Table of Contents

- 1 What is Budgeting?

- 2 Definition of Budgeting

-

3 Elements of Budget

- 3.1 Integrated Plan

- 3.2 Financial Qualification

- 3.3 Operation and Resources

- 3.4 Time Element

- 3.5 Budgeting and Forecasting

- 3.6 Fixed and Variable Costs

- 3.7 Contingency Fund

- 3.8 Financial Goals

- 3.9 Flexibility and Adaptability

- 3.10 Debt Repayment

- 3.11 Savings and Investments

- 3.12 Purpose of Budgeting

- 4 Types of Budgets

- 5 Advantages of Budgeting

-

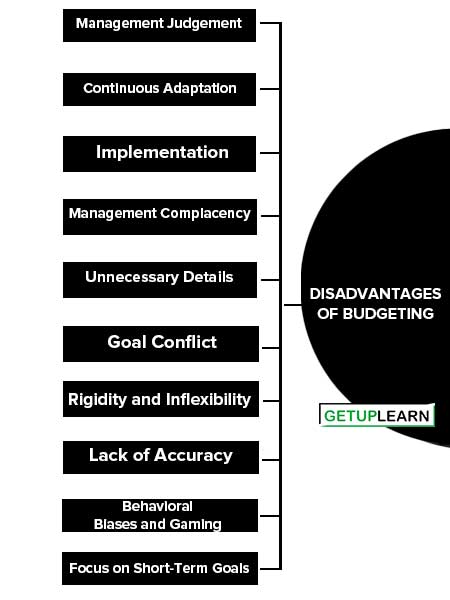

6 Disadvantages of Budgeting

- 6.1 Management Judgement

- 6.2 Continuous Adaptation

- 6.3 Implementation

- 6.4 Management Complacency

- 6.5 Unnecessary Details

- 6.6 Goal Conflict

- 6.7 Rigidity and Inflexibility

- 6.8 Lack of Accuracy

- 6.9 Behavioral Biases and Gaming

- 6.10 Focus on Short-Term Goals

- 6.11 Lack of Accountability and Ownership

- 6.12 Hindrance to Creativity and Innovation

- 6.13 Stress and Pressure

- 7 FAQs About the What is Budgeting?

What is Budgeting?

A budget is a comprehensive and coordinated plan, expressed in financial terms, for the operations and resources of an enterprise for some specific period in the future. It is a plan of the management’s intentions of attaining specified objectives. The commitment of the management is key to the success in the preparation and implementation of a budget.

The basic elements of a budget are:

- It is a comprehensive and coordinated plan.

- It is expressed in financial terms.

- It is a plan for the firm’s operations and resources.

- It is a future plan for a specified period.

Definition of Budgeting

These are the definitions of budgeting by authors:

[su_quote cite=”Larry M. Walther and Christopher J. Skousen”]Budgeting is the process of developing a detailed plan for the financial needs of an organization. It involves estimating revenues and expenses for a future period and allocating resources to achieve the organization’s goals.[/su_quote]

[su_quote cite=”Warren, Reeve, and Duchac”]The process of setting financial and operational targets and developing a plan to achieve them. It involves forecasting future activities, setting goals, and establishing standards against which actual performance can be compared, called budgeting[/su_quote]

[su_quote cite=”M.A. Sahaf”]Budgeting is Defined as “The process of preparing detailed plans and policies for the future of an enterprise, expressed in monetary terms. It involves the estimation of future incomes and expenditures, along with their allocation to various activities and functions within the organization.”[/su_quote]

[su_quote cite=”Horngren, Sundem, Stratton, Burgstahler, and Schatzberg”]Budgeting is defined as “The process of planning future business actions and expressing them as formal plans (budgets). Budgets provide a basis for monitoring and controlling operations, motivating employees, and evaluating performance.[/su_quote]

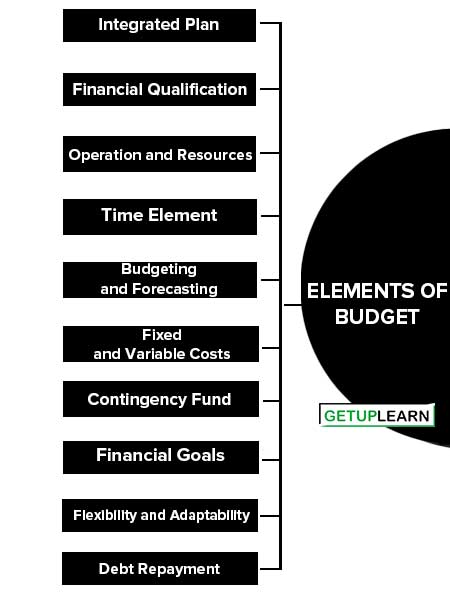

Elements of Budget

A budget is a financial plan that outlines an organization’s or individual’s projected income and expenses over a specified period. It helps in managing finances, setting financial goals, and making informed decisions. The key elements of budget include:

