Table of Contents

- 1 Evolution of Financial Management

-

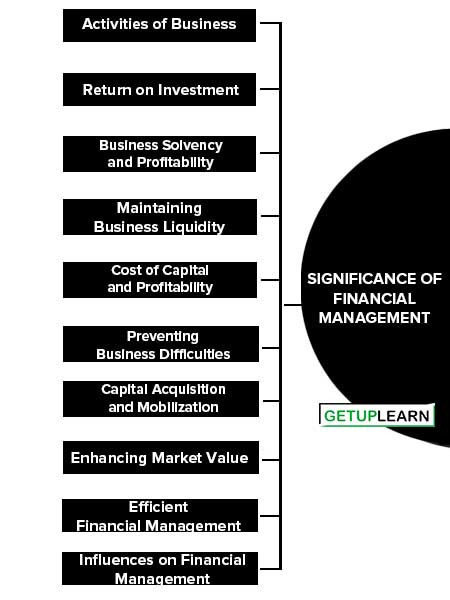

2 Significance of Financial Management

- 2.1 Activities of Business

- 2.2 Return on Investment

- 2.3 Business Solvency and Profitability

- 2.4 Maintaining Business Liquidity

- 2.5 Cost of Capital and Profitability

- 2.6 Preventing Business Difficulties

- 2.7 Capital Acquisition and Mobilization

- 2.8 Enhancing Market Value

- 2.9 Efficient Financial Management

- 2.10 Influences on Financial Management

- 2.11 Optimizing Costs and Revenues

- 2.12 Embracing Global Financial Management

- 3 FAQs About the Significance of Financial Management

Evolution of Financial Management

Finance was long considered a part of economics until the early 20th century when it gained prominence as a separate discipline. During the 1920s, the importance of liquidity management and capital raising emerged. The Great Depression in the 1930s shifted focus to solvency and survival.

From the mid-1950s, financial management pivoted towards fund utilization rather than raising capital, with Modigliani and Miller arguing that only investment decisions were relevant. The 1960s and 1970s saw the rise of portfolio management and the development of financial models like CAPM, APM, and OPM.

The 1980s introduced further advancements in financial management, including the intersection of personal and corporate taxation, financial signaling, and the efficient market hypothesis. The 1990s were marked by financial globalization, giving rise to global financial management and foreign exchange risk management.

In the late 1990s and the 2000s, corporate governance, financial disclosures, and related norms took center stage. The 21st century heralded a new era of digital-supported financial management.

Developments up until the mid-1950s are known as classical financial management, while those from the mid-1950s to the 1980s are termed modern financial management. Developments since the 1990s are referred to as post-modern financial management.

Below that we will be learning about the significance of financial management.

Significance of Financial Management

Financial management is a very important function of overall business management. Here are some reasons for the significance of financial management:

- Activities of Business

- Return on Investment

- Business Solvency and Profitability

- Maintaining Business Liquidity

- Cost of Capital and Profitability

- Preventing Business Difficulties

- Capital Acquisition and Mobilization

- Enhancing Market Value

- Efficient Financial Management

- Influences on Financial Management

- Optimizing Costs and Revenues

- Embracing Global Financial Management

Activities of Business

Financial management covers a very large spectrum of activities of a business, True, whatever a business does has financial implications. Hence, its pervasiveness and significance. Finance knowledge is a must for all irrespective of position, place, portfolio, and whatnot.

Return on Investment

Financial management influences the profitability or return on investment of a business. The choice of capital investment decisively affects the profitability of n undertaking.

Business Solvency and Profitability

Financial management affects the solvency position of a business. Solvency refers to the ability to service debts by paying interest and repaying principles as these become due. Profitability and nature of debts –both concerns of financial management-govern the solvency aspect. Hence the significance of financial management.

Maintaining Business Liquidity

Financial management affects the liquidity position of a business. Liquidity refers to the ability to repay short-term loans. Efficient cash management, cash flow management, and management of relations with the banker influence the level of liquidity. All these factors are aspects of financial management.

Cost of Capital and Profitability

Financial management affects the cost of capital. Able financial managers to find and use fewer cost sources, which in turn contributes to profitability.

In using fixed-cost instruments of capital, the efficacy of sound financial management would be known well. Variable cost instruments of capital are the order of the day. Finance-savvy persons go for such instruments.

Preventing Business Difficulties

Financial management, if well steered, can ward off difficulties, such as restrictive covenants imposed by lenders of capital, inflexibility in capital structure, dilution of management control on the affairs of the business, and so on. Failure to do so has landed many firms in difficulties and a financial mess.

Capital Acquisition and Mobilization

Good financial management enables a business to command capital resources flowing into the business. There is always capital available at attractive terms if business finance is handled well. Even overseas capital can be easily mobilized if sound financial management is ensured.

Enhancing Market Value

The market value of the business can be increased through efficient and effective financial management. As shares and stock are quoted at high prices, more funds, when needed, can be mobilized easily either through public and/or rights offers.

Efficient Financial Management

Efficient financial management is necessary for the survival, growth, expansion, and diversification of a business.

Influences on Financial Management

Financial management significantly influences the business‘s credit rating, employee commitment, suppliers‘ confidence, customers‘ patronage, and the like.

Optimizing Costs and Revenues

Financial management is an exercise in optimizing costs given revenues or optimizing revenues, or optimizing revenues given costs. This is vital to ensure purposeful resource allocation.

Embracing Global Financial Management

Today, financial management has global dimensions with an opportunity to mop up resources and put up investments across borders. The global trend in finance is better learned by all.

The significance of financial management can be well appreciated if one considers the analogy. Finance is like blood. Financial management is like the blood circulation system. without financial management, a business cannot survive,

FAQs About the Significance of Financial Management

What is the significance of financial management?

The following is the significance of financial management:

1. Activities of Business

2. Return on Investment

3. Business Solvency and Profitability

4. Maintaining Business Liquidity

5. Cost of Capital and Profitability

6. Preventing Business Difficulties

7. Capital Acquisition and Mobilization

8. Enhancing Market Value

9. Efficient Financial Management

10. Influences on Financial Management.