Table of Contents

What is Treasury Bills Market?

A market for the purchase and sale of treasury bills is known as the ‘Treasury Bills Market’. A treasury bill is basically an instrument of short-term borrowing by the government of India. It is a particular kind of finance bill (i.e. a bill which does not arise from any genuine transactions in goods) or a promissory note issued by the RBI on behalf of the Government.

The T-bills are used to raise short-term funds to bridge seasonal/temporary gaps between receipts (revenue and capital) and expenditures of the Government of India. Treasury bills are the main financial instruments of the money market. The borrowings of the government are monitored and controlled by the central bank. The RBI is the agent of the Union Government.

They are issued by tender or tap. The bills are sold to the public by tender method up to 1965. These bills were put at weekly auctions. A treasury bill is a particular kind of finance bill. It is a promissory note issued by the government.

Thus, a kind of finance bill, which is in the nature of promissory notes, issued by the government under discount for a fixed period, not exceeding one year, containing a promise to pay the amount stated therein to the bearer of the instrument, are known as ‘treasury bills’.

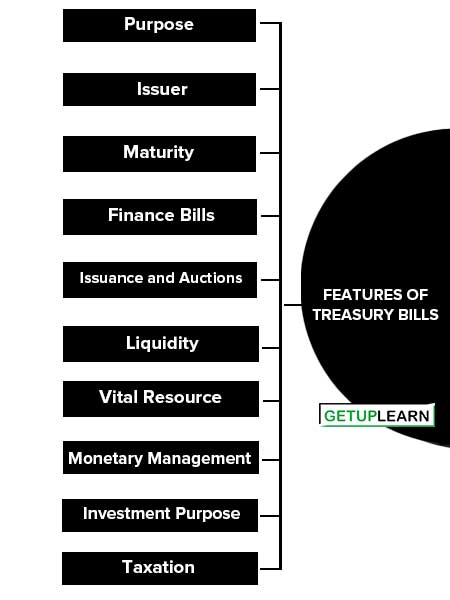

Features of Treasury Bills

Treasury bills (T-bills) are short-term debt instruments issued by governments to raise funds. They are typically issued by the national treasury or central bank and are considered to be one of the safest forms of investment. These are some features of treasury bills:

- Purpose

- Issuer

- Maturity

- Finance Bills

- Issuance and Auctions

- Liquidity

- Vital Resource

- Monetary Management

- Investment Purpose

- Taxation

Purpose

Governments issue treasury bills to finance their short-term borrowing needs and manage their cash flow. They are used to cover budget deficits or fund government projects.

Issuer

Treasury bills are issued by the government for raising short-term funds from institutions or the public for bridging temporary gaps between receipts (both revenue and capital) and expenditure.

Maturity

Treasury bills have a maturity period of less than one year, typically ranging from a few days to 52 weeks (1 year). They are categorized as “money market instruments” due to their short-term nature.

Finance Bills

Treasury bills are in the nature of finance bills because they do not arise due to any genuine commercial transactions in goods.

Issuance and Auctions

Treasury bills are typically issued through regular auctions conducted by the government or central bank. Investors place bids specifying the discount rate at which they are willing to purchase the bills. The highest bids are accepted until the government’s funding target is reached.

Liquidity

Treasury bills are highly liquid investments. They can be bought and sold in the secondary market before their maturity date, providing investors with the flexibility to access their funds when needed. Treasury bills are not self-liquidating like genuine trade bills, although they enjoy a higher degree of liquidity.

Vital Resource

Treasury bills are an important source of raising short-term funds for the government.

Monetary Management

Treasury bills serve as an important tool of monetary management used by the central bank of the country to infuse liquidity into the economy.

Investment Purpose

Treasury bills are commonly used by investors as a safe haven for parking excess cash or as a short-term investment option. They are also popular among institutional investors, banks, and money market funds.

Taxation

The interest earned from treasury bills is generally subject to income tax at the federal level. However, it is exempt from state and local taxes.