- Integrated Plan

- Financial Qualification

- Operation and Resources

- Time Element

- Budgeting and Forecasting

- Fixed and Variable Costs

- Contingency Fund

- Financial Goals

- Flexibility and Adaptability

- Debt Repayment

- Savings and Investments

- Purpose of Budgeting

Integrated Plan

A budget serves as an integrated plan that outlines the expectations and future projections of a firm. It involves controlling and manipulating relevant variables, both controllable and non-controllable, to reduce the impact of uncertainty.

The budget helps management actively influence the business environment in the best interest of the enterprise. It encompasses all activities and operations, making it a comprehensive plan for the entire enterprise.

Financial Qualification

A budget is quantified in financial terms for operational purposes. While budgets may initially be developed in various quantities, they must ultimately be expressed in a common financial unit, such as rupees, dollars, or pounds. This allows for the coordination and comprehensive development of budgets for different segments of the enterprise.

Operation and Resources

A budget acts as a mechanism to plan for the firm’s operations or activities. It focuses on quantifying revenues and expenses related to specific operations. Additionally, the budget plans for the necessary resources to carry out these operations, including assets and sources of funds.

Time Element

A budget must incorporate a time dimension to be meaningful. It relates to a specified period, and the budget estimates are relevant only for that specific period. Setting production targets or profit targets without specifying the time within which they need to be achieved is meaningless.

A typical budget spans over one year, which may be further divided into quarterly or monthly budgets.

Budgeting and Forecasting

A budget differs from a forecast. A forecast predicts the likelihood of events based on past data and expected changes, without assuming management commitment to realize the forecast.

In contrast, a budget expresses management’s intentions to achieve forecasts through positive actions and conscious efforts. It reflects managerial commitment and involves processes such as negotiation, approval, and review.

Fixed and Variable Costs

Fixed costs are expenses that remain constant over the budget period, regardless of the level of activity. Examples include rent, insurance premiums, and subscription fees. Variable costs, on the other hand, fluctuate based on the level of activity or consumption, such as utilities or office supplies.

Contingency Fund

A contingency fund is an allocation within the budget to account for unexpected or unforeseen expenses. It acts as a buffer for emergencies, repairs, or other unexpected financial obligations.

Financial Goals

A budget should align with specific financial goals, such as saving for a down payment on a house, starting a business, or funding higher education. Clearly defining these goals helps in prioritizing expenses and allocating resources accordingly.

Flexibility and Adaptability

A budget should be flexible enough to accommodate changes in income, expenses, or financial goals. Life circumstances, economic conditions, or unexpected events may require adjustments to the budget. Flexibility allows for agile financial management.

Debt Repayment

If there are any outstanding debts, such as credit card balances, loans, or mortgages, they should be included in the budget. Allocating a specific amount towards debt repayment helps in managing and reducing debt effectively.

Savings and Investments

This element focuses on setting aside money for savings and investments. It involves allocating a portion of income towards building an emergency fund, retirement savings, or other investment opportunities. Saving and investing goals should be considered as an integral part of a budget.

Purpose of Budgeting

The major purposes of budgets or budgeting are:

- To state the firm’s expectations (goals) in clear, formal terms to avoid confusion and to facilitate their attainability.

- To communicate expectations to all concerned with the management of the firm so that they are understood, supported and implemented.

- To provide a detailed plan of action for reducing uncertainty and for the proper direction of individual and group efforts to achieve goals. To coordinate the activities and efforts in such a way that the use of resources is maximised.

- To provide a means of measuring and controlling the performance of individuals and units and to supply information on the basis of which the necessary corrective action can be taken.

