Table of Contents

- 1 What is Earnings Management?

- 2 Need for Earnings Management

-

3 Methods of Earnings Management

- 3.1 Cookie Jar Reserve Methods

- 3.2 Big Bath Methods

- 3.3 Big Bet on Future Methods

- 3.4 Flushing Investment Portfolio

- 3.5 Throw Out a Problem Child

- 3.6 Introducing New Standard

- 3.7 Write Off of Long-term Operating Assets

- 3.8 Sale-Leaseback

- 3.9 Operating Versus Nonoperating Income

- 3.10 Early Retirement of Debt

- 3.11 Use of Derivatives

- 3.12 Shrink the Ship

- 4 Objectives of Earnings Management

- 5 Credit Terms or Terms of Payment

- 6 FAQs About the Earnings Management

What is Earnings Management?

Earnings are the profits of a company. Investors and analysts look to earnings to determine the attractiveness of a particular stock. Companies with poor earnings prospects will typically have lower share prices than those with good prospects. Remember that a company’s ability to generate profit in the future plays a very important role in determining a stock’s price.

That said, earnings management is a strategy used by the management of a company to deliberately manipulate the company’s earnings so that the figures match a pre-determined target. This practice is carried out for income-smoothing.

Thus, rather than having years of exceptionally good or bad earnings, companies will try to keep the figures relatively stable by adding and removing cash from reserve accounts (known colloquially as “cookie jar” accounts).

So, Earnings management can be defined as the accounting policies or the accruals control, chosen by the management of enterprises to make the earnings reach the expected level under pressure from the relevant stakeholders and the constraints of generally accepted accounting principles (GAAP).

In addition to the choice of accounting policy and the control of accruals, the means of earnings management have also included lobbying for the regulatory organization to modify the accounting principles and the manipulation of profit figures in the fiscal report.

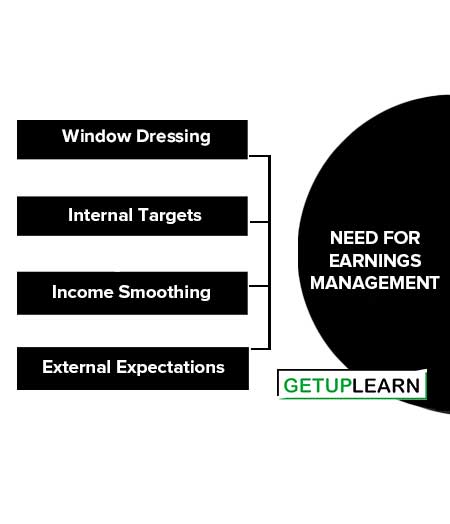

Need for Earnings Management

Earnings management refers to the practice of intentionally manipulating financial results to present a more favorable picture of a company’s performance.

While earnings management is generally discouraged and regulated, there are situations where companies may perceive a need for it. Here are some needs for earnings management:

Window Dressing

Window dressing refers to the company’s decision to dress up the financial statements for potential investors and creditors. The goal of this is to attract new supporters by having financial statements that look like the company’s doing great.

The company needs to appear to have a history of being profitable, even if it means lowering profits in one accounting period to increase profits in another. Even though this seems fraudulent, it isn’t. Overall, the company is still reporting the same amount of profits but is spreading the amount evenly over a specific time period.

Internal Targets

Internal targets are another reason that a company may choose to use earnings management techniques. Oftentimes, the company has set its own internal goals, such as departmental budgeting, and wants to be sure to meet those goals.

No department wants to be the one to blow the proposed budget, so earnings management techniques are used to balance this out.

Income Smoothing

Income smoothing comes into play here because of the fact that potential investors generally like to invest in companies that have a continuous growth pattern. Smoothing out income generated, when there may be spikes at certain times and drops at others, allows it to appear like the company has that smooth growth pattern.

External Expectations

External expectations come into play when the company has already made projections as to what their profits will be and investors now expect that exact amount of profits or more. Management may feel the need to shift revenue from one accounting period to another in order to meet the projected goal.

Earnings management, quite simply, takes advantage of the different ways that accounting policies and procedures can be applied to financial reporting.