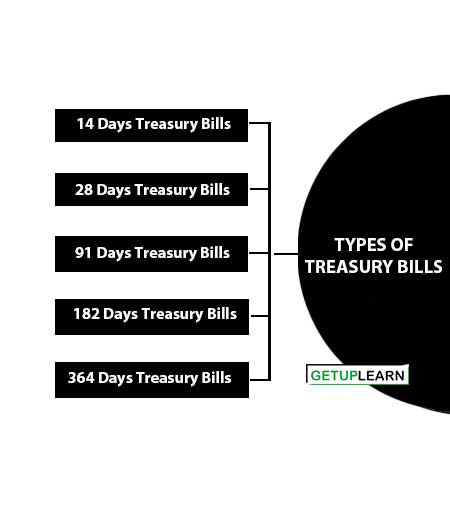

Types of Treasury Bills

Types of treasury bills can be categorized as follows:

- 14 Days Treasury Bills

- 28 Days Treasury Bills

- 91 Days Treasury Bills

- 182 Days Treasury Bills

- 364 Days Treasury Bills

14 Days Treasury Bills

The 14-day T-bills have been introduced from 1996-97. These bills are non-transferable. They are issued only in the book-entry system they would be redeemed at par. Generally, the participants in this market are state governments, specific bodies, and foreign central banks.

The discount rate on these bills will be decided at the beginning of the year quarter. The yield on this market is on par with the interest as ways and means. These bills are not popular in India due to some limitations. These bills are issued every week.

28 Days Treasury Bills

These bills were introduced in 1998. The treasury bills in India are issued on an auction basis. The date of issue of these bills will be announced in advance to the market. The information regarding the notified amount is announced before each auction.

The notified amount in respect of the Treasury bill auction is announced as an advance for the whole year separately. A uniform calendar of Treasury bills issuance is also announced.

The state governments have been allowed to enter into this segment for the investment of their surplus funds as non-competitive bidders. They are also allowed to avail of the special ways and means advances against the collateral of their investment in the bills market.

91 Days Treasury Bills

The 91-day Treasury bills, issued since July 1965, were tap-based and offered at discount rates ranging from 2.5% to 4.6% per annum. The returns on these bills were low, but the RBI provided a free rediscounting facility. Commercial banks also invested surplus funds for short periods, typically 1 or 2 days.

To manage fluctuations in bill volume, the RBI introduced measures: bill recycling from October 1986 and an additional early rediscounting fee from November 1986. However, the bills market did not become an integral part of the money market.

182 Days Treasury Bills

The 182 treasury bills were introduced in November 1986. The Chakravarthy committee made recommendations regarding 182-day treasury bills instruments. There was a significant development in this market. These bills were sold through monthly auctions.

These bills were issued without any specified amount. These bills are tailored to meet the requirements of the holders of short-term liquid funds. These bills were issued at a discount.

These instruments were eligible as securities for SLR purposes. These bills have rediscounting facilities. These instruments could be purchased by individual firms, companies, and corporate bodies. The bill market did not emerge as part of the money market.

364 Days Treasury Bills

The 364-day Treasury bills were introduced in April 1992 to stabilize the money market. They are sold through fortnightly auctions, but the timing of these auctions is undisclosed. Unlike other bills, the RBI does not provide rediscounting facility for these bills. They have helped reduce the net RBI credit to the government and gained popularity in India due to their higher yield and liquidity.

These bills have expanded the money market and provided a secure place for idle funds. Since October 1998, they are auctioned on a monthly basis. The response to these bills depends on factors like government securities market uncertainty, SLR variations, and yield.

Their impact extends to banks’ operations and government monetary policy. Banks’ large holdings of treasury bills can reduce their credit creation capacity, and banks often rely on rediscounting with the central bank to offset losses.

The banks’ participation in the treasury bills market has increased due to the RBI’s tight money policy. Furthermore, the purchase of treasury bills by banks enhances their ability to create deposits, and these bills are considered securities for calculating the SLR position.

