Table of Contents

- 1 What is Financial Services?

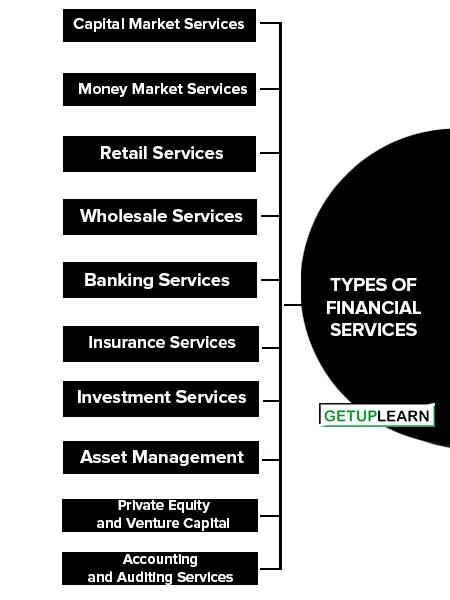

- 2 Types of Financial Services

- 2.1 Capital Market Services

- 2.2 Money Market Services

- 2.3 Retail Services

- 2.4 Wholesale Services

- 2.5 Banking Services

- 2.6 Insurance Services

- 2.7 Investment Services

- 2.8 Asset Management

- 2.9 Private Equity and Venture Capital

- 2.10 Accounting and Auditing Services

- 2.11 Financial Planning Services

- 2.12 Real Estate Services

- 2.13 Foreign Exchange Services

- 2.14 Retirement and Pension Services

- 2.15 Financial Consulting

- 2.16 Fintech Services

- 3 Features of Financial Services

- 4 Importance of Financial Services

- 5 Characteristics of Financial Services

- 6 New Financial Products and Services

- 6.1 Merchant Banking

- 6.2 Housing Finance Companies

- 6.3 Hire Purchase and Consumer Credit Companies

- 6.4 Venture Capital Funds

- 6.5 Lease Financing

- 6.6 Credit Rating Agencies

- 6.7 Factoring Services

- 6.8 Forfaiting

- 6.9 Custodial Services

- 6.10 Loan Syndication

- 6.11 Securitization

- 6.12 Bill Discounting

- 6.13 Corporate Advisory Services

- 7 FAQs About the Financial Services

What is Financial Services?

Financial Services may simply be defined as services offered by different financial intermediaries such as Banks, Financial Institutions, Insurance Companies, Brokerage Firms, Consumer Finance companies, etc.

In simple words, financial services are basically the services provided by the financial market to individuals and organizations. It is concerned with the design and delivery of services and financial products to individuals and businesses within the areas of banking and related financial institutions, financial planning, investments, real assets, insurance, and so on.

The “financial service” can also be called “financial intermediation”. Financial intermediation is a process by which funds are mobilized from a large number of savers and made available to all those who are in need of it and particularly to corporate customers.

Thus, the financial services sector is key and very vital for industrial development. A well-developed financial services industry is absolutely necessary to mobilize the savings and to allocate them to various investable channels and thereby promoting industrial development in a country.

Hence, financial services refer to services provided by the finance industry. The finance industry consists of a broad range of organizations that deals with the management of money. These organizations include banks, credit card companies, insurance companies, consumer finance companies, stock brokers, investment funds, and some government-sponsored enterprises.

In general, all types of activities which are of financial nature may be regarded as financial services. In a broad sense, the term financial services means mobilization and allocation of savings. Thus, it includes all activities involved in the transformation of savings into investments.

Types of Financial Services

Financial services encompass a broad range of more specific services provided by the finance industry, which encompasses a variety of businesses that manage money. Here are some common types of financial services:

- Capital Market Services

- Money Market Services

- Retail Services

- Wholesale Services

- Banking Services

- Insurance Services

- Investment Services

- Asset Management

- Private Equity and Venture Capital

- Accounting and Auditing Services

- Financial Planning Services

- Real Estate Services

- Foreign Exchange Services

- Retirement and Pension Services

- Financial Consulting

- Fintech Services

Capital Market Services

It is the segment of the financial market where long-term funds (one year and above) are issued and traded. The main instruments used in the capital markets are shares, debentures, bonds, etc.

