Table of Contents

What is Hedging?

Hedging is an activity of protecting oneself from future losses. The beauty of a derivative market lies in the fact that an investor can protect his risk by entering into a contract. In a broader sense, hedging is an act of protecting one from future losses due to some reason.

In a future market, the use of future contracts/instruments in such a way that risk is either avoided or minimized is called hedging. The anticipated future losses may occur due to fluctuations in the price, foreign exchange, or interest rate.

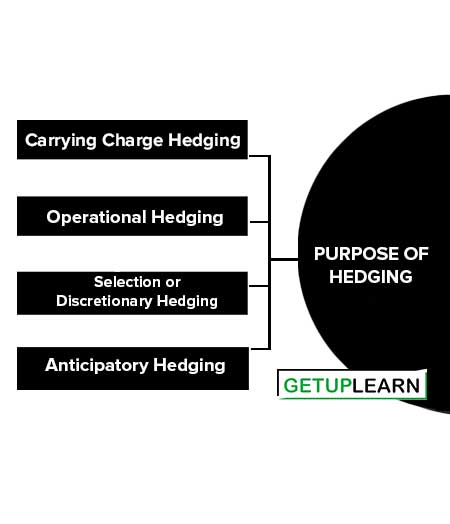

Purpose of Hedging

In case of unfavorable price movement, the hedgers enter into future contracts at different time periods. This concept considers that hedging activity is based on price risk. Why do investors hedge? According to Holbrook Working, hedging has the following purpose of hedging:

Carrying Charge Hedging

In this case, if the spread (Difference between futures and spot price) covers the carry cost too, then stocks should be bought.

Operational Hedging

According to this approach, future markets are supposed to be more liquid and investors (hedgers) use futures as a substitute for the cash market.

Selection or Discretionary Hedging

This hedging is done only on selected occasions or when there may be some adverse price movements in the future.

Anticipatory Hedging

This is done in anticipation of buying or selling the price of an asset in the future.

If an investor uses future contracts in a fashion that eliminates the risk completely is known as the perfect hedging model. The factors which may affect perfect hedging are:

- Profits are affected by changes in commodity, security, interest rate, or exchange rate.

- Knowledge of the firm gives the impact of these factors on the firm’s profit.

- A quantity that affects the firm.

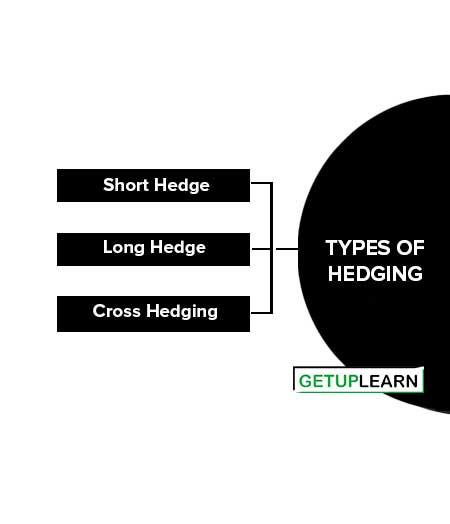

Types of Hedging

There are two types of hedging:

Short Hedge

Having a short position (selling futures) in futures is known as a short hedge. It happens when an investor plans to buy or produce a cash commodity and sells futures to hedge the cash position. It is appropriate when the hedger owns an asset and expects to sell in the future on a particular date.

Thus selling some asset without having the same is known as short-selling. For example, suppose a US exporter expects to receive euros in three months. He will gain if the euro increases in value relative to the US dollar and will sustain a loss if the euro decreases in value relative to the US dollar.

Long Hedge

A long hedge is taking a long position in the futures contract. A long hedge is done in anticipation of future price increases and when the company knows that it will have to buy a certain asset in the future at an anticipated higher price and wants to lock in a price now.

The objective of a long hedge is to protect the company against a price increase in the underlying asset prior to buying the same either in the spot or future market. A net bought position is actually holding an asset which is known as an inventory hedge.

Cross Hedging

A cross hedge is a hedge where characteristics of futures and spot prices do not match perfectly which is known as a mismatch, this may occur due to the following reasons:

- The quantity to be hedged may not be equal to the quantity of the futures contract.

- Features of assets to be hedged are different from the future contract asset.

