Table of Contents

What is Leasing?

Leasing is a contractual arrangement whereby one party (lessor) grants the right to another party (called lessee) to use an asset in return for periodical payments. The owner (lessor) keeps the title of ownership of an asset and the user (lessee) uses it on payment of lease rentals over a specified period of time.

While leasing of buildings, land, and animals has been here from immemorial times, the leasing of equipment is a relatively new concept, particularly on the Indian scene.

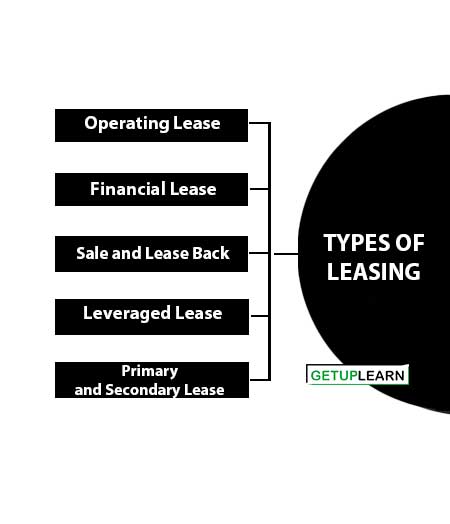

Types of Leasing

There are several types of leases prevalent in financial markets. A few are discussed below:

Operating Lease

An operating lease is also known as a short-term lease. In the case of an operating lease, the lease period is less than the useful life of the asset. In such a type of lease, the lease rentals payable by the lessee during the period of the lease are not sufficient to cover fully the cost of the asset.

This type of lease is usually cancellable at short notice. Moreover, it is the lessor who is responsible for insurance, maintenance, and taxes on the asset. An example of an operating lease is a lease contract for laptops.

Financial Lease

A financial lease or capital lease is a form of borrowing. It is a long-term, non-cancellable lease contract. A financial lease is normally used for leasing buildings and equipment. Under long-term lease arrangements, the lessee is responsible for the insurance and maintenance of an asset.

The financial lease is fully amortized during the primary lease period. After the financial lease contract expires, its agreement may provide the clause to purchasing of assets by the lessee or for renewal of the contract.

Sale and Lease Back

At times, a user may sell an asset owned by him to the lessor and takes it back on lease from him. Such sale and lease-back arrangements offer tax benefits. Generally, this type of arrangement is preferred by a firm that is suffering from a shortage of funds for its operations or is facing a liquidity crisis. The lease provisions are generally similar to those of the financial leases.

Leveraged Lease

In the case of a leveraged lease, the lessor borrows a part of the purchase price of an asset from a lender, which is normally a financial institution. The lessor services the debt out of lease rents received. Typically, such types of leases are popular in structuring the lease of very expensive assets, such as the lease of a plane or ship.

Primary and Secondary Lease

At times, the leasing contract is categorized into two parts namely primary and secondary lease. Primary lease means the recovery of the cost of an asset by way of lease rentals during a period of about five or six years.

This may be followed by a perpetual secondary lease on nominal lease rentals, In other words, more lease rents are charged in the primary and secondary lease periods of the contract. These forms of lease contracts are also referred to as up-fronted leases and back-ended leases respectively.

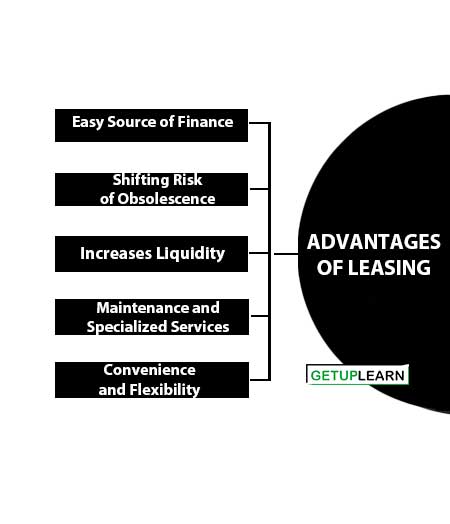

Advantages of Leasing

There are several real advantages to leasing which make it an important arrangement. Some of the advantages of leasing are as follows:

- Easy Source of Finance

- Shifting Risk of Obsolescence

- Increases Liquidity

- Maintenance and Specialized Services

- Convenience and Flexibility

Easy Source of Finance

A lease evades some of the restrictive covenants normally included in long-term loan agreements while borrowing from financial institutions. However, a lease agreement, in contrast with term finance, may impose some restrictions on the use of assets.

For example, it may specify the maximum number of hours per week the asset may be used. Such a restriction is meant to safeguard the asset, not to enhance the ability of the lessee to pay rentals.

