Table of Contents

What is Foreign Exchange Market?

The foreign exchange market is the market in which currencies are bought and sold against each other. Like the money market, the foreign exchange market is a market where financial paper with a relatively short period of maturity is traded. It is a non-localized market that exists in the network of information systems and there is no particular place that can be called a foreign exchange market.

It is the largest market in the world and over counter market which means there is no single physical or electronic marketplace or an organized exchange.

The market itself is actually a worldwide network of inter-bank traders, consisting primarily of banks, connected by telephone lines and computers. The transactions in the foreign exchange market are derived from the transactions in the markets for commodities, services, or assets among the people of two nations.

The trade in the currency is the consequence of the people’s wish to trade in underlying commodities, services, or assets. In a foreign exchange market, a party can never be the demander of one currency without being simultaneously a supplier of another.

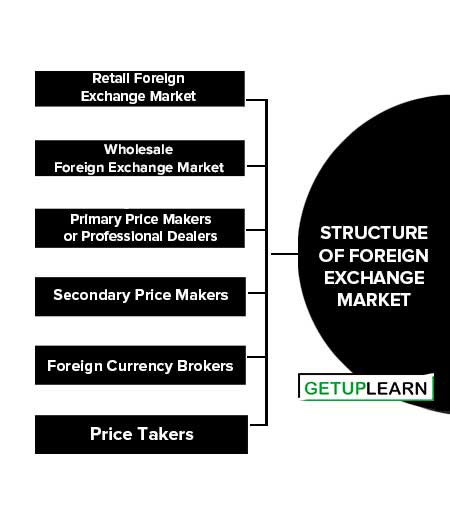

Structure of Foreign Exchange Market

The foreign exchange market is formed by the foreign exchange dealers association and the foreign exchange brokers association. Forex markets are generally located in major financial centers such as New York, Paris, Frankfurt, Zurich, Tokyo, Singapore, Hong Kong, Mumbai etc.

The Forex market is a non-localized market and has no specific trading locations like those for securities or commodities. The following constitutes the structure of foreign exchange market:

- Retail Foreign Exchange Market

- Wholesale Foreign Exchange Market

- Primary Price Makers or Professional Dealers

- Secondary Price Makers

- Foreign Currency Brokers

- Price Takers

Retail Foreign Exchange Market

It is the market in which travelers and tourists exchange one currency for another in the form of currency notes or traveler’s cheques. The main features of this market are: total turnover and average transaction size are very small; the spread between buying and selling is large.

Wholesale Foreign Exchange Market

Wholesale foreign exchange market: It is also known as the interbank market. The average transaction size is very large.

Primary Price Makers or Professional Dealers

These make a two-way market to each other and to their clients, that is, on request, they will quote a two-way price a price to buy currency X against currency Y and a price to sell X against Y and ready to take either the buying or the selling side.

This has a kind of tiering: a few giant multinational banks deal in a large number of currencies on a large amount, the second tier is large banks that deal in a small number of currencies and lastly there are small local institutions that make a market in a very small number of major currencies against their home currency.

Secondary Price Makers

These are the entities that make foreign exchange prices but do not provide a two-way market. Secondary price makes constitute restaurants, and hotel shops catering to tourists who buy foreign currencies in payments of bills. The bid-ask spreads are much larger than the primary price makes.

Foreign Currency Brokers

Foreign currency brokers act as middlemen between two market-makers. The main function of foreign currency brokers is to provide information to market-making banks.

Price Takers

Price takers are those who take the prices quoted by primary price makers and buy or sell currencies for their own purposes but do not make the market. Corporations use foreign exchange markets for payments for imports, conversion of export receipts, hedging of receivables and payables, payment of interest on loans, placement of surplus funds, etc.

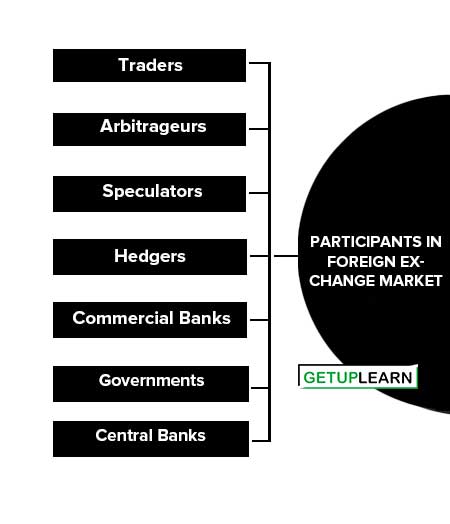

Participants in Foreign Exchange Market

The main participants in foreign exchange market and their activities are mentioned below:

Traders

Traders are those participants who use spot and forward markets to reduce/eliminate the risk of loss of value of export or import that are denominated in foreign currencies. The traders buy foreign currencies when they import goods or machinery and sell foreign currencies when they export goods/machinery.

The objective is usually to hedge a position. The traders buy and sell currencies in the spot and futures markets.

Arbitrageurs

This class of participants always tries to find out the differences in prices of currencies to earn risk-free profits. They buy the currencies from the markets where the prices are lower and sell in the markets where the prices are higher.

