The capital structure of a company refers to the mix of debt and equity that a company uses to finance its operations and growth. Choosing an optimal capital structure is a critical decision for any business as it directly impacts the company’s risk profile and the cost of capital.

Table of Contents

-

1 Factors Determining Capital Structure

- 1.1 Financial Leverage

- 1.2 Growth and Stability of Sales

- 1.3 Cost of Capital

- 1.4 Cash Flow Ability to Service Debt

- 1.5 Nature and Size of Firm

- 1.6 Control

- 1.7 Flexibility

- 1.8 Requirement of Investors

- 1.9 Capital Market Conditions

- 1.10 Assets Structure

- 1.11 Period of Financial

- 1.12 Purpose of Financing

- 1.13 Costs of Floatation

- 1.14 Personal Consideration

- 1.15 Corporate Tax Rule

- 2 FAQs About the Factors Determining Capital Structure

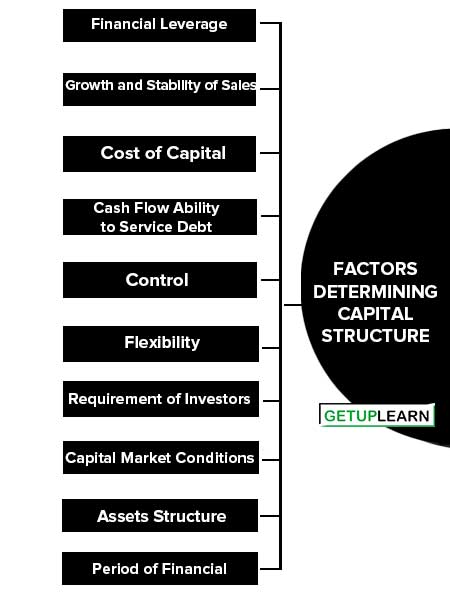

Factors Determining Capital Structure

These are the factors determining capital structure:

- Financial Leverage

- Growth and Stability of Sales

- Cost of Capital

- Cash Flow Ability to Service Debt

- Nature and Size of Firm

- Control

- Flexibility

- Requirement of Investors

- Capital Market Conditions

- Assets Structure

- Period of Financial

- Purpose of Financing

- Costs of Floatation

- Personal Consideration

- Corporate Tax Rule

Financial Leverage

The use of long-term fixed interest-bearing debt and preference share capital along with equity share capital is called financial leverage. The use of long-term debt magnifies the earning per share if the firm yields a return higher than the cost of debt.

The earning per share also increases with the use of preference share capital but due to the fact that interest is allowed to be deducted while computing tax, the leverage impact of debt is more.

Growth and Stability of Sales

The capital structure of a firm is highly influenced by the growth and stability of its sales. If the sales are expected to remain fairly stable, it can raise a higher level of debt.

The stability of sales ensures that the firm will not face any difficulty in meeting its fixed commitments of interest payment and repayments of debts. If sales are highly fluctuating, it should not employ debt financing in its capital structure.

Cost of Capital

Cost of capital refers to the minimum rate of return expected by its suppliers. The capital structure should also provide for the minimum cost of capital. Usually, debt is a cheaper source of finance compared to preference and equity. Preference capital is cheaper than equity because of the lesser risk involved.

Cash Flow Ability to Service Debt

A firm that shall be able to generate larger and more stable cash inflows can employ more debt in its capital structure as compared to one which has an unstable and lesser ability to generate cash inflows. Whenever a firm wants to raise additional funds, it should estimate, and project its cash inflows to ensure the coverage of fixed charges.

Nature and Size of Firm

The nature and size of the firm also influence the capital structure. A public utility concern has a different capital structure as compared to a manufacturing concern.

Public utility concerns may employ more debt because of the stability and regularity of their earnings. Small companies have to depend upon owned capital, as it is very difficult for them to raise long-term loans on reasonable terms.

Control

Whenever additional funds are required, the management of the firm wants to raise the funds without any loss of control over the firm. In case funds are raised through the issue of equity shares, the control of existing shares is diluted.

Preference shareholders and debenture holders do not have voting right. From the point of view of control, debt financing is recommended.

Flexibility

The capital structure of the firm should be flexible. I.e. it should be capable of being adjusted according to top the needs of changing conditions.

A firm should arrange its capital structure in such a way that it can substitute one form of financing with another. Redeemable preference share capital and convertible debentures may be preferred on account of flexibility.

Requirement of Investors

It is necessary to meet the requirement of both institutional as well as private investors when debt financing is used. Investors who are over-cautious prefer the safety of investment, so debentures would satisfy such investors. Investors, who are less cautious in approach, will prefer preference share capital.

Capital Market Conditions

The choice of securities is also influenced by the market conditions. If the share market is depressed the company should not issue equity share capital as investors would prefer safety. In the case of the boom period, it would be advisable to issue equity share capital.

Assets Structure

If fixed assets constitute a major portion of the total assets of the company, it may be possible for the company to raise more long-term debts.

Period of Financial

If finance is required for a limited period, 7 years, debentures should be preferred. If funds are needed on a permanent basis, equity share capital is more appropriate.

Purpose of Financing

If funds are required for productive purposes, debt financing is suitable as interest can be paid out of profits generated from the investment.

Costs of Floatation

The cost of financing a debt is generally less than the cost of floating equity and hence it may persuade the management to raise debt financing.

Personal Consideration

Management, which is experienced and very enterprising, does not hesitate to use more debts in their financing as compared to less experienced and conservative management.

Corporate Tax Rule

The high rate of corporate taxes on profits compels the companies to prefer debt financing because interest is allowed to deduct while computing taxable profits.

FAQs About the Factors Determining Capital Structure

What are the factors determining capital structure?

The following are factors determining capital structure:

1. Financial Leverage

2. Growth and Stability of Sales

3. Cost of Capital

4. Cash Flow Ability to Service Debt

5. Nature and Size of Firm

6. Control

7. Flexibility

8. Requirement of Investors

9. Capital Market Conditions

10. Assets Structure.