Table of Contents

-

1 Importance of Financial Services

- 1.1 Economic Growth

- 1.2 Promotion of Savings

- 1.3 Capital Formation

- 1.4 Creation of Employment Opportunities

- 1.5 Contribution to GNP

- 1.6 Provision of Liquidity

- 1.7 Minimizing Risks

- 1.8 Maximizing Returns

- 1.9 Benefit to Government

- 1.10 Promotion of Domestic and Foreign Trade

- 1.11 Balanced Regional Development

- 2 FAQs About the Importance of Financial Services

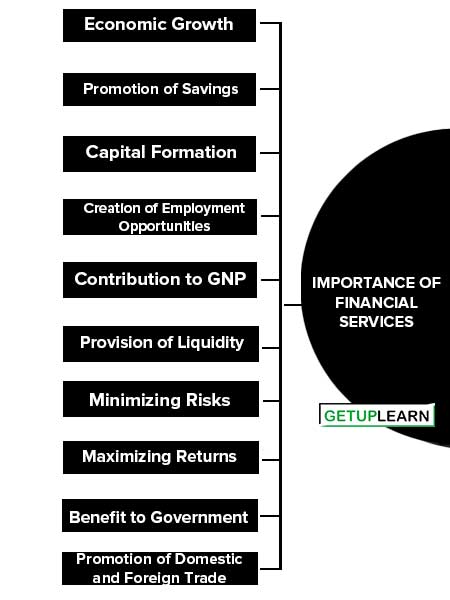

Importance of Financial Services

The successful functioning of any financial system depends upon the range of financial services offered by financial service organizations. The importance of financial services may be understood from the following points:

- Economic Growth

- Promotion of Savings

- Capital Formation

- Creation of Employment Opportunities

- Contribution to GNP

- Provision of Liquidity

- Minimizing Risks

- Maximizing Returns

- Benefit to Government

- Promotion of Domestic and Foreign Trade

- Balanced Regional Development

Economic Growth

The financial service industry mobilizes the savings of the people and channels them into productive investments by providing various services to people in general and corporate enterprises in particular. In short, the economic growth of any country depends upon these savings and investments.

Promotion of Savings

The financial service industry mobilizes the savings of the people by providing transformation services. It provides liability, asset, and size transformation services by providing huge loans from small deposits collected from a large number of people. In this way financial service industry promotes savings.

Capital Formation

The financial service industry facilitates capital formation by rendering various capital market intermediary services. Capital formation is the very basis for economic growth.

Creation of Employment Opportunities

The financial service industry creates and provides employment opportunities to millions of people all over the world.

Contribution to GNP

Recently the contribution of financial services to GNP has been increasing year after year in almost countries.

Provision of Liquidity

The financial service industry promotes liquidity in the financial system by allocating and reallocating savings and investments into various avenues of economic activity. It facilitates the easy conversion of financial assets into liquid cash.

Minimizing Risks

The risks of both financial services as well as producers are minimized by the presence of insurance companies. Various types of risks are covered which not only offer protection from the fluctuating business conditions but also from risks caused by natural calamities.

Insurance is not only a source of finance but also a source of savings, besides minimizing the risks. Taking this aspect into account, the government has not only privatized life insurance but also set up a regulatory authority for the insurance companies known as IRDA, 1999 (Insurance Regulatory and Development Authority).

Maximizing Returns

The presence of financial services enables businessmen to maximize their returns. This is possible due to the availability of credit at a reasonable rate. Producers can avail of various types of credit facilities for acquiring assets. In certain cases, they can even go for leasing certain assets of very high value.

Factoring companies enable the seller as well as the producer to increase their turnover which also increases the profit. Even under stiff competition, the producers will be in a position to sell their products at a low margin. With a higher turnover of stocks, they are able to maximize their return.

Benefit to Government

The presence of financial services enables the government to raise both short-term and long-term funds to meet both revenue and capital expenditure. Through the money market, the government raises short-term funds by the issue of Treasury Bills.

These are purchased by commercial banks out of their depositors’ money. In addition to this, the government is able to raise long-term funds through the sale of government securities in the securities market which forms a part of the financial market. Even foreign exchange requirements of the government can be met in the foreign exchange market.

Promotion of Domestic and Foreign Trade

Financial services ensure the promotion of domestic as well as foreign trade. The presence of factoring and forfeiting companies ensure increasing the sale of goods in the domestic market and the export of goods in the foreign market. Banking and insurance services further contribute to stepping up such promotional activities.

Balanced Regional Development

The government monitors the growth of the economy and regions that remain backward economically are given fiscal and monetary benefits through tax and cheaper credit by which more investment is promoted. This generates more production, employment, income, and demand and ultimately increases prices.

The producers will earn more profits and can expand their activities further. So, the presence of financial services helps backward regions to develop and catch up with the rest of the country that has developed already.

FAQs About the Importance of Financial Services

What is the importance of financial services?

The importance of financial services are:

1. Economic Growth

2. Promotion of Savings

3. Capital Formation

4. Creation of Employment Opportunities

5. Contribution to GNP

6. Provision of Liquidity

7. Minimizing Risks

8. Maximizing Returns

9. Benefit to Government

10 Promotion of Domestic and Foreign Trade.

What is the meaning of financial services?

Financial Services is a term used to refer to the services provided by the finance market. Financial Services is also the term used to describe organizations that deal with the management of money.