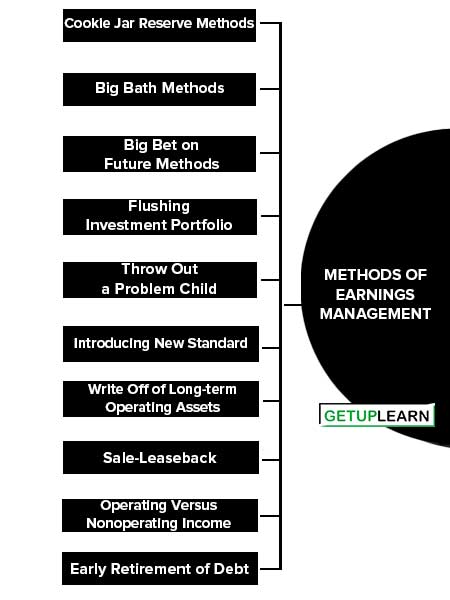

Methods of Earnings Management

Earnings management is a very popular term used by management to manage earnings. But it does not mean any illegal activities by management to manage earnings. Managers can achieve earnings from accounting choices or by operating decisions.

Managers can manage earnings because they have flexibility in making accounting or operating choices. The most successful and widely used earnings management techniques can be classified into twelve categories. These are the methods of earnings management:

- Cookie Jar Reserve Methods

- Big Bath Methods

- Big Bet on Future Methods

- Flushing Investment Portfolio

- Throw Out a Problem Child

- Introducing New Standard

- Write Off of Long-term Operating Assets

- Sale-Leaseback

- Operating Versus Nonoperating Income

- Early Retirement of Debt

- Use of Derivatives

- Shrink the Ship

The cookie-jar technique deals with estimations of future events. According to GAAP, management has to estimate and record obligations that will be paid in the future as a result of events or transactions in the current fiscal year based on an accrual basis. But there is always uncertainty surrounding the estimation process because the future is not always certain.

There is no correct answer; there may be reasonably possible answers. Management has to select a single amount according to GAAP so there is a chance of taking advantage of earnings management. Under the cookie-jar technique, the corporation will try to overestimate expenses during the current period to manage earnings.

If and when actual expenses turn out lower than estimates, the difference can be put into the “cookie jar” to be used later when the company needs a boost in earnings to meet predictions. Some examples of estimation to manage earnings are sales returns and allowances, estimates of bad debt and write-downs; estimating inventory write-downs; estimating warranty costs; estimating pension expense; terminating pension plans, and estimating the percentage of completion for long-term contracts, etc.

Big Bath Methods

Although a rare occurrence, sometimes corporations may restructure debt, write down assets, or change and even close down an operating segment. In these instances, expenses are generally unavoidable. If the management record an estimated charge (a loss) against earnings for the cost of implementing the change then it will negatively affect the cost of the share price.

But the share price may go up rapidly if the charge for restructuring and related operational changes is viewed positively. According to the Big Bath methods, if the manager has to report bad news i.e., a loss from substantial restructuring, it is better to report it all at once and get it out of the way.

Big Bet on Future Methods

When an acquisition occurs, the corporation acquiring the other is said to have made a big bet on the future. Under Generally Accepted Accounting Principles (GAAP) regulations, an acquisition must be reported as a purchase. This leaves two doors open for earnings management.

In the first instance, a company can write off continuing R&D costs against current earnings in the acquisition year, protecting future earnings from these charges. This means that when the costs are actually incurred in the future, they will not have to be reported and thus future earnings will receive a boost.

The second method is to claim the earnings of the recently acquired corporation. When the acquired corporation consolidated with parent company earnings, then immediately receive a boost in the current year’s earnings. By acquiring another company, the parent company buys a guaranteed boost in current or future earnings through the big bet technique.

Flushing Investment Portfolio

To achieve a strategic alliance and invest their excess funds, a company buys the shares of another company. Two forms of investment are trading securities and available-for-sale securities.

Actual gains or losses from sales or any changes in the market value of trading securities are reported as operating income whereas any change in the market value of available-for-sale securities during a fiscal period is reported in “other comprehensive income components” at the bottom of the income statement, not in operating income. When available-for-sale securities are sold, any loss or gain is reported in operating income.

Throw Out a Problem Child

To increase the earnings of future periods, the company can sell the subsidiary which is not performing well i. e. “the problem child” subsidiary may be “thrown out”. Earnings can be managed by selling the subsidiary, exchanging the stock in an equity method subsidiary, and spinning off the subsidiary.

