Table of Contents

- 1 What is Working Capital?

-

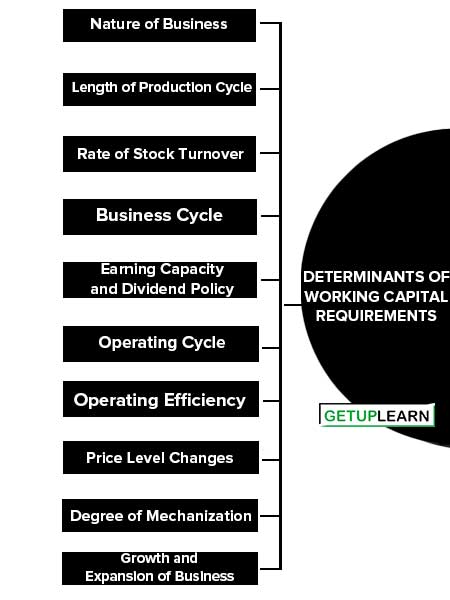

2 Determinants of Working Capital Requirements

- 2.1 Nature of Business

- 2.2 Length of Production Cycle

- 2.3 Rate of Stock Turnover

- 2.4 Business Cycle

- 2.5 Earning Capacity and Dividend Policy

- 2.6 Operating Cycle

- 2.7 Operating Efficiency

- 2.8 Price Level Changes

- 2.9 Degree of Mechanization

- 2.10 Growth and Expansion of Business

- 2.11 Seasonal Variations

- 2.12 Capital Structure of Firm

- 2.13 Credit Policy

- 2.14 Size of Business

- 2.15 Production Policy

- 2.16 Profit Margin

- 2.17 Liquidity and Profitability

- 2.18 Capacity to Repay

- 2.19 Value of Current Assets

- 2.20 Means of Transport and Communication

- 3 FAQs About the Determinants of Working Capital Requirements

What is Working Capital?

Working capital is the amount of funds required for meeting the day-to-day expenses of the business. The firm starts with cash. It buys raw materials, employs workers, and spends on expenditures like advertising, etc. Even then it may not receive cash immediately if sold on credit. The firm will have to use its own cash before it gets back sales revenue and then the cycle can go on.

So the money or funds required to meet the expenditure until it gets back through sales revenue is called working capital and this much funds it has to keep. In simple words, working capital refers to the part of the firm‘s capital that is required for financing short-term or current assets such as cash, marketable securities, debtors, and inventories.

Funds, thus, invested in current assets keep revolving fast and are being constantly converted into cash and this cash flows out again in exchange for other current assets. Hence, it is also known as revolving or circulating, or short-term capital.

Determinants of Working Capital Requirements

The following are the determinants of working capital requirements:

- Nature of Business

- Length of Production Cycle

- Rate of Stock Turnover

- Business Cycle

- Earning Capacity and Dividend Policy

- Operating Cycle

- Operating Efficiency

- Price Level Changes

- Degree of Mechanization

- Growth and Expansion of Business

- Seasonal Variations

- Capital Structure of Firm

- Credit Policy

- Size of Business

- Production Policy

- Profit Margin

- Liquidity and Profitability

- Capacity to Repay

- Value of Current Assets

- Means of Transport and Communication

Nature of Business

working capital is very limited in public sector undertakings such as electricity, water supply, and railways because they offer cash sales only and supply services, not products, and no funds are tied up in inventories and receivables.

On the other hand, trading and financial firms require less investment in fixed assets but have to invest large amounts of working capital along with fixed investment.

Length of Production Cycle

The longer the manufacturing time, the raw materials and other supplies have a be carried for a longer time in the process with progressive increments of labor and service costs before the final product is obtained. So working capital is directly proportional to the length of the manufacturing process.

Rate of Stock Turnover

There is an inverse co-relationship between the question of working capital and the velocity or speed with which the sale is affected. A firm having a high rate of stock turnover will need a lower amount of working capital as compared to a firm having a low rate of turnover.

Business Cycle

In the period of boom, when the business is prosperous, there is a need for a larger amount of working capital due to a rise in sales, a rise in prices, an optimistic expansion of business, etc.

On the contrary, in times of depression, business contracts, and sales decline, difficulties are faced in collection from debtors and the firm may have a large amount of working capital.

Earning Capacity and Dividend Policy

some firms have more earning capacity than others due to the quality of their products, monopoly conditions, etc. such firms may generate cash profits from operations and contribute to their working capital.

