Table of Contents

What is Asset Liability Management?

Asset Liability Management is the ongoing process of formulating, implementing, monitoring, and revising strategies related to assets and liabilities to achieve financial objectives, for a given set of risk tolerances and constraints. Asset Liability Management (ALM) is a part of the overall risk management system in the banks. It is one of the most important risk management functions in a bank.

Asset Liability Management is the process by which a bank manages its balance sheet in order to control risks caused by changes in interest rates, exchange rates, credit risk, and the liquidity position of the bank.

It implies the examination of all the assets and liabilities simultaneously on a continuous basis with a view to ensuring a proper balance between funds mobilization and their deployment with respect to their a) maturity profiles, b) cost, c) yield, d) risk exposure, etc.

It includes product pricing for deposits as well as advances, and the desired maturity profile of assets and liabilities. It involves conscious decisions with regard to asset liability structure in order to maximize interest earnings within the framework of perceived risk with quantification of risk.

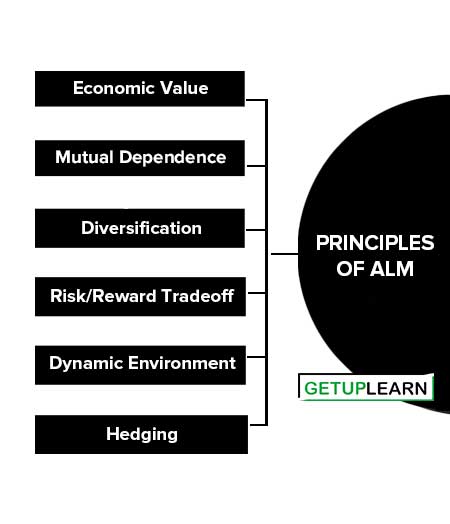

Principles of ALM

Let’s discuss the principles of ALM process explained below:

Economic Value

ALM focuses on Economic Value. Economic value is based on future cash flows of assets and liabilities. ALM uses these future cash flows to determine the risk exposure and achieve the financial objectives of the bank.

Mutual Dependence

The mutual dependence principle of ALM implies that assets and liabilities must be managed together in order to optimize the achievement of economic and financial objectives as liabilities and the assets associated with these liabilities are mutually dependent.

Diversification

This principle of ALM implies that the level of risk associated with a given financial objective can be reduced through diversification by combining exposures that are less than 100% positively correlated. It applies to all combinations of asset and liability portfolios.

Risk/Reward Tradeoff

ALM process determines the riskiness of a portfolio by the net position of the combined assets and liabilities. It is a general view that greater rewards are generally expected from portfolios with higher levels of risk. But the higher risk and greater reward relationship may not hold true if the portfolio is sub-optimal for a given level of risk.

Dynamic Environment

ALM is an ongoing process. The risks to which a bank is exposed and the rewards associated with these risks are determined by internal and external factors that change over time. Internal factors arise from the financial objectives, risk tolerances, and constraints of the bank.

External factors include interest rates, equity returns, competition, the legal environment, regulatory requirements, and tax constraints. Such factors often impact both assets and liabilities simultaneously.

Hedging

The process of ALM relies on the principle of hedging to reduce the overall risk of a portfolio hedging plays an integral role in the ALM process. Once the risks associated with a portfolio or transaction have been identified, the existing risks can be modified to suit the bank‘s risk tolerances and financial objectives.

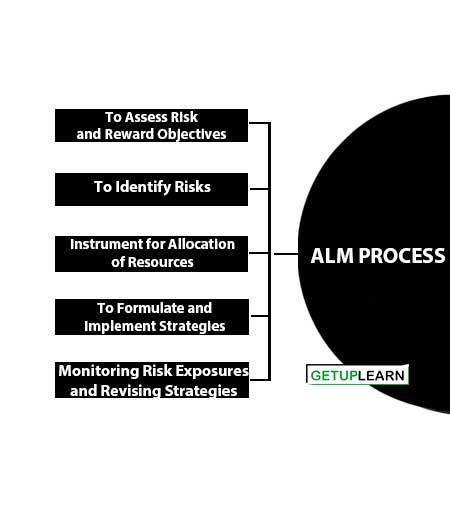

ALM Process

The ALM process consists of five fundamental steps:

- To Assess Risk and Reward Objectives

- To Identify Risks

- To Quantify Level of Risk Exposure

- To Formulate and Implement Strategies

- Monitoring Risk Exposures and Revising Strategies

To Assess Risk and Reward Objectives

The first and foremost step is to assess the risk and reward objectives of the bank. The basic purpose of ALM is to minimize risk. The level of risk will vary with the return requirements and the bank‘s objectives.

To Identify Risks

In the second step, all sources of risk for all assets and liabilities are identified. Risks are then broken down into their component pieces and the underlying causes of each component are assessed. Relationships of various risks to each other and/or to external factors are also identified.

To Quantify Level of Risk Exposure

Exposure to risk is quantified in the third step. Risk exposure can be quantified:

- Relative to changes in the component pieces.

- As a maximum expected loss for a given confidence interval in a given set of scenarios.

- by the distribution of outcomes for a given set of simulated scenarios for the component piece over time. Regular measurement and monitoring of the risk exposure is necessary.

To Formulate and Implement Strategies

The fourth step is to formulate and implement strategies. ALM strategies comprise both pure risk mitigation and optimization of the risk/reward tradeoff. Risk mitigation can be accomplished by modifying existing risks through techniques such as diversification, hedging, and portfolio rebalancing so that the portfolio has the most desirable risk/reward trade-off for a given risk tolerance level.

Optimization presupposes that the management team has been previously educated on the risk/reward profile of the business and understands the necessity to take action based on ALM analysis.

Monitoring Risk Exposures and Revising Strategies

In the last step of the ALM process, all identified risk exposures are monitored and reported to top management on a regular basis. If a risk exposure exceeds its approved limit, corrective actions are taken to reduce the risk exposure.

ALM Tools

The main ALM tools are:

GAP Analysis

GAP is the excess‖ of interest-sensitive assets over interest-sensitive liabilities or vice–versa. Because both assets and liabilities are sensitive to different degrees so it is necessary to identify GAP so as to match identical groups of assets with liabilities In the ALM process, GAP is generally used for quantifying the rate-sensitive groups only.

Duration Analysis

Duration analysis is carried out with respect to banks‘ cash flows and average maturity. Under this method, the impact of changes in interest rates on the market value of assets and liabilities is considered.

Value-At-Risk (VAR)

This method is a variant of the practice of “Market-to-Market” approved securities based on Yield- to Maturity.

Risk Management

The risk profiles of assets and liabilities are evaluated to ensure that they are within acceptable levels of risk. The availability of hedging mechanisms (e.g. derivative instruments) facilitates risk management.

FAQs about the Asset Liability Management ALM

What is ALM (Asset Liability Management)?

Asset Liability Management is the process by which a bank manages its balance sheet in order to control risks caused by changes in interest rates, exchange rates, credit risk, and the liquidity position of the bank.

What are the principles of ALM?

These are the important principles of ALM: 1. Economic Value 2. Mutual Dependence 3. Diversification 4. Risk/Reward Tradeoff 5. Dynamic Environment 6. Hedging.

What is the ALM process?

The following are the steps of an ALM process:

1. To Assess Risk and Reward Objectives

2. To Identify Risks

3. To Quantify Level of Risk Exposure

4. To Formulate and Implement Strategies

5. Monitoring Risk Exposures and Revising Strategies.