Money Market Services

Unlike the capital market, the money market is the segment in which financial instruments with maturities of less than one year are traded. Some of the money market instruments are Treasury bills, commercial paper, trade bills, certificates of deposits, etc.

Retail Services

The financial services which are provided to individual customers by various financial intermediaries are termed retail services.

Wholesale Services

The services provided to corporate institutions may be directly or indirectly converted into retail services.

Banking Services

Traditional banking services include checking and savings accounts, providing short and long-term loans, credit cards, and more.

Insurance Services

Insurance companies provide protection against financial losses from various risks. This includes life insurance, health insurance, car insurance, property insurance, and more.

Investment Services

This includes services offered by brokerage firms and individual investment advisors. These services may involve the buying and selling of financial instruments like stocks, bonds, mutual funds, or other investment vehicles.

Asset Management

This involves managing a client’s investments on their behalf, aiming to grow their wealth over time. This often includes services like portfolio management and wealth planning.

Private Equity and Venture Capital

These firms provide capital to firms in exchange for a percentage of equity. Private equity typically focuses on mature companies, while venture capital is geared toward startups and high-growth companies.

Accounting and Auditing Services

These services include preparing financial reports, conducting audits, and ensuring compliance with financial regulations and standards.

Financial Planning Services

Financial planners help individuals and businesses create plans to meet long-term financial goals, such as retirement planning, education funding, estate planning, and more.

Real Estate Services

These services involve the management, sale, and purchase of real estate properties. This could also include services related to real estate investments.

Foreign Exchange Services

These services involve the exchange of one currency for another, facilitating international trade and travel.

Retirement and Pension Services

These services involve managing pension funds and retirement accounts to ensure individuals have enough money to support themselves after retirement.

Financial Consulting

Financial consultants provide expert advice on a range of financial matters such as mergers and acquisitions, business valuation, and financial risk management.

Fintech Services

This is a relatively new addition to the financial services industry, leveraging technology to improve traditional financial activities. This can include things like mobile banking, peer-to-peer lending, and robo-advisors.

Features of Financial Services

The following are the features of financial services:

Customer-Centric

Financial services are mainly customer focused. The company providing these services needs to study the requirement of the customer in terms of liquidity, safety, risk appetite, and duration of the product. Innovativeness within the regulatory framework is the key to success for the service providers.

Intangibility

Financial services are intangible in nature. Hence, the brand and image of the institution providing the service are very important to restore the confidence of the customers.

Perishable in Nature

Financial services do tend to perish if they cannot be offered as per the requirement of the client. Hence the organization needs to ensure proper synchronization of demand and supply.

Dynamic in Nature

Financial services vary with the changing requirements of the customers and the socio-economic environment such as disposable income, the standard of living, etc.

Importance of Financial Services

For any economy, the success of its financial system depends upon the financial services offered by its financial services organization. The importance of financial services can better be understood by studying the following points:

- Economic Growth

- Promotion of Savings

- Capital Formation

- Creation of Employment

- Provision of Liquidity

Economic Growth

The economic growth of any country depends upon the proper channelization of its savings and investments. The role of the financial services industry is to ensure the proper mobilization of savings of people into productive investments by providing various services to retail as well as corporate clients.

Promotion of Savings

One of the prime importance of financial services is to promote savings among people. Financial services organizations continuously innovate products to promote savings among the general public.

Capital Formation

The financial service industry facilitates capital formation by providing different types of capital market intermediary services.

Creation of Employment

The Financial Services sector employs millions of people across the globe.

Provision of Liquidity

The financial service industry promotes liquidity in the financial system. It facilitates the easy conversion of financial assets into liquid cash.

Characteristics of Financial Services

Generally, financial services have several important characteristics that distinguish them from physical products. The characteristics of financial services are as follows:

- Intangibility

- Customer-Specific

- Inseparability

- Perishability

- Variability

- Dominance of Human Element

- Information-Based

Intangibility

Financial services, by nature, are intangible and hence cannot be standardized or duplicated identically. Success in the financial services sector depends largely on the reputation and trust the providers can build among their clientele.

Achieving this necessitates a focus on quality and inventive solutions. The perception and trustworthiness of financial service providers are pivotal to their success.

