Table of Contents

What is Merger and Acquisition?

Mergers and acquisitions are the most popular means of corporate restructuring or business combinations in comparison to amalgamation, takeovers, spin-offs, leverage buy-outs, buy-back of shares, capital re-organization, sale of business units and assets, etc.

Corporate restructuring refers to the changes in ownership, business mix, assets mix, and alliances with a motive to increase the value of shareholders. To achieve the objective of wealth maximization, a company should continuously evaluate its portfolio of business, capital mix, ownership, and assets arrangements to find out opportunities for increasing the wealth of shareholders.

There is a great deal of confusion and disagreement regarding the precise meaning of terms relating to business combinations, i.e. mergers, acquisition, take-over, amalgamation, and consolidation. Although the economic considerations in terms of motives and effect of business combinations are similar the legal procedures involved are different.

The mergers/amalgamations of corporates constitute a subject matter of the Companies Act and the acquisition/takeover fall under the purview of the Security and Exchange Board of India (SEBI) and the stock exchange listing agreements.

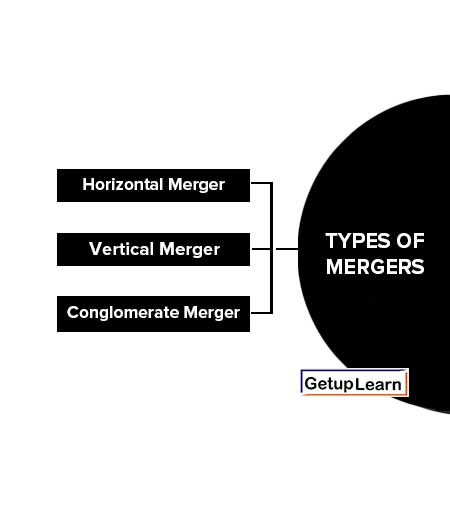

Types of Mergers

These the types of mergers that can be classified into three categories:

Horizontal Merger

A horizontal merger takes place when two or more corporate firms dealing in similar lines of activities combine together. For example, the merger of two publishers or two luggage manufacturing companies.

Elimination or reduction in competition, putting an end to price cutting, economies of scale in production, research and development, marketing, and management are the often cited motives underlying such mergers.

Vertical Merger

A vertical merger is a combination of two or more firms involved in different stages of production or distribution. For example, joining a spinning company and a weaving company. The vertical merger may be a forward or backward merger.

When a company combines with the supplier of material, it is called a backward merger and when it combines with the customer, it is known as a forward merger. The main advantages of such mergers are lower buying cost of materials, lower distribution costs, assured supplies, and market, increasing or creating barriers to entry for competitors, etc.

Conglomerate Merger

A conglomerate merger is a combination in which a firm in one industry combines with a firm from an unrelated industry.

A typical example is the merging of different businesses like manufacturing cement products, fertilizer products, electronic products, insurance investment, and advertising agencies. Voltas Ltd. is an example of a conglomerate company. Diversification of risk constitutes the rationale for such mergers.

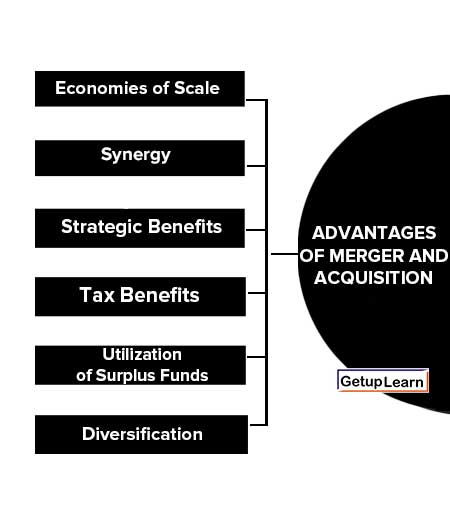

Advantages of Merger and Acquisition

These are the major advantages of merger and acquisition:

- Economies of Scale

- Synergy

- Strategic Benefits

- Tax Benefits

- Utilization of Surplus Funds

- Diversification

Economies of Scale

The operating cost advantage in terms of economies of scale is considered to be the primary objective of mergers. These economies arise because of more intensive utilization of production capacities, distribution networks, engineering services, research and development facilities, data processing systems, etc.

