Table of Contents

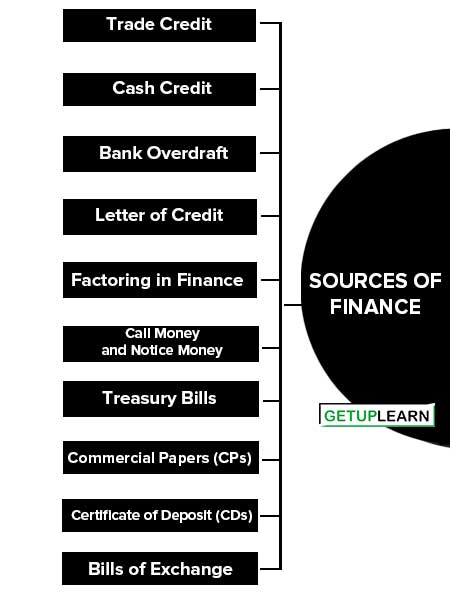

What are the Sources of Finance?

The use of short-term sources of finance is not confirmed by the manufacturing and service sectors. But short-term sources of finance are used by the government and banks also. For the government short-term source of finance is treasury bills of 91 days, 182 days, and 364 days while for banks short-term source of finance is a certificate of deposit.

For business organizations, these sources are creditors of goods and expenses, bills payable, bank overdrafts, cash credits, trade deposits, short-term loans, bill discounting, factoring, etc. This unit deals with short-term sources of finance for manufacturing and service enterprises.

Sources of Finance

Businesses need to secure various sources of finance in order to carry out their activities, invest in growth, and cover operational expenses. These sources can broadly be classified into two categories: equity financing and debt financing. Here are the main sources of finance:

- Trade Credit

- Cash Credit

- Bank Overdraft

- Letter of Credit

- Factoring in Finance

- Call Money and Notice Money

- Treasury Bills

- Commercial Papers (CPs)

- Certificate of Deposit (CDs)

- Bills of Exchange

Trade Credit

Trade Credit: This source of finance is very conventional and popular in the business world. This trade credit is based on norms of industry and business relationships between business enterprises and suppliers. It is a facility whereby business enterprises are allowed by the suppliers of raw materials, services, components, parts, etc. to defer the immediate payment to a definite future period, generally which is less than one year.

Any purchase of raw materials and services obtained without immediate payment to the suppliers is known as trade credit and is shown balance sheet as creditors under the head of current liabilities.

Advantages of Trade Credit

The following advantages of trade credit as a source of financing:

- Trade Credit is readily available according to the prevailing norms.

- Trade Credit is a flexible source of finance, which can be easily adjusted to the changing needs for purchases.

- Trade Creditors generally adjust the time of payment keeping in mind past transactions with the customers.

- Generally, trade credit does not involve any flotation costs. Trade Credit is used to obtain goods on credit for a certain period of time. Thus, it is also one of the sources of finance.

Cash Credit

Cash Credit: This facility is provided by the banker to their account holders generally customers. Under this facility, customers are allowed to withdraw money from their bank account more than their existing balance. The excess withdrawal amount is predetermined by the banker.

This amount varies from customer to customer. A cash credit facility is known as a short-term loan. In the case of this source of finance, interest is charged on the amount of borrowing and not on the borrowing limit. This service is provided by the banker on a continuous basis.

Features of Cash Credit

-

Borrowing Limit: It is limit based short-term loan provided by the bankers. This limit is determined by the creditworthiness of the borrower. A company can withdraw funds up to its established borrowing limit.

-

Interest on borrowed amount: In contrast with other traditional debt financing methods such as loans, the interest charged is only on the amount borrowed from the cash credit account and not on the total borrowing limit.

-

Minimum Commitment Charge: The short-term loan comes with minimum charges for establishing the loan account regardless of whether the borrower utilizes the available credit.

-

Collateral Security: Cash credit is often secured using stocks, fixed assets, or property as collateral.

- Credit Period: Cash credit is typically given for a maximum period of 12 months, after which the drawing power is re-evaluated.