- Same futures period (maturity) on a particular asset is not available.

Suppose a wire manufacturer requires copper in the month of June but in exchange, the copper futures trade in long delivery in Jan, March, July, Sept. in this case hedging horizon does not match with the futures delivery date.

Suppose that the copper required by the manufacturer is substandard quality but the available trading is of pure 100% copper and in quantity aspect too, copper may be traded in different multiples than required actually. These are examples of cross-hedging.

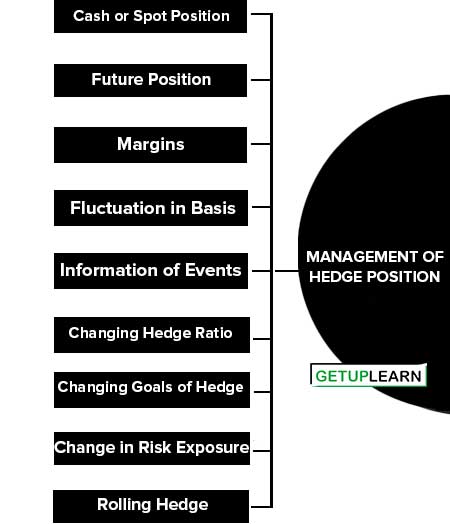

Management of Hedge Position

Hedging requires regular monitoring and frequent adjustments to bring effectiveness. The evaluation of the hedge is quite necessary to identify the reasons for the non-conformity of results. How hedge can be effectively managed? Let’s discuss the following steps:

- Cash or Spot Position

- Future Position

- Margins

- Fluctuation in Basis

- Information of Events

- Changing Hedge Ratio

- Changing Goals of Hedge

- Change in Risk Exposure

- Rolling Hedge

Monitoring of Hedge

To monitor the hedge on a continuous basis the following information should be looked for:

Cash or Spot Position

The hedger should have an idea of the current position in cash/spot and the relevant changes in the same. The gains/losses with reasons for deviation should also be considered.

Future Position

Information regarding futures price, size, volume of trading, profits, and losses should also be taken care of to bring effectiveness.

Margins

Margin requirements, availability of funds, and funding to meet margin can be furnished.

Fluctuation in Basis

The information regarding upward or downward movements of basis should also be considered by hedgers to know the reasons for the difference and timing of the same.

Information of Events

This type of information is necessary because any event can influence the position of spot or futures and thereby the strategy is to be made.

Adjustments of Hedge Position

Due to changing environment and the impact of relevant information on the hedge, the hedger has to adjust his position. The following points are helpful under this heading:

Changing Hedge Ratio

Due to the varying risk profiles of the hedgers, an adjustment is required in the hedge ratio.

Changing Goals of Hedge

Any new information can lead to a change in the hedger goals and hence strategy should be changed/adjusted accordingly.

Change in Risk Exposure

Frequent changes in risk exposure invite changes in cash position which thereby initiate changes in the volume of a futures position.

Rolling Hedge

Due to changes in market development, sometimes it becomes necessary to change hedging strategies. Sometimes, the expiration date of the hedge is later than the delivery dates of all the futures contracts.

Then in this situation, the hedger rolls the hedge forward by closing out one futures contract and taking the same position in a futures contract with a later delivery date.

Summary About the Hedging

Hedging is an activity of protecting oneself from future losses due to some reason. The concepts of hedging include carrying charge hedging, operational hedging, and anticipatory hedging. Here the hedger is interested in knowing the price spread between spot and futures prices which is the spread that covers the carrying cost, then the hedger will buy the stock.

In operational hedging, the hedger uses the futures market for their operation while in anticipatory hedging, the hedger decides short or long positions based on the expectation of price fluctuation in the future. A cross hedging is hedging where there is a mismatch between future and spot prices, quantity, and time, A short hedge is a hedge involving a short position in futures while a long hedge involves a long (buy) future position.

Basis risk is defined as the risk arising from the difference between the cash price and futures price and is an important parameter to decide a hedging strategy. The hedge ratio is the quantity of stock that should be exchanged for one call or put to minimize the risk in the variability of the value of the total (hedged) position.

It also denotes the ratio between the futures position and the cash market position. Management of hedging involves three things monitoring, adjustment, and evaluation of a hedging strategy.