Customer-Specific

The provision of financial services is inherently customer-centric. These companies meticulously analyze their clients’ needs before formulating their financial strategies, always considering factors like cost, liquidity, and maturity. Regular communication with their customers allows financial service firms to design products tailored to meet unique needs.

Market surveys are a frequent activity among these providers, enabling them to introduce new products in anticipation of needs and forthcoming regulations. The deployment of advanced technologies in creating original, user-friendly offerings underscores the emphasis financial service providers place on providing services personalized for each firm or customer.

Inseparability

The production and delivery of financial services are concurrent processes, necessitating a harmonious relationship between financial service institutions and their customers.

Perishability

Similar to other services, the demand and supply of financial services must be balanced. The inability to store services means they must be available exactly when customers require them.

Variability

To meet the diverse financial and associated needs of various customers in different locations, financial service organizations must offer a broad spectrum of products and services.

This implies that financial services must be customized to meet the specific needs of customers. Service institutions strive to distinguish their services to establish their unique identity.

Dominance of Human Element

The provision of financial services is heavily influenced by the human element, rendering it a labor-intensive industry. The marketing of high-quality financial products demands a competent and skilled workforce.

Information-Based

The financial service industry is fundamentally reliant on information. It encompasses the generation, distribution, and application of information, which is a vital ingredient in the production of financial services.

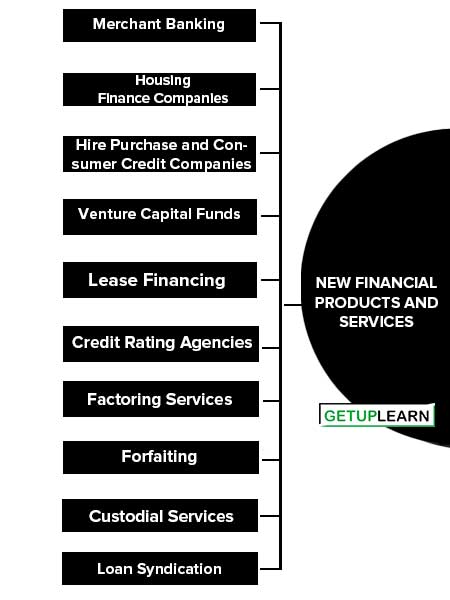

New Financial Products and Services

The intense competition in the financial services sector has forced financial intermediaries to devise new products to meet the demand of their customers. Many new financial products and services have emerged in the capital market. Some of the products and services are given below:

- Merchant Banking

- Housing Finance Companies

- Hire Purchase and Consumer Credit Companies

- Venture Capital Funds

- Lease Financing

- Credit Rating Agencies

- Factoring Services

- Forfaiting

- Custodial Services

- Loan Syndication

- Securitization

- Bill Discounting

- Corporate Advisory Services

Merchant Banking

Merchant banking is primarily focused on providing service to business undertakings on various financial matters. It is mainly concerned with providing non-fund-based services with respect to arranging funds rather than providing them.

They act as an intermediary between those who own capital and those who need it. Merchant banking involves providing a wide range of activities such as marketing corporate and other securities, corporate advisory services, syndication of credit, underwriting new issues, corporate mergers, and so on.

Housing Finance Companies

Housing finance simply refers to providing finance for house building. In India, the National Housing Bank (NHB), a fully owned subsidiary of the Reserve Bank of India was set up in 1988. NHB is the apex institution in the housing finance segment.

Some of the key players in the housing finance segments are Housing Development Finance Corporation (HDFC), Housing and Urban Development Corporation (HUDCO), LIC Housing Finance Limited (LIC HFL), Dewan Housing Finance Corporation (DHFL), etc.

Hire Purchase and Consumer Credit Companies

These types of companies provide finance to business firms to purchase machinery and equipment. They also provide finance to households to purchase consumer goods on a hire-purchase basis. Hire purchase is a transaction where goods are purchased by the consumer on the condition that the payment will be made in installments.

The buyer gets only the possession of the goods but the ownership is transferred only after the payment of the last installment. If the buyer fails to pay the installments, the seller can repossess the goods. Each installment carries an amount of interest.

Venture Capital Funds

Venture capital funds are investment funds that manage the money of investors who would like to take equity stakes in start-up businesses or Small & Medium Enterprises with strong growth potential. The main objectives of the investors are to earn a higher rate of return on their investments, hence venture capital is a high-risk investment vehicle.

