereas a person with a low income may have to pay 5% of his income. Such a progressive type of income tax tends automatically to offset cyclical fluctuation, because in an upswing, when incomes are rising, people would pay more taxes to the government and, thus, their expenditure would be checked; and downswing when incomes are declining and tax-percentage is low, people would pay fewer taxes to the government, leaving more funds for them to spend.

What does the term business cycle describe?

A business cycle is the cyclical fluctuation of demand and supply. Expansion and contraction of demand. Due to the decrease in the price of goods, the demand increases is called the expansion of demand, contrary, if price increases demand decreases called the construction of demand.

What is business cycle and its stages?

R. A. Gordon defined the business cycle as consisting of “recurring alteration of expansion and contraction in aggregate economic activity, the alternating movements in each direction being self-reinforcing and prevailing virtually all parts of the economy”.

What is meant by bank credit?

Bank sanction loans for production and consumption activities are called bank credit.

What is mean by booming?

When prices are rising, employment is rising, the growth rate is rising and reducing.

What is the exact definition of depression?

When prices of commodities are reducing unemployment is going high, salaries are declining and demand is reducing.