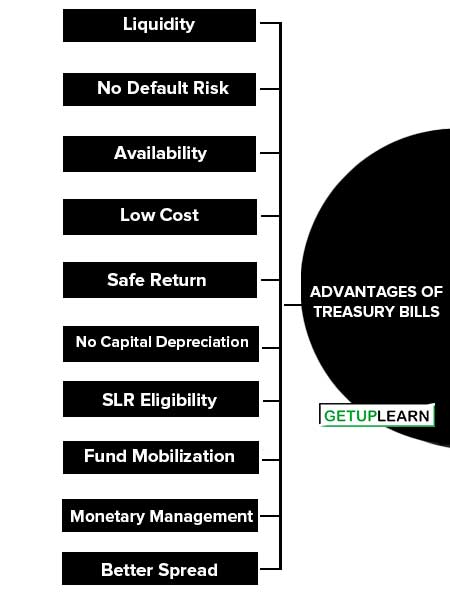

Advantages of Treasury Bills

Treasury bills and important money market instruments. These are some important advantages of treasury bills:

- Liquidity

- No Default Risk

- Availability

- Low Cost

- Safe Return

- No Capital Depreciation

- SLR Eligibility

- Fund Mobilization

- Monetary Management

- Better Spread

- Perfect Hedge

- Fund Management

- Commercial Bill Market

Liquidity

Treasury bills command high liquidity. A number of institutions such as RBI, the DFHI, STCI, commercial banks, etc. take part in the Treasury bill market. In addition, the central bank is always prepared to purchase or discount treasury bills.

No Default Risk

Since there is a guarantee by the central government, treasury bills are absolutely free from the risk of default of payment by the issuer. Moreover, the government itself issues treasury bills.

Availability

RBI has had the policy of making available on a steady basis, treasury bills, especially through the ‘tap’ route since July 12, 1965. This greatly helps banks and other institutions to park their funds temporarily in treasury bills.

Low Cost

Trading in treasury bills involves less transaction cost. This is because two-way quotas with a fine margin are offered by the DFHI on a daily basis.

Safe Return

The biggest advantage of treasury bills is that they offer a steady and safe return to investors. There are not many fluctuations in the discount rate. It is also possible for the investors to earn attractive returns by keeping investment in non-earning cash to the minimum and supplementing it with treasury bills.

No Capital Depreciation

Since treasury bills command high order of liquidity, safety, and yield, there is very little scope for capital depreciation in them.

SLR Eligibility

Treasury bills are of great attraction to commercial banks as it helps them park their funds (Net Demand and Time Liabilities) as per the norms of SLR announced by the RBI from time to time. This reason makes commercial banks dominant dealers in treasury bills.

Fund Mobilization

Treasury bills are used as an ideal tool by the government for raising short-term funds required for meeting temporary budget deficits.

Monetary Management

It is possible for the government to mop up excess liquidity in the economy through the issue of treasury bills. Since treasury bills are subscribed by investors other than the RBI, the issue would neither lead to inflationary pressure nor result in monetization.

Better Spread

Treasury bills facilitate the proper spread of asset mix with different maturity as they are available on a top basis as well as in fortnightly auctions.

Perfect Hedge

Treasury bills can be used as a hedge against the volatility of the call loan market and interest rate fluctuations.

Fund Management

Treasury bills serve as an effective tool of fund management because of reasons like, availability of ready market, both sale and purchase at market-driven prices, facility of rediscounting treasury bills on a tap basis, and refinancing from the RBI, ideally suited for the investment of temporary surplus, etc.

Commercial Bill Market

The corporate sector requires two kinds of capital; they are fixed capital and working capital. The fixed capital can be procured by the companies by issuing shares, term loans from all Indian financial institutions, and other long-term nature of sources.

The working capital of the corporate sector is mainly provided by the banks through cash credit, overdraft, and purchase or discounting of commercial bills.