Economies of scale are the most prominent in the case of horizontal mergers. In a vertical merger, the principal sources of benefits are improved coordination of activities and lower inventory levels.

Synergy

It results from complementary activities. For example, one firm may have financial resources while the other has profitable investment opportunities. In the same manner, one firm may have strong research and development facilities.

The merged concern in all these cases will be more effective than the individual firm’s combined value of merged firms is likely to be greater than the sum of the individual entities.

Strategic Benefits

If a company has decided to enter or expand in a particular industry through the acquisition of a firm engaged in that industry, rather than dependence on internal expansion, may offer several strategic advantages:

- It can prevent a competitor from establishing a similar position in that industry.

- It offers special timing advantages.

- It may entail less risk and even less cost.

Tax Benefits

Under certain conditions, tax benefits may turn out to be the underlying motive for a merger. Suppose that a firm with accumulated losses and unabsorbed depreciation merges with a profit-making firm, tax benefits are utilized better.

Because its accumulated losses/unabsorbed depreciation can be set off against the profits of the profit-making firm.

Utilization of Surplus Funds

A firm in a mature industry may generate a lot of cash but may not have opportunities for profitable investment. In such a situation, a merger with another firm involving cash compensation often represents a more effective utilization of surplus funds.

Diversification

Diversification is yet another major advantage, especially in the conglomerate merger. The merger between two unrelated firms would tend to reduce business risk, which, in turn, reduces the cost of capital (K0) of the firm’s earnings which enhances the market value of the firm.

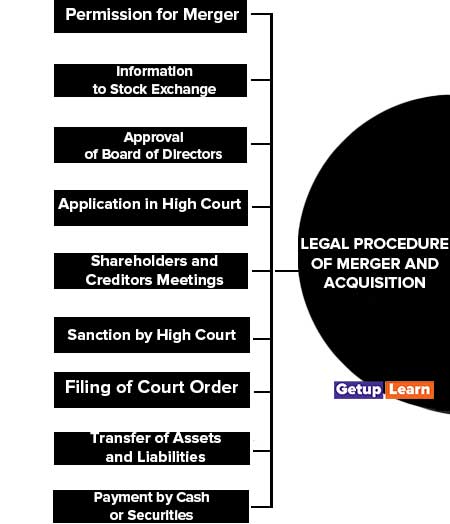

Legal Procedure of Merger and Acquisition

The following is the summary of legal procedures for merger or acquisition as per the Companies Act, of 1956:

- Permission for Merger

- Information to Stock Exchange

- Approval of Board of Directors

- Application in High Court

- Shareholders and Creditors Meetings

- Sanction by High Court

- Filing of Court Order

- Transfer of Assets and Liabilities

- Payment by Cash or Securities

Permission for Merger

Two or more companies can amalgamate only when amalgamation is permitted under their memorandum of association. Also, the acquiring company should have permission in its object clause to carry on the business of the acquired company.

Information to Stock Exchange

The acquiring and the acquired companies should inform the stock exchanges where they are listed about the merger/acquisition.

Approval of Board of Directors

The boards of directors of individual companies should approve the draft proposal for amalgamation and authorize the management of companies to further pursue the proposal.

Application in High Court

An application for approving the draft amalgamation proposal duly approved by the boards of directors of the individual companies should be made to the High Court.

The High Court would convene a meeting of the shareholders and creditors to approve the amalgamation proposal. The notice of the meeting should be sent to them at least 21 days in advance.

the individual companies should hold separate meetings of their shareholders and creditors for approving the amalgamation scheme. At least, 75 percent of shareholders and creditors in separate meetings, voting in person or by proxy, must accord their approval to the scheme.

Sanction by High Court

After the approval of shareholders and creditors, on the petitions of the companies, the High Court will pass an order sanctioning the amalgamation scheme after it is satisfied that the scheme is fair and reasonable.

If it deems so, it can modify the scheme. The date of the court’s hearing will be published in two newspapers, and also, the Regional Director of the Company Law Board will be intimated.

Filing of Court Order

After the Court order, its certified true copies will be filed with the Registrar of Companies.

Transfer of Assets and Liabilities

The assets and liabilities of the acquired company will be transferred to the acquiring company in accordance with the approved scheme, with effect from the specified date.