Lease Financing

A lease is an agreement where a firm acquires a capital asset such as a plant & machinery on payment of an agreed fee called lease rentals. The party who acquires the right to use the asset is known as the lessee and the party who gives the right is known as the lessor. The ownership remains with the lessor.

Credit Rating Agencies

Credit rating agencies are responsible for assessing the creditworthiness of a company. In other words, it rates the issuer of the debt instrument on its ability and willingness to repay both interest and principal over the period of the rated instrument.

A generally higher rating indicates more safety of the instrument. The rating indicates the judgment about an organization’s financial and business prospects.

Factoring Services

It is an arrangement under which the NBFC (factor) purchases the account receivables (arising out of credit sale) and makes an immediate cash payment to the customer (supplier/creditor). Thus the factor provides finance to the client in respect of account receivables.

The factor or the institution undertakes the responsibility of collecting the receivables. Hence the risk is borne by the factor for which it charges fees from the client. The fee or the charge is called factorage.

Forfaiting

Forfaiting is related to international trade, where the forfeiture (financing agency) discounts an export bill and pays immediate cash to the exporter. It is a technique that helps the exporter to sell his goods on credit to the importer and receives cash before the due date against the bill from the financial institution.

Custodial Services

Custodial service is a fee-based service provided by various financial intermediaries. Custodial services include keeping shares and bonds of the clients, collection of dividends & interest on behalf of the client, updating client about the corporate developments, etc.

Some of the projects need a huge amount of funding, hence it is not possible for one bank or financial institution to cater to such an amount of loan.

In such cases, a number of banks or FIs join together and form a syndicate to provide the loan. This act of providing a large sum of money by forming a syndicate or consortium is called loan syndication. The risk and the interest on the loan are also shared among the syndicate members.

Securitization

Securitization is a financial innovation. Loans given by a financial agency are an asset in the books of the organization that is giving the loan. These loans are illiquid in nature and are not tradable or transferable. Securitization is a process of transforming loans into marketable securities.

It is the conversion of existing or future cash flows into marketable securities that can be sold to investors. Some of the assets that can be securitized are loans like car loans, housing loans, etc., and future cash flows like ticket sales, credit card payments, car rentals, or any other form of future receivables.

Bill Discounting

Another popular form of a financial product is bill discounting. In business, most of the bills raised are time bill which is payable after a certain period of time. But the businessman or the trader needs immediate cash for its working capital requirement, in such a situation the holder of the bill discounts it with the banker/ financial agency to meet its liquidity.

The organizations which discount the bill deduct a certain percentage from the bill as their fee and credit the remaining funds to the holder. On the due date of the bill, the drawee makes the payment to the bank/ financial agency.

In case he fails to make the payment on the due date, the banker will recover the amount from the customer who has discounted the bill. So in a nutshell, bill discounting is basically giving loans on the basis of the security of a bill of exchange.

Corporate Advisory Services

Certain financial intermediaries offer advisory services in the field of Euro Loans, GDR (Global Depository Receipts), ADR (American Depository Receipts), etc to their corporate clients. Such services are gaining popularity among corporate in recent times. This service is also referred to as corporate counseling.

FAQs About the Financial Services

What are the types of financial services?

The following are the types of financial services: 1. Capital Market Services 2. Money Market Services 3. Retail Services 4. Wholesale Services 5. Banking Services 6. Insurance Services 7. Investment Services 8. Asset Management 9. Private Equity and Venture Capital 10. Accounting and Auditing Services.

What are the features of financial services?

These are the features of financial services: 1. Customer-Centric 2. Intangibility 3. Perishable in Nature 4. Dynamic in Nature.

What is the importance of financial services?

The importance of financial services is: 1. Economic Growth 2. Promotion of Savings 3. Capital Formation 4. Creation of Employment 5. Provision of Liquidity.

What are the Characteristics of financial service?

The Characteristics of financial service:

1. Intangibility

2. Customer-Centricity

3. Inseparability

4. Heterogeneity

5. Marketability

6. Simultaneous Functions

7. Perishability

8. People-Based Services

9. Dynamic Nature

10. Market Dynamics.