Shifting Risk of Obsolescence

In the case of an operating lease, the risk of obsolescence is borne by the lessor. However, the lessor enhances the lease rental suitably for bearing the risk of obsolescence. In fact, the lessee bears the cost of obsolescence risk.

But the economic cost of obsolescence may be reduced with better access to potential users of assets by the lesser as in this way lessor may be able to find an economic use of somewhat obsolete assets and thereby reduce the economic cost of obsolescence.

Increases Liquidity

Lease financing enhances the liquidity of the firms attempting sale and leaseback arrangements. A sale and leaseback arrangement is more beneficial to those firms which are having a shortage of working capital and foresee a liquidity crisis.

Maintenance and Specialized Services

With a full-service lease, the lessee receives maintenance and other specialized services. For example, laptop manufacturers who lease out laptops are better equipped than the user to provide effective specialized service. However, it may be noted that lease rentals would be higher due to such services.

Convenience and Flexibility

When the asset is required for a short period only, it does not seem to make much sense on the part of the firm first to spend time selecting an asset, negotiating its purchase, arranging insurance, etc., and then repeating all these steps to resell the asset. Operating lease obviates the need for this exercise.

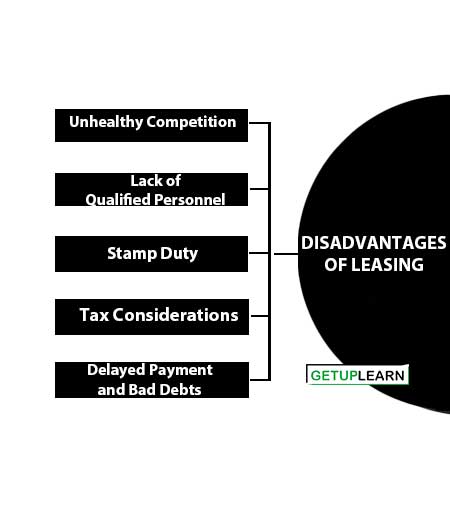

Disadvantages of Leasing

The disadvantages of Leasing are explained as follows:

- Unhealthy Competition

- Lack of Qualified Personnel

- Stamp Duty

- Tax Considerations

- Delayed Payment and Bad Debts

Unhealthy Competition

The market for leasing has not grown at the same pace as the number of lessors. As a result, there is an oversupply of lessors leading to competition.

With the leasing business becoming more competitive, the margin of profit for lessors has dropped from four to five percent to the present 2.5 to 3 percent. Bank subsidiaries and financial institutions have a competitive edge over the private sector concerns because of cheap sources of finance.

Lack of Qualified Personnel

Leasing requires qualified and experienced people at the helm of its affairs. Leasing is a specialized business and persons constituting its top management should have expertise in accounting, finance, legal and decision areas.

In India, the concept of the leasing business is recent, and hence it is difficult to get the right man to deal with the leasing business. On account of this, the operations of the leasing business are bound to suffer.

Stamp Duty

The States treat a leasing transaction as a sale for the purpose of making them eligible for sales tax. On the contrary, for stamp duty, the transaction is treated as a pure lease transaction. Accordingly, heavy stamp duty is levied on lease documents. This adds to the burden of the leasing industry.

Tax Considerations

Most people believe that lessees prefer leasing because of the tax benefits it offers. In reality, it only transfers the benefit i.e. the lessee’s tax shelter is the lessor’s burden. The lease becomes economically viable only when the transfer’s effective tax rate is low.

In addition, taxes like sales tax, wealth tax, additional tax, surcharge, etc. add to the cost of leasing. Thus leasing becomes a more expensive form of financing than conventional modes of finance such as hire purchase.

Delayed Payment and Bad Debts

The problem of a delayed payment of rent and bad debts add to the costs of the lease. The lessor does not take into consideration this aspect while fixing the rentals at the time of the lease agreement. These problems would disturb the prospects of the leasing business.

FAQs About the What is Leasing?

What is Lease?

A lease is a legal contract or agreement that allows one party (the lessee) to use and occupy a property owned by another party (the lessor) for a specified period in exchange for regular payments. The terms and conditions of the lease are outlined in the lease agreement.

What are the types of leasing?

The types of leasing are: 1. Operating Lease 2. Financial Lease 3. Sale and Lease Back 4. Leveraged Lease 5. Primary and Secondary Lease.

What are the advantages of leasing?

The following are the points advantages of leasing: Easy Source of Finance 2. Shifting Risk of Obsolescence 3. Increases Liquidity 4. Maintenance and Specialized Services 5. Convenience and Flexibility.

What are the disadvantages of leasing?

The disadvantages of leasing are: Unhealthy Competition 2. Lack of Qualified Personnel 3. Stamp Duty 4. Tax Considerations 5. Delayed Payment and Bad Debts.