A gain or loss is reported in the current period statement when a subsidiary is sold. The existing shareholders become the owner of the problem child by distributing or exchanging the shares of a subsidiary with the current shareholders. As a result, no gain or loss is normally reported on a spin-off. Moreover, it is possible to “swap” the stock in an equity method subsidiary without having any recordable gain or loss.

Introducing New Standard

New rules and regulations are introduced in GAAP due to changing demands of the business environment. Accounting principles can be modified in a way that will not change the earnings. When a new accounting standard is adopted it takes two to three years to adopt the standard.

Voluntary early adoption may provide an opportunity to manage the earnings. A company can take advantage of managing earnings by changing the time on an accrual basis rather than a cash basis which is recorded as expenses on a cash basis. Moreover, the timely adoption of a better revenue recognition rule will provide a new window to manage earnings.

Write Off of Long-term Operating Assets

The cost of long-term operating assets used or consumed is recorded as an amortization (intangible assets- goodwill, patents, copyrights, and trademark), depreciation (tangible assets- buildings, machinery, equipment), and depletion expense (natural resources-timber, coal, oil, natural gas) over the periods expected to be benefited.

Management has discretionary power when selecting the write-off method; write-off period; estimating salvage value. It is not necessary to record depreciation or amortization expense if the long-term operating asset changes to the nonoperating asset.

Sale-Leaseback

A company can enhance the earnings of the financial statement by selling a long-term asset that has unrealized gains or losses. For instance, the cost of a machine showed in the balance sheet at Tk 20 lac, but its market value is now Tk. 30 lac. If the machine is sold then Tk. 10 lac gain will enhance the current period earnings.

In addition, by recording a gain or loss a company can manage its earnings. According to IAS 17, losses occurring in a sale/leaseback transaction are recognized on the seller’s book immediately, and gains are amortized over the period if it is a capital lease or a proportion of the payment is an operating lease.

Operating Versus Nonoperating Income

Earnings are of two types: operating and nonoperating. Nonoperating earnings will not affect future earnings where as operating earnings are expected to continue in the near future. Non-operating income includes discontinued operations, extraordinary gains or losses, and the cumulative effect of change in accounting principles.

The manager can manage its earnings when making decisions about items that fall into those areas. To illustrate, a disposition of a major manufacturing plant could possibly be classified as either a special or unusual charge or as discontinued operations. What classification is more accurate may depend on management judgment regarding this factor.

Early Retirement of Debt

Management can manage the earnings by selecting the fiscal period of early retirement of debt. A gain or loss occurs when the company makes the early payment of cash which is different from the book value of long-term debt such as bonds.

This gain or loss is recorded as an extraordinary item at the bottom of the income statement which boosts the earnings of that period.

Use of Derivatives

Derivatives offer a lot of opportunities for managers to manage earnings. Derivatives can be used to protect against some types of business risk, such as interest rate changes; commodity price changes; the weather; oil price changes; changes in foreign currency exchange rates.

Derivates should be reported as assets and liabilities in the balance sheet and measured at fair value. Gains and losses from derivate transactions are generally recognized immediately in regular income.

Shrink the Ship

Companies do not have to report any gain or loss for the repurchase of their own shares on the income statement because no income is recognized on the transaction. Income is only earned through equity transactions outside the firm, not with those involving the firm’s owners. A stock buy does not affect earnings but it is used to affect earnings per share.

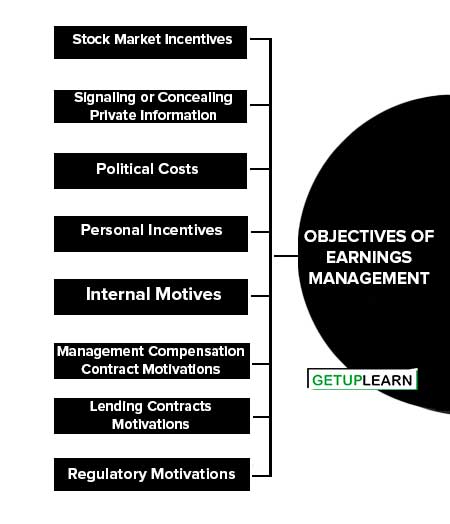

Objectives of Earnings Management

The reasons for Earnings management are diverse and range from the intention to satisfy analysts’ expectations to incentives to realize bonuses or to maintain a competitive position within the financial market.