Types of Bills

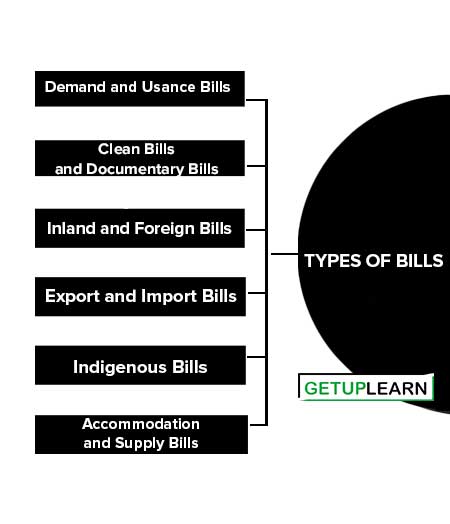

Many types of bills are in circulation in a bill market. They can be broadly classified as follows:

- Demand and Usance Bills

- Clean Bills and Documentary Bills

- Inland and Foreign Bills

- Export and Import Bills

- Indigenous Bills

- Accommodation and Supply Bills

Demand and Usance Bills

Demand bills are otherwise called sight bills. These bills are payable immediately as soon as they are presented to the drawee. No time of payment is specified and hence they are payable at sight.

Usance bills are called time bills. These bills are payable immediately after the expiry of the time period mentioned in the bills. The period varies according to the established trade customs or usage prevailing in the country.

Clean Bills and Documentary Bills

When bills have to be accompanied by the documents of title to goods like railway receipt, lorry receipt, bill of lading, etc. The bills are called documentary bills. These bills can be further classified into D/A bills and D/P bills. In the case of D/A bills, the documents accompanying bills have to be delivered to the drawee immediately after his acceptance of the bill.

Thus, D/A bills become a clean bill immediately after acceptance. Generally, D/A bills are drawn on parties who have a good financial standing. On the other hand, the documents have to be handed over to the drawee only against payment in the case of D/P bills.

The documents will be retained by the banker till the payment of such bills. When bills are drawn without accompanying any document they are called clean bills. In such a case, documents will be directly sent to the drawee.

Inland and Foreign Bills

Inland bills are those drawn upon a person resident in India and are payable in India. Foreign bills are drawn outside India and they may be payable either in India or outside India. They may be drawn upon a person resident in India also. Foreign bills have their origin outside India.

Export and Import Bills

Export bills are those drawn by the Indian exporters on importers outside India and import bills are drawn on Indian importers in India by exporters outside India.

Indigenous Bills

Indigenous bills are those drawn and accepted according to native custom or usage of trade. These bills are popular among indigenous bankers only. In India, they are called hundis. The hundies are known by various names such as, ‘Shahjog’, ‘Namjog’, ‘Jokhani’, ‘TermainJog’, ‘Darshani’, ‘Dhanijog’ and so on.

Accommodation and Supply Bills

If bills do not arise out of genuine trade transactions, they are called accommodation bills. They are known as ‘kite bills’ or ‘wind bills’. Two parties draw bills on each other purely for the purpose of mutual financial accommodation.

These bills are discounted with bankers and the proceeds are shared among themselves on the due dates they are paid. Supple bills are those drawn by suppliers or contractors on the government departments for the goods supplied by them.

These bills are neither accepted by the departments nor accompanied by documents of title to goods. So, they are not considered as negotiable instruments. These bills are useful only for the purpose of getting advances from commercial banks by creating a charge on these bills.

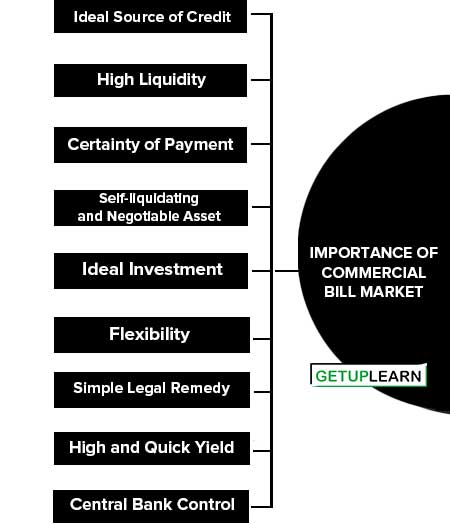

Importance of Commercial Bill Market

The commercial bill market is an important source of short-term funds for trade and industry. It provides liquidity and activates the money market for its development in the following ways. These are the importance of commercial bill market:

- Ideal Source of Credit

- High Liquidity

- Certainty of Payment

- Self-liquidating and Negotiable Asset

- Ideal Investment

- Flexibility

- Simple Legal Remedy

- High and Quick Yield

- Central Bank Control

Ideal Source of Credit

Bill financing is considered to be the most common method of meeting the short-term credit needs of trade and industry. It is quite possible for even banks to rediscount the bills in their possession. In this manner, banks are able to meet their short-term liquidity requirements.