Speculators

Speculators actively expose themselves to currency risk by buying and selling currencies to profit from the foreign exchange rate fluctuation.

Hedgers

Many multinational firms engage themselves in forward contracts to protect the home currency values of foreign currency-denominated assets and liabilities on their balance sheet that are not to be realized over the life of the contract. These companies hedge receivables and payables in foreign currencies.

Commercial Banks

Commercial banks are the main participants in the foreign exchange market. Commercial banks participate in the foreign exchange market as an intermediary for their corporate customers who wish to operate in the market.

Governments

The role of governments in the foreign exchange markets for stabilizing the exchange rates is a very important activity because these activities infuse confidence in the functioning of forex markets. The government regularly monitors markets and intervenes in policy targets they set in for the economy.

Central Banks

The central bank is often responsible for maintaining the value of the domestic currency vis-à-vis the foreign currencies. This is more true in the case of a ‘fixed exchange rate’. In the case of ‘Floating Exchange Rates’ the role of the control bank should be minimal unless it has certain preferences for what the foreign exchange rate should be, for example, if it wishes to protect the local export industry.

Then, the control bank will try to make the domestic currency cheaper relative to those of other countries by selling its local currency as the exchange market.

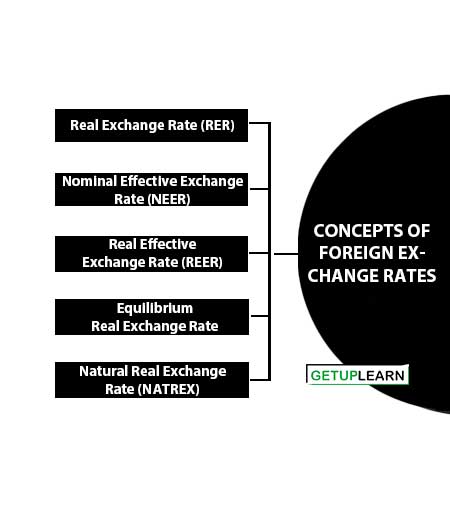

Concepts of Foreign Exchange Rates

Foreign exchange markets are mainly concerned with nominal exchange rates but for analysis purposes, the only nominal rates are not sufficient there are other concepts of foreign exchange rates which are mentioned below:

- Real Exchange Rate (RER)

- Nominal Effective Exchange Rate (NEER)

- Real Effective Exchange Rate (REER)

- Equilibrium Real Exchange Rate

- Natural Real Exchange Rate (NATREX)

Real Exchange Rate (RER)

The real exchange rate of foreign exchange adjusts the inflation rate in the economies of the currencies involved. The real exchange rate is given as:

Real exchange rate = S (Rs/$) × (P$ × PRs)

Wherein, S (Rs/$) = Spot nominal exchange rate; P$ = Price level in the US; and PRs = Domestic price level. The real exchange rate actually refers to the charge in the real purchasing power of a currency relative to its past purchasing power in relation to a foreign currency.

Nominal Effective Exchange Rate (NEER)

This rate is used in the context of export where incentives to exports are provided. When export incentive per unit is added to the nominal exchange rate then it is called the nominal effective exchange rate.

For example, if the official rate is Rs. 25/$ and each dollar earned gets a 10% subsidy from the state, then the effective exchange rate is Nominal Exchange Rate + Per Unit Subsidy i.e. Rs. 25 + 10% of Rs. 25 = 27.5.

Real Effective Exchange Rate (REER)

When the nominal effective exchange rate is adjusted for relative prices in different countries, the real effective exchange rate is obtained.

REER = NEER × (Pf × Pd)

Wherein, S (Rs/$) = Spot nominal exchange rate; P$ = Price level in the US; and PRs = Domestic price level.

The real exchange rate actually refers to the charge in the real purchasing power of a currency relative to its past purchasing power in relation to a foreign currency.

Equilibrium Real Exchange Rate

It is the relative price of tradable goods to non-tradable goods that for given sustainable equilibrium values of other relevant variables such as taxes, international prices, and technology results in the simultaneous attainment of internal and external equilibrium.

Internal equilibrium means that the market for non-tradable goods clears. External equilibrium, on the other hand, is attained when the current account is balanced.

Natural Real Exchange Rate (NATREX)

It refers to a medium-run inter cyclical equilibrium real exchange rate, determined by real and fundamental factors. The Natrex is a moving equilibrium real exchange rate responding to continual changes in exogenous and endogenous real fundamentals.

FAQs About the Foreign Exchange Market

What is the structure of foreign exchange market?

The following constitutes the structure of foreign exchange market:

1. Retail Foreign Exchange Market

2. Wholesale Foreign Exchange Market

3. Primary Price Makers or Professional Dealers

4. Secondary Price Makers

5. Foreign Currency Brokers

6. Price Takers.

Who are the participants in foreign exchange market?

The participants in foreign exchange market are:

1. Traders

2. Arbitrageurs

3. Speculators

4. Hedgers

5. Commercial Banks

6. Governments

7. Central Banks.