Legal earnings management means financial reports are adjusted in line with financial reporting standards. Earnings management becomes fraudulent financial reporting when it falls outside the bounds of acceptable accounting practice. Here are some common objectives of earnings management:

- Stock Market Incentives

- Signaling or Concealing Private Information

- Political Costs

- Personal Incentives

- Internal Motives

- Management Compensation Contract Motivations

- Lending Contracts Motivations

- Regulatory Motivations

Stock Market Incentives

The relationship between accounting numbers and stock market reactions can incentivize earnings management. Meeting or surpassing analysts’ forecasts is important for firms to enjoy higher returns and CEO compensation.

Managers engage in earnings management to achieve these expectations. Companies with increased earnings and revenues are less prone to earnings management. Equity incentives for CEOs and senior management can further drive opportunistic behavior. Research also examines earnings management in specific stock markets situations, like IPOs and seasoned equity offerings.

Signaling or Concealing Private Information

Earnings management is, by definition, a process of altering financial information in order to achieve certain goals. Failing firms engage in earnings management and alter their annual accounts to conceal their financial struggle without immediately measuring the consequences on stock price or CEO compensation.

The growth signal combined with another signal such as a stock split might be an effective way of communicating private information.

Political Costs

Firms manipulate financial statements to influence shareholder opinions and decisions, potentially driven by governmental regulations and tax laws. Earnings management can help companies appear more or less profitable to evade government interference.

Tax calculation based on accounting numbers creates incentives for tax avoidance. Political costs serve as a strong incentive for earnings management, even in economies without efficient stock markets and with government-appointed CEOs.

Personal Incentives

There might be other than financial motives for the CEO to manage earnings. A new CEO can be tending to downward earnings management in the year of change and upwards earnings management in the following years. Retiring CEOs use upwards earnings management to leave in style and keep a seat on the board.

Internal Motives

Finally, there are motives for earnings management that are not linked to external stakeholders (such as shareholders, government, or unions) but are intracompany. Within a company, it might also be useful to alter financial reports or structure transactions in such a way that budget ratcheting is avoided or performance standards are met.

Managers will choose to use income-decreasing unexpected accruals when the earnings innovations are transitory. Companies using externally determined standards (i.e. relatively unaffected by participants such as peer group standards, fixed standards, or cost of capital) are less likely to smooth earnings than those companies that use internal standards (budget goals, prior year, subjective standards).

Management Compensation Contract Motivations

Management compensation theory suggests that managers are motivated to engage in earnings management to enhance their compensation, as their bonuses are often linked to the firm’s earnings. When bonus caps are reached, managers are more likely to report accruals that defer income to increase earnings in subsequent years.

This aligns with the ‘big bath’ hypothesis, which suggests that if managers cannot manipulate earnings to meet a specific target, they may use earnings management to decrease current earnings for the sake of future earnings and bonuses. Dechow & Sloan (1995) observed managers reducing research and development expenditure in their final year to boost earnings and their payout upon leaving the company.

Lending Contracts Motivations

Another major hypothesis is the debt covenant hypothesis. This theory is based on the fact that creditors often impose restrictions on the payment of dividends, share buybacks, and the issuing of additional debt in terms of reported accounting figures and ratios, in order to ensure the repayment of the firm’s borrowings.

Regulatory Motivations

Some industries, in particular the banking, insurance, and utility industries are monitored for compliance with regulations linked to accounting figures and ratios. Banks and insurance firms especially are often subject to requirements that they have enough capital or assets to meet their liabilities.

Such regulations may give managers incentives to use earnings management. Research has shown that banks that are close to minimum capital requirements use earnings management techniques such as overstating loan loss provisions, understating loan write-offs, and recognizing abnormal realized gains on their investment portfolios, presumably so as not to breach the regulatory requirements.

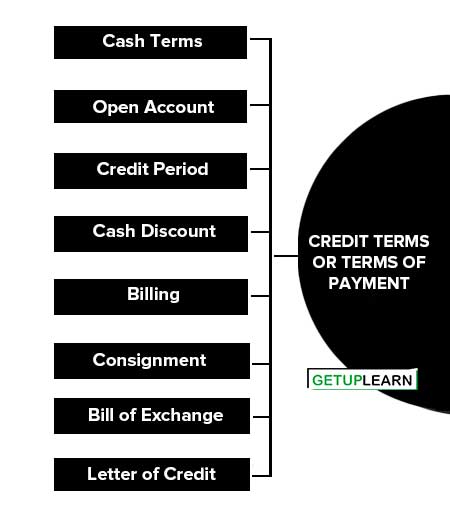

Credit Terms or Terms of Payment

Terms of payment vary widely in practice. At one end, if the seller has financial sinews it may extend liberal credit to the buyer till it converts goods bought into cash. At the other end, the buyer may pay cash in advance to the seller and finance the entire trade cycle.

