Table of Contents

What is Supply of Money?

The supply of money at any particular point in time is the total amount of money in the economy. In a broad sense, money supply refers to the total stock of money held by individuals and business firms in the economy.

However, the cash balances held by the central bank and commercial banks do not form the part of money supply being money-creating agencies. The supply of money is a stock concept, though it conveys the idea of a flow over time.

When money supply is viewed at a point in time, it is a stock and on the other side, when viewed over a period of time, it is a flow. Thus, money refers to the total currency notes, coins, and demand deposits with the banks held by the public.

Money is an asset that has to be held by the public. As a result, it has its demand and supply and also a market. The demand for money refers to the money that comes from the general public. The supply of money is made by its producers, i.e. government and banking system.

The study of the nature and determinants of demand and supply of money is essential because of the fact that changes in demand and supply tend to influence the price level, interest rate, and real income. Thus money supply is a key variable in policy formulations.

Definition of Money Supply

These are some simple definitions of money supply by economists:

Money supply as currency with public and demand deposits with commercial banks. Demand deposits are the current accounts of depositors in a commercial bank.

Getuplearn

Money supply includes currency demand deposits and timedeposits. It emphasises on store of value function of money.

Monet Arist

Money supply covers the whole liquidity position that is relevant to spending decisions. Money supply includes crash, all kinds of bank deposits, deposits with other institutions, near-money assets and the borrowing facilities available to people.

Radcliffe Committee

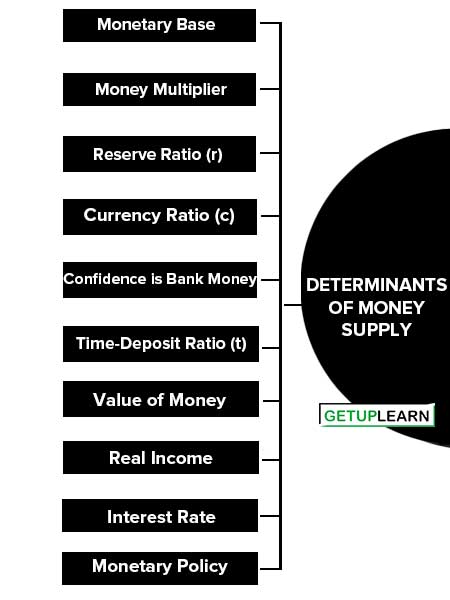

Determinants of Money Supply

The determinants of money supply are explained below:

- Monetary Base

- Money Multiplier

- Reserve Ratio (r)

- Currency Ratio (c)

- Confidence is Bank Money

- Time-Deposit Ratio (t)

- Value of Money

- Real Income

- Interest Rate

- Monetary Policy

Monetary Base

The magnitude of the monetary base is the significant determinant of the size of the money supply. Monetary base refers to the supply of funds available for use either as cash or reserves of the Central Bank. Monetary base changes due to the policy of the government and is also influenced by the value of money.

Money Multiplier

The money multiplier has a positive influence on the supply.

Reserve Ratio (r)

It is an important determinant. The smaller cash reserve ratio enables greater expansion in the credit by banks and increases the money supply and vice-versa.

Currency Ratio (c)

Represents the ratio of currency demand to the demand deposit as long as the r ratio is less than unity, a rise in the c ratio must reduce the multiplier.

Confidence is Bank Money

General economic conditions affect the confidence of the public in bank money. During Boom, confidence is bank money is high, and vice versa.

Time-Deposit Ratio (t)

Time-Deposit Ratio (t) represents the ratio of time deposits to demand deposits and has a negative effect on the money multiplier (m) and on the money supply.

Value of Money

The value of money (I/P) in terms of other goods and services has a positive influence on the monetary base and on money stock.

Real Income

Real Income has a positive impact on money multiplier and money supplier.

Interest Rate

Interest Rate has a positive impact on money multiplier and money supply.

Monetary Policy

If reserve requirements are raised the value of the reserve ratio will rise, reducing the money multiplier and money supply and vice versa.

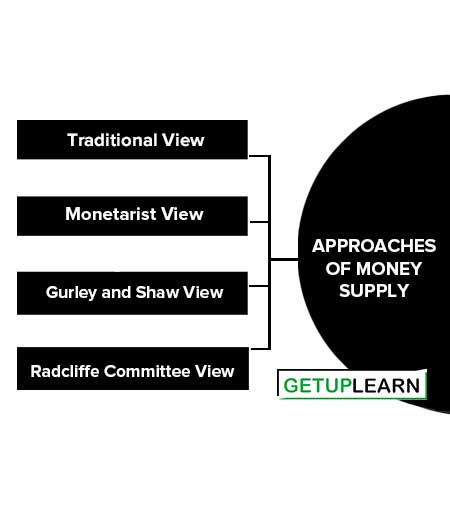

Approaches of Money Supply

These are the following approaches to money supply are discussed below:

Traditional View

The most common view is in line with traditional and Keynesian thinking which considered money as the medium of exchange. As per this view, money supply is defined as currency with the public and demand deposits with commercial banks.