High Liquidity

Commercial bills are highly liquid assets. Such bills have a fixed and short tenure of maturity. In times of necessity, bills can be converted into cash readily by rediscounting them with the central bank.

Certainty of Payment

Bills are drawn and accepted by business people. As the payment must be made on the due date of the bill, the use of commercial bills as an instrument of credit imposes financial discipline on the borrowers. Hence, bills would be honored on the due date.

Self-liquidating and Negotiable Asset

Bills are self-liquidating in character since they have a fixed tenure. Moreover, they are negotiable instruments and hence they can be transferred freely by mere delivery.

Ideal Investment

Bills are of the period not exceeding 6 months. They represent advances for a definite period. This enables financial institutions to invest their surplus funds profitably by selecting bills of different maturities.

For instance, commercial banks can invest their funds in bills in such a way that the maturity of these bills can coincide with the maturity of their fixed deposits.

Flexibility

An important function of an efficient bill market is that it imparts flexibility to the money market by functioning as its effective constituent. The bill market helps ease out liquidity crunch in the banking system.

Simple Legal Remedy

In case the bills are dishonored, the legal remedy is simple. Such dishonored bills have to be simply noted and protested and the whole amount should be debited to the customer’s accounts.

High and Quick Yield

Financial institutions earn a high and quick yield. The discount is deducted at the time of discounting itself, whereas in the case of other loans and advances, interest is payable only when it is due. The discount rate is also comparatively high.

Central Bank Control

The central bank can easily influence the money market by manipulating the bank rate or the rediscounting rate. Suitable monetary policy can be taken by adjusting the bank rate depending upon the monetary conditions prevailing in the market.

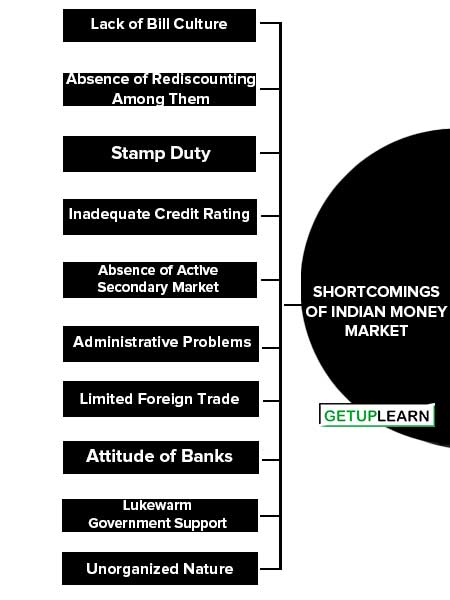

Shortcomings of Indian Money Market

In spite of the merits, the bill market has not been well developed in India. There are many reasons why the Indian bill market remains in a state of underdevelopment. The shortcomings of the Indian money market:

- Lack of Bill Culture

- Absence of Rediscounting Among Them

- Stamp Duty

- Inadequate Credit Rating

- Absence of Active Secondary Market

- Administrative Problems

- Limited Foreign Trade

- Attitude of Banks

- Lukewarm Government Support

- Unorganized Nature

Lack of Bill Culture

The trade and industry and government departments are reluctant to move towards the bill culture, which requires observance of strict financial discipline, particularly on the part of the borrower.

Business people in India prefer OD and cash credit to bill financing. Therefore, banks usually accept bills for the conversion of cash credits and overdrafts of their customers. Hence, bills are not popular.

Absence of Rediscounting Among Them

There is no practice of rediscounting bills among banks that need funds and those that have surplus funds. In order to enlarge the rediscounting facility, the RBI has permitted financial institutions like LIC, UTI, GIC, and ICICI to rediscount genuine eligible trade bills of commercial banks. Even then, bill financing is not popular.