Most commonly, however, some in-between arrangement is chosen wherein the trade cycle is financed partly by the seller, partly by the buyer, and partly by some financial intermediary. The major terms of payment are discussed below:

- Cash Terms

- Open Account

- Credit Period

- Cash Discount

- Billing

- Consignment

- Bill of Exchange

- Letter of Credit

Cash Terms

When goods are sold on cash terms, the payment is received either before the goods are shipped (cash in advance) or when the goods are delivered (cash on delivery). Cash in advance is generally insisted upon when goods are made to order.

In such a case, the seller would like to finance production and eliminate marketing risks. Cash on delivery is often demanded by the seller if it is in a strong bargaining position and/or the customer is perceived to be risky.

Open Account

Credit sales are generally on open accounts. This means that the seller first ships the goods and then sends the invoice (bill). The credit terms (credit period, cash discount for prompt payment, the period of discount, and so on) are stated in the invoice which is acknowledged by the buyer. There is no formal acknowledgment of indebtedness by the buyer.

Credit Period

The credit period refers to the length of time the customer is allowed to pay for its purchases. It is usually mentioned in days from the date of the invoice. If a firm allows 30 days, say, of credit with no discount for early payment, its credit terms are stated as ‘net 30’.

Cash Discount

Firms generally offer cash discounts to induce customers to make prompt payments. For example, credit terms of 2/10, and net 30 mean that a discount of 2 percent is offered if the payment is made by the tenth day; otherwise, the full payment is due by the thirteenth day.

Billing

To streamline billings, it is a common practice to send a single bill every month. For example at the end of every month, the customer may be sent a consolidated bill for the purchases made from the 26th of the previous month to the 25th of the current month.

Consignment

When goods are sent on consignment, they are merely shipped but not sold to the consignee. The consignee acts as the agent of the seller (consignor). The title of the goods is retained by the seller till they are sold by the consignee to a third party. Periodically, sales proceeds are remitted by the consignee to the seller.

Bill of Exchange

Whether goods are shipped on an open account or consignment, the seller does not have strong evidence of the buyer’s obligation. A draft represents an unconditional order issued by the seller asking the buyer to pay on demand (demand draft) or at a certain future date (time draft), the amount specified on it.

It is typically accompanied by shipping documents that are delivered to the drawee when he pays or accepts the draft. When the drawee accepts a time draft it becomes a trade acceptance.

The seller may hold the acceptance till it matures or get it discounted. The draft performs three useful functions:

- It serves as written evidence of a definite obligation.

- It helps in reducing the cost of financing to some extent.

- It represents a negotiable instrument.

Letter of Credit

Commonly used in international trade, the letter of credit is now used in domestic trade as well. A letter of credit, or L/C, is issued by a bank on behalf of its customer (buyer) to the seller. As per this document, the bank agrees to honor drafts drawn on it for the supplies made to the customer, if the seller fulfills the conditions laid down in the L/C.

The L/C serves several useful functions:

- It virtually eliminates credit risk, if the bank has a good standing.

- It reduces uncertainty as the seller knows the conditions that should be fulfilled to receive payment.

- It offers safety to the buyer who wants to ensure that payment is made only in conformity with the conditions of the L/C.

FAQs About the Earnings Management

What is the need for earnings management?

The following are needs for earnings management:

1. Window Dressing

2. Internal Targets

3. Income Smoothing

4. External Expectations.

What are the methods of earnings management?

These are the methods of earnings management:

1. Cookie Jar Reserve Methods

2. Big Bath Methods

3. Big Bet on Future Methods

4. Flushing Investment Portfolio

5. Throw Out a Problem Child

6. Introducing New Standard

7. Write Off of Long-term Operating Assets

8. Sale-Leaseback

9. Operating Versus Nonoperating Income

10. Early Retirement of Debt.

What are the objectives of earnings management?

The following are the objectives of earnings management:

1. Stock Market Incentives

2. Signaling or Concealing Private Information

3. Political Costs

4. Personal Incentives

5. Internal Motives

6. Management Compensation Contract Motivations

7. Lending Contracts Motivations

8. Regulatory Motivations.