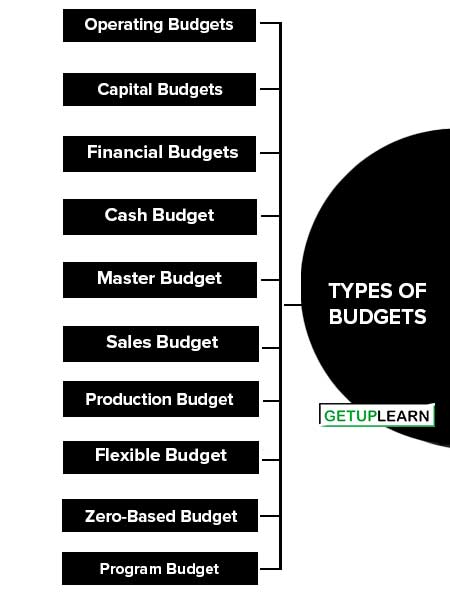

Types of Budgets

Budgets can take different forms depending on their purpose, scope, and time horizon. Here are some common types of budgets:

- Operating Budgets

- Capital Budgets

- Financial Budgets

- Cash Budget

- Master Budget

- Sales Budget

- Production Budget

- Flexible Budget

- Zero-Based Budget

- Program Budget

- Personal Budget

Operating Budgets

Operating budgets relate to the planning of the activities or operations of the enterprise, such as production, sales, and purchases. The operating budget is composed of two parts a program or activity budget and a responsibility budget. These represent two different ways of looking at the operations of the enterprise, but arriving at the same results.

Capital Budgets

Capital budget involves the planning to acquire worthwhile projects, together with the timings of the estimated cost and cash flows of each project. Such projects require large sum of funds and have long-term implications for the firm. Capital budgets are difficult to prepare because estimates of the cash flows over a long period have to be made which involve a great degree of uncertainty.

The capital budgets are generally prepared separately from the operating budgets. In many companies, there is a committee separate from the budget committee to appropriate funds for capital investment projects. In capital budgeting, the profitability of each project has to be carefully evaluated.

Various techniques can be used to determine the profitableness of a project. The technique used should be objective free from personal bias and capable of clearly indicating whether the project should be accepted or not.

Financial Budgets

Financial budgets are concerned with the financial implications of the operating budgets the expected cash inflows and cash outflows, financial position and the operating results.

The important components of financial budgets are: cash budget, pro forma balance sheet and income statement and statements of changes in financial position.

Cash Budget

A cash budget focuses on tracking and projecting cash inflows and outflows over a specific period, usually on a monthly basis. It helps businesses manage their cash flow effectively, ensuring they have sufficient funds to cover expenses, pay debts, and meet other financial obligations. The cash budget is crucial for maintaining liquidity and avoiding cash shortages.

Master Budget

The master budget consolidates all the individual budgets of different departments and functions within an organization. It provides an overall financial plan for the entire organization, integrating the operating, capital, and cash budgets. The master budget serves as a comprehensive roadmap that guides the organization’s financial activities and performance.

Sales Budget

A sales budget forecasts the expected sales revenue for a specific period. It helps organizations set sales targets, allocate resources, and plan production and marketing strategies accordingly. The sales budget often serves as the basis for developing other budgets within the organization.

Production Budget

A production budget outlines the quantity of goods or services to be produced during a specific period. It takes into account the sales forecast, inventory levels, and desired levels of finished goods. The production budget helps organizations plan their production schedules, resource requirements, and manage inventory efficiently.

Flexible Budget

A flexible budget is designed to adjust to different levels of activity or output. It allows for variations in revenues and expenses based on changes in production volumes, sales levels, or other variables. A flexible budget provides a more accurate reflection of costs and performance at different levels of activity compared to a static budget.

Zero-Based Budget

In a zero-based budget, all expenses must be justified from scratch for each budgeting period, regardless of previous budget allocations. It requires a thorough review and justification of all expenses, challenging the assumption that certain expenses will automatically continue. Zero-based budgeting encourages cost control, efficiency, and the allocation of resources based on priorities.

Program Budget

A program budget allocates resources and funds to specific programs or projects within an organization. It enables organizations to assess the financial impact and effectiveness of individual programs, facilitating decision-making and resource allocation based on program priorities and performance.

Personal Budget

A personal budget focuses on an individual’s income and expenses, helping to manage personal finances effectively. It includes tracking income sources, and budgeting for expenses such as rent, utilities, groceries, transportation, debt repayments, savings, and discretionary spending.

Personal budgets enable individuals to plan and control their finances, save for goals, and make informed financial decisions.

