After mergers and consolidation, the companies face a number of financial problems. The liquidity of the companies has to be established afresh. The merging and consolidating companies pursue their own financial policies when they are working independently.

A number of adjustments are required to be made in financial planning and policies so that consolidated efforts may enable to improve short-term and long-term finances of the companies.

Table of Contents

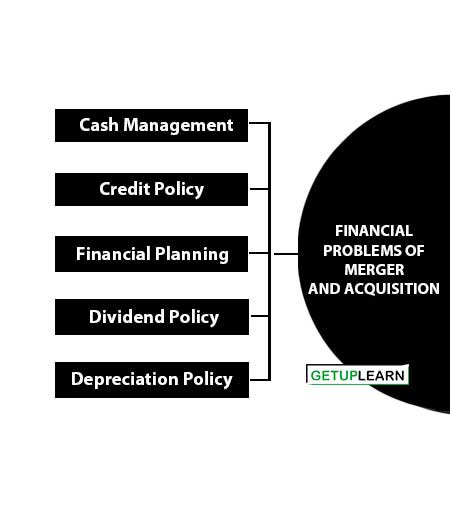

Financial Problems of Merger and Acquisition

Some of the financial problems of merger and acquisition companies are discussed as follows:

Cash Management

The liquidity problem is the usual problem faced by acquiring companies. Before merger and consolidation, the companies had their own methods of payment, cash behavior patterns, and arrangements with financial institutions. The cash pattern will have to be adjusted according to the present needs of the business.

Credit Policy

The credit policies of the companies are unified so that the same terms and conditions may be applied to the customers. If the market areas of the companies are different, then the same old policies may be followed.

The problem will arise only when the operating areas of the companies are the same and the same credit policy will have to be pursued.

Financial Planning

The companies may be following different financial plans before merger and consolidation. The methods of budgeting and financial controls may also be different.

After the merger and consolidation, unified financial planning is followed. The divergent financial controls will be unified to suit the needs of the acquiring concerns.

Dividend Policy

The companies may be following different policies for paying dividends. The stockholders will be expecting higher rates of dividend after the merger and consolidation on the belief that financial position and earning capacity has increased after combining the resources of the companies.

This is a ticklish problem and management will have to devise an acceptable pay-out policy. In the earlier stages of merger and consolidation, it may be difficult to maintain even the old rates of dividends.

Depreciation Policy

The companies follow different depreciation policies. The methods of depreciation, the rates of depreciation, and the amounts to be taken to revenue accounts will be different. After the merger and consolidation, the first thing to be decided will be about the depreciable and non-depreciable assets.

The second will be about the rates of depreciation. Different assets will be in different stages of use and appropriate amounts of depreciation should be decided.