Table of Contents

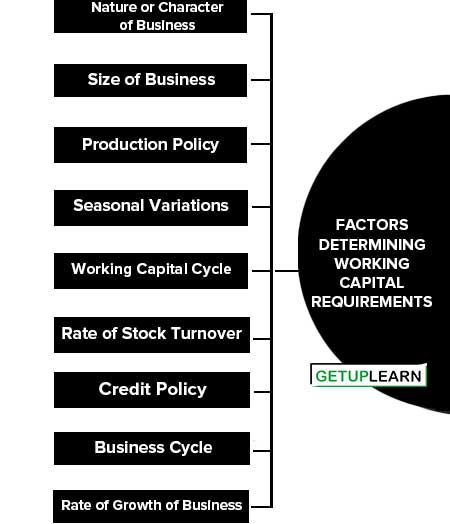

Factors Determining Working Capital Requirements

The working capital requirement of a concern depends upon a large number of factors, Here are the factors determining working capital requirements as follows:

- Nature or Character of Business

- Size of Business

- Production Policy

- Seasonal Variations

- Working Capital Cycle

- Rate of Stock Turnover

- Credit Policy

- Business Cycle

- Rate of Growth of Business

Nature or Character of Business

Public utility undertakings like Electricity, Water supply, and Railways need very limited working capital because they offer cash sales only and supply services, not products.

On the other hand, Trading and Financial firms require less investment in fixed assets but have to invest a large amount in current assets like inventories, receivables, etc.

Size of Business

The greater the size of the business unit, generally the more prominent will be the requirement for working capital. In some case, even a more minor concern need more working capital due to high overhead charges, inefficient use of resources, etc.

Production Policy

The production could be kept either steady by accumulating inventories during slack periods with a view to meet high demand during the peak season or the production could be curtailed during the slack season and increased during peak season.

If the policy is to keep the production steady by accumulating inventories it will require higher working capital.

Seasonal Variations

In certain industries, raw material; is not available throughout the year. They have to buy raw materials in bulk during the season to ensure an uninterrupted flow and process them during the entire year. A huge amount is blocked in the form of material inventories during such a season, which gives rise to more working capital.

Working Capital Cycle

In a manufacturing concern, the working capital cycle starts with the purchase of raw materials and ends with the realization of cash from the sales of finished products. This cycle involves the purchase of raw materials and starts.

Its conversion into the stock of finished goods through work in progress with a progressive increment of labor and service costs, conversion of finished stock into sales, Debtors, and receivables, and ultimately the realization of cash, and this cycle continues again from cash to purchase of raw material so on.

Rate of Stock Turnover

There is a high degree of inverse co-relationship between the quantum of working capital and the velocity or speed with which the sales are affected. A firm with a high rate of stock turnover will need a lower amount of working capital as compared to a firm having a low rate of turnover.

Credit Policy

A concern that purchases its requirement on credits and sells its products/services on cash require a lesser amount of working capital.

On the other hand, concerned buying its requirement for cash and allowing credit to its customers, will need a larger amount of working capital as a very huge amount of funds are bound to be tied up in debtors or bills receivables.

Business Cycle

Business Cycle refers to alternate expansion and contraction in general business activity. In a period of boom i.e. when the business is prosperous, there is a need for a larger amount of working capital due to an increase in sales, a rise in prices, and an expansion of business.

On the contrary in times of depression i.e., when there is a downswing of the cycle, the business contracts, sales decline, difficulties are faced in the collection from debtors and firms may have a large amount of working capital lying idle.

Rate of Growth of Business

For the fast-growing concern, a larger amount of working capital is required.

Advantages of Adequate Working Capital

Working capital is the lifeblood and nerve center of a business. No business can run successfully without an adequate amount of working capital. The main advantages of adequate working capital are as follows:

- Solvency of Business

- Goodwill

- Easy Loans

- Cash Discounts

- Exploitation of Favorable Market Condition

- Ability to Face Crises

- Quick and Regular Return on Investments

- Regular Supply of Raw Material

Solvency of Business

An adequate amount of working capital helps in marinating the solvency of a business by providing an uninterrupted flow of production.