Bank Overdraft

A bank overdraft is a short-term borrowing facility made available to companies in case of urgent need of funds. The bank will impose limits on the amount they can lend. When the borrowed funds are no longer required they can quickly and easily be repaid. The banks issue overdrafts with a right to cash them in at short notice.

Features of Bank Overdraft

These are the features of bank overdraft:

- To avail overdraft account facility bank account with a respective bank is mandatory.

- The money extension is granted on the basis of the customer’s account value, repayment history, or credit score.

- It is short–term credit provided by the banks that need to be paid within the stipulated time period.

- Credit amount or overdraft attracts interest for the time of use which can be from one day to weeks or months.

Letter of Credit

A letter of credit is also a one-time short-term credit guarantee issued by the bank for its customer. A letter of Credit (LC) is a financial document that facilitates international as well as domestic trade.

It is an arrangement by the issuing bank, on the instruction of the customer or on its own behalf, undertakes to pay or accept or negotiate, or authorized another bank to do so against stipulated documents subject to compliance with specified terms and conditions.

The documentary credit is considered as the best payment arrangement since a reputed bank pays against the presentation of stipulated documents as mentioned in the letter of credit.

Characteristics of Letter of Credit

Letter of Credit is a very traditional and short-term source of finance. There are certain characteristics of it:

-

Negotiability: The LC is usually considered as a negotiable instrument that can be passed freely.

-

Revocability: The LC can be either revocable or irrevocable.

-

Transferable: The beneficiary of LC can be transferred.

- Sight and Time based: A sight form is pad when the LC is presented and the time form is paid after a certain duration of time.

Advantages of Letter of Credit

- It is useful to expand business internationally with safety.

- It is highly customizable.

- Seller receives money on fulfilling terms.

- It works as a credit certificate for the buyer.

- Seller is free from any kind of risk on recovery of receivables.

- It is very quick to execute the credit-worthy parties.

- Payment is assured in disputable transactions.

Factoring in Finance

Under this instrument trade debt of the firm is purchased by a financial institution at a discount. Factoring is a regular arrangement between bankers and clients. Here banker is known as a factor. Factoring is a financial service that involves meaning, financing, and calculating receivables.

A factor makes the conversion of receivables into cash possible. Factoring may be defined as a contract between the suppliers of goods/services. The core part or component of factoring is the purchase of book debts or receivables. The client (supplier) submits invoices arising from contracts of sale of goods to the factor. The factor performs at least two of the following services:

- Financing for the seller, by way of advance payments.

- Maintenance of accounts relating to the account receivables.

- Collection of accounts receivables.

- Credit protection against default in payment by the buyer.

Factoring Commission

The commission charged by the factor for providing factoring services is known as the factoring commission. It is generally expressed as a percentage of the face value of receivables factored. In India, it ranges between 2.5 to 3%.

Top Factoring Companies in India are:

- IFCI Factors Ltd

- SBI Global

- Canbank Factors Ltd, etc.

Advantages of Factoring

These are the advantages of factoring:

- Firms can sell a good quantum of goods on credit.

- Flexible cash flow is available to the firm.

- No collateral/security, therefore availability of finance is comparatively easier.

- More attention can be given to the main business because factoring reduces the burden of collection.

- It is such an arrangement that reduces the incidence of bad debts.

- Expansion of business can be done due to this facility.

Call Money and Notice Money

This source of finance deals in overnight funds and deals in funds for 2–14 days. The Narasimhan Committee (1998) recommended that call/notice money market in India should be made available purely as an interbank market.

Hence it is known as ‘Inter Bank Call / Notice Money Market. There are two important parties Borrowers and lenders. According to RBI guidelines, some parties can play dual roles, borrowers and lenders.

Treasury Bills

There are three different entities that are using specific sources of finance to meet their short-term financial needs. These entities are banks, business enterprises, and government. The short-term financial needs of the government are met with the help of Treasury Bills.