Payment by Cash or Securities

As per the proposal, the acquiring company will exchange shares and debentures and/or pay cash for the shares and debentures of the acquired company. These securities will be listed on the stock exchange.

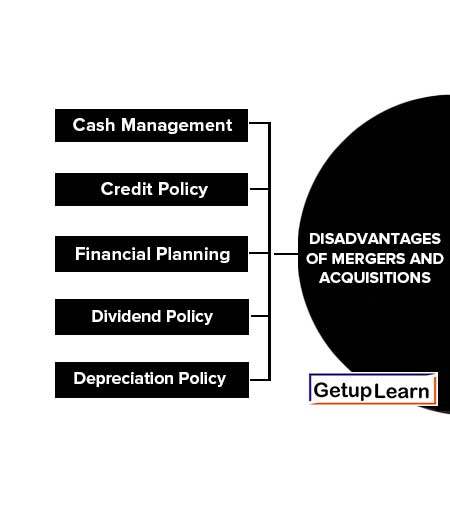

Disadvantages of Mergers and Acquisitions

After mergers and consolidation, the companies face a number of financial problems. The liquidity of the companies has to be established afresh. The merging and consolidating companies pursue their own financial policies when they are working independently.

A number of adjustments are required to be made in financial planning and policies so that consolidated efforts may enable to improvement short-term and long-term finances of the companies.

These are the disadvantages of mergers and acquisitions:

Cash Management

The liquidity problem is the usual problem faced by acquiring companies. Before merger and consolidation, the companies had their own methods of payments, cash behavior patterns, and arrangements with financial institutions. The cash pattern will have to be adjusted according to the present needs of the business.

Credit Policy

The credit policies of the companies are unified so that the same terms and conditions may be applied to the customers. If the market areas of the companies are different, then the same old policies may be followed.

The problem will arise only when the operating areas of the companies are the same and the same credit policy will have to be pursued.

Financial Planning

The companies may be following different financial plans before merger and consolidation. The methods of budgeting and financial controls may also be different.

After the merger and consolidation, unified financial planning is followed. The divergent financial controls will be unified to suit the needs of the acquiring concerns.

Dividend Policy

The companies may be following different policies for paying dividends. The stockholders will be expecting higher rates of dividend after the merger and consolidation on the belief that financial position and earning capacity has increased after combining the resources of the companies.

This is a ticklish problem and management will have to devise an acceptable pay-out policy. In the earlier stages of merger and consolidation, it may be difficult to maintain even the old rates of dividends.

Depreciation Policy

The companies follow different depreciation policies. The methods of depreciation, the rates of depreciation, and the amounts to be taken to revenue accounts will be different.

After the merger and consolidation, the first thing to be decided will be the depreciable and non-depreciable assets. The second will be about the rates of depreciation. Different assets will be in different stages of use and appropriate amounts of depreciation should be decided.

FAQs About the Mergers and Acquisitions

What is Mergers and Acquisitions?

A merger is said to occur when two or more companies combine into one company. One or more companies may merge with an existing company or they may merge to form a new company. The acquisition may be defined as an act of acquiring effective control over assets or management of a company by another company without any combination of businesses.

What are the types of mergers and acquisitions?

The following are the types of mergers and acquisitions:

1. Horizontal Merger

2. Vertical Merger

3. Conglomerate Merger.

What are the advantages of merger and acquisition?

The following are the advantages of merger and acquisition:

1. Economies of Scale

2. Synergy

3. Strategic Benefits

4. Tax Benefits

5. Utilization of Surplus Funds

6. Diversification.

What is legal requirements of merger and acquisition?

These are the legal procedure of merger and acquisition:

1. Permission for Merger

2. Information to Stock Exchange

3. Approval of the Board of Directors

4. Application in High Court

5. Shareholders and Creditors Meetings

6. Sanction by High Court

7. Filing of Court Order

8. Transfer of Assets and Liabilities

9. Payment by Cash or Securities.

What are the disadvantages of mergers and acquisitions?

The following are the disadvantages of mergers and acquisitions:

1. Cash Management

2. Credit Policy

3. Financial Planning

4. Dividend Policy

5. Depreciation Policy.