Table of Contents

Meaning of Debentures

When borrowed capital is divided into equal parts, then, each part is called a debenture. Debenture represents debt. For such debts, the company pays interest at regular intervals.

It represents borrowed capital and a debenture holder is the creditor of the company. The debenture holder provides a loan to the company and he has nothing to do with the management of the company.

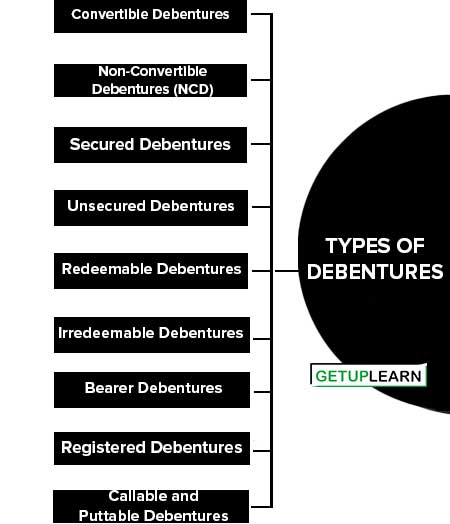

Types of Debentures

These are different kinds or types of debentures explained below:

- Convertible Debentures

- Non-Convertible Debentures (NCD)

- Secured Debentures

- Unsecured Debentures

- Redeemable Debentures

- Irredeemable Debentures

- Bearer Debentures

- Registered Debentures

- Callable and Puttable Debentures

Convertible Debentures

Convertible debentures can be converted into equity shares of the issuing company after a certain period of time. This conversion can be either at the option of the debenture holder or at the option of the issuing company.

For example, if a company issues a 10-year convertible debenture, the debenture holder can convert these debentures into company shares after 10 years. This is advantageous to investors if the company’s equity value increases over time.

Non-Convertible Debentures (NCD)

Non-convertible debentures (NCD) are traditional debentures, and cannot be converted into equity shares of the liable company. They are usually offered a higher interest rate compared to convertible debentures.

Secured Debentures

Secured debentures are debentures that are backed by collateral, i.e., if the issuing company defaults, the debenture holders have a claim on the assets of the company.

Unsecured Debentures

Unsecured debentures are also known as naked debentures, these are not secured by any collateral. The holders of these debentures are, therefore, treated as general creditors in case of a company’s bankruptcy.

Redeemable Debentures

Redeemable debentures are issued for a specified period of time. After the expiry of that period, the company has the right to pay back the debenture holders and redeem the debentures.

For example, a company could issue a 15-year redeemable debenture, where the company is obliged to pay back the principal to the debenture holders after 15 years.

Irredeemable Debentures

Irredeemable debentures do not have any maturity date, i.e., the principal amount is repayable only at the time of winding up of the company.

Bearer Debentures

Bearer debentures are payable to the bearer of the debenture and are transferable by mere delivery. They do not require any transfer deed.

Registered Debentures

Registered debentures are registered with the issuing company and can only be transferred with the help of a transfer deed. The company keeps a record of holders’ addresses and changes in ownership.

For example, if person X sells their registered debentures to person Y, the company would need to update its records to show person Y as the new debenture holder.

Callable and Puttable Debentures

Callable debentures are those that can be redeemed by the issuer before the maturity date under certain conditions. Puttable debentures provide the holders the right to sell the debenture back to the company before the maturity date under certain conditions.

FAQs about the Types of Debentures

What are the types of debentures?

The following are the types of debentures:

1. Convertible Debentures

2. Non-Convertible Debentures (NCD)

3. Secured Debentures

4. Unsecured Debentures

5. Redeemable Debentures

6. Irredeemable Debentures

7. Bearer Debentures

8. Registered Debentures

9. Callable and Puttable Debentures.