Goodwill

sufficient amount of working capital enables business concerns to make prompt payments and helps in creating and marinating goodwill.

Easy Loans

A concern having an adequate amount of working capital, high solvency, and credit standing can arrange loans from banks.

Cash Discounts

An adequate amount of working capital also enables a concern to avail cash discounts on purchases and hence it reduces the costs.

Exploitation of Favorable Market Condition

An adequate amount of working capital enables a concern to exploit favorable market conditions such as purchasing its requirement in bulk when the prices are lower and by holding its inventories for higher prices.

Ability to Face Crises

An adequate amount of working capital enables a concern to face business crises in emergencies such as depression because during such periods, generally there is much pressure on working capital.

Quick and Regular Return on Investments

An adequate amount of working capital enables a concern to pay quick and regular dividends to its investors as there may not be much pressure to plow back profits.

Regular Supply of Raw Material

An adequate amount of working capital ensures a regular supply of raw materials and continuous production.

Financing of Working Capital

There are two major way financing of working capital:

- Financing of Permanent

- Indigenous Bankers

- Trade credit

- Installment Credit

- Advances

- Factoring or Accounts Receivable Credit

- Accrued Expenses

- Deferred Incomes

- Commercial Paper

Financing of Permanent

Permanent working capital should be financed in such a manner that the enterprise may have its uninterrupted use for a sufficiently long period. There are five important sources of long-term or permanent capital.

- Shares

- Debentures/bonds

- Public Deposits

- Plugging Back of Profits

- Loans from financial institutions

These long-term sources of finance have already been discussed in detail in the first unit of the book.

Short-Term of Financing

Financing of Temporary, variable, or short-term working capital: The main sources of short-term working capital are as follows:

Indigenous Bankers

Private money lenders used to be the only source of finance prior to the establishment of commercial banks. They used to charge very high rates of interest.

Trade credit

Trade credit refers to the credit extended by suppliers of goods in the normal course of business. The creditworthiness of a firm and the confidence of its suppliers are the main basis of securing trade credit. The main advantages of trade credit are:

- It is an easy and convenient method of finance.

- It is flexible as the credit increases with the growth of the firm.

- It is an informal and spontaneous source of finance.

Installment Credit

In these assets are purchased and possession of goods is taken immediately but payment is made in installments over a predetermined period. Generally, interest is charged on the unpaid price or it may be adjusted in the price.

Advances

Some business houses get advances from their customers and agents against orders. Usually, the manufacturing concerns having long production cycles prefer to take advances from their customers.

Factoring or Accounts Receivable Credit

A commercial bank may provide finance by discounting bills or invoices of its customers. Thus, a firm gets immediate payment for sales made on credit. A factor is a financial institution that offers services related to the management and financing of debts arising out of credit sales.

Accrued Expenses

Accrued expenses are the expenses that have been incurred but not yet due and hence not yet paid also. For example Wages, salaries, rent, interest, taxes, etc.

Deferred Incomes

Deferred incomes are incomes received in advance before supplying goods or services. However, firms having great demand for their products and services, and those having good reputations in the market can demand deferred incomes.

Commercial Paper

Commercial paper represents unsecured promissory notes issued by firms to raise short-term funds. But only large companies enjoying high credit ratings and sound financial health can issue commercial paper to raise short-term funds. The Reserve Bank of India has laid down a number of conditions to determine the eligibility of a company for the issue of commercial paper.

Only a company is listed on the. The stock exchange has a net worth of at least Rs. 10 corners and a maximum permissible bank finance of Rs. 25 crores and can issue commercial paper not exceeding 30 percent of its working capital limit. The maturity period of commercial paper mostly ranges from 91 to 180 days. It is sold at a discount from its face value and redeemed at face value on its maturity.