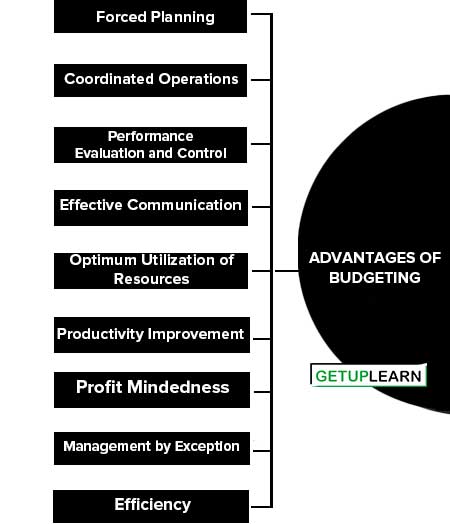

Advantages of Budgeting

To reiterate, budgeting is a management tool; it is a way of managing. It predicts the future with reasonable precision and removes uncertainty to a great extent. The following are some of the more significant advantages of budgeting:

- Forced Planning

- Coordinated Operations

- Performance Evaluation and Control

- Effective Communication

- Optimum Utilization of Resources

- Productivity Improvement

- Profit Mindedness

- Management by Exception

- Efficiency

Forced Planning

Budgeting compels management to plan for the future. The budgeting process forces management to look ahead and become more effective and efficient in administering business operations. It instills into managers the habit of evaluating carefully their problems and related variables before making any decisions.

Coordinated Operations

Budgeting helps to coordinate, integrate and balance the efforts of various departments in light of the overall objectives of the enterprise. This results in goal congruency and harmony among the departments.

Performance Evaluation and Control

Budgeting facilitates control by providing definite expectations in the planning phase that can be used as a frame of reference for judging the subsequent performance.

Undoubtedly, budgeted performance is a more relevant standard for comparison than past performance, since past performance is based on historical factors which are constantly changing.

Effective Communication

Budgeting improves the quality of communication. The enterprise objectives, budget goals, plans, authority and responsibility and procedures to implement plans are clearly written and communicated through budgets to all individuals in the enterprise. This results in better understanding and harmonious relations among managers and subordinates.

Optimum Utilization of Resources

Budgeting helps to optimize the use of the firm’s resources capital and human; it aids in directing the total efforts of the firm into the most profitable channels.

Productivity Improvement

Budgeting increases the morale and thus, the productivity of the employees by seeking their meaningful participation in the formulation of plans and policies, bringing harmony between individual goals and the enterprise objectives, and by providing incentives to perform more effectively.

Profit Mindedness

Budgeting develops an atmosphere of profit-mindedness and cost-consciousness.

Management by Exception

Budgeting permits to focus management attention on significant matters through budgetary reports; thus, it facilitates management by exception and thereby saves management time and energy considerably.

Efficiency

Budgeting measures efficiency, permits management self-evaluation, and indicates the progress in attaining the enterprise objectives.

Disadvantages of Budgeting

While budgeting is a valuable tool for financial planning and control, it also has some potential disadvantages that organizations should be aware of. Here are some common disadvantages of budgeting:

- Management Judgement

- Continuous Adaptation

- Implementation

- Management Complacency

- Unnecessary Details

- Goal Conflict

- Rigidity and Inflexibility

- Lack of Accuracy

- Behavioral Biases and Gaming

- Focus on Short-Term Goals

- Lack of Accountability and Ownership

- Hindrance to Creativity and Innovation

- Stress and Pressure

Management Judgement

Budgeting is not an exact science; its success hinges upon the precision of estimates. Estimates are based on facts and managerial judgment. Managerial judgment can suffer from subjectivism and personal biases. The adequacy of budgeting, thus, depends upon the adequacy of managerial judgment.

Continuous Adaptation

The installation of a perfect system of budgeting is not possible in a short period. Business conditions change rapidly; therefore, budgeting programmes should be continuously adapted. Budgeting has to be a continuous exercise; it is a dynamic process.

Management should not lose patience; they should go on trying various techniques and procedures in developing and using the budgeting system. Ultimately, they will achieve success and reap the benefits of budgeting.

Implementation

A skillfully prepared budgetary program will not improve the management of an enterprise unless it is properly implemented. For the success of the budgetary program, it is essential that it is understood by all, and that the managers and subordinates put concerted effort into accomplishing the budget goals.

All persons in the enterprise must have full involvement in the preparation and execution of budgets, otherwise, budgeting will not be effective.

Management Complacency

Budgeting is a management tool a way of managing; not the management. The presence of a budgetary system should not make management complacent.

To get the best results managing, management should use budgeting with intelligence and foresight, along with other managerial techniques. Budgeting assists management; it cannot replace management.

