Table of Contents

What is Endorsement?

The word ‘endorsement’ in its literal sense means, writing on the back of an instrument. But under the Negotiable Instruments Act, it means, the writing of one’s name on the back of the instrument or any paper attached to it with the intention of transferring the rights therein.

Thus, the endorsement is signing a negotiable instrument for the purpose of negotiation. The person who effects an endorsement is called an ‘endorser’, and the person to whom the negotiable instrument is transferred by endorsement is called the ‘endorsee’.

Essentials of Valid Endorsement

The following are the essentials of a valid endorsement:

- It must be on the instrument. The endorsement may be on the back or face of the instrument and if no space is left on the instrument, it may be made on a separate paper attached to it called allonage. It should usually be in ink.

- It must be made by the maker or holder of the instrument. A stranger cannot endorse it.

- It must be signed by the endorser. Full name is not essential. Initials may suffice. The thumb impression should be attested. A signature may be made on any part of the instrument. A rubber stamp is not accepted but the designation of the holder can be done by a rubber stamp.

- It may be made either by the endorser merely signing his name on the instrument (it is a blank endorsement) or by any words showing an intention to endorse or transfer the instrument to a specified person (it is an endorsement in full).

No specific form of words is prescribed for an endorsement. But the intention to transfer must be present. When in a bill or note payable to order the endorsee’s name is wrongly spelled, he should when he endorses it, sign the name as spelled in the instrument and write the correct spelling within brackets after his endorsement.

- It must be completed by the delivery of the instrument. The delivery must be made by the endorser himself or by somebody on his behalf with the intention of passing property therein. Thus, where a person endorses an instrument to another and keeps it in his papers where it is found after his death and then delivered to the endorsee, the latter gets no right on the instrument.

- It must be an endorsement of the entire bill. A partial endorsement i.e. which purports to transfer to the endorse a part only of the amount payable does not operate as a valid endorsement. If delivery is conditional, the endorsement is not complete until the condition is fulfilled.

Who may Endorse?

The payee of an instrument is the rightful person to make the first endorsement. Thereafter the instrument may be endorsed by any person who has become the holder of the instrument. The maker or the drawer cannot endorse the instrument but if any of them has become the holder thereof he may endorse the instrument. (Sec. 51).

The maker or drawer cannot endorse or negotiate an instrument unless he is in lawful possession of the instrument or is the holder thereof. A payee or indorsee cannot endorse or negotiate unless he is the holder thereof.

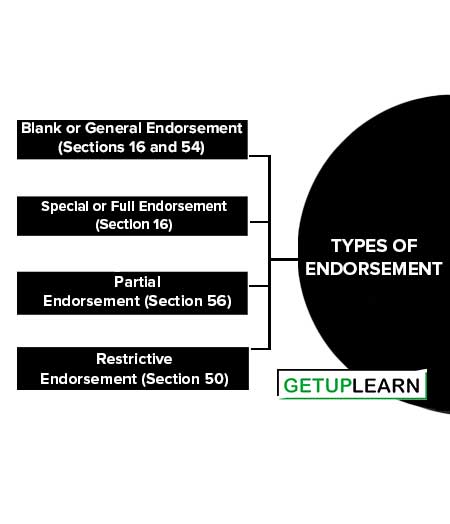

Types of Endorsement

These are some important types of endorsement:

- Blank or General Endorsement (Sections 16 and 54)

- Special or Full Endorsement (Section 16)

- Partial Endorsement (Section 56)

- Restrictive Endorsement (Section 50)

Blank or General Endorsement (Sections 16 and 54)

It is an endorsement when the endorser merely signs on the instrument without mentioning the name of the person in whose favor the endorsement is made. The endorsement in blank specifies no endorsee. It simply consists of the signature of the endorser on the endorsement.

A negotiable instrument even though payable to order becomes a bearer instrument if endorsed in blank. Then it is transferable by mere delivery. An endorsement in blank may be followed by an endorsement in full.

Example: A bill is payable to X. X endorses the bill by simply affixing his signature. This is an endorsement in blank by X. In this case, the bill becomes payable to the bearer. There is no difference between a bill or note indorsed in blank and one payable to the bearer. They can both be negotiated by delivery.

Special or Full Endorsement (Section 16)

When the endorsement contains not only the signature of the endorser but also the name of the person in whose favor the endorsement is made, then it is an endorsement in full. Thus, when an endorsement is made by writing the words “Pay to A or A’s order,” followed by the signature of the endorser, it is an endorsement in full. In such an endorsement, it is only the endorsee who can transfer the instrument.

Example: A is the holder of a bill endorsed by B in the blank. A writes over B’s signature the words “Pay to C or order.” A is not liable as an endorser but the writing operates as an endorsement in full from B to C. Where a bill is endorsed in blank or is payable to the bearer and is afterward endorsed by another in full, the bill remains transferable by delivery with regard to all parties prior to such endorser in full. But such an endorser in full cannot be sued by anyone except the person in whose favor the endorsement in full is made. (Section 55).

Example: C the payee of a bill endorses it in blank and delivers it to D, who specially endorses it to E or order. E without endorsement transfers the bill to F. F as the bearer is entitled to receive payment or to sue the drawer, the acceptor, or C who endorsed the bill in blank but he cannot sue D or E.

Partial Endorsement (Section 56)

A partial endorsement is one which purports to transfer to the endorsee a part only of the amount payable on the instrument. Such an endorsement does not operate as a negotiation of the instrument.

Example: A is the holder of a bill for Rs.1000. He endorses it “pay to B or order Rs.500.” This is a partial endorsement and invalid for the purpose of negotiation.

Restrictive Endorsement (Section 50)

The endorsement of an instrument may contain terms making it restrictive. A restrictive endorsement is one which either by express words restricts or prohibits the further negotiation of a bill or which expresses that it is not a complete and unconditional transfer of the instrument but is a mere authority to the endorsee to deal with the bill as directed by such endorsement.

“Pay C,” “Pay C for my use,” and “Pay C for the account of B” are instances of restrictive endorsement. The endorsee under a restrictive endorsement acquires all the rights of the endorser except the right of negotiation.

FAQs About the What is Endorsement?

What is meaning of endorsement?

The endorsement is signing a negotiable instrument for the purpose of negotiation. The person who effects an endorsement is called an ‘endorser’, and the person to whom the negotiable instrument is transferred by endorsement is called the ‘endorsee’.

What are the types of endorsement?

The types of endorsement are:

1. Blank or General Endorsement (Sections 16 and 54)

2. Special or Full Endorsement (Section 16)

3. Partial Endorsement (Section 56)

4. Restrictive Endorsement (Section 50).