This is a very crucial instrument for the government. These bills are issued by RBI on behalf of the government. These bills have a duration of 91 days, 182 days, and 364 days. It is totally finance bills.

These bills are not created through business transactions. It is a very liquid instrument (source of finance). It gives a certain return to investors. No endorsement can be done in these bills like bills of exchange. It is a most safe investment opportunity.

Commercial Papers (CPs)

In 1987 Vaghul Committee recommended the introduction of CPs, which was accepted by RBI in March 1989 and made effective on 01-01-1998. The basic objective for the introduction of this bill is to enable highly rated corporate borrowers to diversify their sources of short-term borrowings and to provide an additional instrument to investors.

Now primary dealers and financial institutions are permitted to issue CPs. Guidelines for the issue of CP are presently governed by various directives issued by RBI as amended from time to time.

Commercial Paper is a short-term issuance promissory note issued by a company in a private sector or public sector at such a discount/interest on face value as may be determined by the issuing company and negotiable by endorsement and delivery.

Certificate of Deposit (CDs)

Various factors affect the expected outcome of the financial system. For expected results in the financial system from time to time different financial instruments are introduced in the money market. All these instruments is having important roles in economic development.

A certificate of deposit is the receipt of funds deposited with banks that can be easily sold in the money market. This is an investment in the form deposit where the time period is fixed. This instrument increases the mobility of bank deposits. This scheme was introduced in 1989.

Types of Certificate of Deposit

Banks accept two types of certificates of deposit:

-

Ordinary Fixed Term: Such deposits are not negotiable instruments and therefore cannot be transferred in favor of another person.

-

Certificate of Deposit: It is a negotiable instrument and therefore it can be transferred in favor of another person by endorsement or delivery. Under this scheme scheduled commercial banks can issue funds for a fixed term and it cannot be converted into cash before its maturity but if an investor needs cash, he can raise cash by endorsement or delivery.

Certain norms are developed to implement this scheme and certain modifications are also made on the basis of uncertainties and recommendations.

Bills of Exchange

Bill of exchange is defined under section 5 of the Negotiable Instrument Act, of 1881. Bill of exchange is a written negotiable instrument, that carries an unconditional order to pay a specific sum of money to a designated person or the holder of the instrument as directed in the instrument by the maker. The bill of exchange is either payable on demand or after a special fixed term.

Features of Bills of Exchange

The features of bills of exchange are:

- A bill of exchange is an instrument in writing.

- It is drawn and signed by the maker i.e. Drawer of the bill.

- It is drawn on a specific person i.e. drawee, to pay the specified amount.

- It contains unconditional order to a person i.e. drawee.

- To make an instrument of value the drawee must accept it.

- The specified amount is payable to the person whose name is mentioned in the bill or to his order or to the holder.

- It specifies the date by which the amount should be paid.

- Payment of the bill must be in the legal currency of the country.

- It must be properly stamped.

Types of Bills of Exchange

Bills of exchange consist of trade transactions involving the sale and purchase of goods. But this mechanism of the bills of exchange can also be of use in raising finance. The type of bill of exchange depends on its objective. There are two types of bills of exchange from the viewpoint of trade transactions and finance transactions.

-

Trade Bill: Trade bill used for trade transactions. Here making and accepting bills is based on trade transactions. (Purchase and sale of goods). This bill of exchange is drawn by the seller of the goods and is accepted by the buyer.

- Accommodation Bill: The accommodation bill is used to meet the financial needs of the drawer and drawer. This bill is for mutual benefit without a trade transaction. It does not involve the sale or purchase of any goods or services. This bill carries an agreement between two parties for the purpose of meeting the financial needs of each other.

FAQs About the Sources of Finance

What are the Sources of Finance?

These are the main sources of finance:

1. Trade Credit

2. Cash Credit

3. Bank Overdraft

4. Letter of Credit

5. Factoring in Finance

6. Call Money and Notice Money

7. Treasury Bills

8. Commercial Papers (CPs)

9. Certificate of Deposit (CDs)

10. Bills of Exchange.