Stamp Duty

In respect of transactions involved in making bills of exchange, there is a necessity of affixing a stamp on each bill. Many a time, stamp papers of the required denomination are not available. Besides, the amount of stamp duty is also high.

Inadequate Credit Rating

Credit Rating in India is of recent origin. Services of specialized and expert credit investigating agencies are not adequately available so as to facilitate valid judgment about the credibility of the parties concerned. Further, credit rating has also become expensive.

Absence of Active Secondary Market

The secondary market for bills is an important requirement for the development of an efficient bill market. Facilities such as rediscounting, etc are available only with the apex-level financial institutions, thus curtailing the size of the bill market.

Further, the bill acceptance service in the commercial bill market has been very much restricted. Similarly, the rediscounting facility is available only in Mumbai, Kolkata, Delhi, Chennai, Ahmedabad, Bangalore, Hyderabad, Nagpur, Kanpur, and Patna.

Administrative Problems

There are many administrative problems, which are faced by players in the bill market. These include physical scrutiny of invoices accompanying bills to ensure that they are the trade-related, physical presentation of bills for repayment, and requirement of physical endorsement and re-endorsement of bills at the time of rediscount.

Limited Foreign Trade

Whereas a bill market is required to be constituted for the purpose of financing foreign trade, it is unfortunate that the development in the volume of international trade transactions in India is relatively small and restricted.

For example, in India, foreign trade as a percentage of national income has always remained small which has contributed to the small size of the bill market.

Attitude of Banks

The attitude of commercial banks towards bill financing leaves much to be desired. Banks are shy of rediscounting bills even with the central bank. They have a tendency to hold the bills till maturity and hence it affects the velocity of circulation of bills. Again, banks prefer to purchase bills instead of discounting them.

Lukewarm Government Support

There has been lukewarm support from the government in encouraging the practice of bill financing. A large part of the trading activity at the government level in India is carried on through public sector units like STC, MMTC, FCI, etc. Unfortunately, the government does not prefer financing its activities through commercial bills.

Unorganized Nature

Indian bill market is plagued by the problem of the widespread presence of indigenous bankers and money lenders. Their dominating presence has led to nefarious practices, thus choking the growth of the bill market.

FAQs about the Treasury Bills Market

What are the features of treasury bills?

The features of treasury bills are:

1. Purpose

2. Issuer

3. Maturity

4. Finance Bills

5. Issuance and Auctions

6. Liquidity

7. Vital Resource

8. Monetary Management

9. Investment Purpose

10. Taxation.

What are the types of treasury bills?

The following are the types of treasury bills:

1. 14 Days Treasury Bills

2. 28 Days Treasury Bills

3. 91 Days Treasury Bills

4. 182 Days Treasury Bills

5. 364 Days Treasury Bills.

What are the advantages of treasury bills?

The following are the advantages of treasury bills:

1. Liquidity

2. No Default Risk

3. Availability

4. Low Cost

5. Safe Return

6. No Capital Depreciation

7. SLR Eligibility

8. Fund Mobilization

9. Monetary Management

10. Better Spread.

What are the types of bills?

The types of bills are:

1. Demand and Usance Bills

2. Clean Bills and Documentary Bills

3. Inland and Foreign Bills

4. Export and Import Bills

5. Indigenous Bills

6. Accommodation and Supply Bills.

What is the importance of commercial bill market?

This is the importance of commercial bill market:

1. Ideal Source of Credit

2. High Liquidity

3. Certainty of Payment

4. Self-liquidating and Negotiable Asset

5. Ideal Investment

6. Flexibility

7. Simple Legal Remedy

8. High and Quick Yield

9. Central Bank Control.

What are the shortcomings of bill market?

There are many reasons as to why the Indian bill market remains in a state of underdevelopment. The shortcomings of the Indian money market:

1. Lack of Bill Culture

2. Absence of Rediscounting Among Them

3. Stamp Duty

4. Inadequate Credit Rating

5. Absence of Active Secondary Market

6. Administrative Problems

7. Limited Foreign Trade

8. Attitude of Banks

9. Lukewarm Government Support

10. Unorganized Nature.