The dividend policy also affects the requirement of working capital. A firm maintaining a steady high rate of cash dividend irrespective of its profits, needs more working capital than a firm that retains a larger part of its profits and does not pay so high a rate of cash dividend.

Operating Cycle

The speed with which the operating cycle completes its round (i.e., cash raw materials finished product accounts receivables cash) plays a decisive role in influencing the working capital needs.

Operating Efficiency

operating efficiency means optimum utilization of resources. The firm can minimize its need for working capital by efficiently controlling its operating costs.

With increased operating efficiency, the use of working capital is improved and the pace of the cash cycle is accelerated. Better utilization of resources improves profitability and helps in relieving the pressure on working capital.

Price Level Changes

Generally, a rising price level requires a higher investment in working capital. With increasing prices, the same levels of current assets need enhanced investment. However, firms that can immediately revise the prices of their products upwards may not face a severe working capital problem in periods of rising levels.

The effects of increasing price levels may, however, be felt differently by different firms due to variations in individual prices. It is possible that some companies may not be affected by rising prices, whereas others may be badly hit by it.

Degree of Mechanization

In a highly mechanized concern having a low degree of dependence on labor, working capital requirement gets reduced. Conversely, in labor-intensive industries, greater sums shall be required to pay for wages and related facilities.

Growth and Expansion of Business

In business, the working capital requirements of a firm are low. However, with the gradual growth and expansion, its working capital needs also increase. Discernibly, the larger amount of working capital in a growing concern is required for its expansion programs.

Seasonal Variations

some industries manufacture and sell goods only during certain seasons. For example, the sugar, oil, timber, and textile industries have either seasonal supplies of raw materials or make their sales in a particular season.

Hence, the working capital requirements of such industries will be higher during a certain season as compared to any other period.

Capital Structure of Firm

If shareholders have provided some funds towards the working capital needs(at least to satisfy the permanent working capital needs), the management will find it relatively easy to manage working capital.

If the firm has to depend entirely upon outside sources for both permanent and temporary working capital needs, it faces an uphill task under dear money conditions.

Credit Policy

A firm making purchases on credit and sales on cash will always require a lower amount of working capital. On the contrary, a firm that is compelled to sell on credit and at the same time has no credit facilities may find itself in a tight corner.

Prevailing trade practices and changing economic conditions do generally exert greater influence on the credit policy of the concern.

Size of Business

The size of the business has also an important impact on its working capital needs. Size may be measured in terms of scale of operation. A firm with a larger scale of operation will need more working capital than a small firm.

Production Policy

The production policies pursued by the management have a significant effect on the requirement of the working capital of the business. The production schedule has a great influence on the level of inventories. The decisions of the management regarding automation, etc.

Will also have an effect on working capital requirements. In the case of labor-intensive industries, the working capital requirements will be more. While in the case of a highly automatic plant, the requirement for long-term funds will be more.

Profit Margin

Firms differ in their capacity to generate profit from business operations. Some firms enjoy a dominant position, due to quality products or good marketing management, or monopoly power in the market and earn a high-profit margin.

Some other firms may have to operate in an environment of intense competition and may earn a low margin of profit. A high net profit margin contributes towards the working capital pool. In fact, the net profit is a source of working capital to the extent it has been earned in cash.

Liquidity and Profitability

In case, a firm desires to take a greater risk for bigger gains, it reduces the size of its working capital in relation to its sales. If it is interested in improving its liquidity, it increases the level of its working capital.

However, this policy is likely to result in a reduction in the sales volume, and therefore, of profitability. A firm, therefore, should choose between liquidity and profitability and decide about its working capital requirements accordingly.

Capacity to Repay

A firm‘s ability to repay determines the level of its working capital. The usual practice of a firm is to prepare cash flow projections according to its plans of repayment and fix the working capital levels accordingly.

Value of Current Assets

A decrease in the real value of current assets as compared to their book value reduces the size of the working capital. If the real value of current assets increases, there is an increase in working capital.

Means of Transport and Communication

Working capital needs also depend upon the means of transport and communication. If they are not well developed, the industries will have to keep huge stocks of raw materials, spares, finished goods, etc., at places of production as well as distribution outlets.

FAQs About the Determinants of Working Capital Requirements

What are the determinants of working capital requirements?

The determinants of working capital requirements are:

1. Nature of Business

2. Length of Production Cycle

3. Rate of Stock Turnover

5. Business Cycle

6. Earning Capacity and Dividend Policy

7. Operating Cycle

8. Operating Efficiency

9. Price Level Changes

10. Degree of Mechanization.