Unnecessary Details

Budgeting will be ineffective and expensive if it is unnecessarily detailed and complicated. A budget should be precise in format and simple to understand; it should be flexible, not rigid in application.

Goal Conflict

The purpose of budgeting will be defeated if carelessly set budget goals conflict with enterprise objectives. This confuses means with the end results. Budget goals are definite targets to achieve the overall enterprise objectives. They must be in harmony with enterprise aims.

Rigidity and Inflexibility

Budgets are often created based on assumptions and projections of future events. However, business environments are dynamic and can change rapidly. Budgets may lack the flexibility to adapt to unforeseen circumstances, leading to misalignment between budgeted figures and actual performance.

This rigidity can limit the organization’s ability to respond effectively to changing market conditions or emerging opportunities.

Lack of Accuracy

Budgets are based on estimates, assumptions, and forecasts, which may not always accurately predict future outcomes. Unforeseen events, such as economic downturns, industry disruptions, or changes in customer behavior, can significantly impact actual results and render budgeted figures less reliable. Inaccurate budgeting can lead to unrealistic expectations and ineffective decision-making.

Behavioral Biases and Gaming

Budgets can sometimes create undesirable behaviors within organizations. Individuals and departments may be incentivized to engage in “gaming” or manipulating figures to meet budget targets, even if it compromises long-term objectives or ethical practices. This can undermine transparency, collaboration, and trust within the organization.

Focus on Short-Term Goals

Budgeting often emphasizes short-term financial targets, such as meeting quarterly revenue or profit goals. This focus on short-term objectives may come at the expense of long-term strategic planning and investment.

Organizations may miss opportunities for innovation, research, and development, or long-term growth if they excessively prioritize short-term financial targets.

Lack of Accountability and Ownership

In some cases, budgets can be perceived as top-down impositions rather than participatory processes. This can lead to a lack of ownership and accountability among employees, as they may not feel fully engaged or responsible for achieving budget targets.

When individuals do not have a sense of ownership, they may be less motivated to contribute to the budget’s success.

Hindrance to Creativity and Innovation

Budgeting can create a mindset focused on cost control and adherence to predetermined plans. This mindset may stifle creativity and innovation within the organization, as employees may hesitate to propose new ideas or take calculated risks that deviate from the budgeted norms. The rigidity of budgeting may limit experimentation and impede adaptation to changing market dynamics.

Stress and Pressure

The pressure to meet budget targets can create stress and strain on individuals and teams. Unrealistic targets or constant scrutiny can lead to a high-pressure work environment, potentially affecting morale, job satisfaction, and work-life balance. Excessive focus on meeting budget targets may overshadow other important aspects of performance and employee well-being.

FAQs About the What is Budgeting?

What is a budgeting simple definition?

Budgeting definition can be defined as “The process of developing a detailed plan for the financial needs of an organization. It involves estimating revenues and expenses for a future period and allocating resources to achieve the organization’s goals.”

What is the meaning of budgeting?

Budgeting can be defined as “The process of setting financial and operational targets and developing a plan to achieve them. It involves forecasting future activities, setting goals, and establishing standards against which actual performance can be compared.”

What are the elements of budget?

The following are the elements of budget:

1. Integrated Plan

2. Financial Qualification

3. Operation and Resources

4. Time Element

5. Budgeting and Forecasting

6. Fixed and Variable Costs

7. Contingency Fund

8. Financial Goals

9. Flexibility and Adaptability

10. Debt Repayment.

What are the types of budgets?

These are the some types of budgets:

1. Operating Budgets

2. Capital Budgets

3. Financial Budgets

4. Cash Budget

5. Master Budget

6. Sales Budget

7. Production Budget

8. Flexible Budget

9. Zero-Based Budget

10. Program Budget.

What are the advantages of budgeting?

The advantages of budgeting are:

1. Forced Planning

2. Coordinated Operations

3. Performance Evaluation and Control

4. Effective Communication

5. Optimum Utilization of Resources

6. Productivity Improvement

7. Profit Mindedness

8. Management by Exception

9. Efficiency.

What are the disadvantages of budgeting?

A budget is a comprehensive and coordinated plan, expressed in financial terms, for the operations and resources of an enterprise for some specific period in the future. The disadvantages of budgeting:

1. Management Judgement

2. Continuous Adaptation

3. Implementation

4. Management Complacency

5. Unnecessary Details

6. Goal Conflict

7. Rigidity and Inflexibility

8. Lack of Accuracy

9. Behavioral Biases and Gaming

10. Focus on Short-Term Goals.