Demand deposits are savings and current accounts of depositors in a commercial bank. They are a highly liquid form of money as depositors can draw cheques for any amount lying in their accounts at any banking time and the bank has to make immediate payment on demand.

Monetarist View

The second definition is broader and is in line with the modern quantity theorists given by Friedman. Prof. Friedman defines the money supply at any point in time as “literally the number of dollars people are carrying around in their pockets, the number of dollars they have to their credit at banks or dollars they have to their credit at banks in the form of demand deposits, and also commercial bank time deposits”.

Time deposits are fixed deposits of customers for a fixed period in a commercial bank that carries a fixed rate of interest. Money can be withdrawn before the expiry of that period by paying a penalty rate of interest to the bank.

Thus time deposits are liquid in nature and hence included in the money supply by Friedman. Thus the definition includes a traditional view of money supply plus time deposits of commercial banks in the supply of money. This definition stresses money as a function of the store of value.

Gurley and Shaw View

The third function is in line with Gurley and Shaw’s approach and it is the broadest definition of the supply of money. They include the money supply, monetarist view plus deposits of saving banks, building societies, loan associations, and deposits of other credit and financial institutions.

Radcliffe Committee View

It is also known as the liquidity approach and provides a much wider view of the concept of money supply. This approach viewed the concept of money supply in terms of the liquidity of the economy which is relevant to the spending decisions of the commodity.

But spending alone is not limited to the amount of money in existence rather it is related to the amount of money people want to hold either by receipts of income or disposal of assets or by borrowing.

Hence as per this approach, the concept of money is viewed in terms of general liquidity which includes cash, all types of bank deposits, deposits with other institutions, near money assets, and borrowing facilities available to the people.

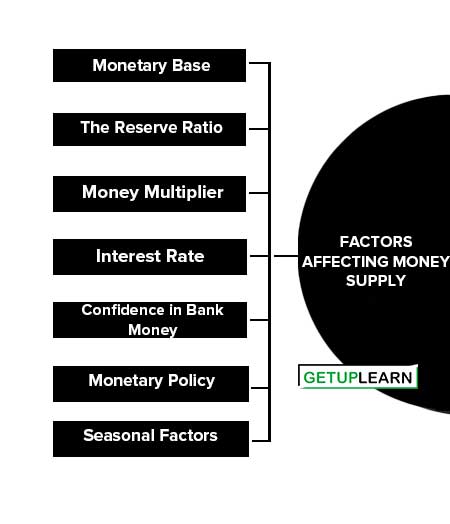

Factors Affecting Money Supply

Various factors affecting money supply are discussed below:

- Monetary Base

- The Reserve Ratio

- Money Multiplier

- Interest Rate

- Confidence in Bank Money

- Monetary Policy

- Seasonal Factors

Monetary Base

The magnitude of the monetary base is an important determinant of the size of the money supply. A monetary base implies a supply of funds available for use either for cash or for reserves of the central bank.

There is a direct relation between the monetary base and the size of the money supply. The monetary base is affected by the change in government policy and hence influenced the money supply.

The Reserve Ratio

The reserve ratio is a significant determinant of the money supply. Reserve ratio refers to the percentage of liabilities in the form of deposits that every commercial bank is required to keep a certain percentage of these reserves with the central bank of the country.

With the increase in the required reserve ratio, the supply of money with commercial banks reduces, and with the decrease in the required reserve ratio money supply with the commercial banks increases.

Money Multiplier

The money multiplier has a direct and positive influence on the money supply. With the increase in the size of the multiplier, the money supply increases, and with the decrease in the size of the multiplier, the money supply decreases.

Interest Rate

Interest rate and multiplier have positive relationships. So with the increase in interest rate, the size of the multiplier increases, and hence money supply increases and vice versa.

Confidence in Bank Money

General economic conditions prevailing in the economy affect the confidence of people in bank money and thereby influencing the money supply. During a period of recession, the confidence of people in bank money is low, and as a result, deposits will be low which affects the creation of credit in the economy and hence negatively influences the money supply.

During prosperity, people have confidence in banks, and deposits will be high which leads to the generation of more credit in the economy and hence positively influences the money supply.

Monetary Policy

Monetary policy is the way through which government can regulate the supply of money in the economy. If the reserve requirements are raised, the supply of the money increases and vice-versa.

Seasonal Factors

Seasonal factors have a negative effect on the money multiplier and hence on the money supply. These are the various factors that influence the money supply in the economy. In the next part, we will see how these factors affect the working of the money supply.

What are the approaches to money supply?

The following are the approaches to money supply: 1. Traditional View 2. Monetarist View 3. Gurley and Shaw View 4. Radcliffe Committee View.

What are the factors affecting money supply?

The following are the factors affecting money supply:

1. Monetary Base

2. The Reserve Ratio

3. Money Multiplier

4. Interest Rate

5. Confidence in Bank Money

6. Monetary Policy

7. Seasonal Factors.